Tennessee Borrowers Certification of No Material Change No Damage

Description

How to fill out Borrowers Certification Of No Material Change No Damage?

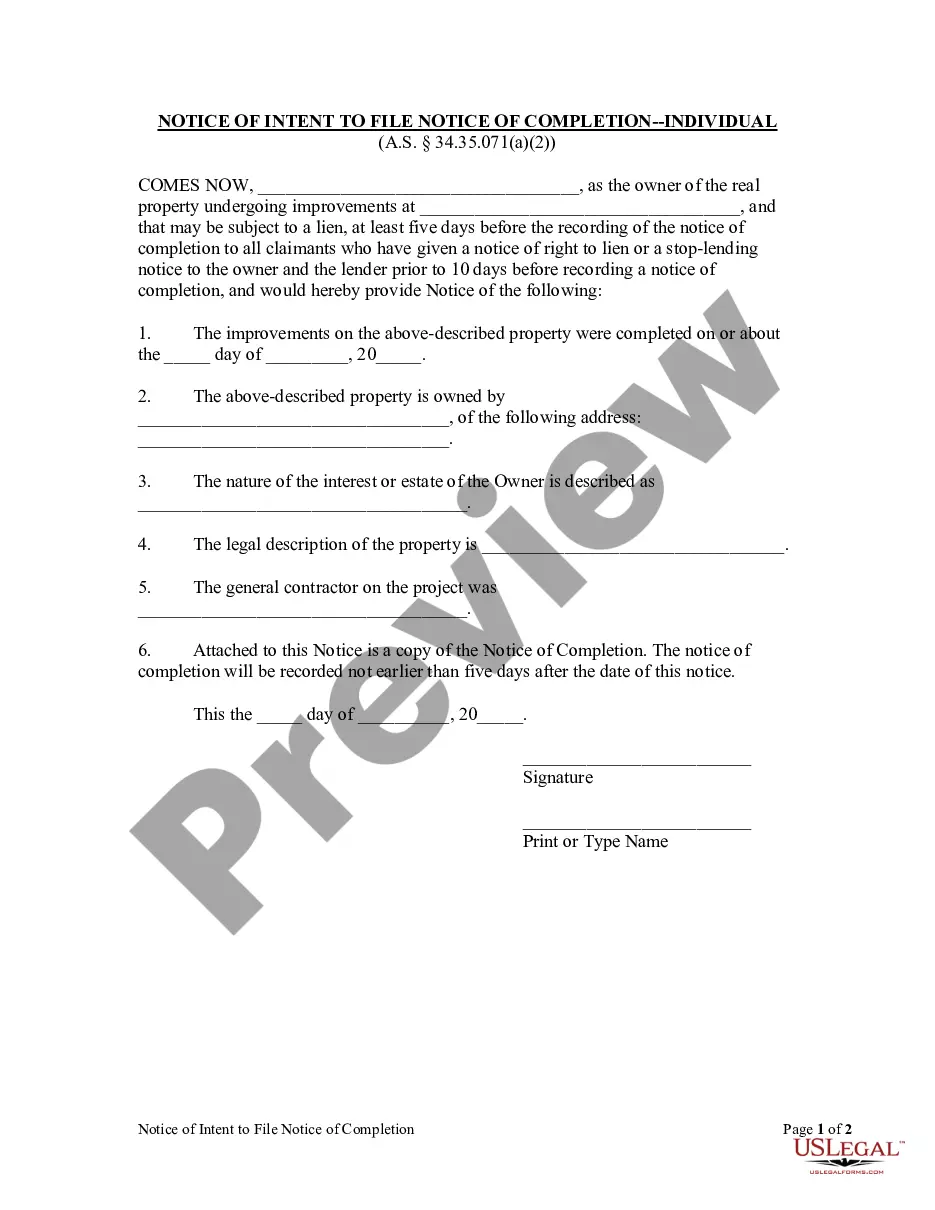

US Legal Forms - among the greatest libraries of authorized forms in the USA - gives an array of authorized record themes you can download or printing. Making use of the website, you can find a huge number of forms for company and individual reasons, categorized by classes, suggests, or keywords.You will discover the most recent models of forms just like the Tennessee Borrowers Certification of No Material Change No Damage within minutes.

If you currently have a membership, log in and download Tennessee Borrowers Certification of No Material Change No Damage from your US Legal Forms local library. The Obtain button will show up on each form you look at. You have accessibility to all previously downloaded forms inside the My Forms tab of the account.

If you want to use US Legal Forms for the first time, allow me to share straightforward recommendations to get you started:

- Be sure to have selected the best form for your personal metropolis/state. Click on the Preview button to check the form`s content. Read the form explanation to actually have chosen the right form.

- If the form does not match your specifications, utilize the Lookup area at the top of the display screen to discover the one who does.

- If you are pleased with the shape, validate your option by clicking the Purchase now button. Then, select the costs prepare you like and offer your references to register to have an account.

- Process the deal. Make use of your bank card or PayPal account to finish the deal.

- Select the file format and download the shape on your own device.

- Make alterations. Fill up, modify and printing and indication the downloaded Tennessee Borrowers Certification of No Material Change No Damage.

Every template you included in your bank account lacks an expiry particular date and is also yours for a long time. So, in order to download or printing one more duplicate, just go to the My Forms portion and click on about the form you need.

Obtain access to the Tennessee Borrowers Certification of No Material Change No Damage with US Legal Forms, by far the most extensive local library of authorized record themes. Use a huge number of skilled and condition-distinct themes that meet your business or individual requires and specifications.

Form popularity

FAQ

Borrower Certification means, with respect to any request for a Loan, a certification of the Borrower stating that (i) no Default or Event of Default will occur or be continuing after giving effect to such Loan, and (ii) the proceeds of such Loan will be used solely for Permitted Uses.

In most states, your spouse doesn't need to be listed on the mortgage. However, if you're using an FHA loan to buy a house in one of the nine community property states, for example, your spouse's debts will still impact your ability to get a mortgage by yourself, even if they won't be listed on the loan.

(a) Notwithstanding any other provision of law, any person who purchases or is otherwise assigned a high-cost home loan shall be subject to all claims and defenses with respect to the high-cost home loan that the borrower could assert against the lender of the high-cost home loan, unless the purchaser or assignee ...

Can I Keep My Spouse's Name Off The Mortgage? Whether you live in a community property or common-law state, you have the option to leave your spouse off the mortgage. Let's take a look at some reasons it might make sense to apply for the mortgage alone.

Sole Ownership in Tennessee This means that spouses can buy, sell, or own property without the involvement of the non-owner spouse. The only exception to this is when using a deed of trust. A non-owner spouse would need to sign any deed of trust other than a purchase money deed of trust.

The borrower's certification and authorization also authorizes the lender to share information in the loan application with other parties. It also gives the lender the right to verify information in the loan application, credit application, and employment history.

If you are not on the mortgage for whatever reason, you are not liable for paying the mortgage loan. That said, you get your spouse's interest in the property if they die. However, if you default on mortgage payments, the mortgage lender has the power to foreclose on the home and evict you.

A: It is not a legal requirement. But any lender will want the Deed of Trust to be signed by both married parties because of occupancy and homestead rights which are encumbered by that instrument. If both do not sign, then the loan will probably not be made.