Tennessee Revocable Trust for Lottery Winnings

Description

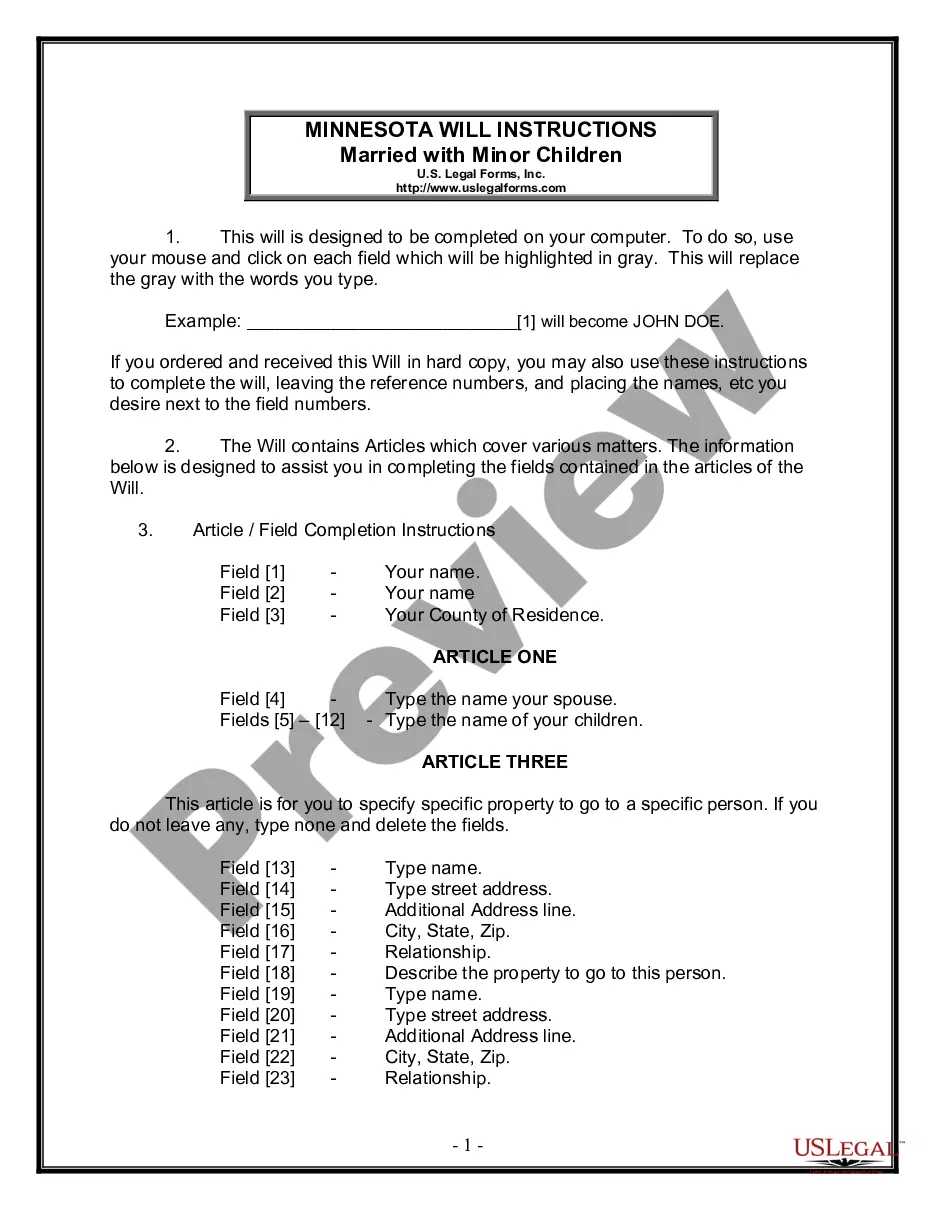

How to fill out Revocable Trust For Lottery Winnings?

In the event you need to obtain, download, or print valid document templates, utilize US Legal Forms, the largest collection of valid forms available online.

Employ the site’s simple and user-friendly search to locate the documents you require.

An array of templates for business and personal use are categorized by types and states, or keywords.

Step 4. Once you have found the form you need, click the Purchase now option. Choose the payment plan you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You may use your Visa or Mastercard or PayPal account to finalize the purchase. Step 6. Choose the format of the legal form and download it to your device. Step 7. Complete, modify, and print or sign the Tennessee Revocable Trust for Lottery Winnings.

- Utilize US Legal Forms to find the Tennessee Revocable Trust for Lottery Winnings with just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and then click the Acquire option to find the Tennessee Revocable Trust for Lottery Winnings.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Make sure you have selected the form for the appropriate city/state.

- Step 2. Utilize the Review option to examine the form’s content. Don’t forget to read the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the valid form template.

Form popularity

FAQ

To avoid gift tax on lottery winnings, consider establishing a Tennessee Revocable Trust for Lottery Winnings. This type of trust can help manage and distribute your winnings without incurring significant gift taxes. Working with a financial advisor can provide additional strategies tailored to your specific situation.

When a trust wins the lottery, it means the lottery prize is awarded to the trust rather than an individual. This situation can be advantageous as having a Tennessee Revocable Trust for Lottery Winnings allows for better management of the prize and can help with tax strategies. It also ensures that your winnings are used according to your plans for beneficiaries.

The best place to deposit lottery winnings is in a reputable bank or credit union that offers high-interest savings accounts. Alternatively, consider using a Tennessee Revocable Trust for Lottery Winnings to manage your funds efficiently. This strategy ensures that your winnings are protected and managed according to your wishes.

Certainly, a trust can claim a lottery prize in Tennessee. If you have a Tennessee Revocable Trust for Lottery Winnings, it serves as the legal entity to receive the winnings. This arrangement provides more security and can simplify the distribution process to your beneficiaries.

Yes, a trust can claim lottery winnings in Tennessee. By setting up a Tennessee Revocable Trust for Lottery Winnings, you ensure that the trust can receive and manage your lottery prize. This setup can also offer additional benefits such as asset protection and streamlined estate planning.

The best way to handle large lottery winnings is to consult with financial advisors and estate planners. Establishing a Tennessee Revocable Trust for Lottery Winnings allows for effective management of your assets and provides clarity for your beneficiaries. It also helps in planning for taxes and maintaining privacy.

The first thing to do if you win the lottery is to take a deep breath and stay calm. Next, sign the back of your ticket to secure your prize and consult with financial and legal professionals right away. They can help you decide if creating a Tennessee Revocable Trust for Lottery Winnings is right for you, setting the foundation for responsible financial management and wealth preservation.

The best trust to set up if you win the lottery is often a Tennessee Revocable Trust for Lottery Winnings. This type of trust allows you to maintain control over your assets while providing flexibility in how your wealth is managed and distributed. It protects your winnings from an uncertain future and facilitates the transfer of assets according to your specific instructions.

Yes, a trust can claim a lottery prize in Tennessee. This is a common strategy that helps maintain privacy and manage assets effectively. By creating a Tennessee Revocable Trust for Lottery Winnings, you can enjoy the benefits of anonymity while also ensuring that your winnings are distributed according to your wishes, without complications.

The best option after winning the lottery often includes seeking professional legal and financial advice. Opting for a lump-sum payment can provide immediate access to funds, but a structured payout might offer more manageable long-term wealth. Establishing a Tennessee Revocable Trust for Lottery Winnings can protect your newfound wealth and provide structured distribution, ensuring your financial future remains secure.