Tennessee Triple Net Lease

Description

How to fill out Triple Net Lease?

If you wish to be thorough, obtain, or create authentic document templates, utilize US Legal Forms, the largest collection of legal forms, which can be accessed online.

Leverage the site's user-friendly and convenient search function to find the documents you need.

A variety of templates for business and personal uses are organized by categories and states, or keywords. Utilize US Legal Forms to find the Tennessee Triple Net Lease in just a few clicks.

Each legal document template you purchase is yours indefinitely. You will have access to every form you saved within your account.

Click on the My documents section and select a form to print or download again. Be proactive and acquire, and print the Tennessee Triple Net Lease with US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, sign in to your account and then click the Download option to access the Tennessee Triple Net Lease.

- You can also retrieve forms you previously saved within the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps listed below.

- Step 1. Ensure you have selected the form for your correct city/region.

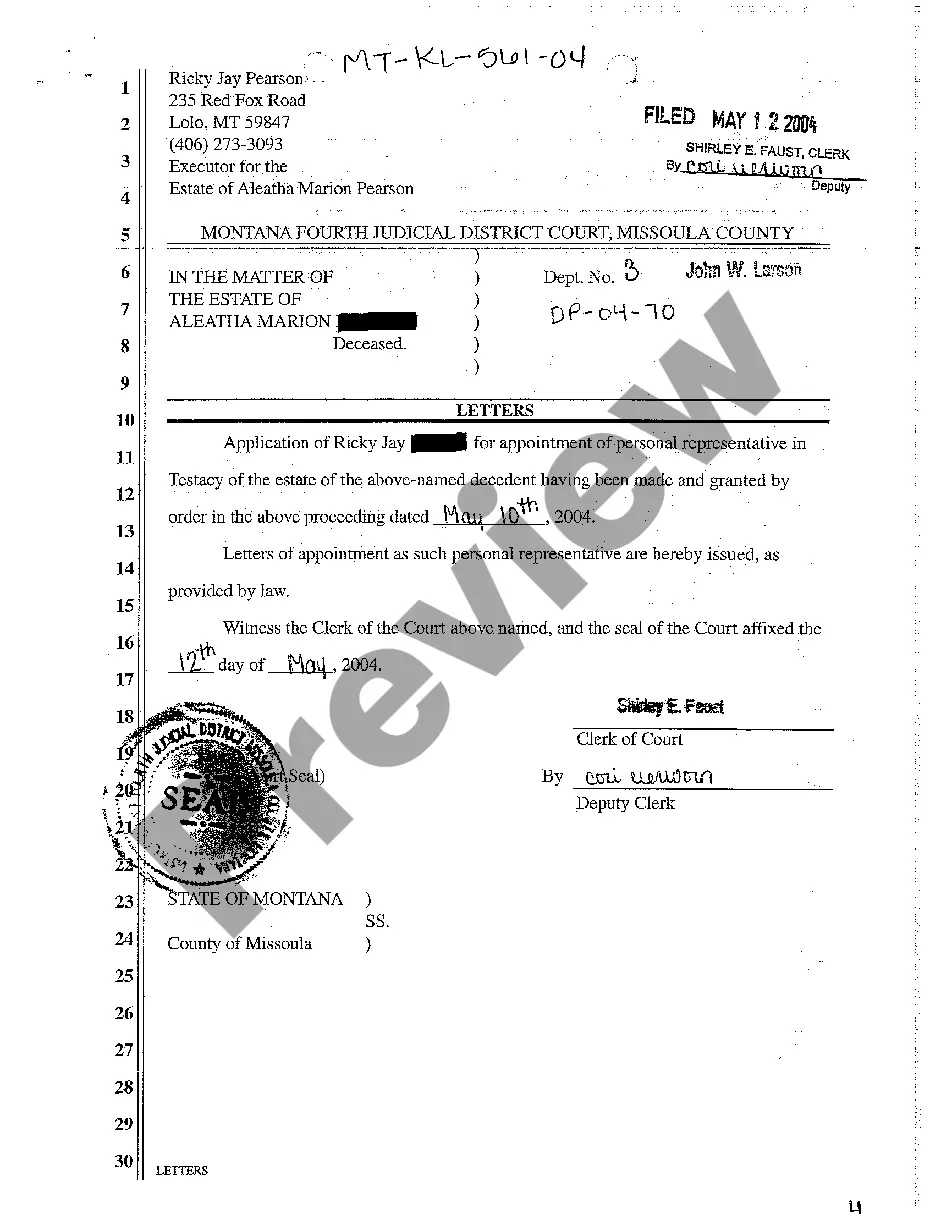

- Step 2. Use the Preview option to review the form's content. Remember to read the explanation.

- Step 3. If you are not satisfied with the form, utilize the Search box at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have located the form you need, click the Buy now button. Choose the payment plan you prefer and enter your information to register for an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the legal form and download it onto your device.

- Step 7. Complete, edit, and print or sign the Tennessee Triple Net Lease.

Form popularity

FAQ

Calculating a Tennessee Triple Net Lease involves determining the base rent plus the tenant's proportional share of property expenses. You need to add property tax, insurance, and maintenance costs to the base rent. This calculation helps ensure both parties understand their financial commitments, fostering a transparent relationship.

The Tennessee Triple Net Lease is primarily a type of lease where the tenant assumes all expenses related to the property. In contrast, an absolute lease offers extreme tenant responsibility, including even structural repairs. Both leases provide unique benefits, but understanding this difference can help landlords and tenants make better decisions.

