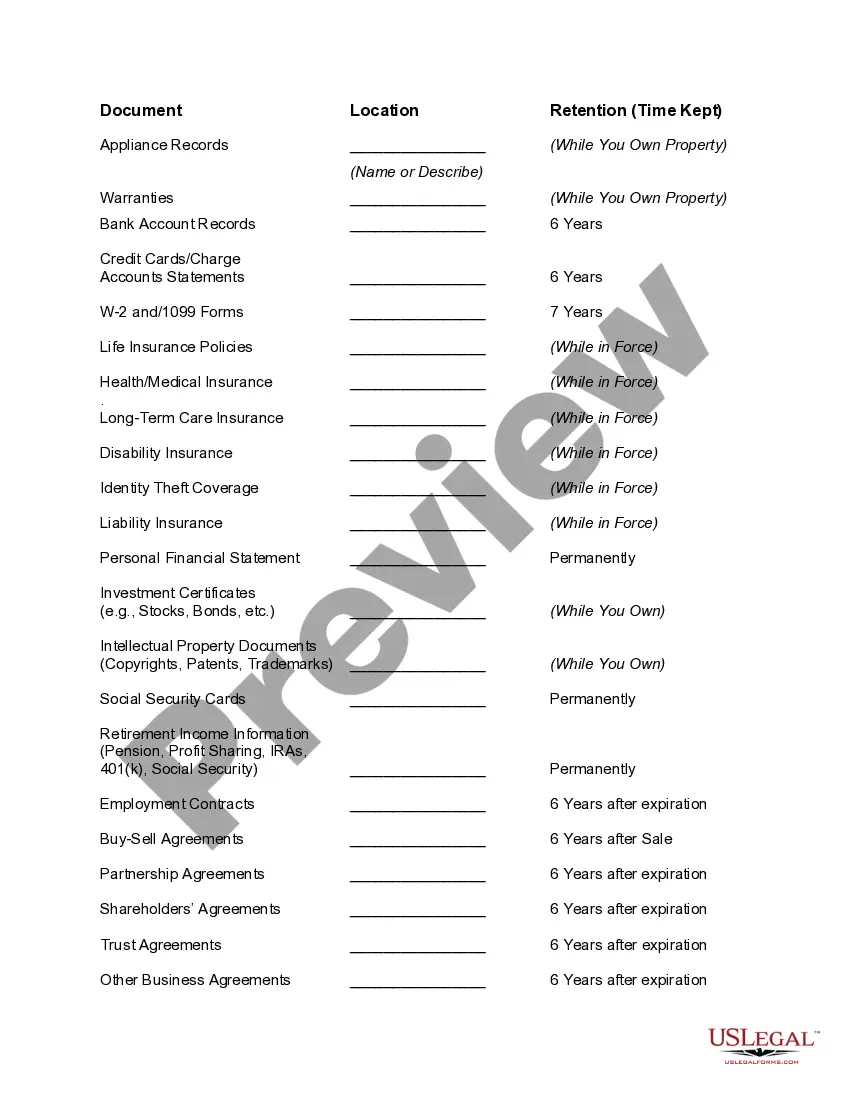

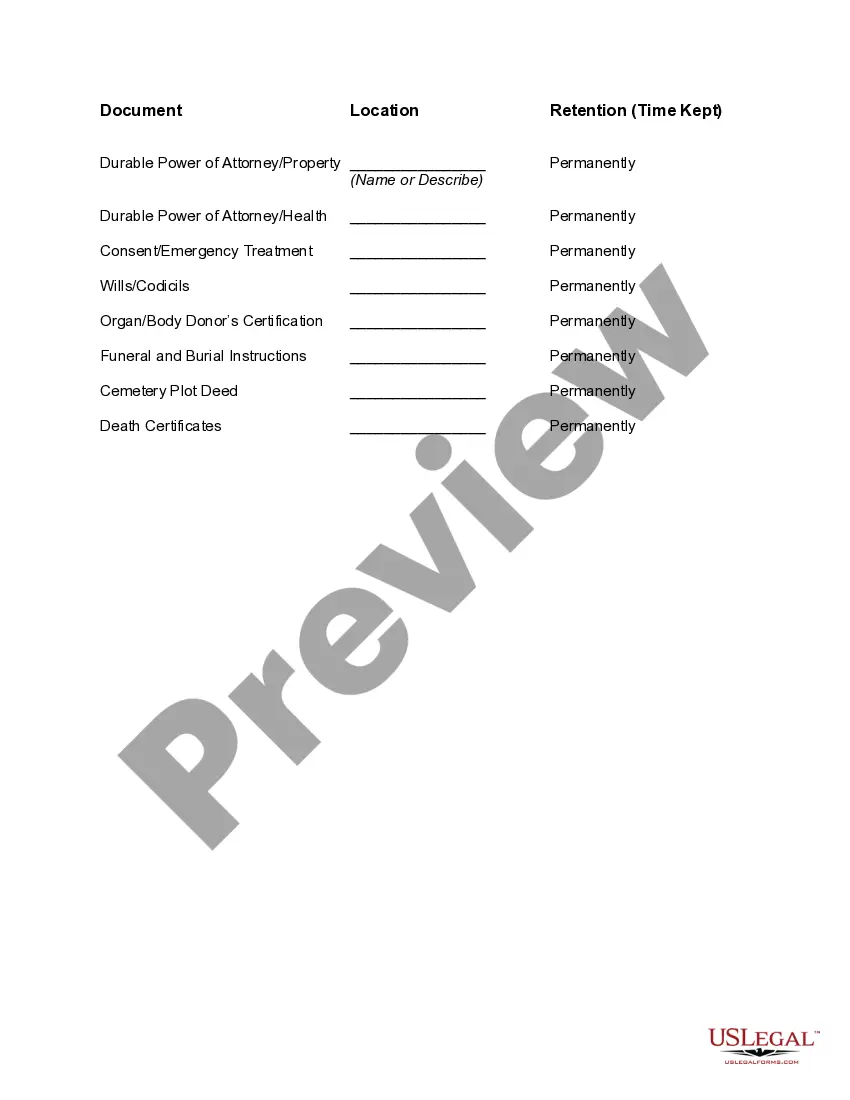

Tennessee Document Organizer and Retention

Description

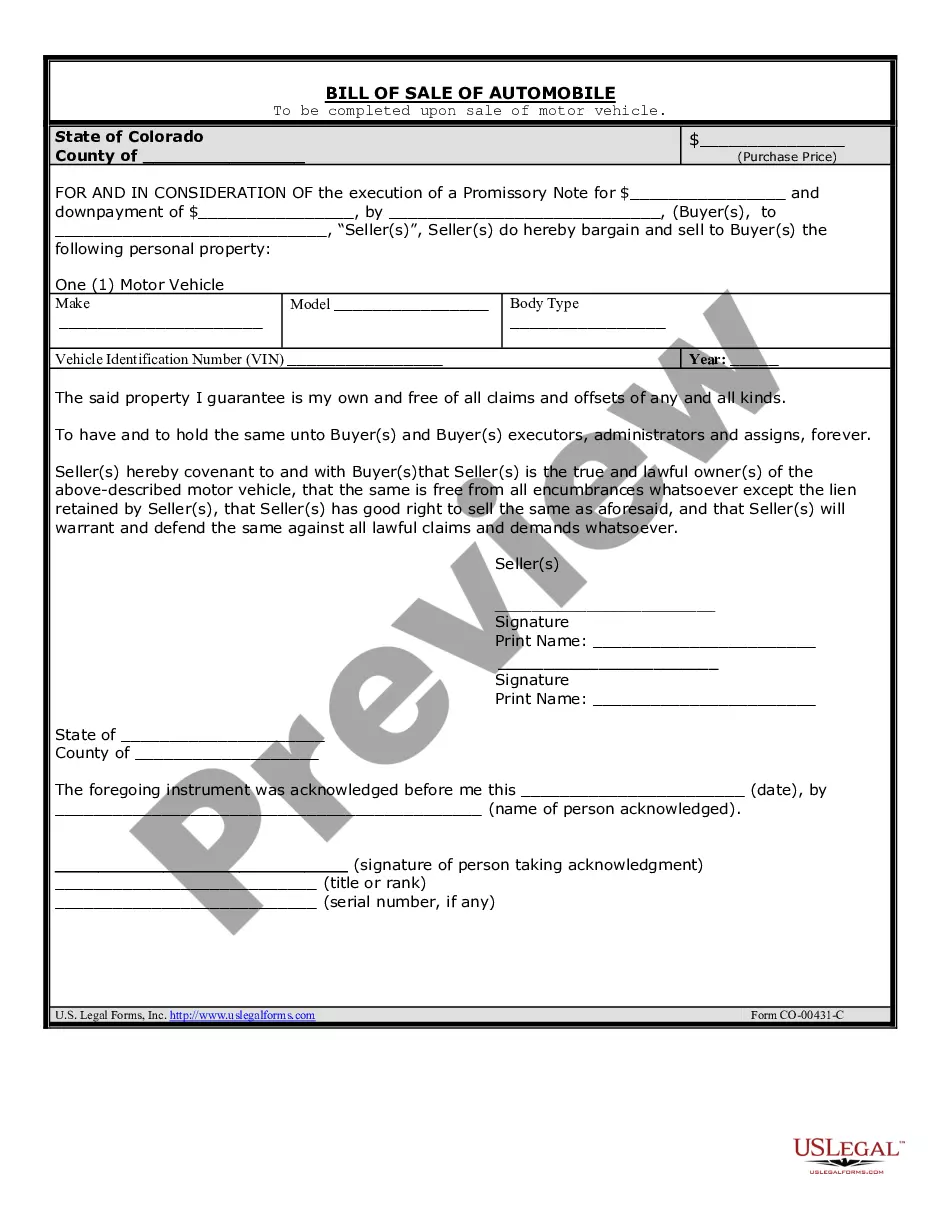

How to fill out Document Organizer And Retention?

Selecting the appropriate valid document template can be a challenge.

Clearly, there is an array of templates accessible online, but how can you acquire the valid format you require.

Utilize the US Legal Forms website. The platform offers numerous templates, such as the Tennessee Document Organizer and Retention, suitable for business and personal needs.

You can review the form using the Preview button and examine the form description to ensure it is suitable for your needs. If the form does not meet your requirements, use the Search area to find the appropriate document.

- All forms are validated by experts and conform to federal and state regulations.

- If you are already a member, Log In to your account and click the Acquire button to download the Tennessee Document Organizer and Retention.

- Use your account to browse the legal documents you have previously purchased.

- Visit the My documents section of your account and download another copy of the documents you require.

- If you are a new user of US Legal Forms, here are some simple steps to follow.

