Tennessee Sample Letter for Reinstatement of Loan

Description

How to fill out Sample Letter For Reinstatement Of Loan?

You can spend time online looking for the legal document template that meets your state and federal requirements.

US Legal Forms offers a wide array of legal forms that have been evaluated by professionals.

You can conveniently download or print the Tennessee Sample Letter for Loan Reinstatement from our platform.

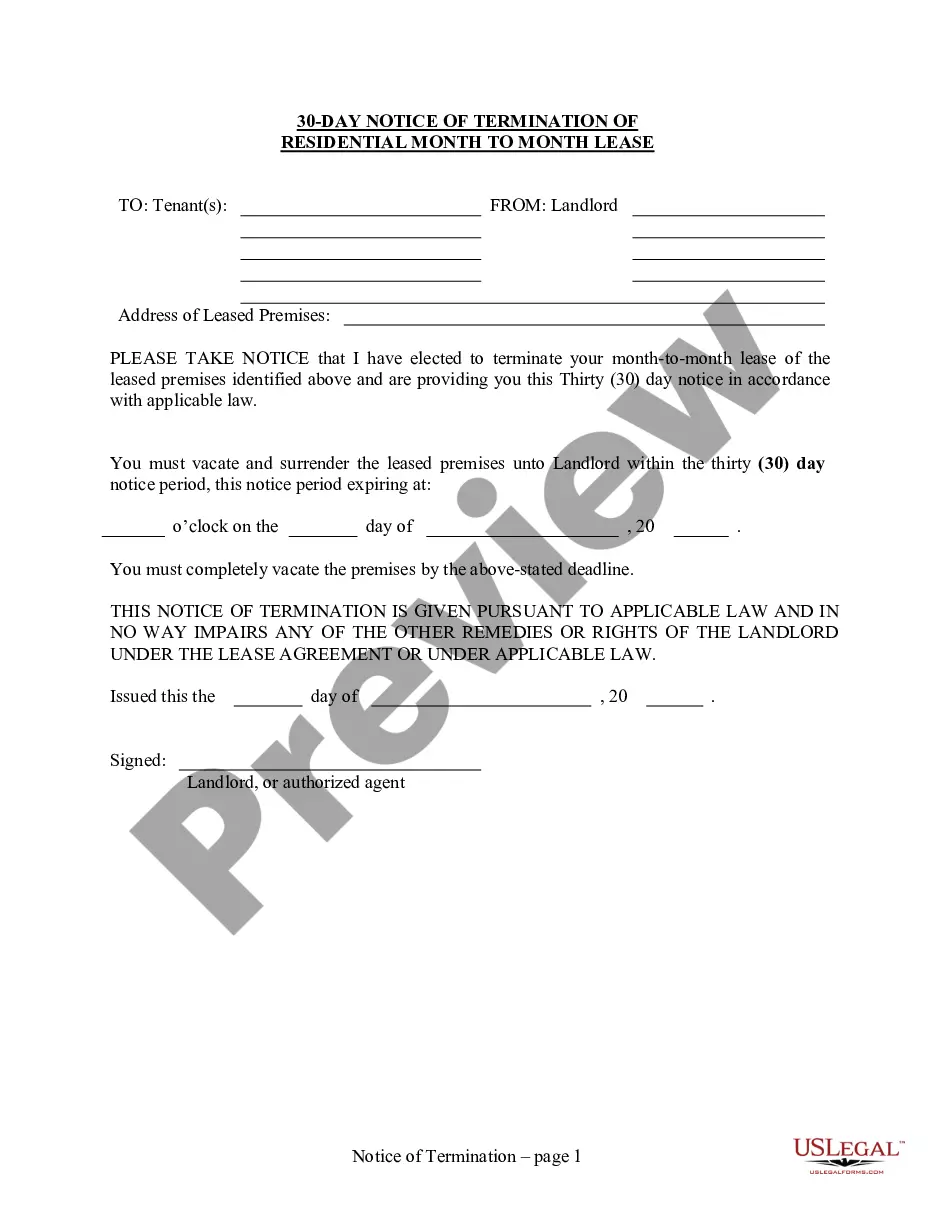

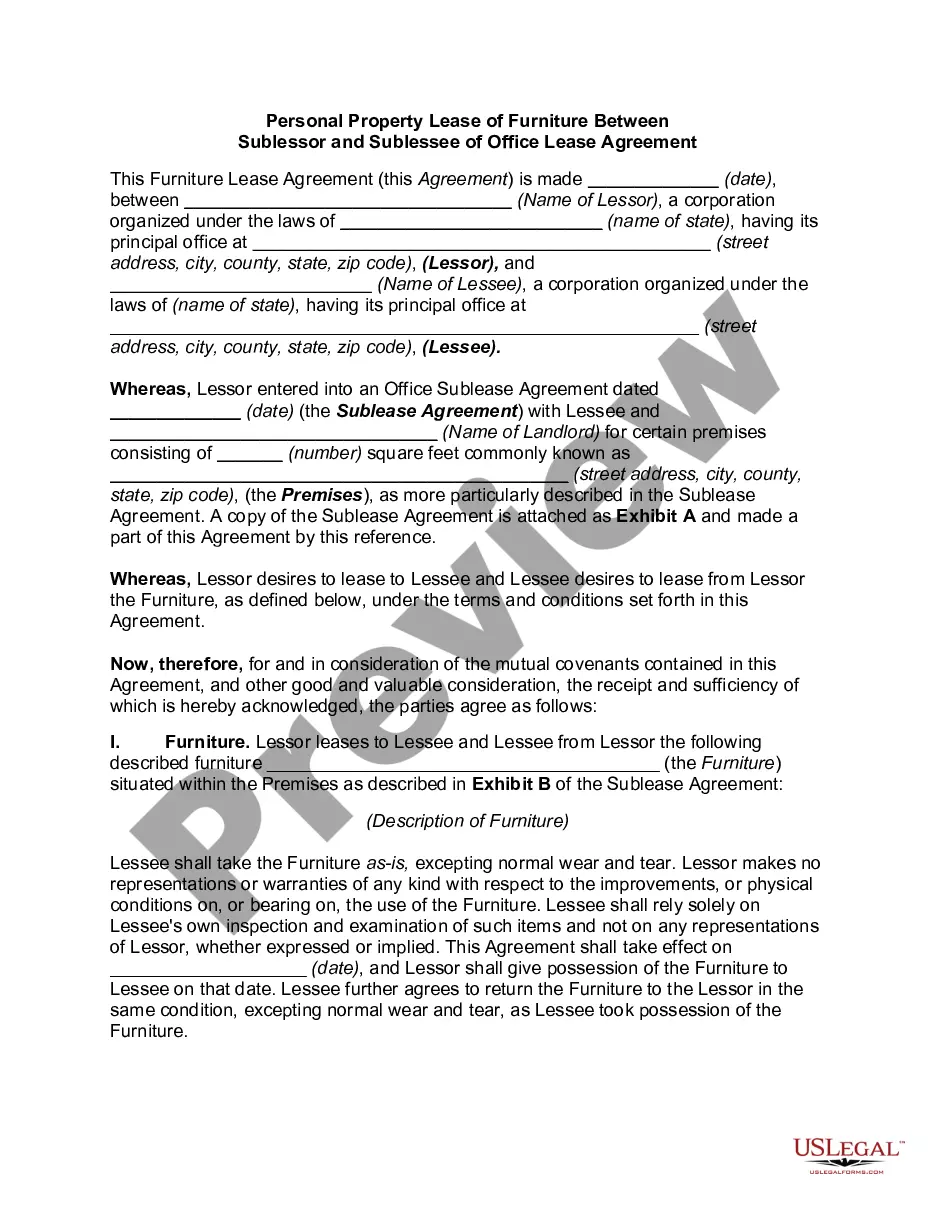

First, ensure that you have selected the correct document template for the state/city of your choice. Check the form description to confirm you have chosen the right one. If available, utilize the Preview button to review the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click the Obtain button.

- Subsequently, you can fill out, modify, print, or sign the Tennessee Sample Letter for Loan Reinstatement.

- Each legal document template you acquire is yours indefinitely.

- To obtain another copy of any purchased form, navigate to the My documents section and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

Form popularity

FAQ

To get a Tennessee tax exempt certificate, individuals or organizations must first establish their eligibility based on specific criteria. Eligible entities can submit an application to the Tennessee Department of Revenue, providing necessary documentation to support their request. Once approved, you will receive your tax exempt certificate, enabling you to make qualifying purchases without incurring state sales tax.

To acquire a certificate of tax clearance for termination purposes in Tennessee, you should verify that all tax obligations have been satisfied. After ensuring compliance, you can apply for the clearance certificate through the Tennessee Department of Revenue's official channels. This certificate is often crucial for businesses and individuals intending to finalize agreements or contracts.

