Tennessee Sale or Return

Description

How to fill out Sale Or Return?

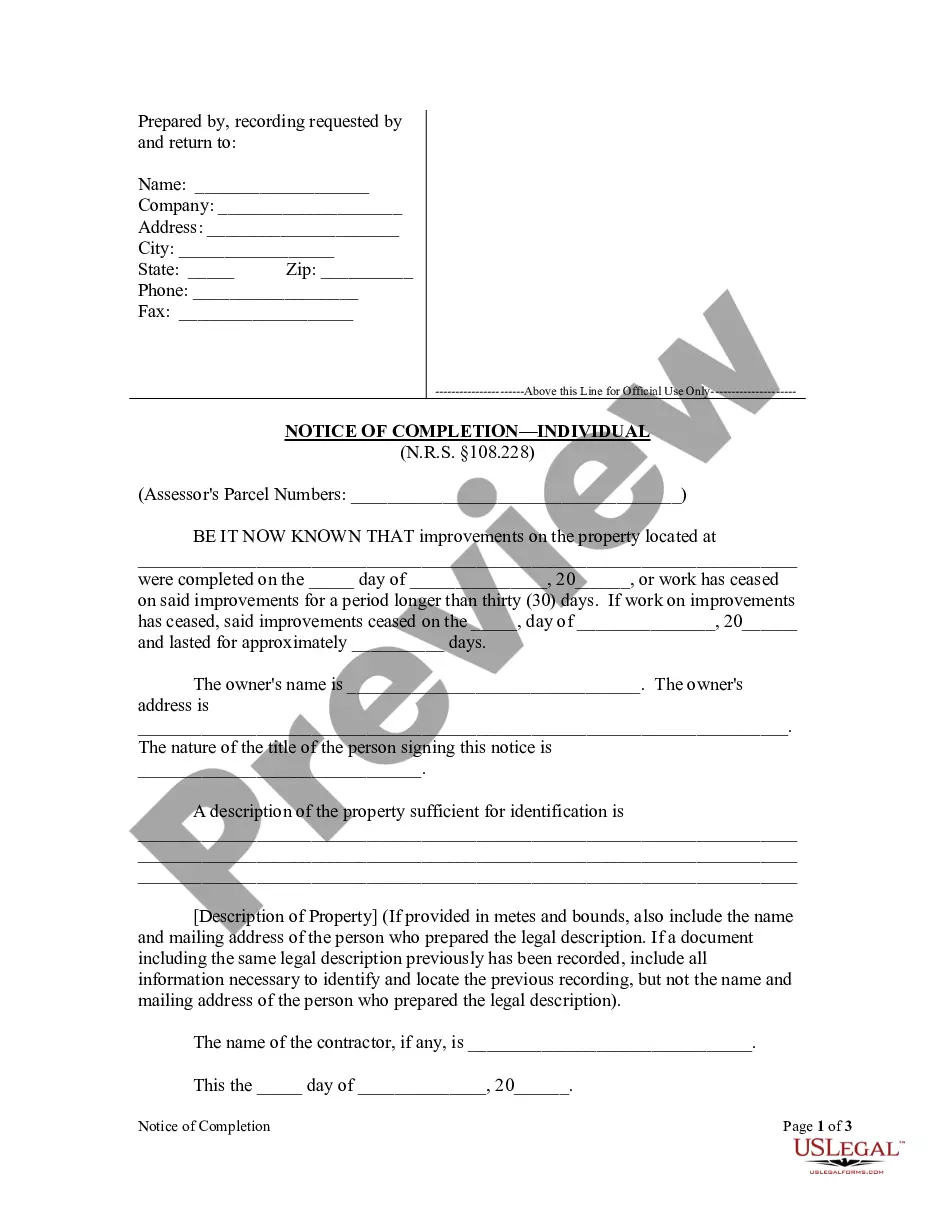

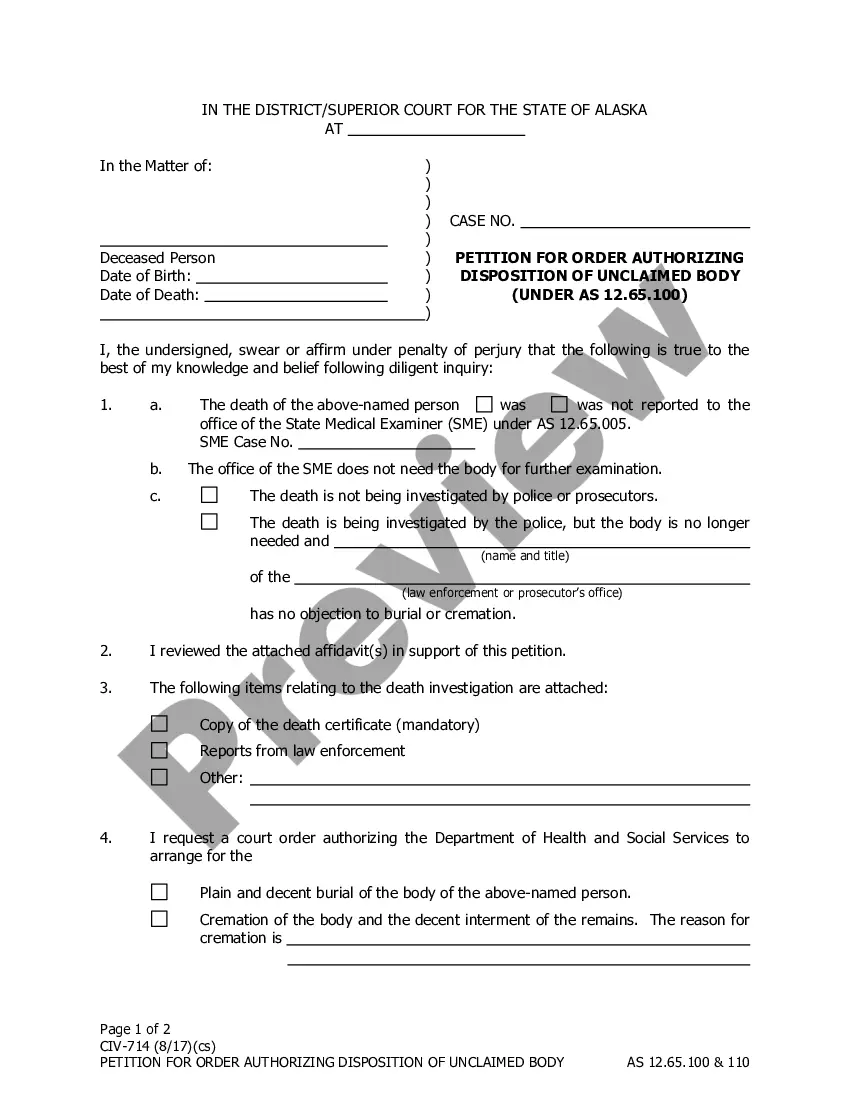

Are you in a situation where you frequently require documentation for both business or personal reasons? There are numerous legal form templates accessible on the web, but locating reliable versions isn’t easy.

US Legal Forms provides thousands of form templates, such as the Tennessee Sale or Return, which can be generated to comply with federal and state regulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. You can then download the Tennessee Sale or Return template.

Access all the form templates you have purchased in the My documents section. You can download another copy of the Tennessee Sale or Return if needed. Just click the desired form to download or print the document template.

Utilize US Legal Forms, the largest collection of legal forms, to save time and avoid mistakes. The service provides well-crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start simplifying your life.

- Obtain the form you need and ensure it's for the correct jurisdiction.

- Utilize the Review button to examine the form.

- Read the details to confirm you have selected the correct form.

- If the form isn’t what you need, use the Search field to find the form that meets your requirements.

- Once you locate the right form, click on Get now.

- Select the pricing plan you desire, complete the necessary details to create your account, and place an order using your PayPal or credit card.

- Choose a convenient file format and download your copy.

Form popularity

FAQ

To back tax out of a sale, you must subtract the sales tax from the total sale amount to arrive at the net sales amount. This adjustment is important for accurate financial reporting, especially when handling refunds or corrections. Recording this accurately is crucial for maintaining compliance with Tennessee Sale or Return guidelines.

To calculate Tennessee sales tax, you need to multiply the sale amount by the current sales tax rate, which is typically 7%. Ensure you check for any local taxes that may apply in addition to the state tax. Knowing how to properly calculate sales tax is essential for compliance and accurate reporting, particularly for the Tennessee Sale or Return process.

