Tennessee Job Description Worksheet

Description

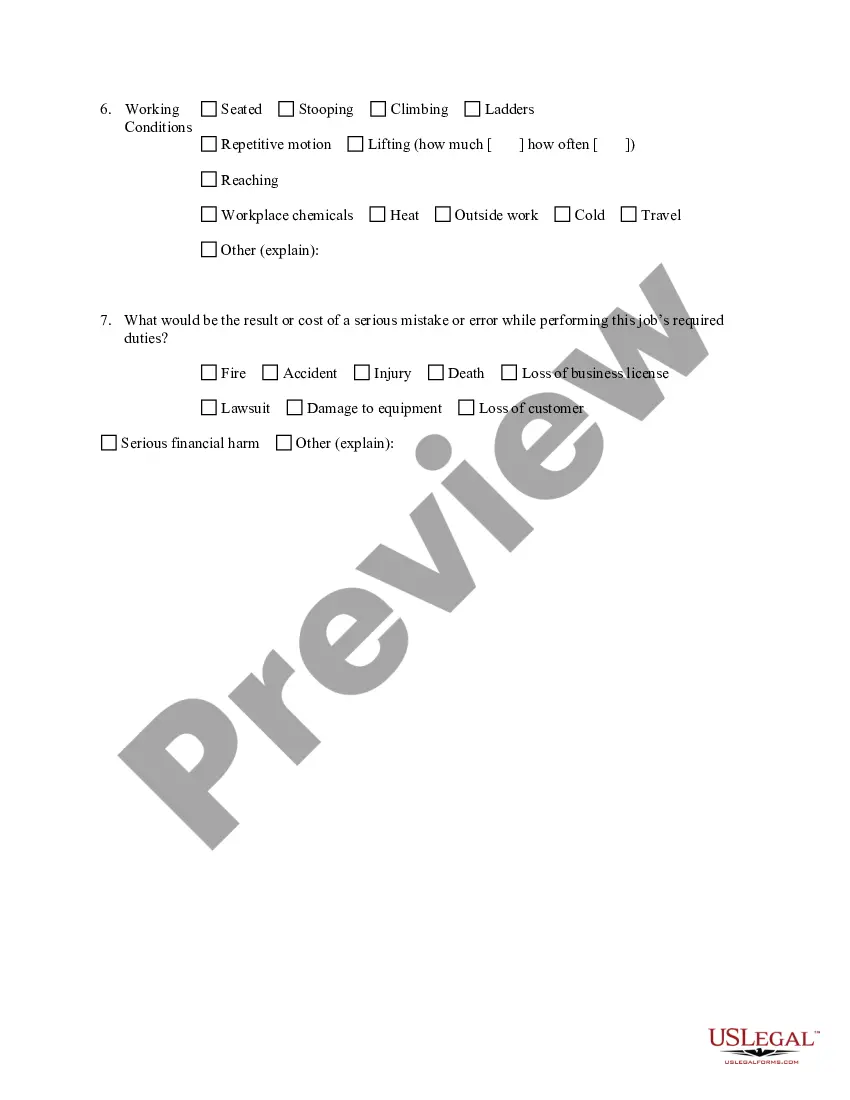

How to fill out Job Description Worksheet?

If you require to obtain, download, or print authentic document templates, utilize US Legal Forms, the largest selection of official forms available online.

Make use of the site’s straightforward and convenient search to locate the documents you need.

Numerous templates for business and personal purposes are categorized by groups, claims, or keywords. Utilize US Legal Forms to locate the Tennessee Job Description Worksheet with just a few clicks.

Each official document template you purchase is yours forever. You have access to every form you downloaded within your account. Visit the My documents section and select a form to print or download again.

Complete and download, and print the Tennessee Job Description Worksheet using US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to retrieve the Tennessee Job Description Worksheet.

- You can also access forms you previously obtained from the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Review option to go through the form’s content. Don’t forget to check the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other versions of the official form template.

- Step 4. Once you have located the form you desire, click on the Buy now button. Select the pricing plan of your choice and enter your information to create an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Choose the format of the official form and download it to your device.

- Step 7. Complete, modify and print or sign the Tennessee Job Description Worksheet.

Form popularity

FAQ

Excess wages are the portion of wages paid in a quarter that are above the yearly taxable wage base.

Steingold, Contributing Author. If your small business has employees working in Tennessee, you'll need to pay Tennessee unemployment insurance (UI) tax. The UI tax funds unemployment compensation programs for eligible employees. In Tennessee, state UI tax is one of the primary taxes that employers must pay.

Under Tennessee law, you can request a modification whenever there is a 15% difference between the current child support order and the proposed child support. This is called a significant variance.

The Premium Report contains fields for reporting the number of workers who were on an employer's payroll during the first, second, and third months of the quarter. Employers must report all full-time and part-time employees who worked during or received pay for the payroll period that included the 12th of the month.

The Premium Report contains fields for reporting the number of workers who were on an employer's payroll during the first, second, and third months of the quarter. Employers must report all full-time and part-time employees who worked during or received pay for the payroll period that included the 12th of the month.

Your weekly benefit amount is determined by averaging your wages from the two highest quarters in your base period and plugging that number into a Benefits Table to determine your weekly amount. There is a minimum weekly amount of $30, and a maximum weekly amount of $275. Benefits are available for up to 26 weeks.

The calculation of Excess Wages is based on the first $7000 paid to each employee during the calendar year (the Tennessee Taxable Wage Base applicable to the quarter being reported). Modifying the Prior Wage amount in this system does not actually modify your prior quarterly reports.

One child: 6.81 percent. Two children: 7.22 percent. Three children: 7.77 percent. Four children: 8.05 percent.