Tennessee Change of Beneficiary

Description

How to fill out Change Of Beneficiary?

Choosing the right legal file design can be quite a battle. Needless to say, there are a lot of themes accessible on the Internet, but how will you get the legal type you require? Use the US Legal Forms web site. The services gives a large number of themes, like the Tennessee Change of Beneficiary, which you can use for enterprise and private requirements. All of the types are inspected by professionals and meet up with federal and state demands.

If you are previously registered, log in for your accounts and click the Down load switch to get the Tennessee Change of Beneficiary. Make use of accounts to look through the legal types you have acquired formerly. Go to the My Forms tab of the accounts and acquire an additional duplicate of the file you require.

If you are a brand new end user of US Legal Forms, listed below are simple directions that you can comply with:

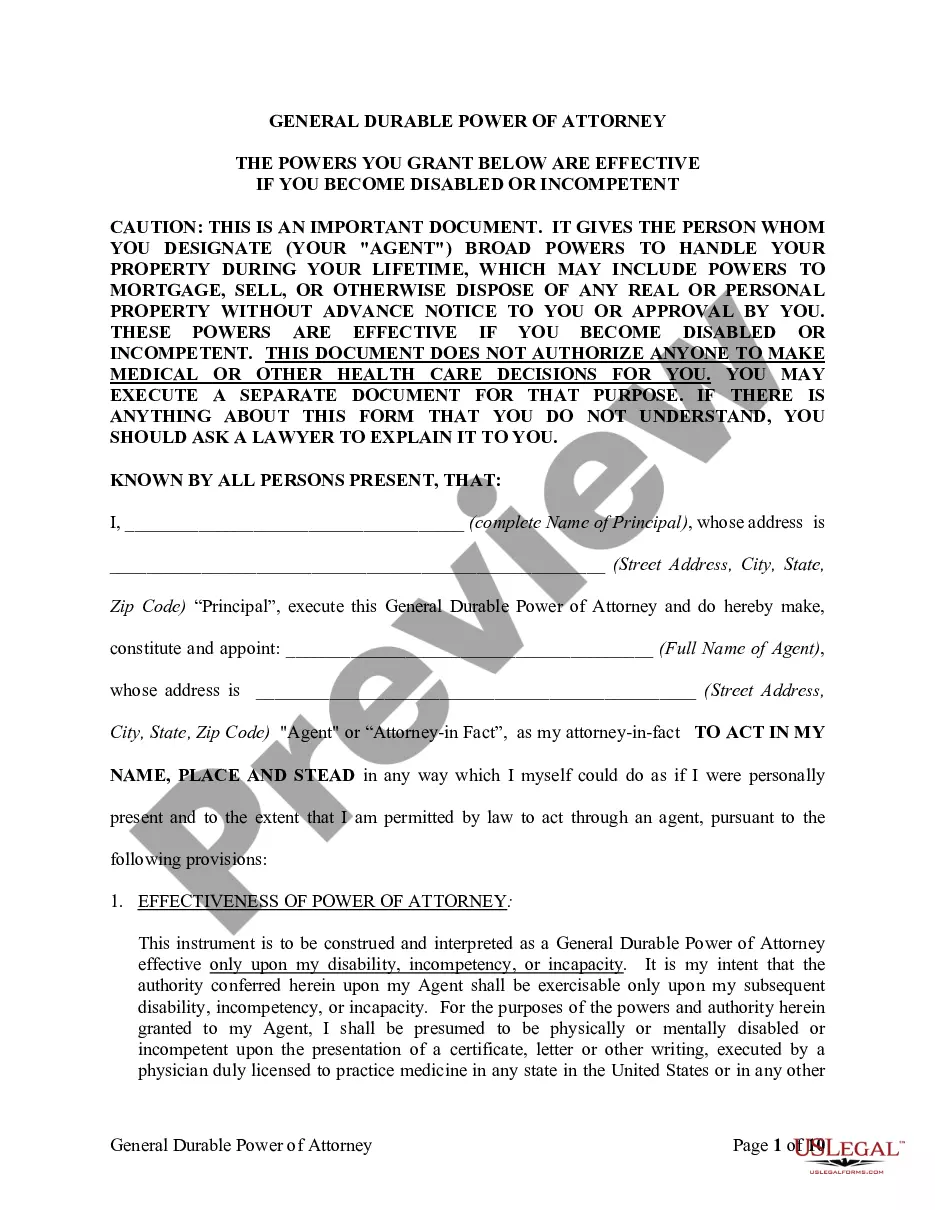

- Very first, ensure you have chosen the correct type to your area/state. You can check out the shape while using Review switch and browse the shape outline to make certain this is the right one for you.

- In the event the type is not going to meet up with your needs, utilize the Seach industry to get the proper type.

- Once you are sure that the shape would work, go through the Acquire now switch to get the type.

- Choose the rates plan you desire and enter the essential information and facts. Create your accounts and pay for your order making use of your PayPal accounts or Visa or Mastercard.

- Pick the submit file format and down load the legal file design for your product.

- Full, edit and print and indicator the received Tennessee Change of Beneficiary.

US Legal Forms may be the biggest collection of legal types for which you will find a variety of file themes. Use the company to down load skillfully-manufactured files that comply with state demands.

Form popularity

FAQ

Generally, you can review and update your beneficiary designations by contacting the company or organization that provides your insurance or retirement plan. You can sometimes do this online. Otherwise, you'll have to complete, sign, and mail a paper form.

When you establish an IRA or 401(k), you complete a form to name your beneficiaries. Changes are made in the same way ? you complete a new beneficiary designation form. A will or trust does not override your beneficiary designation form. However, spouses may have special rights under federal or state law.

Death grants If you die within 5 years of retiring, and you are under age 75 at the date of your death, your dependants or the person previously chosen by you will get a lump sum, known as a death grant. This will be equal to five years' pension, less any pension you have already received.

When a participant in a retirement plan dies, benefits the participant would have been entitled to are usually paid to the participant's designated beneficiary in a form provided by the terms of the plan (lump-sum distribution or an annuity).

When TCRS is notified of a retired member's death, TCRS will review the member's record to determine what survivor benefits, if any, may be payable. TCRS will issue a notification to your named beneficiary requesting a death certificate, and if benefits are due, a payment form for the beneficiary to complete.

A survivor benefit is paid as a monthly amount to a qualifying survivor. The death benefit is usually paid in a lump sum to someone you name on your Beneficiary Designation who may or may not be a family member.

Generally, you will need to fill out a change of beneficiary form which includes information such as the policyholder's name, the new beneficiary's name, and the reason for the change. You may also need to provide a copy of the policyholder's death certificate if the beneficiary is being changed due to their death.

If you retire under the Civil Service Retirement System (CSRS), the maximum survivor benefit payable is 55 percent of your unreduced annual benefit.