An absolute NNN lease is a specific type of Triple Net Lease where the tenant assumes all responsibilities for the property. This includes covering all expenses such as repairs, maintenance, and property taxes, leaving the landlord with minimal obligations. Investors often favor the Tennessee Triple Net Lease due to its security and low management requirements. If you are looking for a stable investment option, exploring absolute NNN leases could be beneficial.

Subleasing in Tennessee is not illegal but typically requires the landlord's consent. When involved in a Tennessee Triple Net Lease, it's essential to consult the lease terms to determine if subleasing is permitted or if any specific conditions apply. This ensures compliance with your lease agreement and avoids potential disputes.

Absolutely, Tennessee has comprehensive lease laws that address various aspects of rental agreements. These laws cover everything from lease duration to repair responsibilities. Familiarity with these legal requirements is particularly important for parties involved in a Tennessee Triple Net Lease.

Tennessee is generally considered more landlord-friendly compared to some other states, though it does provide tenants with certain protections. The laws governing leases in Tennessee, including those related to notice and eviction procedures, can be more favorable for landlords. Nevertheless, understanding your rights is crucial, especially when entering a Tennessee Triple Net Lease.

Structuring a Tennessee Triple Net Lease involves outlining key expenses such as property taxes, insurance, and maintenance in the lease agreement. Typically, the tenant assumes these costs in addition to rent, which can create a more straightforward financial obligation for the landlord. It’s essential to detail each party's responsibilities in the lease to avoid any misunderstandings.

In Tennessee, a lease does not have to be notarized to be valid. However, having a lease agreement notarized can add an additional layer of protection for both parties involved. This is particularly beneficial in a Tennessee Triple Net Lease, where having clear terms is essential to prevent disputes.

Yes, Tennessee has specific lease laws that govern rental agreements. These laws outline the rights and responsibilities of both landlords and tenants, including regulations on security deposits and lease termination. Understanding these laws is crucial when working within a Tennessee Triple Net Lease, as they can impact obligations under the contract.

In Tennessee, the notice a tenant must give depends on the type of lease agreement. For month-to-month leases, tenants must provide at least 30 days' notice before vacating. In the case of a Tennessee Triple Net Lease, the specific terms can vary, so it's essential to consult the lease agreement for any additional stipulations regarding notice.