Tennessee Customer Order Form

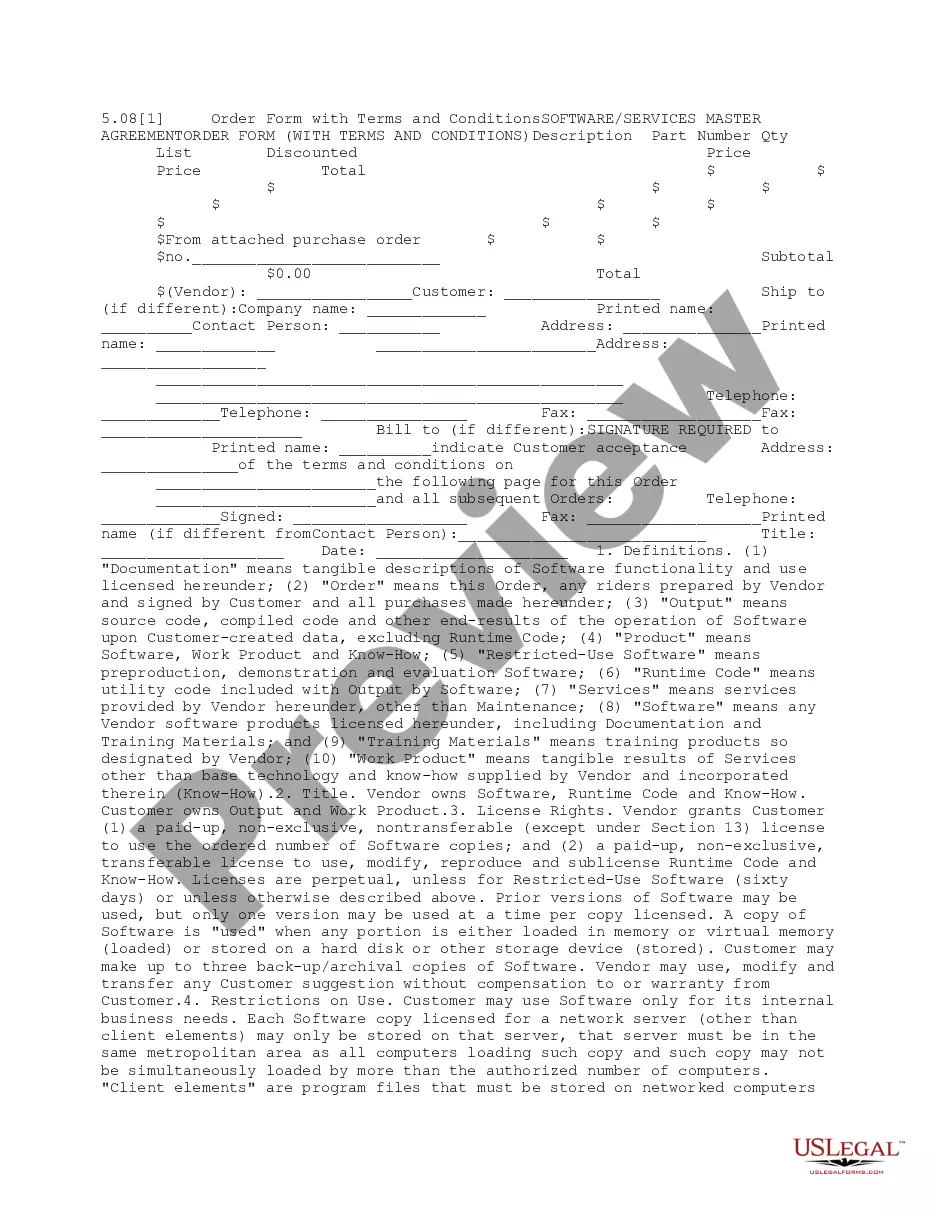

Description

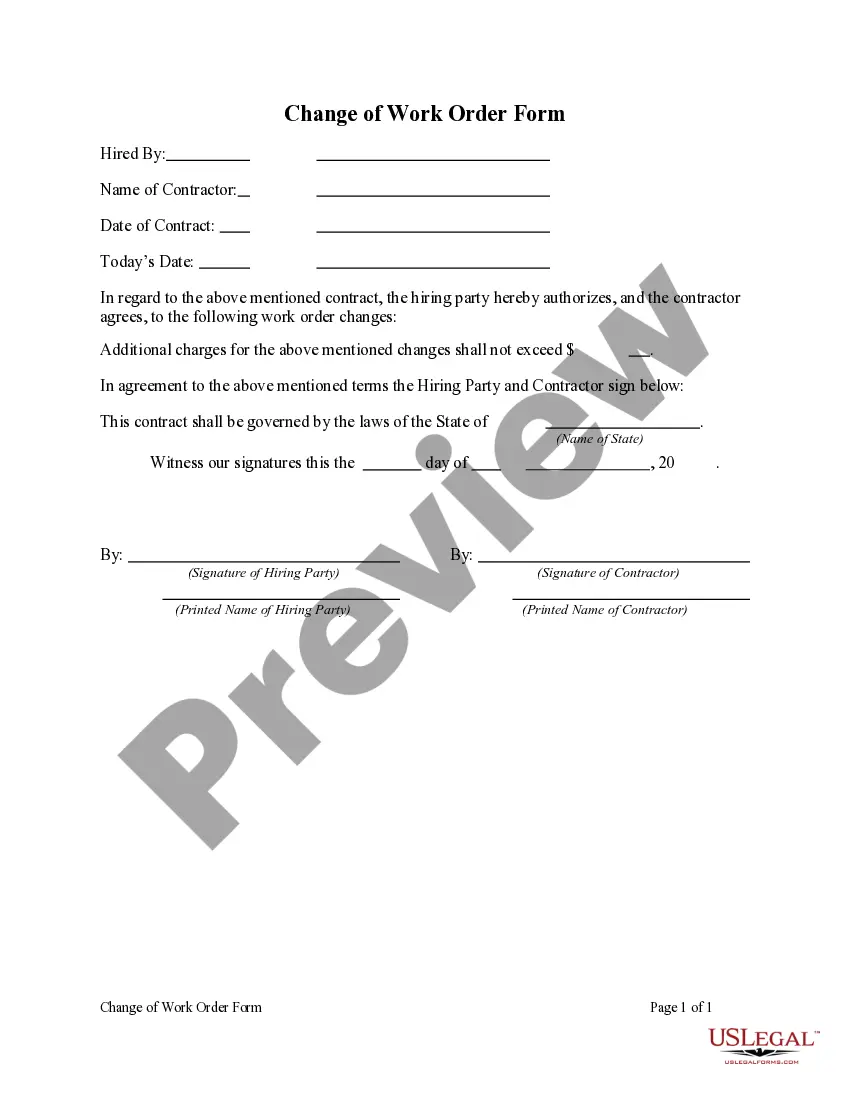

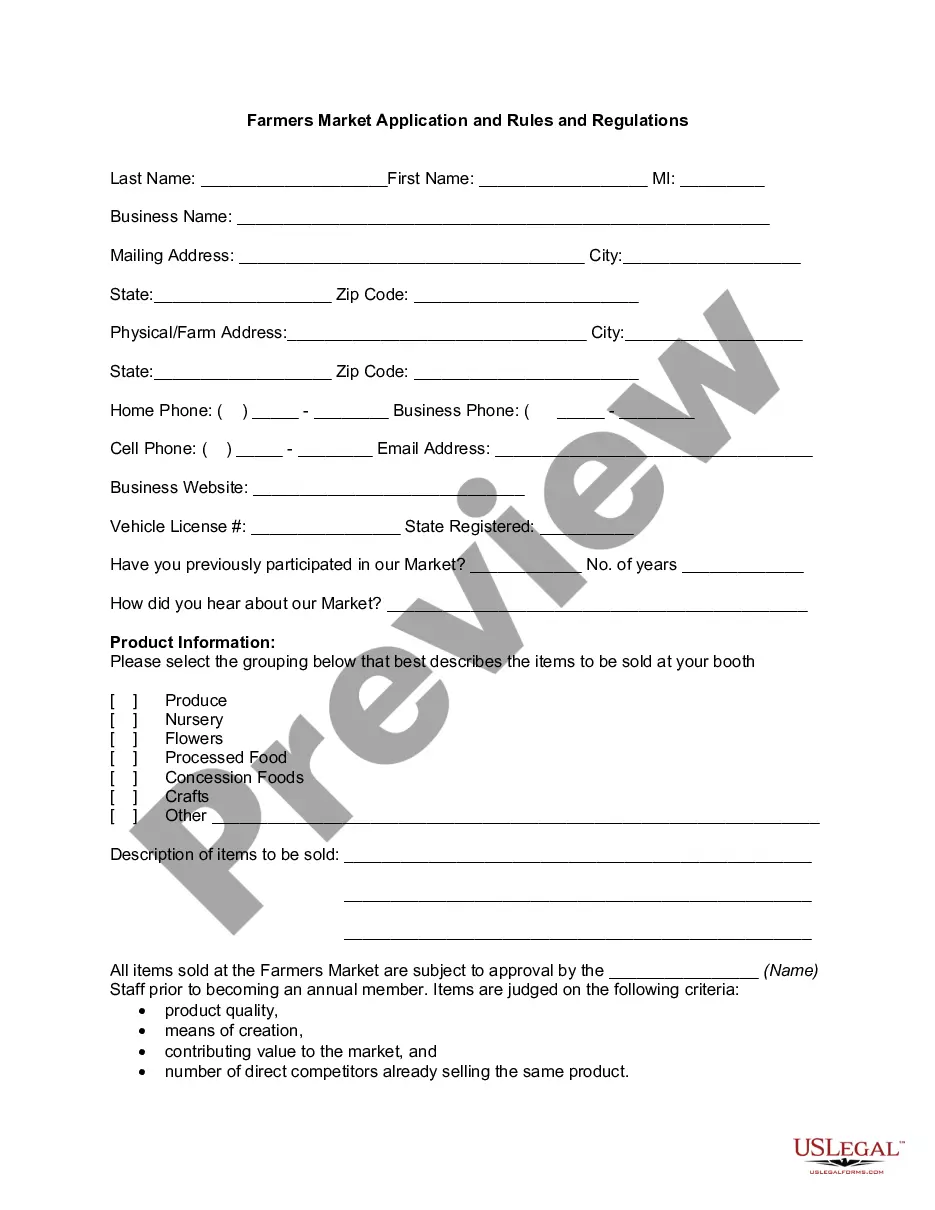

How to fill out Customer Order Form?

US Legal Forms - one of the largest collections of certified documents in the USA - provides a vast selection of legitimate document templates that you can acquire or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, sorted by categories, states, or keywords. You can find the latest editions of forms like the Tennessee Customer Order Form within minutes.

If you already have an account, Log In and retrieve the Tennessee Customer Order Form from the US Legal Forms library. The Download button will appear on each form you view. You can access all previously saved forms in the My documents section of your account.

Process the transaction. Use your Visa or Mastercard or PayPal account to complete the transaction.

Download the form to your device in your chosen format. Edit. Complete, modify, and print as well as sign the saved Tennessee Customer Order Form.

- Ensure you have selected the correct form for your city/county.

- Click the Preview button to review the content of the form.

