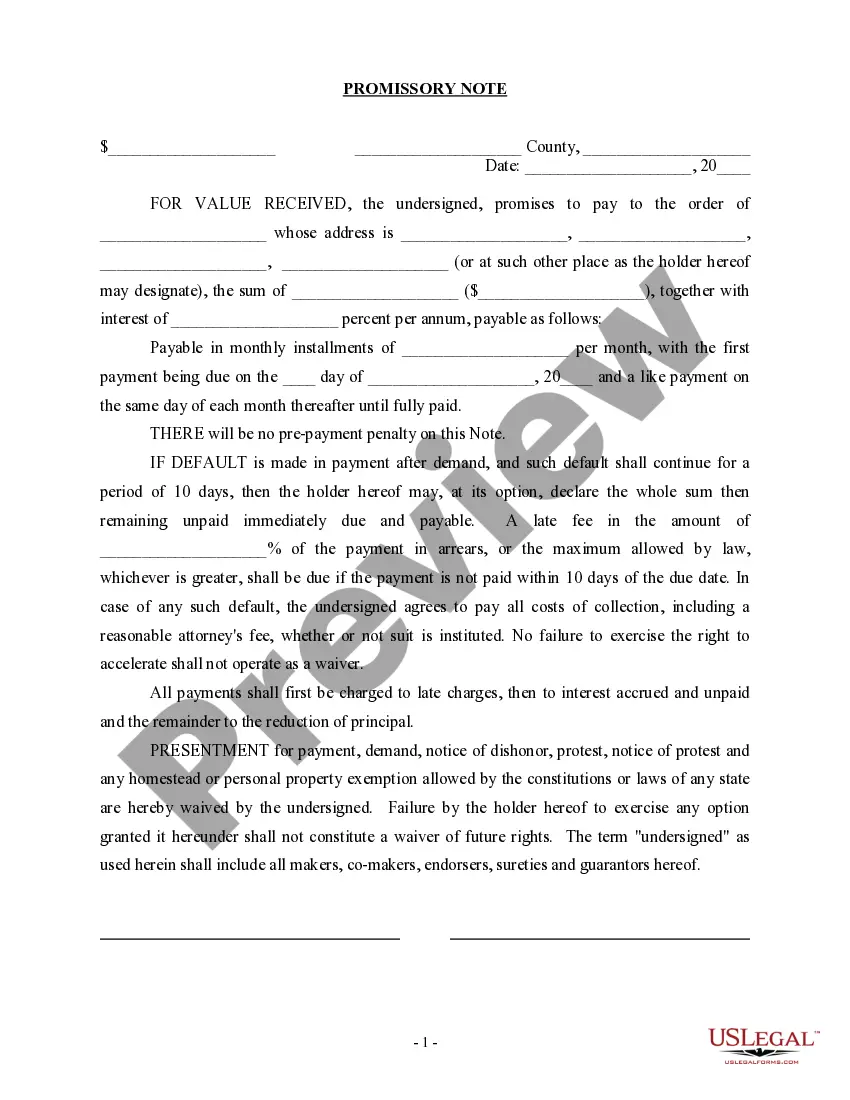

A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person A promissory note should have several essential elements, including the amount of the loan, the date by which it is to be paid back, the interest rate, and a record of any collateral that is being used to secure the loan. Default terms (what happens if a payment is missed or the loan is not paid off by its due date) should also be spelled out in the promissory note.

Tennessee Promissory Note secured by Real Property with a Fixed Interest Rate and Installment Payments in Connection with a Purchase of a Business

Description

How to fill out Promissory Note Secured By Real Property With A Fixed Interest Rate And Installment Payments In Connection With A Purchase Of A Business?

You are capable of spending hours online searching for the proper legal document template that meets the state and federal criteria you require.

US Legal Forms provides thousands of authentic forms that are verified by professionals.

You can download or print the Tennessee Promissory Note secured by Real Estate with a Fixed Interest Rate and Installment Payments related to a Business Purchase from my service.

If available, utilize the Preview button to view the document template simultaneously.

- If you already have an account with US Legal Forms, you can Log In and then click the Download button.

- Once done, you can complete, modify, print, or sign the Tennessee Promissory Note secured by Real Property with a Fixed Interest Rate and Installment Payments related to a Business Purchase.

- Every authentic document template you obtain is yours permanently.

- To get another copy of the downloaded form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple steps below.

- First, ensure you have selected the correct document template for your desired area/city.

- Check the form details to confirm you have chosen the right document.

Form popularity

FAQ

What is a Secured Promissory Note? A Secured Promissory Note is a legal agreement that requires a borrower to provide security for a loan. With this lending document, the borrower puts forth their personal property or real estate as collateral if the loan isn't repaid.

A Secured Promissory Note is a legal agreement that requires a borrower to provide security for a loan. With this lending document, the borrower puts forth their personal property or real estate as collateral if the loan isn't repaid.

A promissory note is the document that sets forth the terms of a loan's repayment. A promissory note can be secured with a pledge of collateral, which is something of value that can be seized if a borrower defaults.

Secured Promissory Notes The property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust.

Secured Promissory Notes The property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust.

A Promissory Note may be secured or unsecured. In case of a secured note, the borrower will be required to provide a collateral such as property, goods, services, etc., in the event that they fail to repay the borrowed amount.

A secured promissory note is a document that allows a lender to lend money with the added insurance of having assets or property handed over to them in the chance the borrower defaults. This type of note carries less risk to the lender and usually allows the borrower to pay a lesser interest rate.

As part of the home loan mortgage process, you can expect to execute both a legally binding mortgage and mortgage promissory note, which work toward complementary purposes.

As when applying for a traditional mortgage, a promissory note is signed which obligates the buyer to make principal and interest payments according to a preset schedule. Should the buyer default on payments, the seller can foreclose on the property and sell the home.