A judicial foreclosure proceeding can be initiated at any time after default on a secured obligation or a judgment which constitutes a lien on real property. The following form is a complaint that adopts the "notice pleadings" format of the Federal Rules of Civil Procedure, which have been adopted by most states in one form or another. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

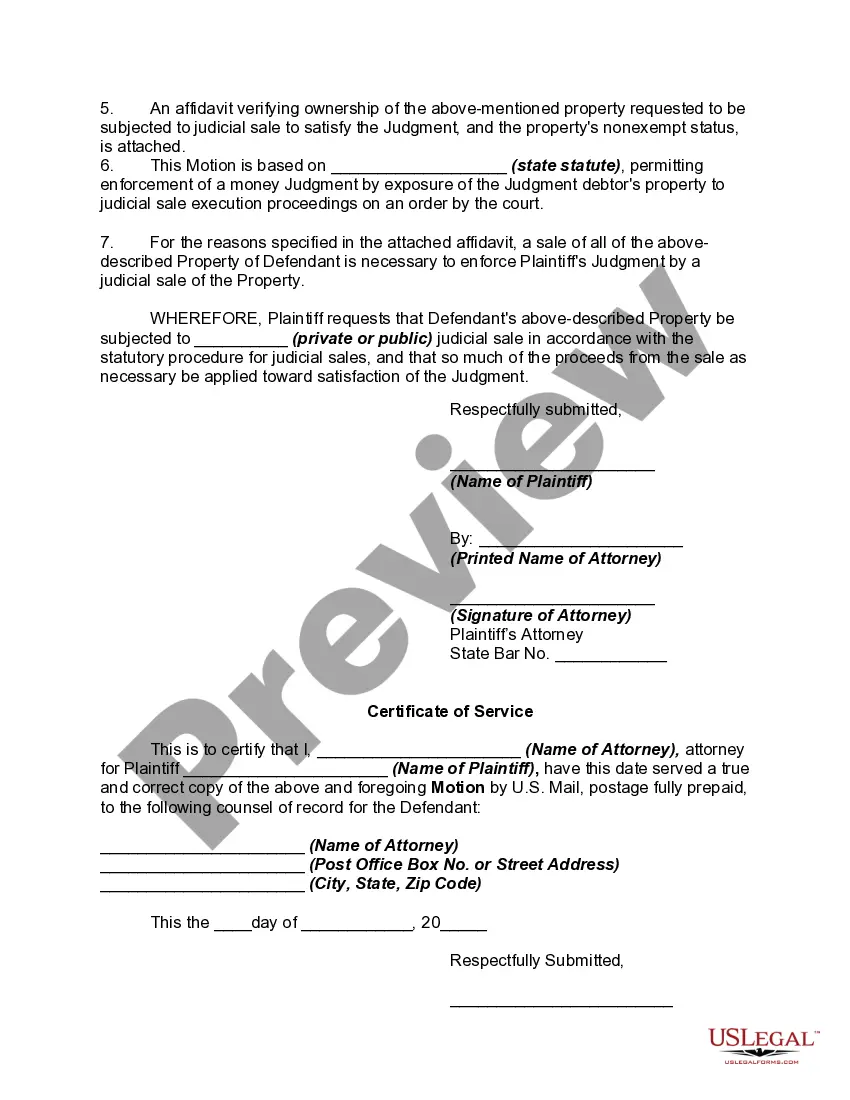

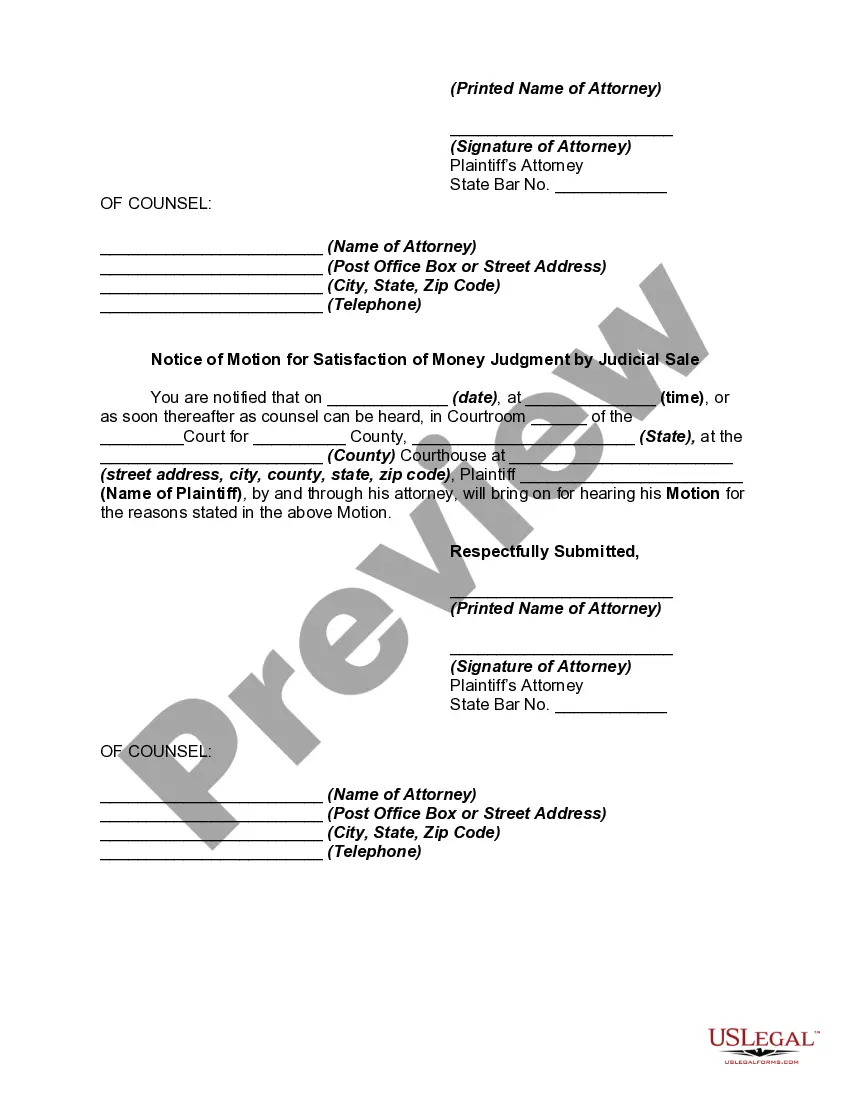

Tennessee Motion for Satisfaction of Money Judgment by Judicial Sale

Description

How to fill out Motion For Satisfaction Of Money Judgment By Judicial Sale?

Are you currently within a place in which you need to have documents for possibly company or individual reasons virtually every working day? There are a lot of legitimate papers layouts available on the Internet, but locating kinds you can trust isn`t simple. US Legal Forms offers thousands of type layouts, just like the Tennessee Motion for Satisfaction of Money Judgment by Judicial Sale, which can be written to meet state and federal demands.

In case you are presently knowledgeable about US Legal Forms site and possess an account, just log in. Next, you may down load the Tennessee Motion for Satisfaction of Money Judgment by Judicial Sale template.

Should you not offer an bank account and wish to start using US Legal Forms, abide by these steps:

- Get the type you want and make sure it is for the appropriate area/area.

- Use the Preview switch to review the form.

- See the explanation to actually have selected the proper type.

- If the type isn`t what you`re seeking, make use of the Lookup field to discover the type that suits you and demands.

- Once you get the appropriate type, click on Acquire now.

- Select the pricing strategy you desire, submit the specified info to produce your account, and pay for the order making use of your PayPal or credit card.

- Decide on a hassle-free document format and down load your copy.

Get every one of the papers layouts you may have bought in the My Forms menus. You may get a additional copy of Tennessee Motion for Satisfaction of Money Judgment by Judicial Sale at any time, if possible. Just go through the necessary type to down load or produce the papers template.

