Both the Model Business Corporation Act and the Revised Model Business Corporation Act provide that any action required or permitted by these Acts to be taken at a meeting of the shareholders or a meeting of the directors of a corporation may be taken without a meeting if the action is taken by all the shareholders or directors entitled to vote on the action. The action should be evidenced by one or more written consents bearing the date of signature and describing the action taken, signed by all the shareholders and/or directors entitled to vote on the action, and delivered to the corporation for inclusion in the minutes or filing with the corporate records.

Tennessee Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement

Description

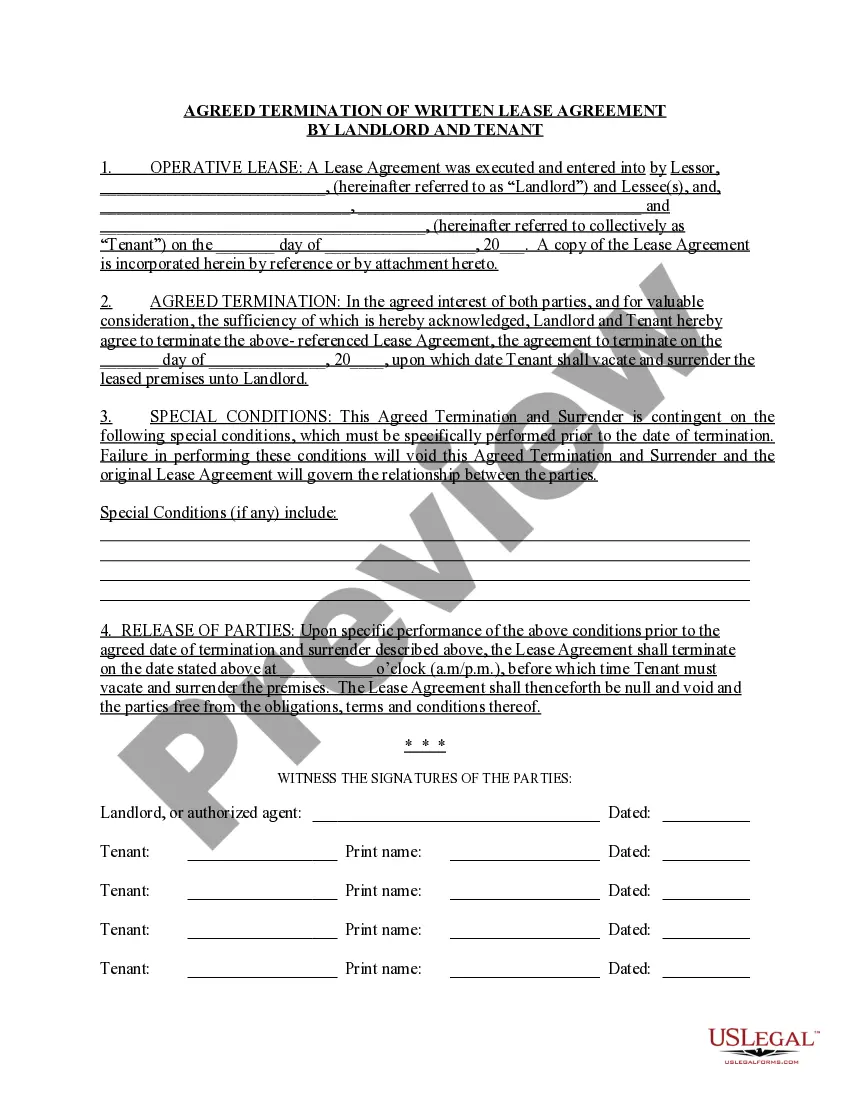

How to fill out Resolutions Of Shareholders And Directors Approving Liquidating Trust Agreement?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a variety of legal form templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by type, state, or keywords.

You can find the latest versions of forms such as the Tennessee Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement in just a few minutes.

Check the form description to make sure you have selected the correct document.

If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you have a subscription, Log In and download the Tennessee Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement from your US Legal Forms library.

- The Download button will be present on every form you view.

- You can access all previously downloaded forms from the My documents tab in your account.

- If you would like to use US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have chosen the correct form for your city/state.

- Click the Preview button to review the content of the form.

Form popularity

FAQ

The resolution of a shareholder agreement typically refers to the formal endorsement or approval of specific actions, like establishing a Liquidating Trust Agreement. This resolution outlines the intentions and agreements made among shareholders. Clear documentation ensures that everyone understands the terms and benefits governed by the Tennessee Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement.

Filing a shareholder resolution involves submitting the signed document to the company's board or designated officer. Ensure all shareholders have received their copies as required. Proper filing is crucial for compliance, especially when dealing with Tennessee Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement.

An example of a shareholder resolution might be a proposal to approve a Liquidating Trust Agreement. This resolution would outline the rationale behind the decision and the expected benefits for the company. It might also include details about the trust's management and assets. Using such clear illustrations can help clarify Tennessee Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement.

Writing a shareholders resolution requires a straightforward format. Start with the title, followed by a clear statement of the resolution's purpose. Include all relevant facts and considerations, and conclude with a section for signatures. This format is particularly useful when dealing with Tennessee Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement.

To create a shareholder resolution, begin by clearly stating the purpose, such as approving a Liquidating Trust Agreement. Ensure all required information, including date and meeting details, is included. Once drafted, distribute the resolution to all shareholders for review and obtain their signatures. This process is essential for Tennessee Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement.

The board resolution format typically includes a title, introductory statement, and resolution clauses that specify the actions being authorized. Additionally, it should have space for signatures from board members to validate the decision. Adhering to the Tennessee Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement is vital for compliance and legitimacy. Using a standardized template can simplify the process and ensure accuracy.

Passing a shareholders resolution requires winning the support of a majority of shareholders. Organize a meeting or distribute a written resolution to collect votes. It’s crucial to consider the guidelines in the Tennessee Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement to ensure that the process follows legal stipulations. Keeping clear communication will foster a favorable environment for obtaining the required approvals.

To fill out a board of directors resolution, begin by stating the resolution's title and purpose. Include the names of the board members involved and their respective votes on the resolution. When referencing the Tennessee Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement, ensure you incorporate all necessary elements for compliance and clarity. Completing this document accurately will aid in preventing future disputes.

A written resolution of the board of directors is a formal document that captures decisions made by the board without holding a physical meeting. This resolution must be signed by all board members, providing a record of their approval. It is essential to ensure compliance with state regulations, particularly the Tennessee Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement, to validate your actions. This document serves as a critical record for future reference.

Filling out a corporate resolution form involves entering basic information about your company, such as its name and address. Next, specify the action the directors or shareholders are approving, detailing the resolution's context. Referencing the Tennessee Resolutions of Shareholders and Directors Approving Liquidating Trust Agreement can guide you in including all necessary components. Be precise and complete all required fields to avoid complications.