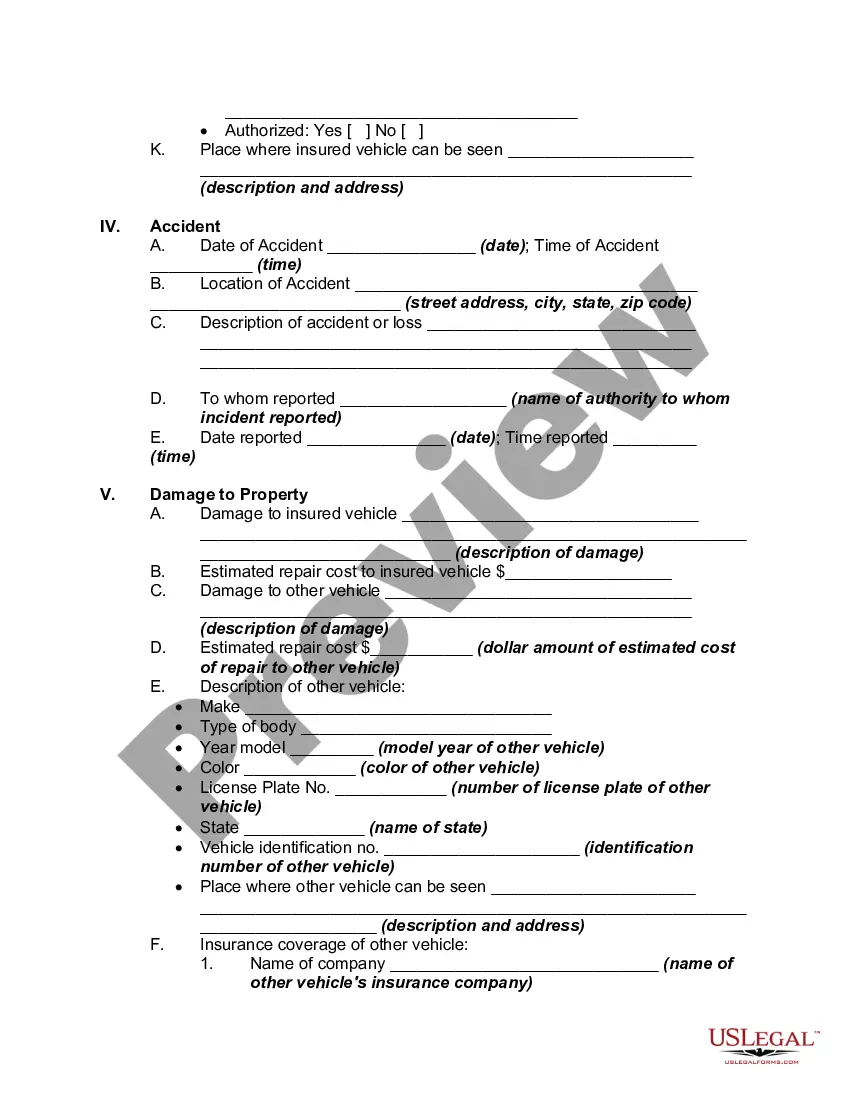

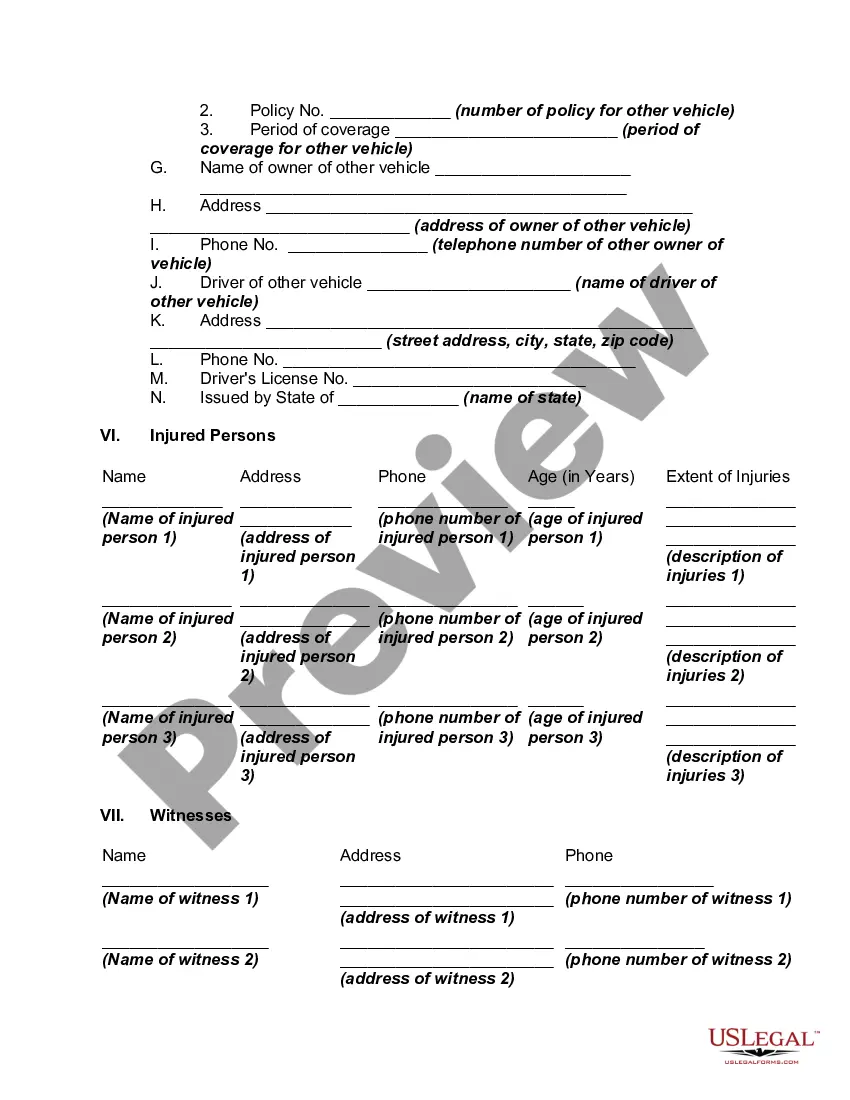

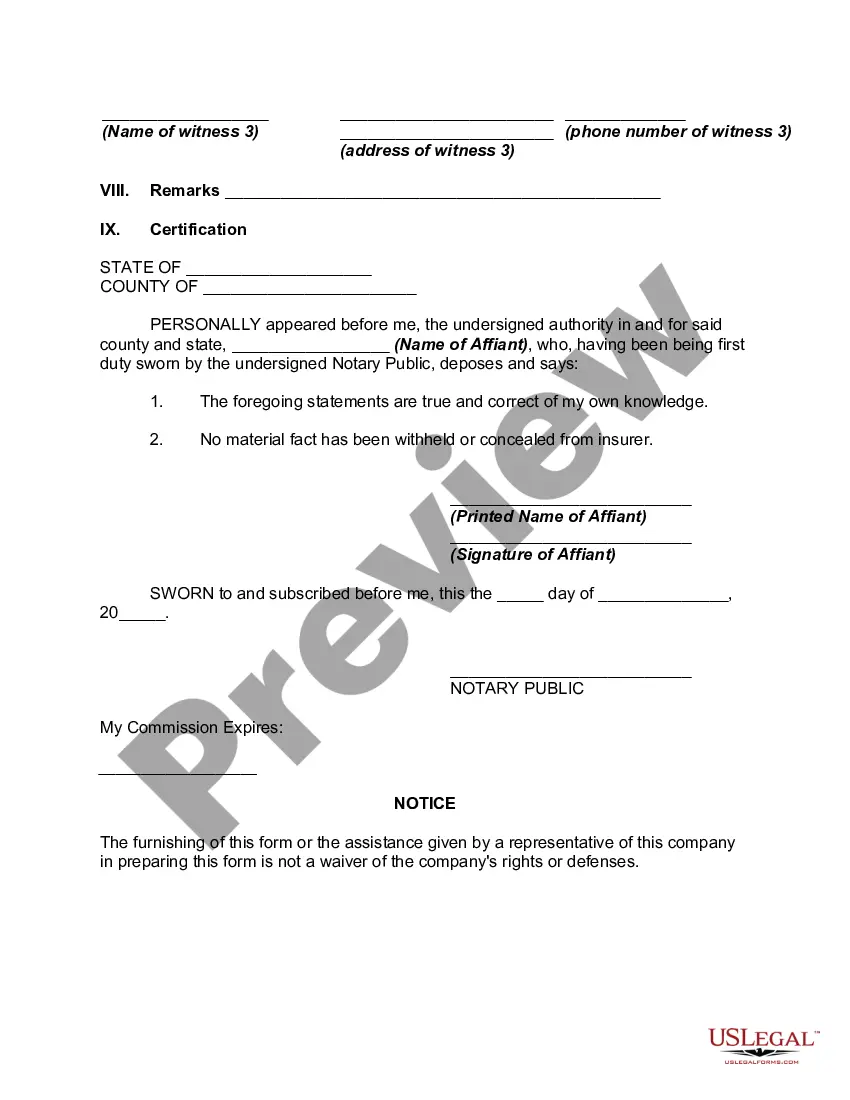

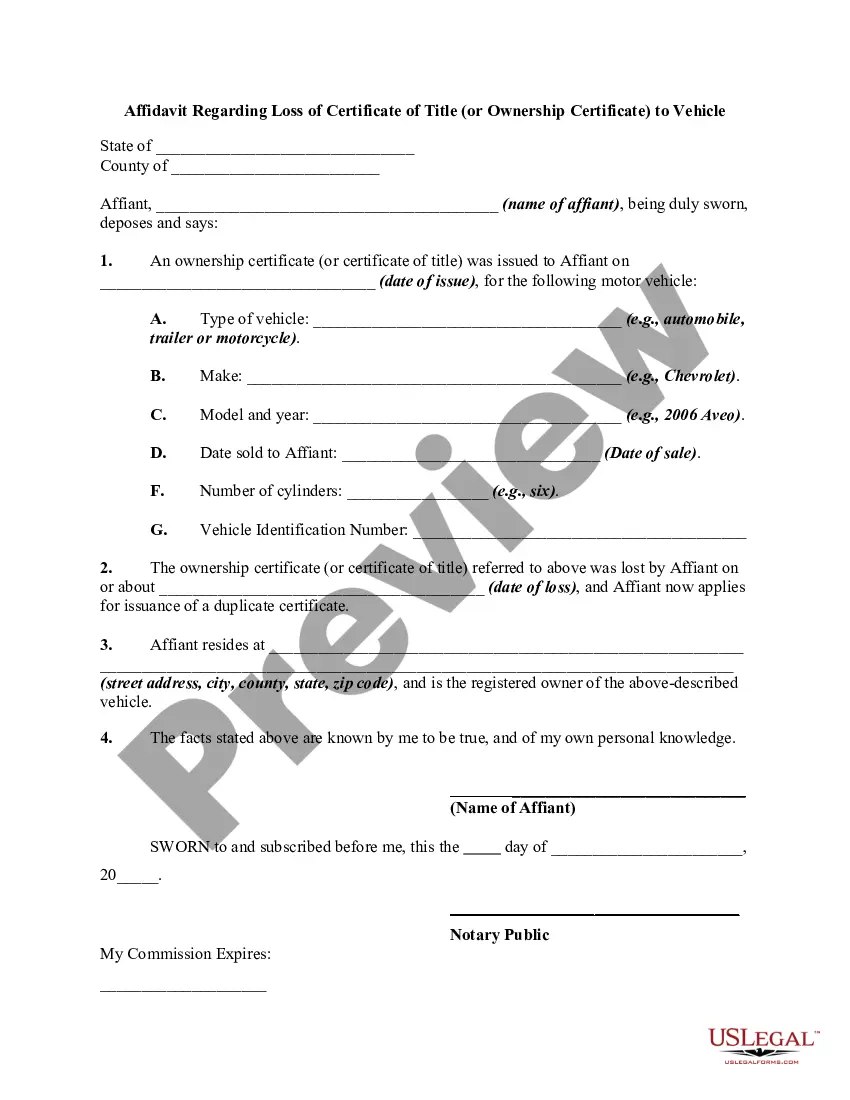

Tennessee Sworn Statement regarding Proof of Loss for Automobile Claim

Description

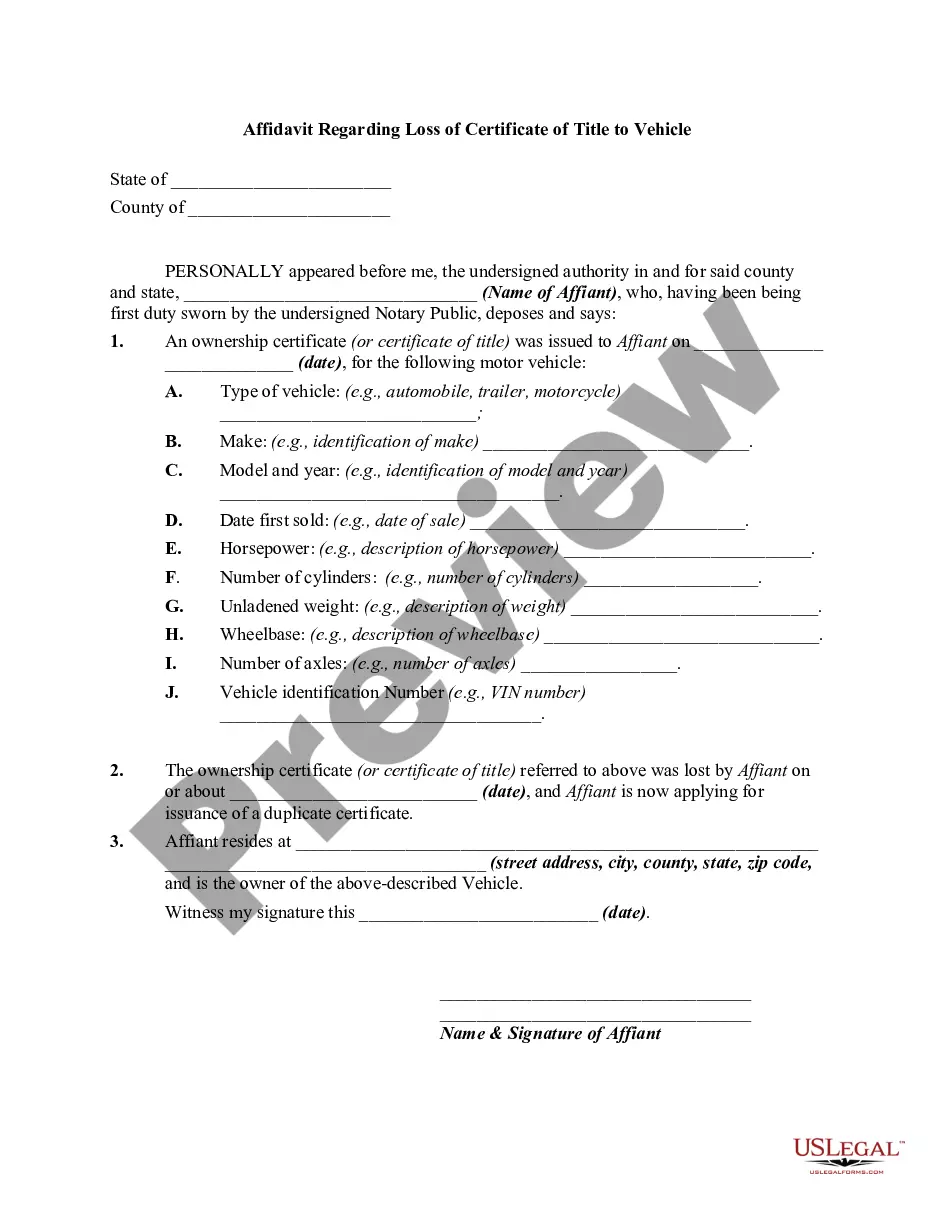

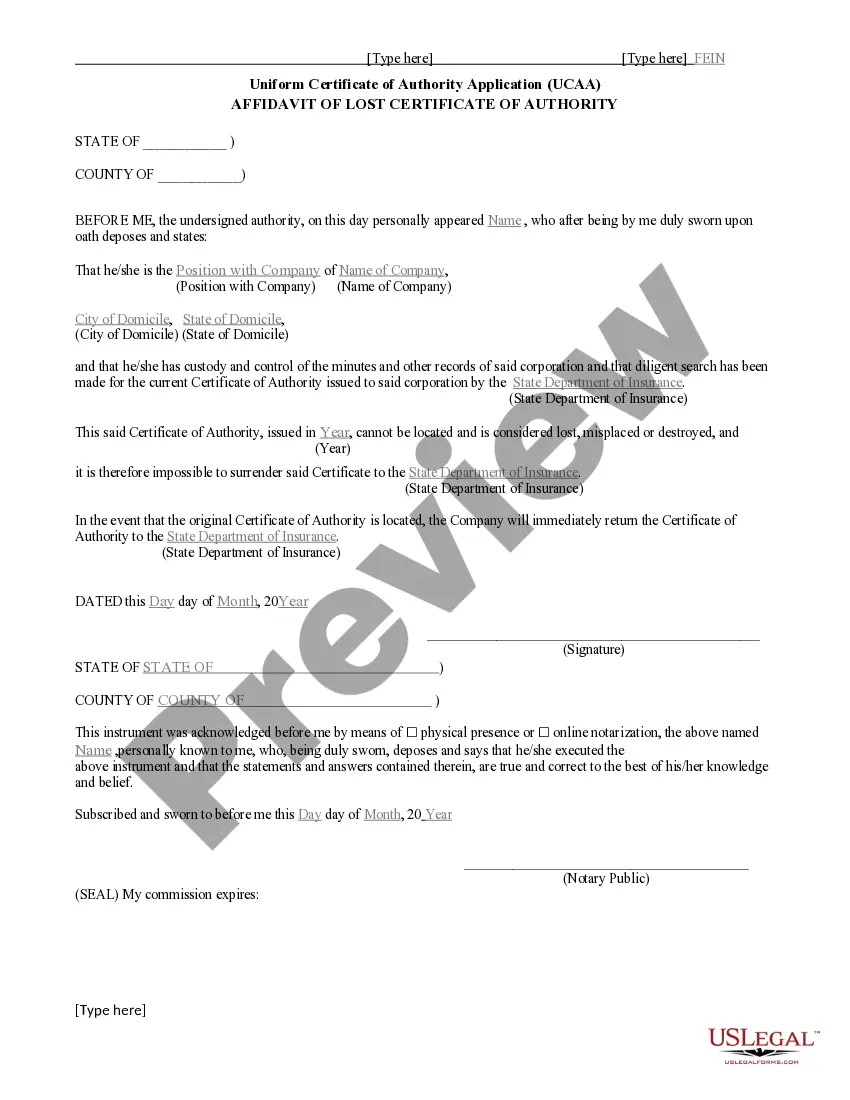

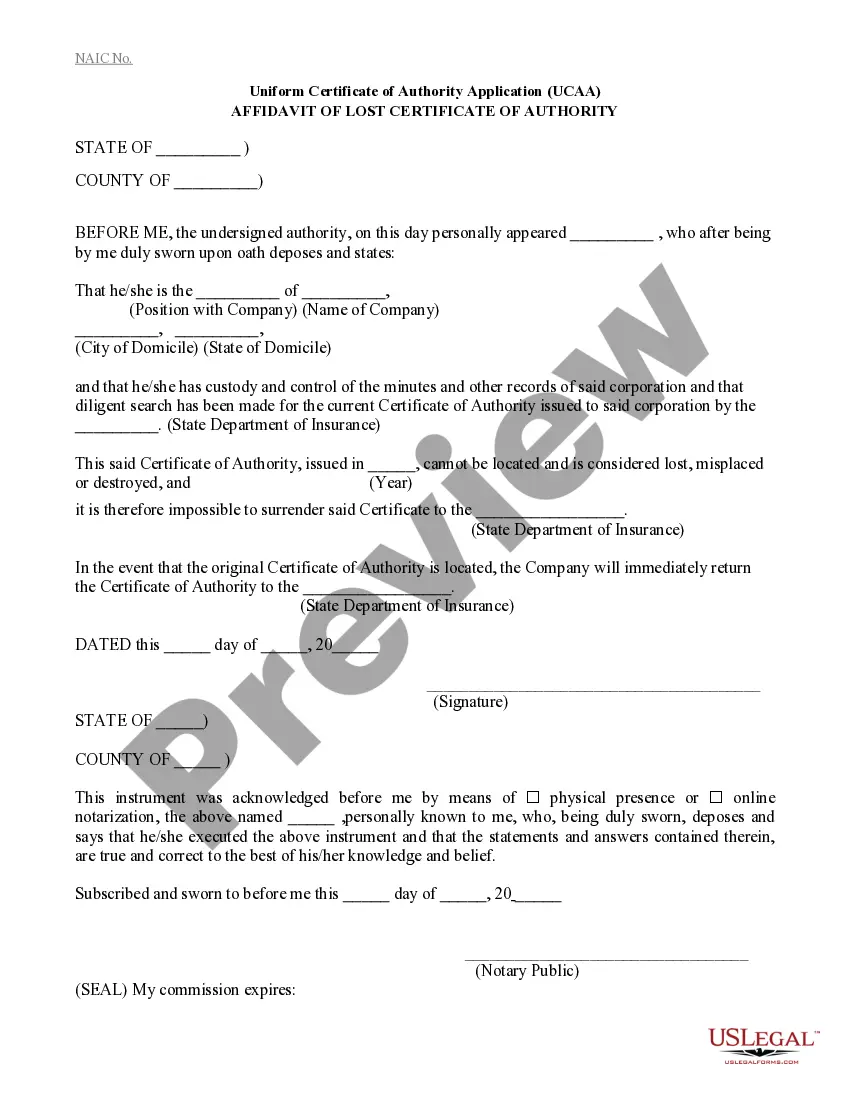

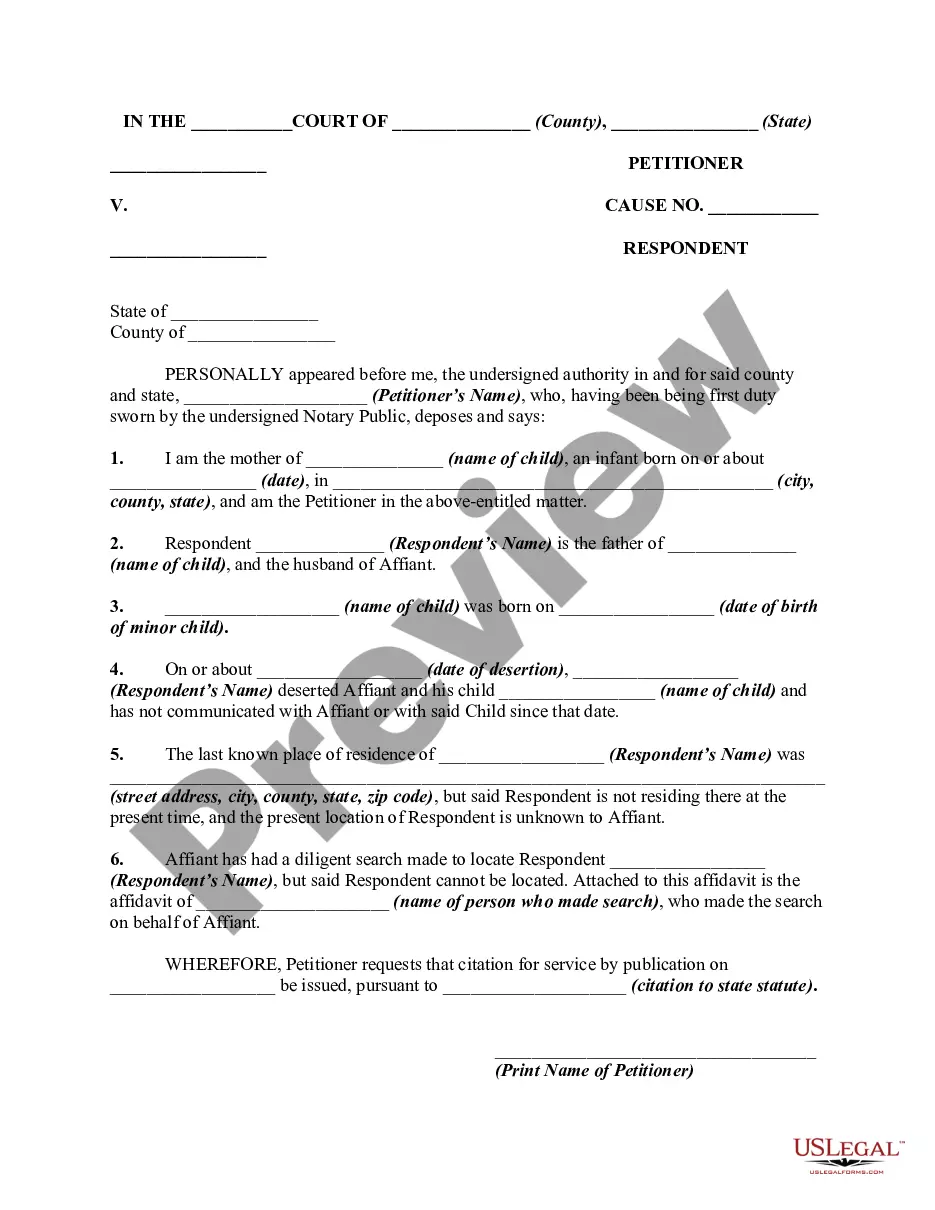

How to fill out Sworn Statement Regarding Proof Of Loss For Automobile Claim?

US Legal Forms - among the biggest libraries of lawful forms in the USA - provides a wide array of lawful papers themes you are able to down load or produce. Utilizing the