Tennessee Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption

Description

How to fill out Certification Of No Information Reporting On Sale Or Exchange Of Principal Residence - Tax Exemption?

If you aim to finalize, obtain, or create authentic document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the website's straightforward and user-friendly search to find the documents you need.

A selection of templates for commercial and personal applications is organized by categories and states, or keywords.

Every legal document template you purchase is yours permanently. You have access to every form you have acquired in your account. Click on the My documents section and select a form to print or download again.

Complete, obtain, and print the Tennessee Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption with US Legal Forms. There are millions of professional and state-specific forms available for your commercial or personal needs.

- Utilize US Legal Forms to locate the Tennessee Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption with just a few clicks.

- If you are already a US Legal Forms member, sign in to your account and click the Download button to obtain the Tennessee Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption.

- You can also access forms you have previously obtained from the My documents section of your account.

- If this is your first experience with US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

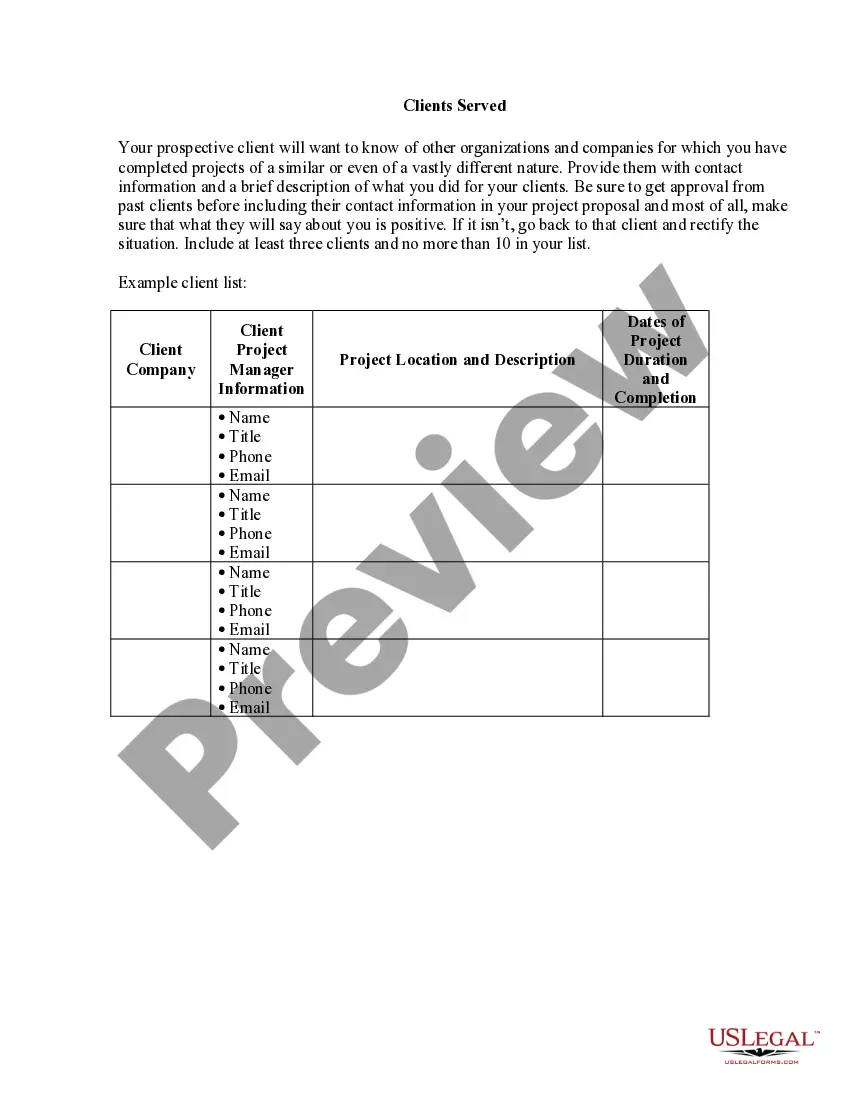

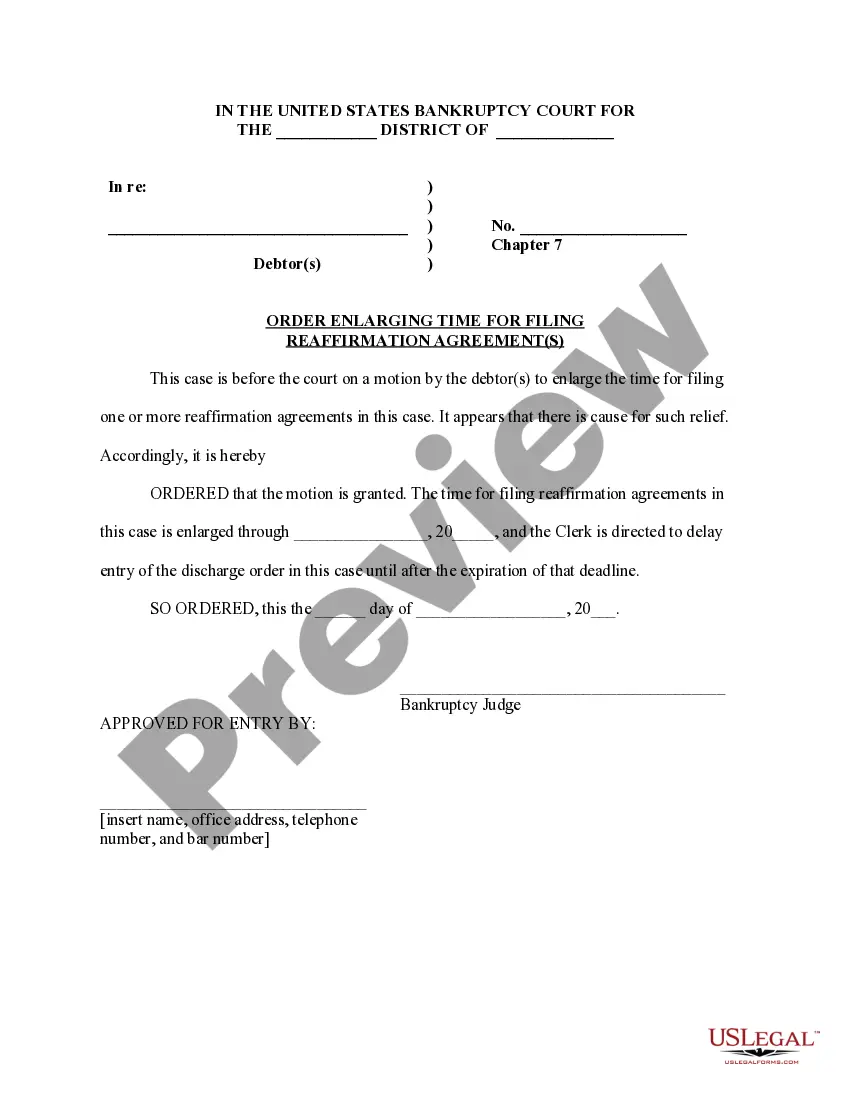

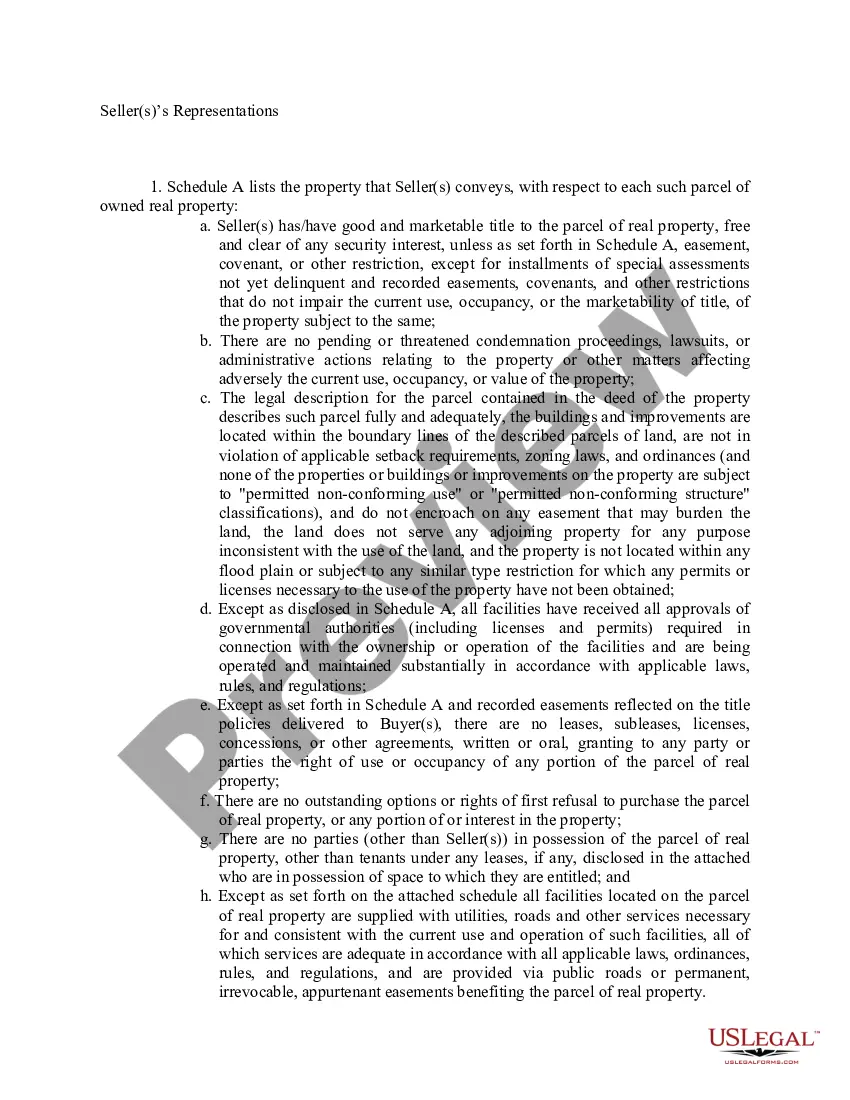

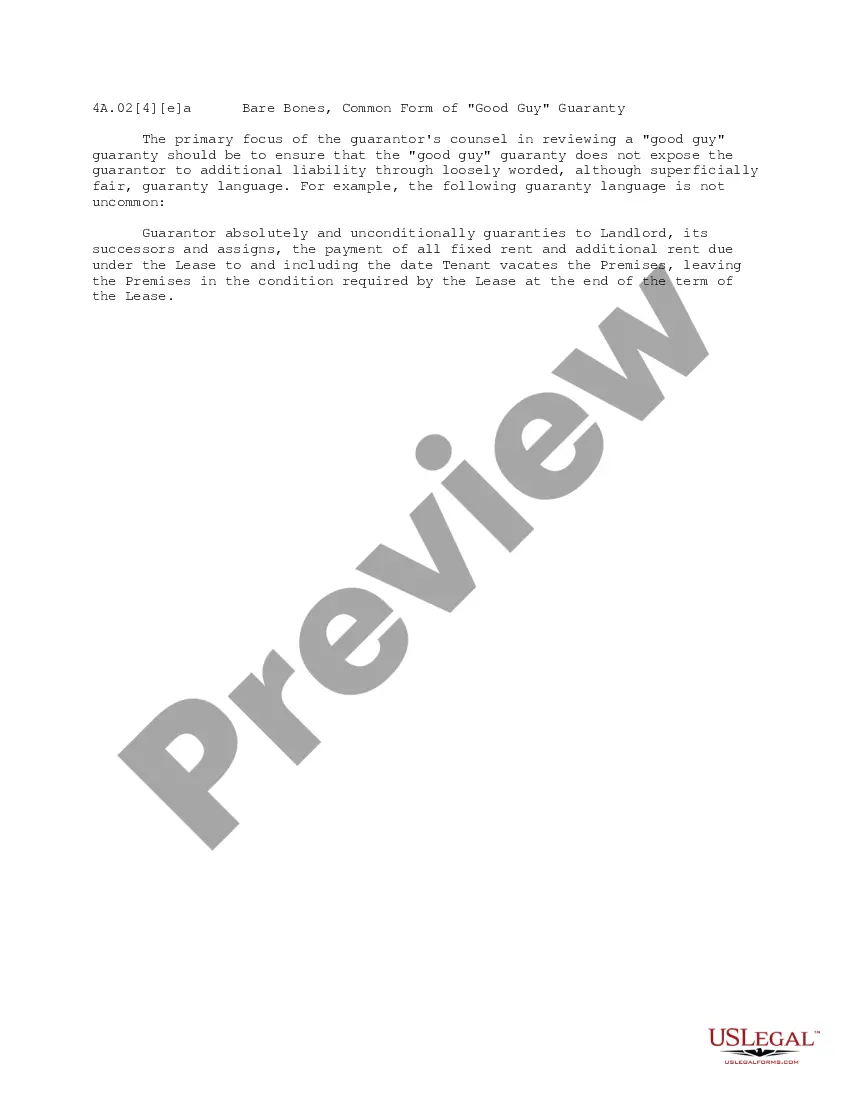

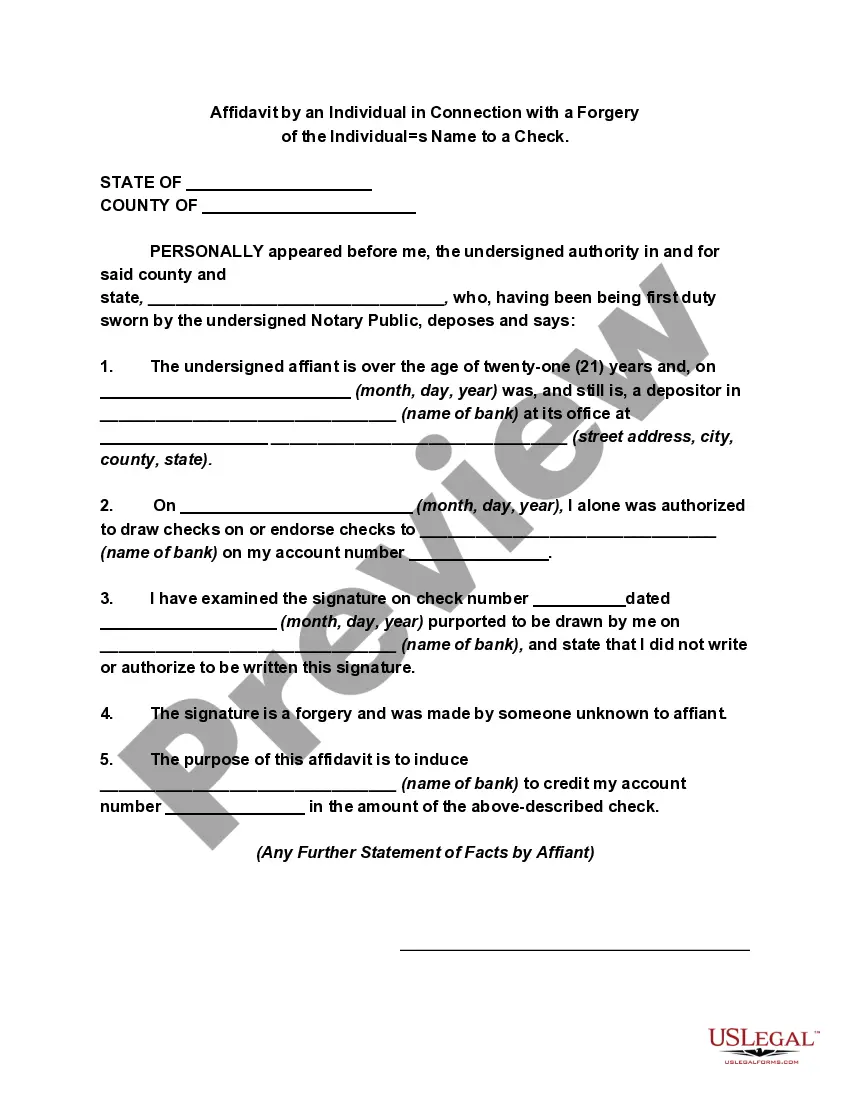

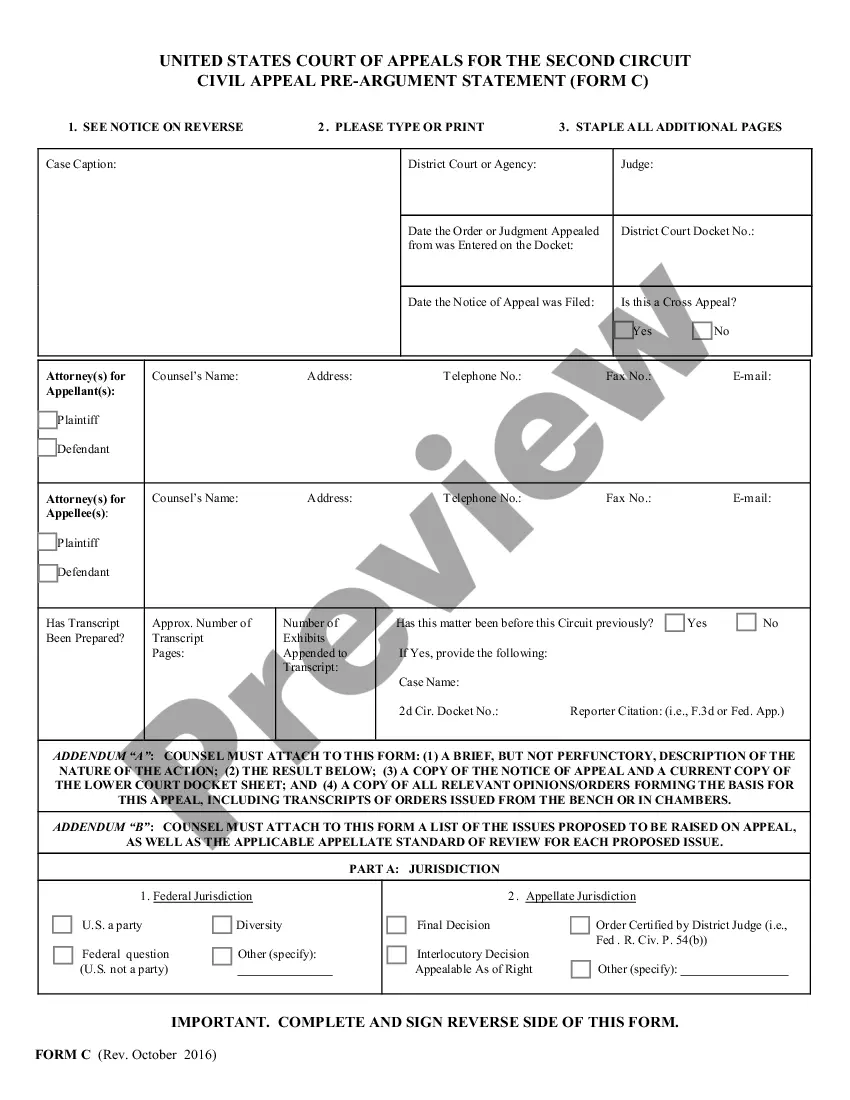

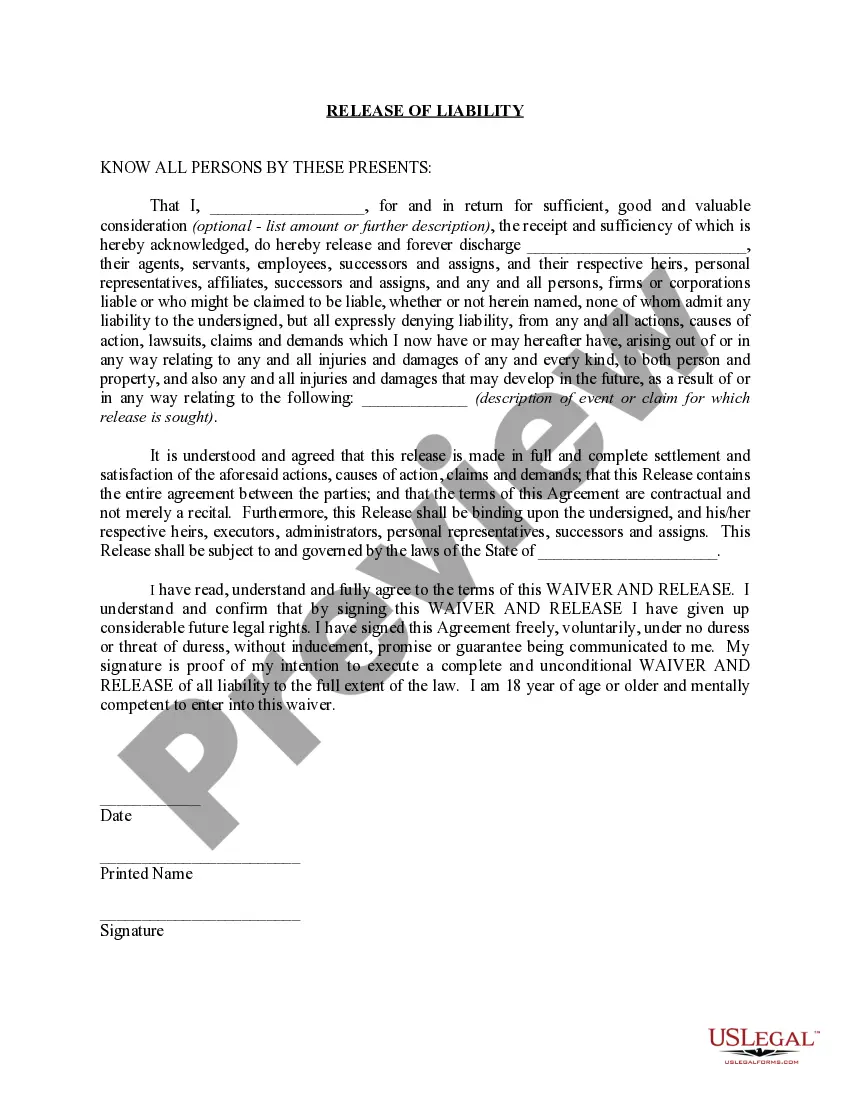

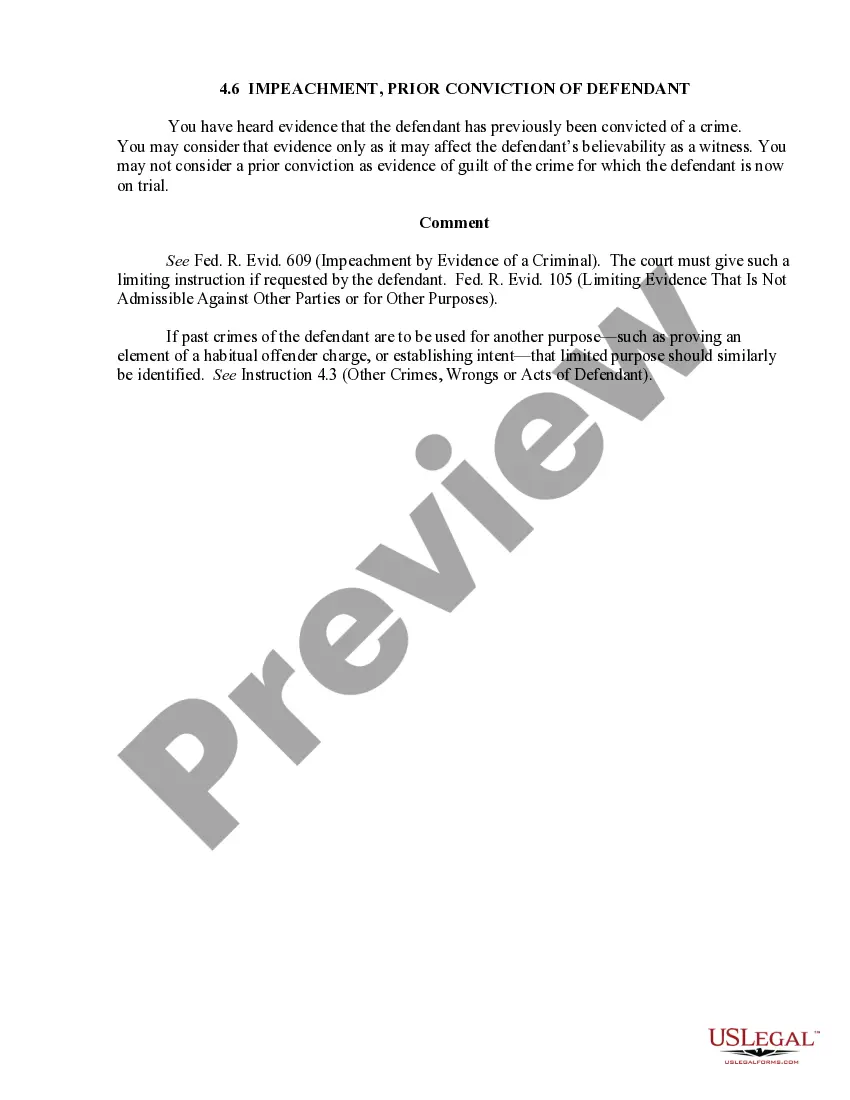

- Step 2. Use the Preview option to review the form's content. Be sure to read the information.

- Step 3. If you are unsatisfied with the form, utilize the Search field at the top of the screen to find alternative forms in the legal template category.

- Step 4. Once you have found the form you need, click the Get Now button. Choose your preferred pricing plan and enter your information to create an account.

