The decree of the bankruptcy court which terminates the bankruptcy proceedings is generally a discharge that releases the debtor from most debts. A bankruptcy court may refuse to grant a discharge under certain conditions.

Tennessee Complaint Objecting to Discharge in Bankruptcy Proceeding for Transfer, Removal, Destruction, or Concealment of Property Within One Year Preceding

Description

How to fill out Complaint Objecting To Discharge In Bankruptcy Proceeding For Transfer, Removal, Destruction, Or Concealment Of Property Within One Year Preceding?

Choosing the best authorized papers template could be a have a problem. Naturally, there are a variety of layouts accessible on the Internet, but how would you get the authorized form you need? Utilize the US Legal Forms internet site. The service delivers a huge number of layouts, like the Tennessee Complaint Objecting to Discharge in Bankruptcy Proceeding for Transfer, Removal, Destruction, or Concealment of Property, which you can use for company and personal requirements. All of the kinds are inspected by experts and meet federal and state requirements.

Should you be previously authorized, log in to your profile and click on the Obtain key to obtain the Tennessee Complaint Objecting to Discharge in Bankruptcy Proceeding for Transfer, Removal, Destruction, or Concealment of Property. Utilize your profile to search from the authorized kinds you possess bought formerly. Check out the My Forms tab of your own profile and have an additional duplicate in the papers you need.

Should you be a fresh customer of US Legal Forms, listed below are straightforward instructions for you to comply with:

- Initial, be sure you have selected the correct form for your town/state. You are able to check out the form making use of the Review key and read the form outline to make certain it will be the best for you.

- In case the form fails to meet your preferences, use the Seach discipline to obtain the correct form.

- When you are certain that the form is proper, go through the Get now key to obtain the form.

- Choose the costs prepare you need and enter the required information. Build your profile and pay money for an order making use of your PayPal profile or bank card.

- Opt for the document formatting and obtain the authorized papers template to your product.

- Comprehensive, edit and produce and indicator the obtained Tennessee Complaint Objecting to Discharge in Bankruptcy Proceeding for Transfer, Removal, Destruction, or Concealment of Property.

US Legal Forms will be the largest local library of authorized kinds in which you can discover different papers layouts. Utilize the service to obtain expertly-made paperwork that comply with state requirements.

Form popularity

FAQ

Chapter 7 Bankruptcy Doesn't Clear All Debts Mortgages, car loans, and other "secured" debts if you keep the property. ... Recent income taxes, support obligations, and other "priority" debt. ... Debts incurred by fraud or criminal acts. ... Student loans.

Filing for Chapter 7 bankruptcy eliminates credit card debt, medical bills and unsecured loans; however, there are some debts that cannot be discharged. Those debts include child support, spousal support obligations, student loans, judgments for damages resulting from drunk driving accidents, and most unpaid taxes.

In fact, the federal courts (which handle bankruptcy cases) list 19 different types of debt that are not eligible for discharge. 2 The most common ones are child support, alimony payments, and debts for willful and malicious injuries to a person or property.

Debts not discharged include debts for alimony and child support, certain taxes, debts for certain educational benefit overpayments or loans made or guaranteed by a governmental unit, debts for willful and malicious injury by the debtor to another entity or to the property of another entity, debts for death or personal ...

An objection to discharge is a notice lodged with the Official Receiver by a trustee to induce a bankrupt to comply with their obligations. An objection will extend the period of bankruptcy so automatic discharge will not occur three years and one day after the bankrupt filed a statement of affairs.

If a debt arose from the debtor's intentional wrongdoing, the creditor can object to discharging it. This might involve damages related to a drunk driving accident, for example, or costs caused by intentional damage to an apartment or other property.

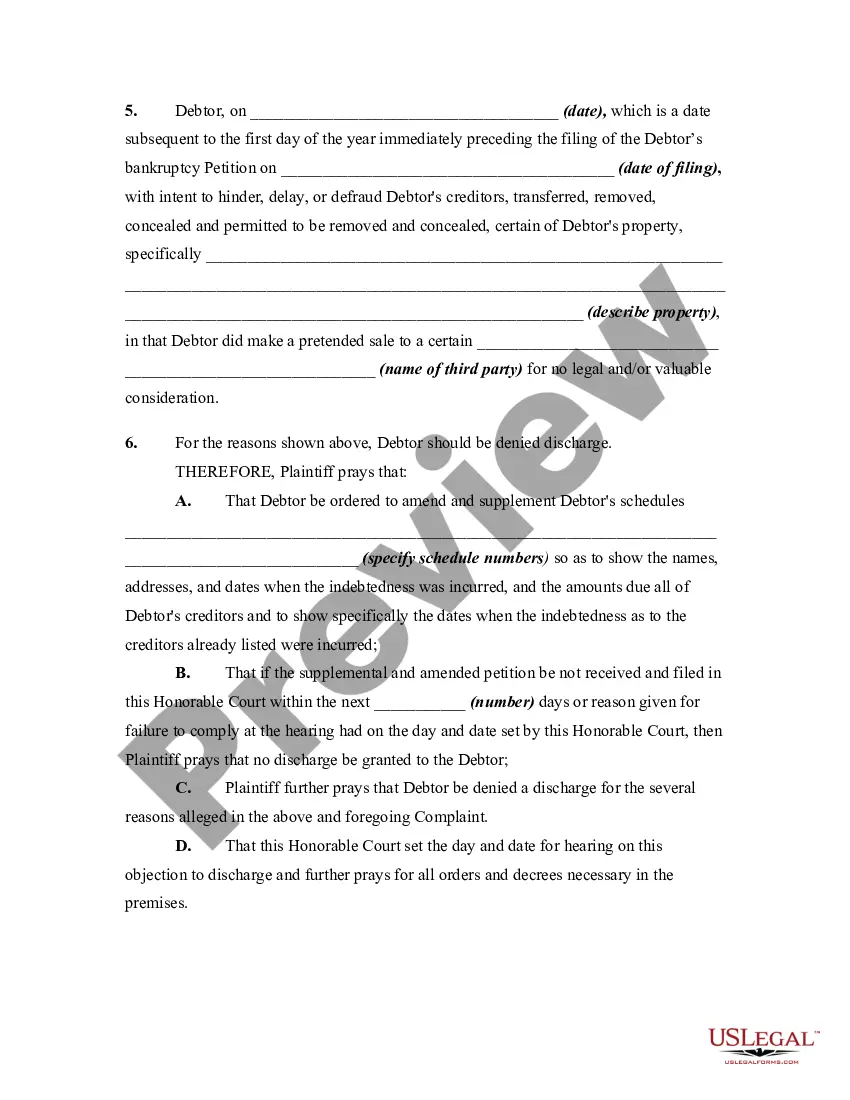

The court may deny a chapter 7 discharge for any of the reasons described in section 727(a) of the Bankruptcy Code, including failure to provide requested tax documents; failure to complete a course on personal financial management; transfer or concealment of property with intent to hinder, delay, or defraud creditors; ...

Key Takeaways. Types of debt that cannot be discharged in bankruptcy include alimony, child support, and certain unpaid taxes. Other types of debt that cannot be alleviated in bankruptcy include debts for willful and malicious injury to another person or property.