Tennessee Sample Letter for Request to Creditor for Temporary Reduction of Loan Payment Amount

Description

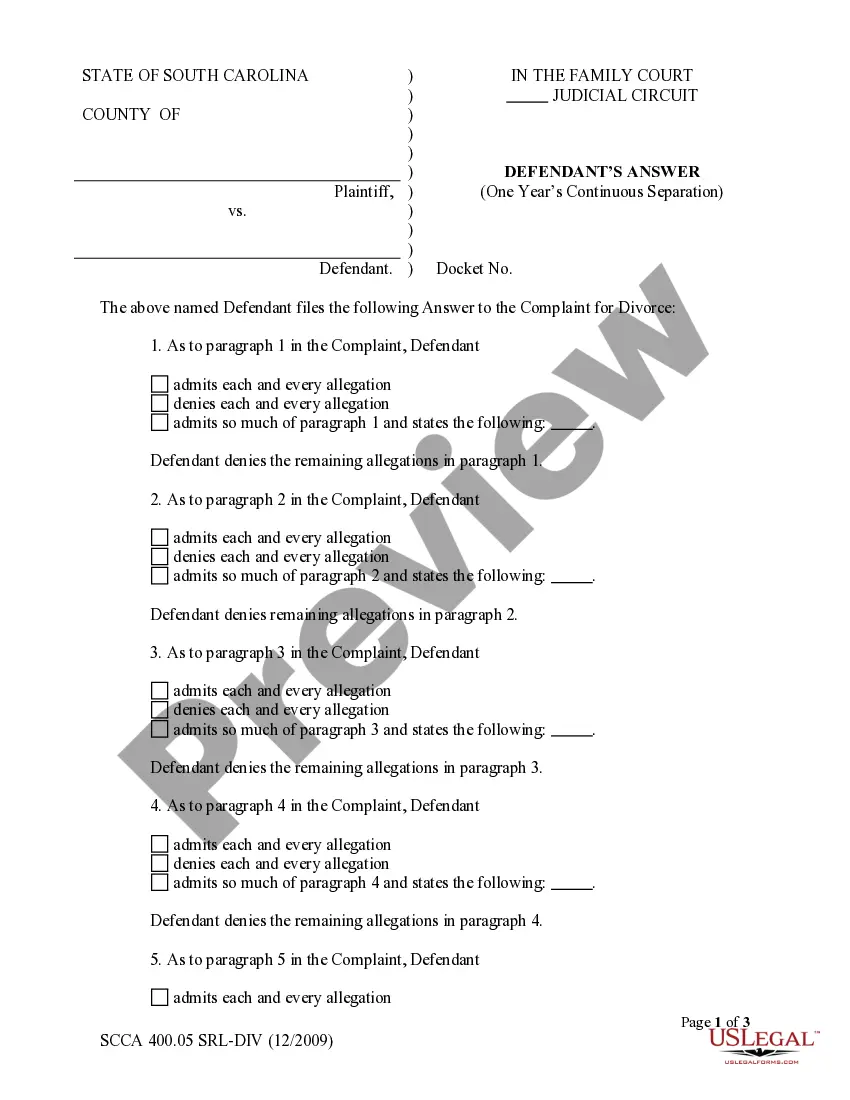

How to fill out Sample Letter For Request To Creditor For Temporary Reduction Of Loan Payment Amount?

If you wish to be thorough, obtain, or printing authentic document templates, utilize US Legal Forms, the most significant repository of authentic forms, that is accessible online.

Take advantage of the site's intuitive and user-friendly search feature to find the documents you require. Numerous templates for business and personal purposes are categorized by types and regions, or keywords.

Use US Legal Forms to acquire the Tennessee Sample Letter for Request to Creditor for Temporary Reduction of Loan Payment Amount with just a few clicks.

Step 5. Proceed with the payment. You can use your credit card or PayPal account to complete the transaction.

Step 6. Choose the format of the legal form and download it to your device. Step 7. Complete, edit, and print or sign the Tennessee Sample Letter for Request to Creditor for Temporary Reduction of Loan Payment Amount.

- If you are already a US Legal Forms customer, sign in to your account and then click the Acquire option to locate the Tennessee Sample Letter for Request to Creditor for Temporary Reduction of Loan Payment Amount.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Preview feature to review the form's content. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find additional templates of the legal form type.

- Step 4. Once you have found the form you need, click the Get now option. Select your preferred pricing plan and enter your details to create an account.

Form popularity

FAQ

Tips for Writing a Hardship LetterKeep it original.Be honest.Keep it concise.Don't cast blame or shirk responsibility.Don't use jargon or fancy words.Keep your objectives in mind.Provide the creditor an action plan.Talk to a Financial Couch.

Contact the creditor you've selected and ask the requirements for a letter of credit. You'll need to follow the creditor's procedures to get your letter. Provide any documents the creditor requests, such as the agreement you have with the seller and your financial documents.

Dear debt collector, I am responding to your contact about collecting a debt. You contacted me by phone/mail, on date and identified the debt as any information they gave you about the debt. I do not have any responsibility for the debt you're trying to collect.

A "hardship letter" is a letter that you write to your lender explaining the circumstances of your hardship. The letter should give the lender a clear picture of your current financial situation and explain what led to your financial difficulties. The hardship letter is a normal part of the loss mitigation process.

How to Write an Effective Hardship LetterPart 1: Explain what happened and why you are applying.Part 2: Specifically illustrate the time and severity of the hardship.Part 3: Back up the reasons traditional remedies won't work.Part 4: Detail why you are stable enough to succeed with a modification.More items...?

Some examples of events that a lender may consider to be a financial hardship include:Layoff or reduction in pay.New or worsening disability.Serious injury.Serious illness.Divorce or legal separation.Death.Incarceration.Military deployment or Permanent Change of Station orders.More items...?

Before you write a request letter, one should know to whom the letter is addressed....Here is the simple format of the request letter:Date.Recipient Name, designation and address.Subject.Salutation (Dear Sir/Mam, Mr./Mrs./Ms.)Body of the letter.Gratitude.Closing the letter (Your's Sincerely)Your Name and Signature.

Due to my financial hardship and in order to meet necessary household expenses plus credit payments, I am asking each creditor to accept a reduced payment for the next (#) months on my debt. By that time I hope to be back to work. If my situation improves sooner, I will notify you at that time.

Financial hardship may be deemed to exist when the debtor needs substantially all of his or her current and anticipated income and liquid assets to meet current and anticipated ordinary and necessary living expenses during the projected period of collection.

You can stop calls from collection agencies by sending a certified letter asking them to stop calling. Debt collectors must send you a written validation notice that states how much money you owe, the name of the creditor and how to proceed if you want to dispute the debt.