site, you can get 1000s of forms for business and person functions, categorized by classes, says, or search phrases.You can find the newest versions of forms such as the Tennessee Sworn Statement regarding Proof of Loss for Automobile Claim in seconds.

If you already possess a registration, log in and down load Tennessee Sworn Statement regarding Proof of Loss for Automobile Claim from your US Legal Forms local library. The Down load option will appear on every single develop you perspective. You get access to all previously saved forms inside the My Forms tab of your own bank account.

In order to use US Legal Forms the first time, listed here are straightforward guidelines to obtain started:

- Be sure you have chosen the best develop for the city/region. Click the Preview option to analyze the form`s information. Read the develop description to ensure that you have selected the appropriate develop.

- If the develop doesn`t match your requirements, use the Look for area towards the top of the monitor to find the one that does.

- If you are happy with the shape, verify your selection by simply clicking the Purchase now option. Then, select the rates strategy you favor and offer your qualifications to register for an bank account.

- Process the deal. Make use of your charge card or PayPal bank account to accomplish the deal.

- Pick the format and down load the shape in your device.

- Make changes. Fill up, change and produce and indicator the saved Tennessee Sworn Statement regarding Proof of Loss for Automobile Claim.

Each design you added to your money does not have an expiry particular date which is your own eternally. So, in order to down load or produce yet another version, just go to the My Forms portion and click on around the develop you want.

Obtain access to the Tennessee Sworn Statement regarding Proof of Loss for Automobile Claim with US Legal Forms, the most comprehensive local library of lawful papers themes. Use 1000s of professional and state-specific themes that fulfill your company or person requirements and requirements.

