Tennessee Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse and Stock Transfer Restrictions

Description

How to fill out Shareholders Buy Sell Agreement Of Stock In A Close Corporation With Agreement Of Spouse And Stock Transfer Restrictions?

Have you ever found yourself in a circumstance where you require documents for either business or personal reasons almost all the time.

There are numerous legal form templates accessible online, but finding those that you can rely on is challenging.

US Legal Forms offers thousands of form templates, such as the Tennessee Shareholders Buy Sell Agreement of Stock in a Close Corporation with Spousal Agreement and Stock Transfer Limitations, which are designed to comply with state and federal regulations.

Once you find the right form, click on Get now.

Select the pricing plan you desire, complete the necessary information to create your account, and purchase the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Tennessee Shareholders Buy Sell Agreement of Stock in a Close Corporation with Spousal Agreement and Stock Transfer Limitations template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

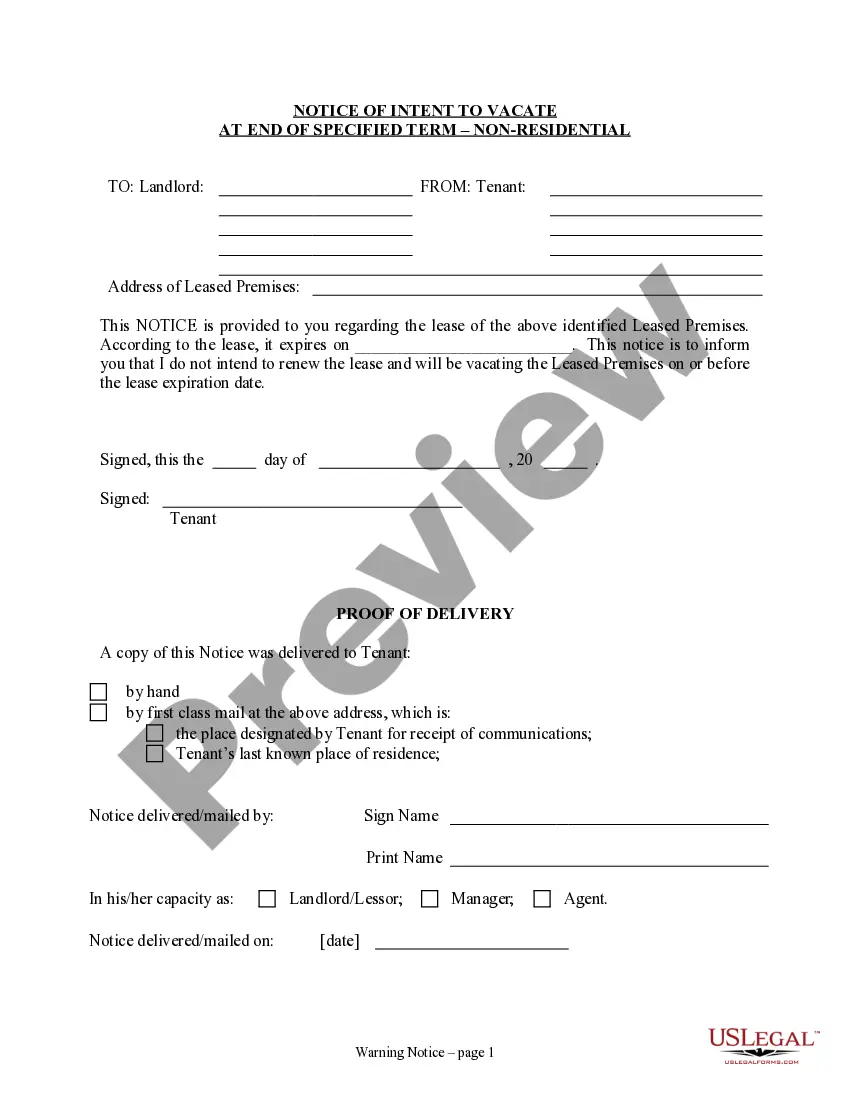

- Use the Preview button to review the form.

- Read the description to confirm that you have selected the appropriate form.

- If the form is not what you are looking for, use the Search field to find the form that meets your needs and requirements.

Form popularity

FAQ

Despite their many benefits, buy-sell agreements may have some disadvantages. For instance, they can limit flexibility in transferring shares and may require assistance from legal professionals to set up, which could incur additional costs. Therefore, it is essential to carefully consider your business's specific needs before implementing a Tennessee Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse and Stock Transfer Restrictions.

A buyout may lead to financial strain on the company, especially if funds are limited. Additionally, the Tennessee Shareholders Buy Sell Agreement of Stock in a Close Corporation with Agreement of Spouse and Stock Transfer Restrictions may require extensive negotiations, which can be time-consuming. Furthermore, buyouts can alter the dynamics of the company and lead to uncertainty among remaining shareholders.

The key elements of a buy-sell agreement include:Element 1. Identify the parties.Element 2. Triggered buyout event.Element 3. Buy-sell structure.Element 4. Company valuation.Element 5. Funding resources.Element 6. Taxation considerations.

What happens with no shareholders' agreement? With no shareholders' agreement, both the company as a whole and individual shareholders could be exposed to unresolvable future conflict. Without an agreement to clarify the legal standpoint of each party, if a dispute occurs, a deadlock situation could occur.

A shareholder agreement, on the other hand, is optional. This document is often by and for shareholders, outlining certain rights and obligations. It can be most helpful when a corporation has a small number of active shareholders.

In a cross-purchase agreement, one or more of the remaining shareholders agrees to purchase the stock from the estate of a deceased shareholder or from the departing shareholder.

Buy-sell agreements, also called buyout agreements and shareholder agreements, are legally binding documents between two business partners that govern how business interests are treated if one partner leaves unexpectedly.

Definition. A buy/sell-back is a pair of simultaneous transactions: the first is the purchase of a bond or other asset and the second is the sale of the same asset back again from the same counterparty for settlement on a later date.

A buy/sell clause provides a mechanism for how and when the remaining shareholders can purchase a departing shareholder's shares due to a triggering event, such as a shareholder retirement, disability, death or dispute. It also defines how that purchase will be funded to ensure liquidity.

A shareholder agreement, on the other hand, is optional. This document is often by and for shareholders, outlining certain rights and obligations. It can be most helpful when a corporation has a small number of active shareholders.