Tennessee FMLA Tracker Form - Calendar - Fiscal Year Method - Employees with Set Schedule

Description

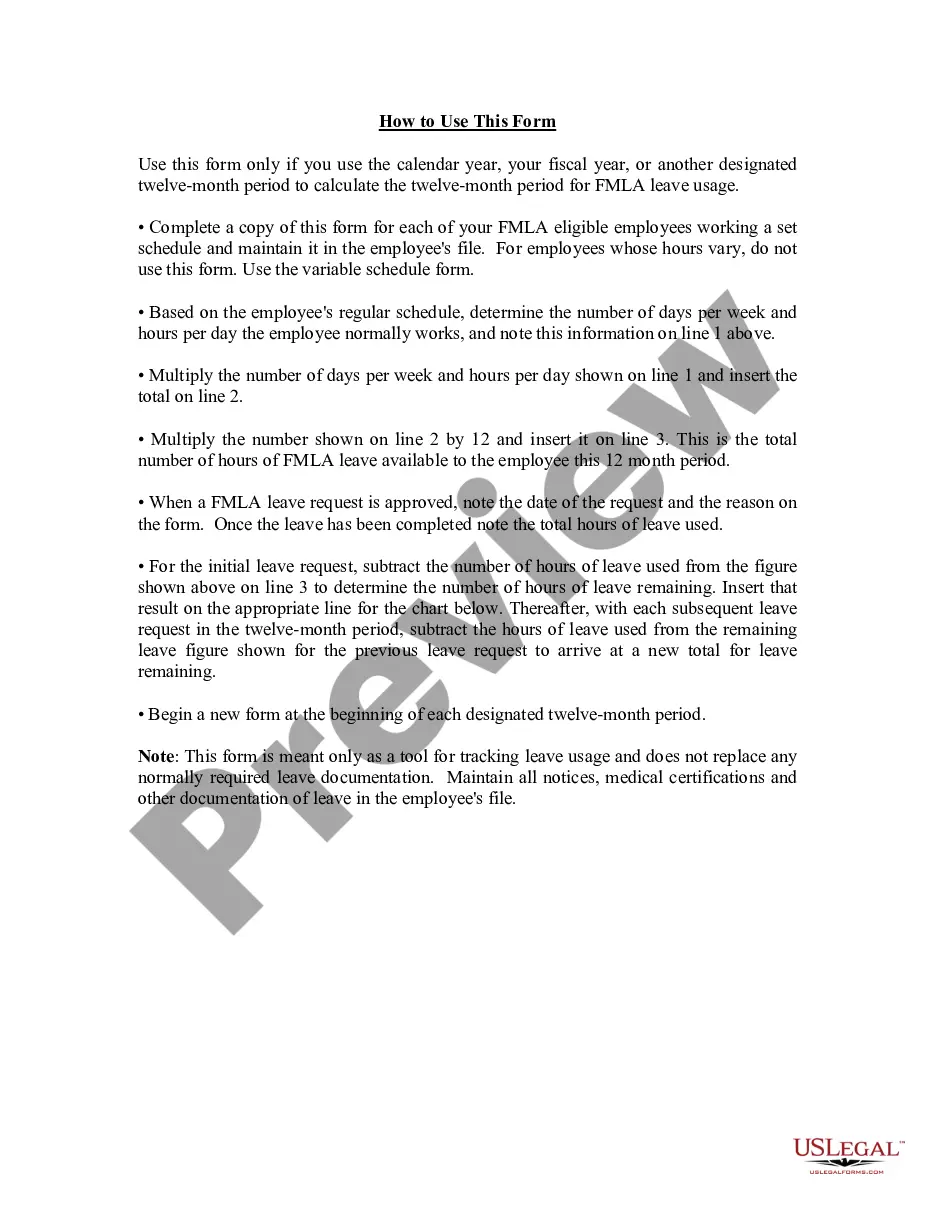

How to fill out FMLA Tracker Form - Calendar - Fiscal Year Method - Employees With Set Schedule?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a broad selection of legal document templates that you can download or print.

By using the website, you will find numerous forms for business and personal use, organized by categories, states, or keywords. You can quickly access the latest forms like the Tennessee FMLA Tracker Form - Calendar - Fiscal Year Method - Employees with Set Schedule.

If you are already a subscriber, Log In and download the Tennessee FMLA Tracker Form - Calendar - Fiscal Year Method - Employees with Set Schedule from the US Legal Forms library. The Download button will appear on each form you view. You can access all previously obtained forms in the My documents tab of your account.

Complete the transaction. Use your Visa or Mastercard or PayPal account to finalize the purchase.

Select the format and download the document to your device. Edit. Fill in, modify, print, and sign the downloaded Tennessee FMLA Tracker Form - Calendar - Fiscal Year Method - Employees with Set Schedule. Each template you save to your account does not expire and is yours permanently. So, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the Tennessee FMLA Tracker Form - Calendar - Fiscal Year Method - Employees with Set Schedule with US Legal Forms, the most extensive repository of legal document templates. Utilize a large number of professional and state-specific templates that cater to your business or personal requirements.

- Ensure you’ve selected the correct form for your city/state.

- Click the Review button to view the form’s content.

- Check the form description to verify you’ve chosen the appropriate document.

- If the form isn’t suitable, use the Search field at the top of the page to find one that meets your needs.

- Once satisfied with the form, confirm your selection by clicking the Buy now button.

- Next, select the payment plan you prefer and provide your information to create an account.

Form popularity

FAQ

The employee's actual workweek is the basis for determining the employee's FMLA leave entitlement. An employee does not accrue FMLA leave at any particular hourly rate. FMLA leave may be taken in periods of whole weeks, single days, hours, and in some cases even less than an hour.

Under the ''rolling'' 12-month period, each time an employee takes FMLA leave, the remaining leave entitlement would be the balance of the 12 weeks which has not been used during the immediately preceding 12 months. 2022

The FMLA, or Family and Medical Leave Act, is a federal law that allows certain employees working for covered employers to take up to 12 weeks of unpaid leave during each 12-month period. The 12-week allowance resets every 12 months, so in a sense, FMLA continues each year.

Under the rolling method, known also in HR circles as the look-back method, the employer looks back over the last 12 months, adds up all the FMLA time the employee has used during the previous 12 months and subtracts that total from the employee's 12-week leave allotment.

For example, an employer considers Thanksgiving a holiday and is closed on that day, and none of its employees work. One of its employees is taking 12 weeks of unpaid FMLA leave the last 12 weeks of the calendar year. The employer would count Thanksgiving Day as FMLA leave for that employee.

The 12-month rolling sum is the total amount from the past 12 months. As the 12-month period rolls forward each month, the amount from the latest month is added and the one-year-old amount is subtracted. The result is a 12-month sum that has rolled forward to the new month.

Under the ''rolling'' 12-month period, each time an employee takes FMLA leave, the remaining leave entitlement would be the balance of the 12 weeks which has not been used during the immediately preceding 12 months. 2022 Example 1: Michael requests three weeks of FMLA leave to begin on July 31st.

An employee's 12-week FMLA leave can be calculated using the calendar year, any fixed 12-month year, the first day of FMLA leave or a rolling period.