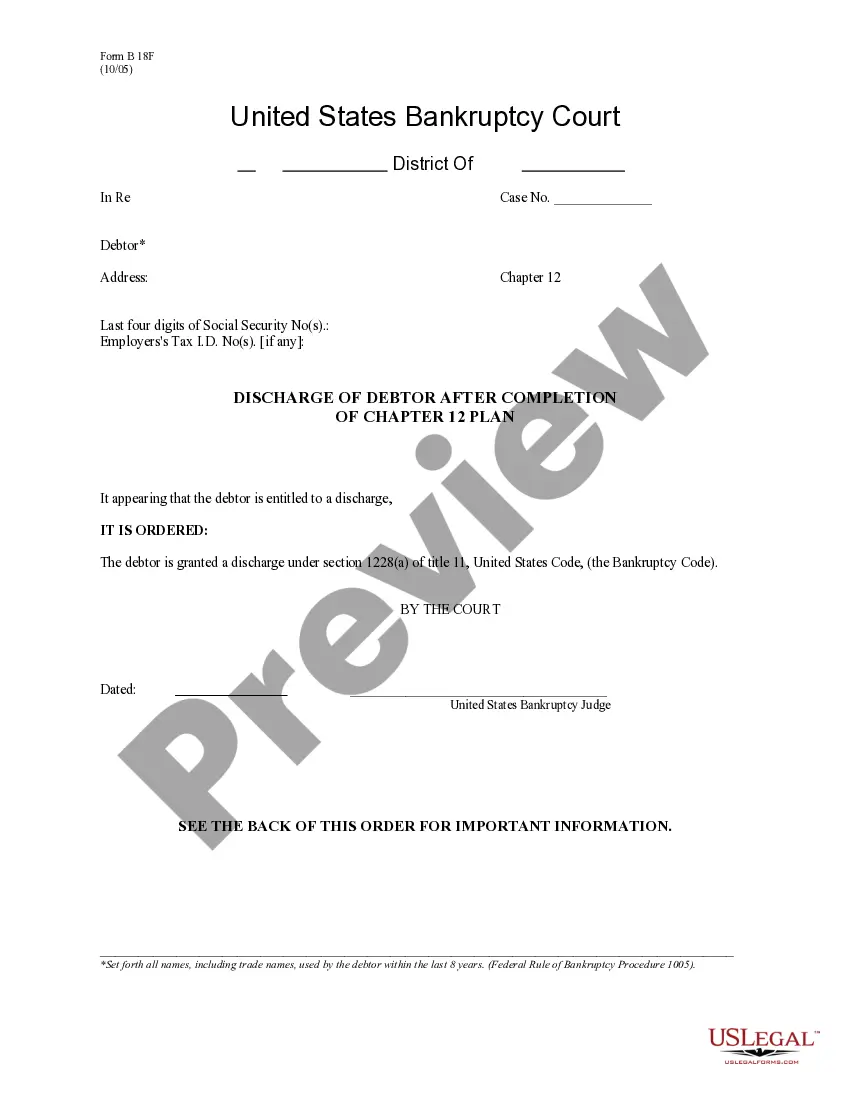

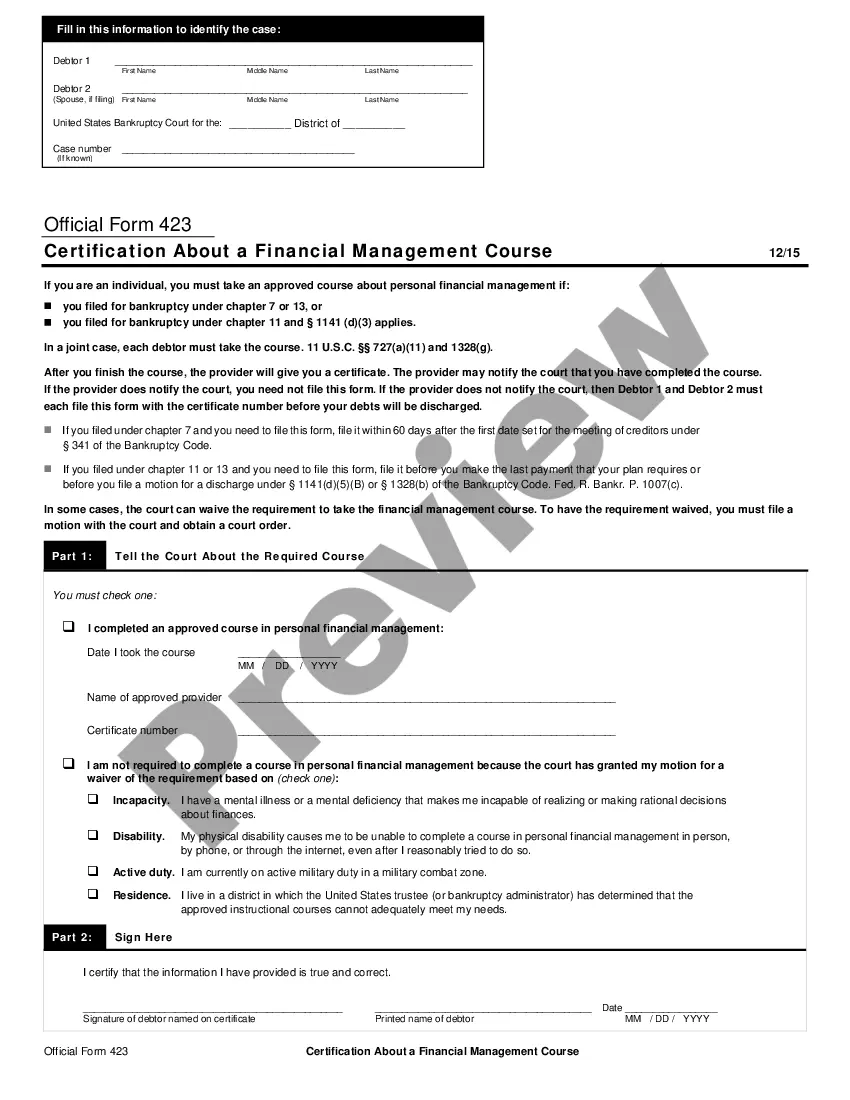

Tennessee Debtor's Certification of Completion of Instructional Course Concerning Personal Financial Management - Post 2005