- Step 5. Process the transaction. You can utilize your credit card or PayPal account to complete the payment.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the Tennessee Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption.

Form popularity

FAQ

Not every sale of a home prompts the issuance of a 1099-S form. The issuance usually depends on the details of the transaction and if you meet specific criteria set by the IRS. If you qualify for the Tennessee Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption, you might not receive a 1099-S. Always verify your eligibility and keep thorough records of your transactions.

Tangible personal property, taxable services, amusements, and digital products specifically intended for resale are not subject to tax. Retail sales to the federal government or its agencies and the State of Tennessee or a county or municipality within Tennessee are not subject to tax.

To obtain a Certificate of Tax Clearance, contact the Tennessee Department of Revenue at (615) 741-8999.

Tax-exempt refers to income or transactions that are free from tax at the federal, state, or local level. The reporting of tax-free items may be on a taxpayer's individual or business tax return and shown for informational purposes only. The tax-exempt article is not part of any tax calculations.

An official document that gives someone special permission not to do or pay something: a medical/tax exemption certificate.

Sales tax exemption certificates enable a purchaser to make tax-free purchases that would normally be subject to sales tax. The purchaser fills out the certificate and gives it to the seller. The seller keeps the certificate and may then sell property or services to the purchaser without charging sales tax.

A tax clearance certificate (TCC) is a document issued by SARS confirming that the applicant's tax affairs are in order. TCCs are required for tender applications, to reflect "good standing, for foreign investment, and for emigration purposes.

In Tennessee a Tax Status Compliance Certificate is called a Letter of Tax Clearance and is issued by the Tennessee Department of Revenue for a Company or Sole Proprietor which has met all of its Tennessee tax obligations.

You likely received a Tennessee resale certificate when you registered for your Tennessee sales tax permit. If you don't have this document, you can contact the Tennessee Department of Revenue to request a new copy by calling 615-253-0600 or submitting a request on their website.

Before entering a new contract or a continuing contract with the Government, its Department, Agencies and Instrumentalities, one of the requirements is to submit a Tax Clearance Certificate (TCC) from the Bureau of Internal Revenue (BIR) to prove full and timely payment of taxes, and compliance with tax laws.