Tennessee Business Trust

Description

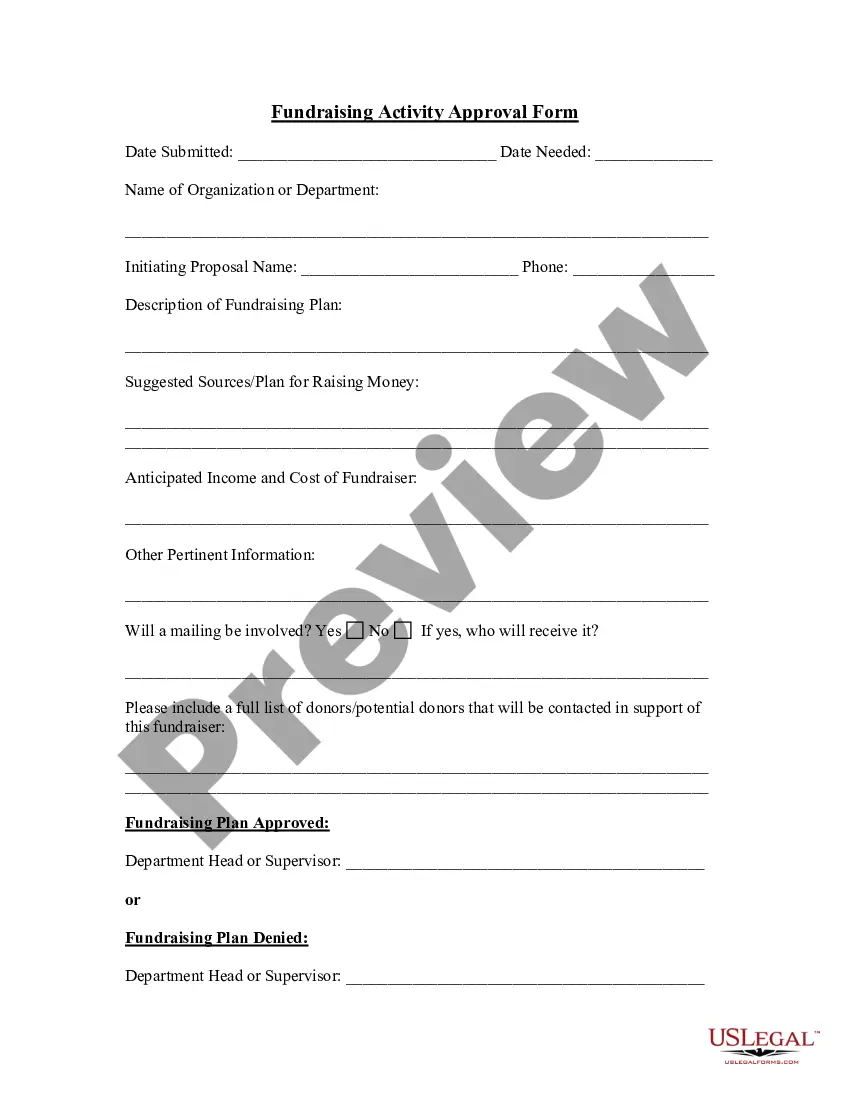

How to fill out Business Trust?