Description

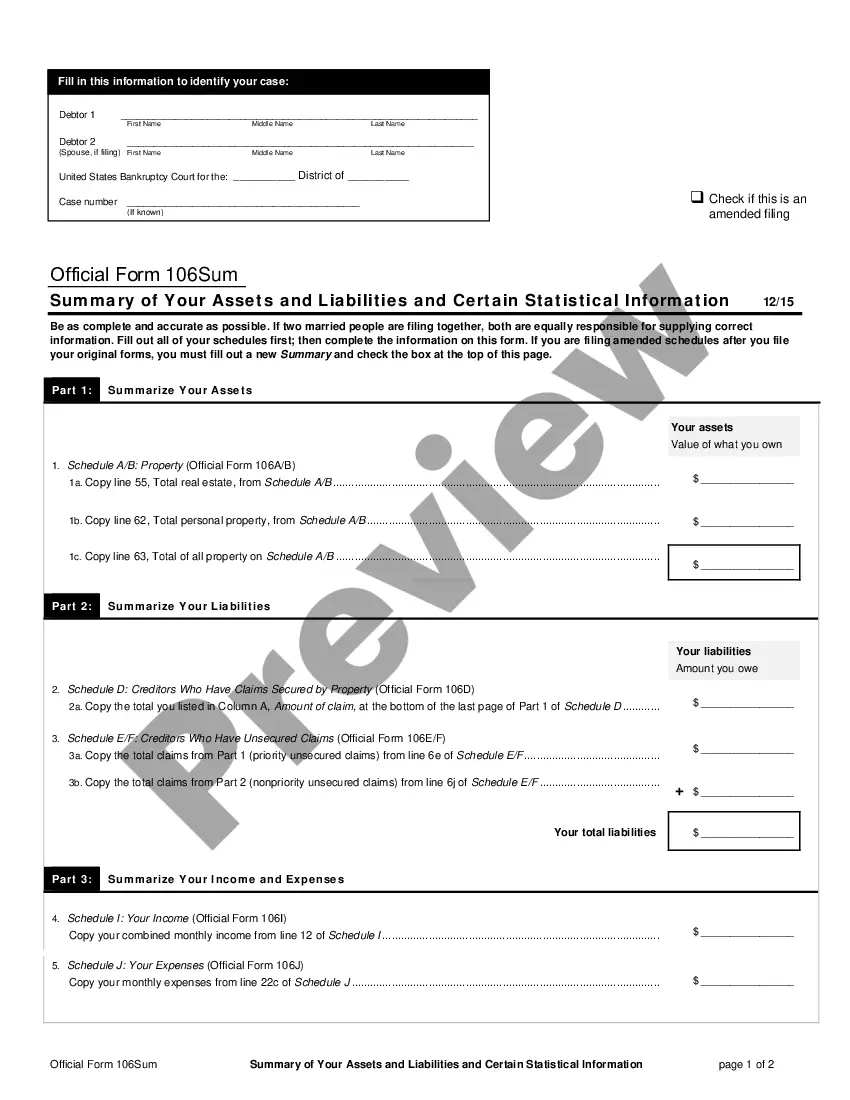

How to fill out Debtor's Certification Of Completion Of Instructional Course Concerning Personal Financial Management - Post 2005?