Use US Legal Forms, by far the most comprehensive collection of legitimate kinds, in order to save some time and steer clear of mistakes. The services offers professionally produced legitimate papers layouts that you can use for a range of reasons. Create an account on US Legal Forms and initiate creating your daily life easier.

Form popularity

FAQ

Once a judgment lien is created by registration as provided in § 25-5-101(b), it will last for the time remaining in a ten-year period from the date of final judgment entry in the court clerk's office.

A money judgment is enforced by a writ of execution, unless the court directs otherwise. The procedure on execution?and in proceedings supplementary to and in aid of judgment or execution?must with the procedure of the state where the court is located, but a federal statute governs to the extent it applies.

Tennessee judgments are good for 10 years. Tenn. Code Ann. § 28-3-110(2) limits the life of a judgment and provides that ?actions on judgments and decrees of courts of record of this or any other state or government ?

Specifically, Rule 69.04 of the Tennessee Rules of Civil Procedure provides that: Within ten years from the entry of a judgment, the creditor whose judgment remains unsatisfied may file a motion to extend the judgment for another ten years.

Collecting a Judgment in Tennessee Wage Garnishment. If you can discover the defendant's employer, you should file their employment information with the court. ... Bank Levy. If you know where the defendant has money in a bank account, you can also file this information with the court. ... Property Liens.

59.04 to alter or amend the judgment. These motions are the only motions contemplated in these rules for extending the time for taking steps in the regular appellate process. Motions to reconsider any of these motions are not authorized and will not operate to extend the time for appellate proceedings.

RULE 60. Clerical mistakes in judgments, orders or other parts of the record, and errors therein arising from oversight or omissions, may be corrected by the court at any time on its own initiative or on motion of any party and after such notice, if any, as the court orders.

How do I collect my money? If you know where the Judgment Debtor banks, you can ask the Sheriff to collect money from their account (bank account levy). If you know where the Judgment Debtor works, the Sheriff can collect 25% of the debtor's wages each pay period until your judgment is paid in full (wage garnishment).