Form popularity

FAQ

When any company under any insurance policy requires a written proof of loss after notice of such loss has been given by the insured or beneficiary, the company or its representative must furnish a blank form to be used for that purpose.

A proof of loss form is evidence of any damages from an accident. Without this form, your insurer would not be able to process your claim. This would put repairs on hold, and prevent you from receiving accident benefits.

The insurer must supply claim forms to the insured for submitting proof of loss within 15 days of receiving notice of the claim, the insured may submit proof of loss on any piece of paper or in any manner the insured wishes. The insurer will be required to accept this as proof of loss.

Even if every insurance company does not mandate the submission of a Proof of Loss statement form following a covered event, there are certain circumstances in which one might be required. This includes suspected fraud, questionable causes of damage or high-claim amounts.

A Proof of Loss is a document filled out by the policyholder when property damage occurs resulting in an insurance claim. This form helps to substantiate the value of the insured's loss to the insurance company.

What is a Proof of Loss? A Sworn Statement in Proof of Loss outlines the basic details of your property damage claim and serves as a cover document for your supporting claim materials and documentation.

When required, you should file your Proof of Loss form as soon as possible but no later than the date specified in your insurance policy. It's typically required within 60 days after the incident that led to your insurance claim. If you won't be able to file it on time, ask for an extension in advance.

In most cases, the Proof of Loss must include the following: Amount of loss that the policyholder is claiming. Documentation that supports the amount of claimed loss. Date that the loss occurred.