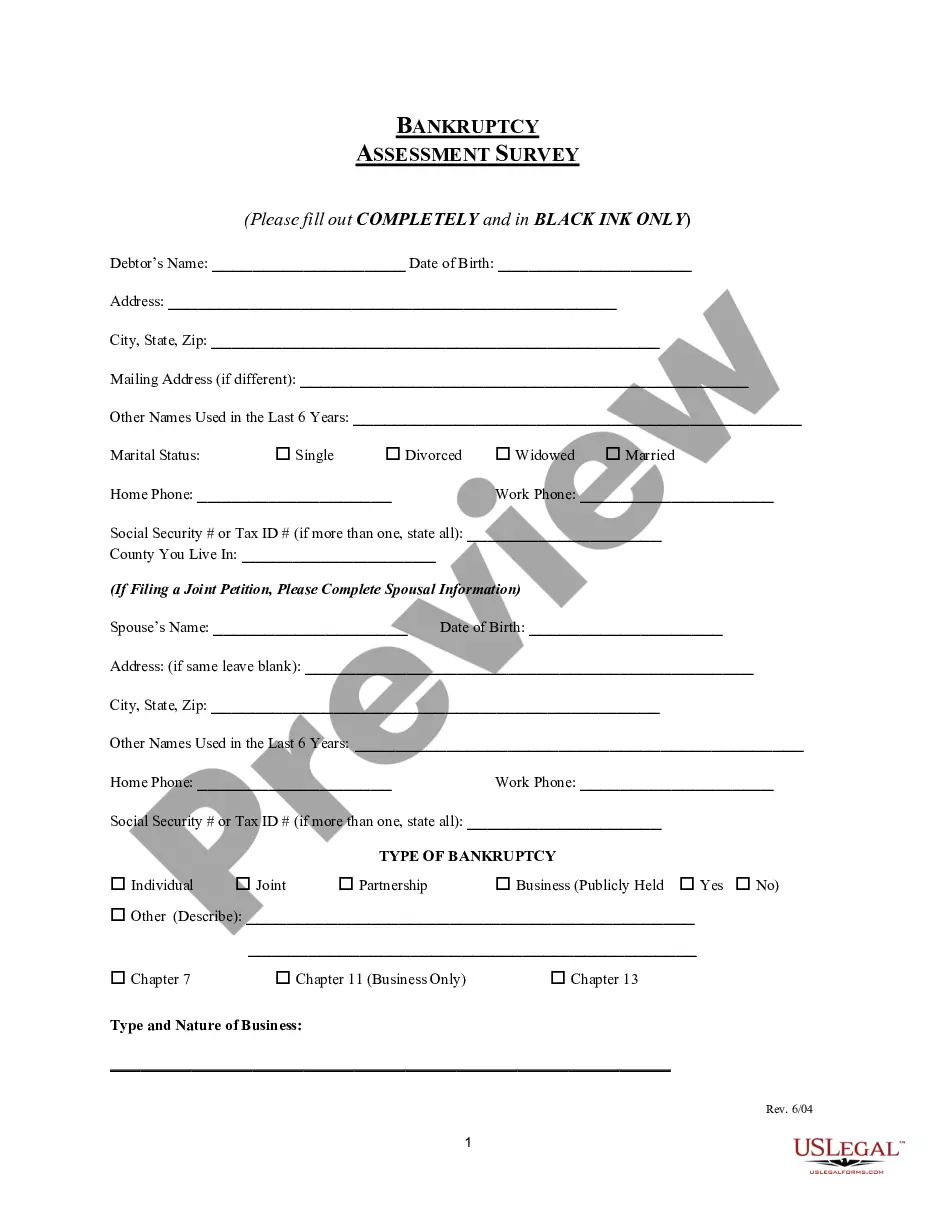

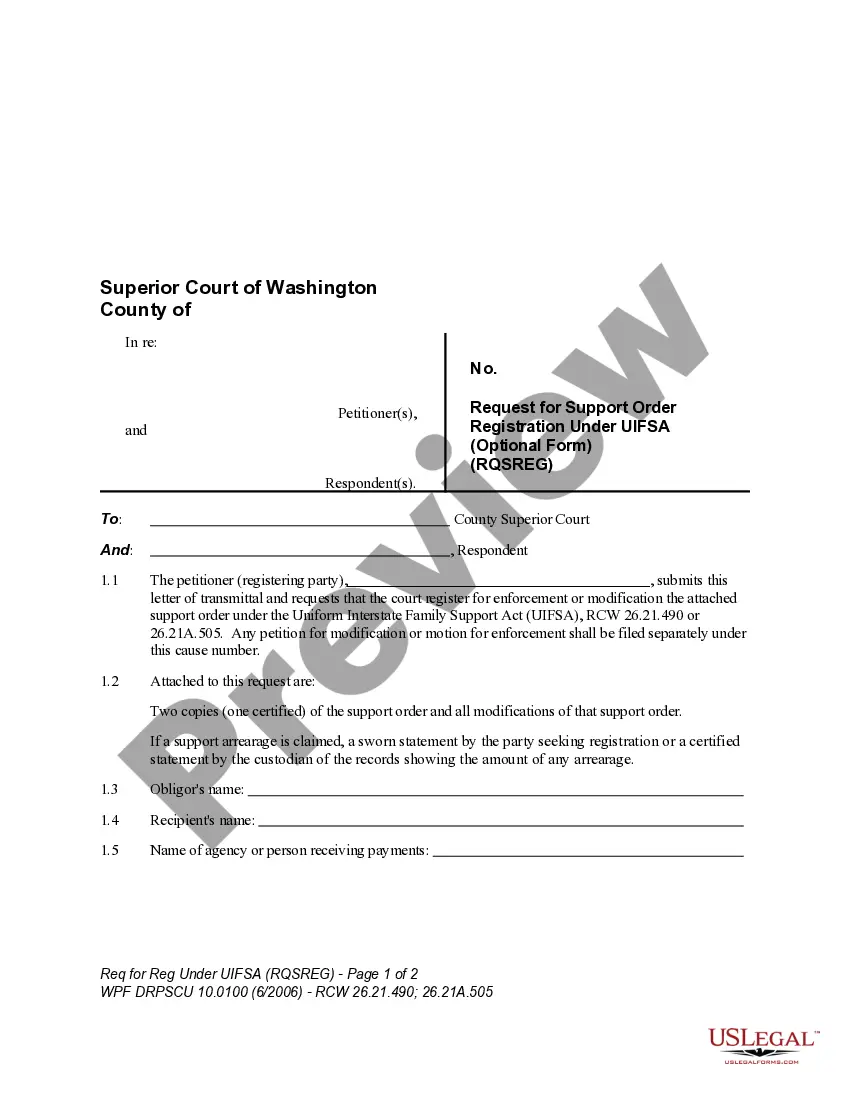

US Legal Forms - one of several biggest libraries of legal varieties in America - gives a variety of legal papers web templates you may download or produce. Using the internet site, you can find a huge number of varieties for company and personal functions, categorized by categories, says, or search phrases.You can find the latest variations of varieties such as the Tennessee Debtor's Certification of Completion of Instructional Course Concerning Personal Financial Management - Post 2005 in seconds.