To get your revoked license back in Tennessee, start by determining the reason for the revocation and make sure to address any issues related to it. Next, you may need to attend a hearing or complete specific requirements, such as paying fines or completing a driving course. Once these steps are completed, you can apply for reinstatement, which may include submitting relevant documents and fees.

Mortgage reinstatement, sometimes called loan reinstatement, is the process of restoring your mortgage after a mortgage default by paying the total amount past due. You will arrive at the point of a mortgage default after missing payments for several months.

Reinstatement involves making a single payment to catch up with everything due on a loan. By contrast, payoff involves paying the lender the total remaining balance of the loan. (Payoff before a foreclosure sale is commonly known as redemption, which is an equitable right available in every state.)

You may be able to reinstate the loan by catching up on payments. However, you will need to repay all past due bills, including late fees and the costs a lender incurs from repossession.

How to write a reinstatement letterKnow who you're writing to.Look at the current job openings.Start with a friendly introduction.State the reason for writing.Explain why they should hire you.Conclude with a call to action.Include your contact information.

To reinstate a loan, you must first find out the amount needed to bring the loan current. You can get this information by requesting a "reinstatement quote" or "reinstatement letter" from the loan servicer.

Reinstatement involves making a single payment to catch up with everything due on a loan. By contrast, payoff involves paying the lender the total remaining balance of the loan. (Payoff before a foreclosure sale is commonly known as redemption, which is an equitable right available in every state.)

Reinstatement, in employment law, refers to placing a worker back in a job he has lost without loss of seniority or other job benefits. Usually ordered by an agency, such as the National Labor Relations Board, or judicial authority, together with back pay, as a remedy in discrimination cases.