- First, ensure you have selected the right document for your city/county.

Form popularity

FAQ

6.2 Retention times for specific records are defined in Table 1, unless otherwise specified quality records shall be retained for 10 years. In no case shall the retention time be less than seven years after final payment on the associated contract.

Bank statements, credit card statements, canceled checks, paid invoices and other financial information quickly pile up. Accountants typically will advise businesses to keep their bank account and credit statements for 7 years.

The minimum retention period is the shortest amount of time that a WORM file can be retained in a SnapLock volume. If the application sets the retention period shorter than the minimum retention period, Data ONTAP adjusts the retention period of the file to the volume's minimum retention period.

Records Retention Guideline # 1: Some items should never be thrown outIncome tax returns and payment checks.Important correspondence.Legal documents.Vital records (birth / death / marriage / divorce / adoption / etc.)Retirement and pension records.More items...

Regarding employment and payroll data, under the Fair Labor Standards Act (FLSA) and others, you must: For at least 3 years: keep payroll records, certificates, agreements, notices, collective bargaining agreements, employment contracts, and sales and purchase records.

For example, if financial records have a retention period of five years, and the records were created during the 1995-1996 fiscal year (July 1, 1995 - June 30, 1996), the five-year retention period begins on July 1, 1996 and ends five years later on July 1, 2001.

A retention period (associated with a retention schedule or retention program) is an aspect of records and information management (RIM) and the records life cycle that identifies the duration of time for which the information should be maintained or "retained," irrespective of format (paper, electronic, or other).

The general minimum amount of time to keep business records is a minimum of 7 years. The following documents and records should be kept; Business Tax Returns and other supporting documents: Until the IRS can no longer audit your return.

Knowing that, a good rule of thumb is to save any document that verifies information on your tax returnincluding Forms W-2 and 1099, bank and brokerage statements, tuition payments and charitable donation receiptsfor three to seven years.

How much should be the retention of internal audit and MRM records? The logical answer is a minimum of 3 years as that is the time frame of ISO certificate.