Tennessee Sample Letter regarding Articles of Incorporation - Drafts of Minutes

Description

How to fill out Sample Letter Regarding Articles Of Incorporation - Drafts Of Minutes?

Are you in the placement where you will need paperwork for either company or individual uses just about every working day? There are plenty of legal document web templates available online, but finding ones you can depend on is not easy. US Legal Forms delivers a huge number of develop web templates, like the Tennessee Sample Letter regarding Articles of Incorporation - Drafts of Minutes, that are composed to satisfy state and federal specifications.

When you are already informed about US Legal Forms web site and possess your account, just log in. Following that, you can download the Tennessee Sample Letter regarding Articles of Incorporation - Drafts of Minutes template.

If you do not offer an accounts and want to begin using US Legal Forms, abide by these steps:

- Discover the develop you need and make sure it is for that correct city/county.

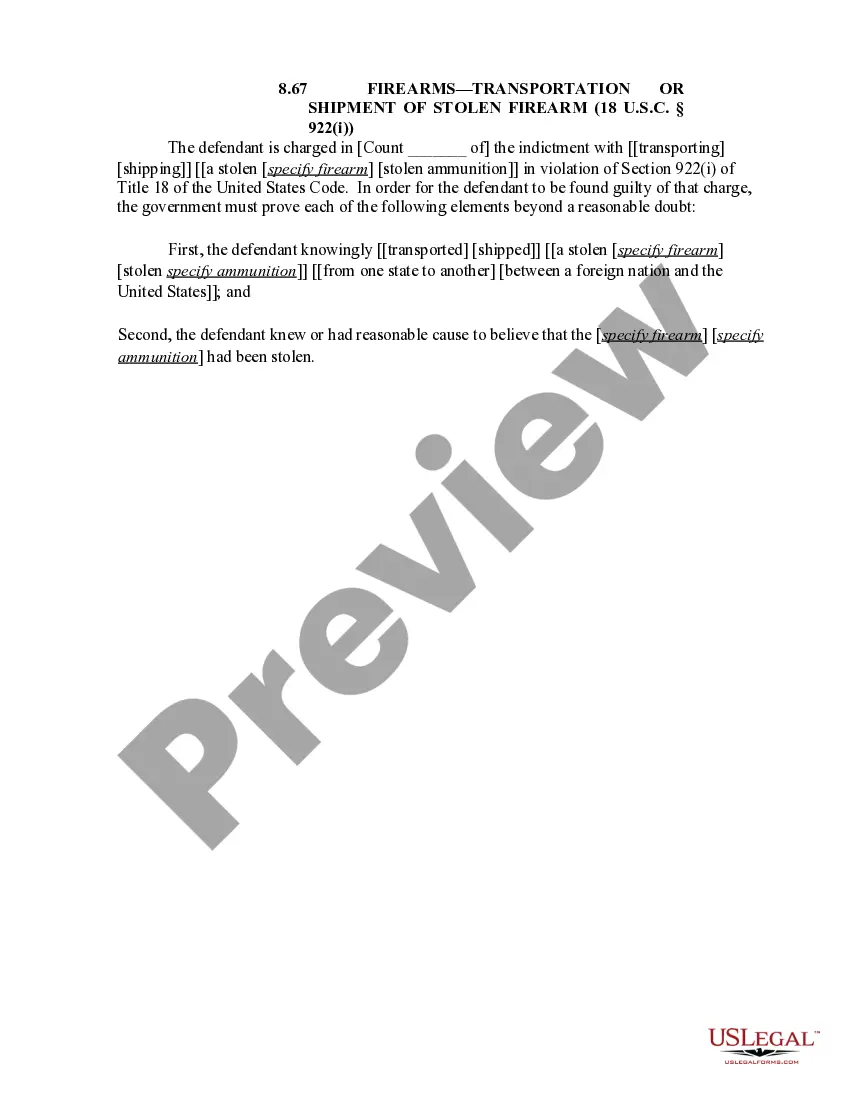

- Make use of the Preview option to check the form.

- Look at the information to actually have selected the appropriate develop.

- In case the develop is not what you are seeking, take advantage of the Lookup field to discover the develop that meets your requirements and specifications.

- If you get the correct develop, click on Purchase now.

- Choose the rates plan you need, submit the specified information to produce your account, and purchase an order with your PayPal or charge card.

- Select a handy data file formatting and download your version.

Find all the document web templates you have purchased in the My Forms food selection. You may get a more version of Tennessee Sample Letter regarding Articles of Incorporation - Drafts of Minutes whenever, if necessary. Just go through the necessary develop to download or produce the document template.

Use US Legal Forms, the most substantial collection of legal kinds, to save lots of efforts and stay away from blunders. The support delivers professionally created legal document web templates that you can use for an array of uses. Generate your account on US Legal Forms and start generating your daily life a little easier.

Form popularity

FAQ

Basic Requirements Corporations are required to hold meetings only once a year, especially if the corporation is small. The corporation must give adequate notice to company shareholders or directors and maintain annual meeting minutes, which are a written record of proceedings at the meeting.

Articles of Incorporation example Information about authorized shares. The legal name of the company. The company's official address. The business purpose. A Tax ID number. The names and contact information of official agents of the company. The date of incorporation.

To start a corporation in Tennessee, you must file a For-Profit Corporation Charter with the Secretary of State. You can file the document online, by mail or in person. The For-Profit Corporation Charter costs $100 to file ($102.35 for online filings).

Tennessee-Specific Considerations Just like C corporations, S corporations must pay a 6.5% excise tax in addition to a franchise tax, which is equal to the greater of $0.25 for each $100 of net worth or actual value of tangible property, but no less than $100. However, Tennessee has no personal income tax.

The articles should include: The corporation's name, location, and purpose. The number of shares the corporation is authorized to issue. The registered agent's name and registered office's address. Each incorporator's name and address. The names of each initial director. The corporation's purpose and primary activities.

LLCs can have an unlimited number of members; S corps can have no more than 100 shareholders (owners). Non-U.S. citizens/residents can be members of LLCs; S corps may not have non-U.S. citizens/residents as shareholders. S corporations cannot be owned by corporations, LLCs, partnerships or many trusts.

Immediately in-person. Choose a Corporate Structure. Incorporating means starting a corporation. ... Check Name Availability. ... Appoint a Registered Agent. ... File Tennessee Articles of Incorporation. ... Establish Bylaws & Corporate Records. ... Appoint Initial Directors. ... Hold Organizational Meeting. ... Issue Stock Certificates.

One main difference is that C-corp owners pay a corporate tax to the federal, and sometimes state, governments, while S-corps don't. S-corps owners are limited to 100 shareholders and must file a special form with the IRS to elect S-corp status.