If you have a monthly subscription, log in and download Tennessee Debtor's Certification of Completion of Instructional Course Concerning Personal Financial Management - Post 2005 from your US Legal Forms catalogue. The Down load switch can look on every single develop you look at. You have access to all previously downloaded varieties inside the My Forms tab of the profile.

If you want to use US Legal Forms initially, listed below are easy directions to help you get started off:

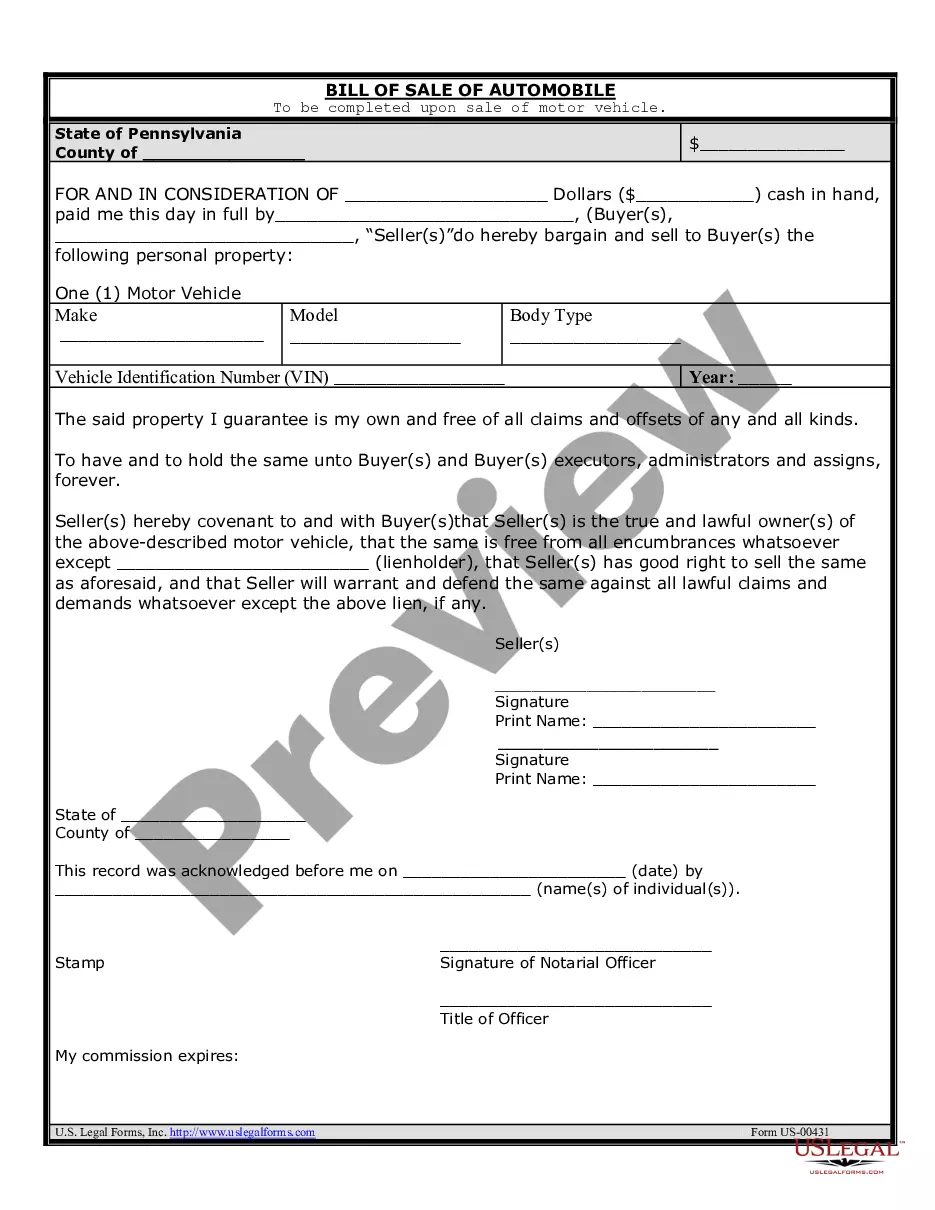

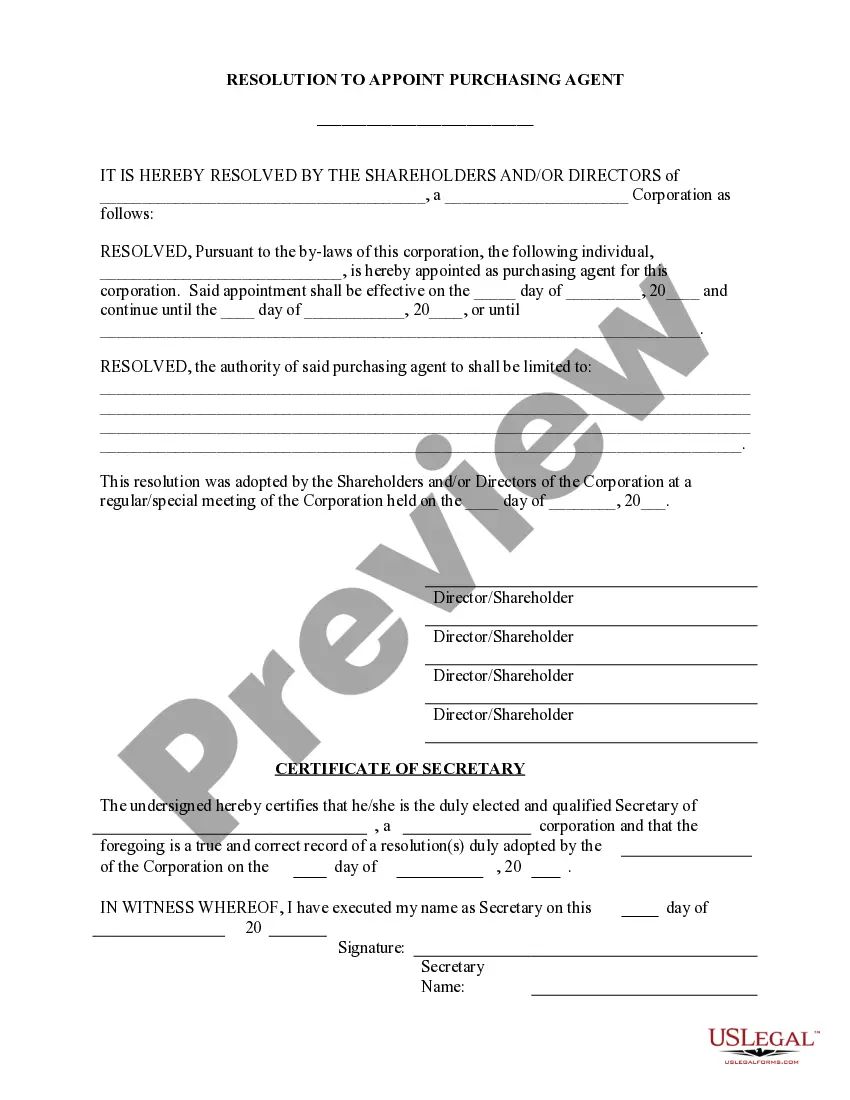

- Ensure you have picked out the right develop for the area/county. Click on the Preview switch to review the form`s information. Read the develop description to ensure that you have selected the correct develop.

- In the event the develop does not suit your demands, take advantage of the Look for discipline near the top of the display to get the one which does.

- In case you are pleased with the shape, affirm your choice by simply clicking the Buy now switch. Then, opt for the costs prepare you like and give your accreditations to sign up for an profile.

- Method the purchase. Make use of bank card or PayPal profile to finish the purchase.

- Pick the file format and download the shape on the system.

- Make alterations. Fill up, change and produce and sign the downloaded Tennessee Debtor's Certification of Completion of Instructional Course Concerning Personal Financial Management - Post 2005.

Every template you put into your bank account lacks an expiry date and it is the one you have permanently. So, if you would like download or produce yet another copy, just go to the My Forms area and click in the develop you require.

Gain access to the Tennessee Debtor's Certification of Completion of Instructional Course Concerning Personal Financial Management - Post 2005 with US Legal Forms, one of the most comprehensive catalogue of legal papers web templates. Use a huge number of professional and condition-distinct web templates that fulfill your business or personal needs and demands.