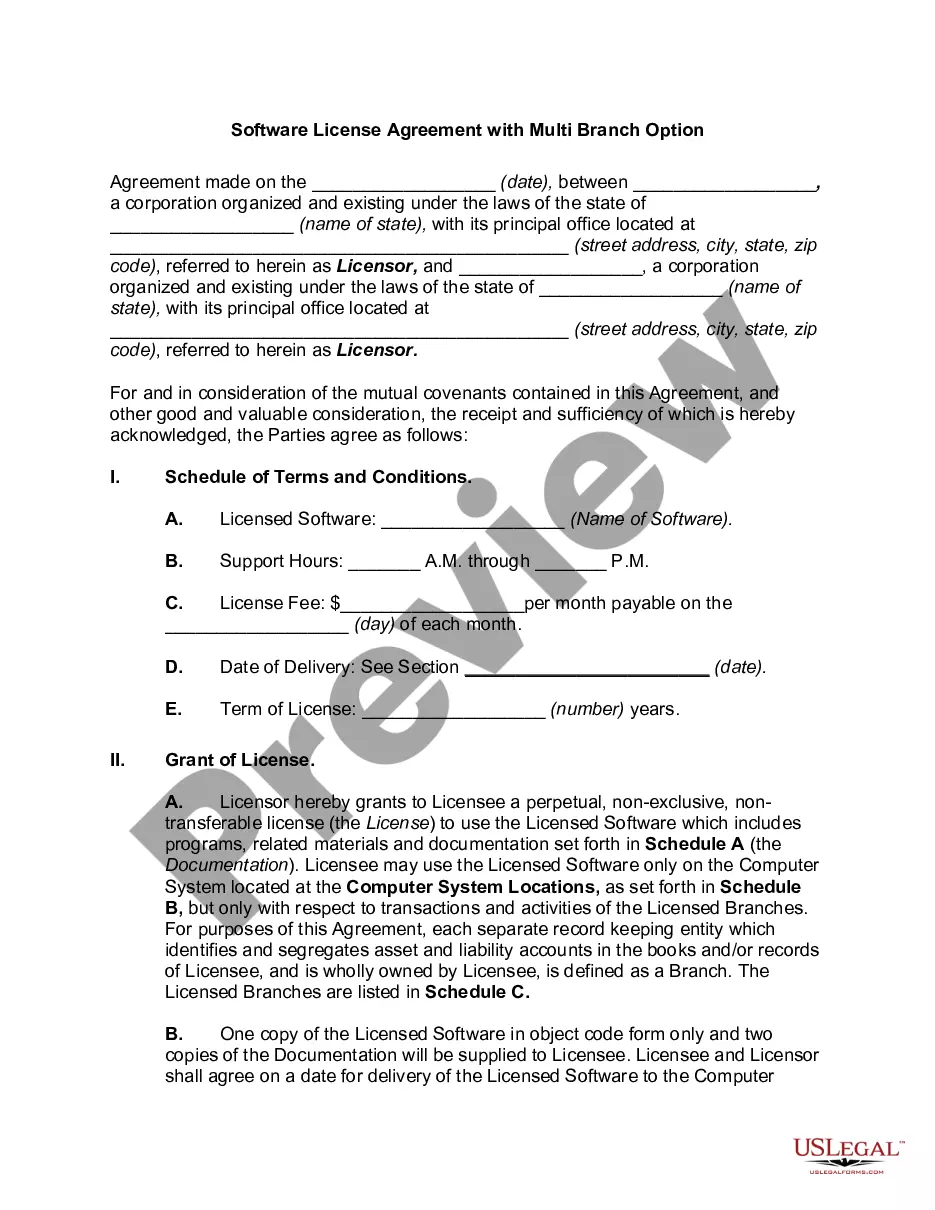

You can devote several hours online trying to locate the legal document template that suits the federal and state requirements you need.

US Legal Forms offers thousands of legal documents that can be reviewed by professionals.

You can easily download or print the Tennessee Business Trust from their services.

If available, use the Review button to browse through the document template as well.

- If you possess a US Legal Forms account, you can Log In and click on the Acquire button.

- After that, you can complete, modify, print, or sign the Tennessee Business Trust.

- Each legal document template you purchase is yours permanently.

- To obtain another copy of any purchased form, go to the My documents section and click the corresponding button.

- If you are using the US Legal Forms website for the first time, adhere to the simple steps below.

- First, ensure that you have selected the correct document template for your region/city of choice.

- Check the form outline to confirm that you have chosen the appropriate form.

Form popularity

FAQ

Trust beneficiaries must pay taxes on income and other distributions that they receive from the trust. Trust beneficiaries don't have to pay taxes on returned principal from the trust's assets. IRS forms K-1 and 1041 are required for filing tax returns that receive trust disbursements.

Tennessee's probate period is considered long and it does not use the Uniform Probate Code. So a living trust is likely a good call if your estate is worth more than $50,000. At or below that amount, Tennessee allows for a simplified small estate process, which makes a living trust unnecessary.

Generally, a trust is considered to be a separate individual for tax purposes, meaning that any income earned on trust assets is taxed as if the income were earned by a person who is separate from the settlor, trustee, or beneficiaries.

A Tennessee living trust is an estate planning tool that lets you maintain the use of your assets while placing ownership of them in a trust. After your death, they are passed to beneficiaries of your choice. A living trust in Tennessee is created by the grantor, the person transferring assets into the trust.

With Tennessee no longer taxing investment income, Tennessee trusts will not incur Tennessee income tax. Of course, each state has its definition of what makes a trust's income taxable in that state.

Trust beneficiaries must pay taxes on income and other distributions that they receive from the trust. Trust beneficiaries don't have to pay taxes on returned principal from the trust's assets. IRS forms K-1 and 1041 are required for filing tax returns that receive trust disbursements.

A Tennessee living trust is an estate planning tool that lets you maintain the use of your assets while placing ownership of them in a trust. After your death, they are passed to beneficiaries of your choice.

Some trustmakers have so much control over the trusts they have created that the IRS ignores the trusts completely. These are called Grantor Trusts and any income earned by the trust is simply part of the trustmaker's personal income tax return.

Tennessee has no personal or trust 'state' income tax. The retained (undistributed) income and net capital gains of TN situs trusts (those drafted under TN law) are subject to federal income tax only.