In QuickBooks, you can record sales and use tax by setting up a sales tax item. When you create invoices, include the sales tax item to automatically calculate and record the tax. This feature helps keep your records accurate and simplifies your reporting for Tennessee Sale or Return.

Recording sales and use taxes involves documenting the sales tax collected while processing sales. This requires entering the sales tax amounts in your accounting system, ensuring they are separate from regular sales revenue. Regularly updating these records will help you stay compliant with Tennessee Sale or Return regulations.

Typically, sales and expenses are recorded in accounting software or spreadsheets. You should maintain clear records in a dedicated sales ledger and an expense ledger to track your transactions effectively. If you are dealing with Tennessee Sale or Return, keeping organized records is crucial for accurate tax reporting.

To record sales with tax, you should first record the total sale amount including tax. This can be done by creating a sales journal entry that captures the sales revenue and the corresponding sales tax collected. Using a platform like UsLegalForms can simplify the process, ensuring compliance with Tennessee Sale or Return regulations.

You can check the status of your refund by visiting the Tennessee Department of Revenue’s online portal. Enter the required information to view updates regarding your claim’s status efficiently. Utilizing this tool can provide you with peace of mind while awaiting your Tennessee Sale or Return refund.

To claim your refund on TN TAP, log into your account and navigate to the refund section. There you will find the option to submit your refund request for the Tennessee Sale or Return. Following the instructions carefully will ensure a smooth process.

After submitting your refund claim, the Tennessee Department of Revenue will process your request. Depending on the method of claim and processing times, refunds may arrive via check or direct deposit. Stay informed on your refund’s status by regularly checking updates from the Department.

Claiming a refund involves submitting a request through the Tennessee Department of Revenue’s official channels. You need to fill out and file the appropriate forms, providing details about the Tennessee Sale or Return and any supporting documentation. Consider leveraging USLegalForms for step-by-step guidance on the procedure.