- Read the form summary to ensure you've selected the right one.

- If the form doesn't meet your needs, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, choose your preferred payment plan and provide your details to register for an account.

Form popularity

FAQ

Tennessee is one of 16 states to levy a franchise (or capital stock) tax on businesses. Among these states, it levies the fourth-highest rate of 0.26 percent and does not place a cap on payments.

Business tax can be filed and paid online using the Tennessee Taxpayer Access Point (TNTAP). A TNTAP logon should be created to file this tax.

Tennessee Forms provides more than a thousand pleading and practice forms for civil, criminal, and commercial practice, giving particularly thorough coverage to commercial topics.

No Tennessee State Income Tax Tennessee is one of the seven states that does not impose an income tax. Taxpayers are not required to file a state return or pay tax on their wages and monetary bonuses. The only income subject to tax is investment dividends and interest.

Good news! Tennessee does not have a personal income tax, so that's one tax return you won't need to file. Just use 1040.com to file your federal return, and any returns you need to file for states that do have an income tax.

How do I become federally exempt? You can obtain federal tax-exempt status by applying with the IRS, by filing the detailed form 1023 and submitting it with the fee and the many required attachments. The review process will take several months and if you are successful, you will receive the Letter of Determination.

Tennessee is one of the seven states that does not impose an income tax. Taxpayers are not required to file a state return or pay tax on their wages and monetary bonuses. The only income subject to tax is investment dividends and interest.

Tennessee does not have a state income tax since they do not tax individuals' earned income, so you are not required to file an individual Tennessee state tax return. Tennessee residents are only taxed on dividend and investment income (if dividend and investment income exceeds preset limits).

Generally, if you are a person whose legal domicile is in Tennessee, you only need to file the Tennessee Hall Tax return if your taxable interest and dividend income exceeded $1,250 ($2,500 if married filing jointly) during the tax year.