Form popularity

FAQ

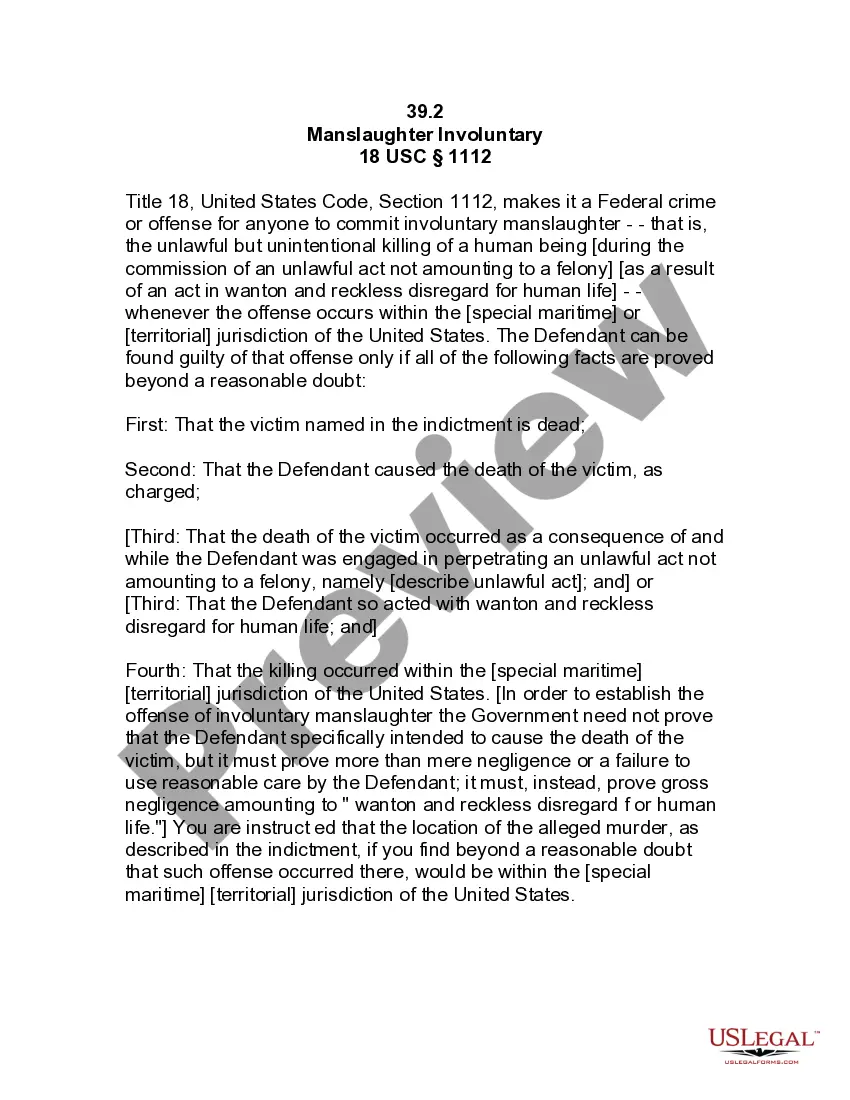

1 The automatic stay applies to individual debtors, to businesses, and to all of the chapters of the bankruptcy code. The automatic stay does not apply to non-debtor entities, such as corporate affiliates, corporate officers, co-defendants, or guarantors.

It's a Long Term Commitment ? Filing Chapter 13 bankruptcy requires you to make a long-term commitment to the process. Tough To Get Credit or a Mortgage for 7 Years ? Other impacts include the inability to get credit cards at a good rate, and filing Chapter 13 makes it tough to get a mortgage.

Whether it's a Chapter 13 or 7 or 11, no bankruptcy filing eliminates all debts. Child support and alimony payments aren't dischargeable, nor are student loans and most taxes.

Chapter 13 and debt Firstly, all Chapter 13 payment plans must repay all priority claims and administrative expenses in full. These types of debts include taxes, child support, alimony, attorneys' fees and court costs.

Background. A chapter 13 bankruptcy is also called a wage earner's plan. It enables individuals with regular income to develop a plan to repay all or part of their debts. Under this chapter, debtors propose a repayment plan to make installments to creditors over three to five years.

A Chapter 13 petition for bankruptcy will likely necessitate a $500 to $600 monthly payment, especially for debtors paying at least one automobile through the payment plan. However, since the bankruptcy court will consider a large number of factors, this estimate could vary greatly.