Tennessee Personal Guaranty - General

Description

How to fill out Personal Guaranty - General?

You can spend countless hours online searching for the proper legal document template that meets the federal and state criteria you need.

US Legal Forms offers a vast selection of legal forms that have been reviewed by professionals.

You can easily obtain or print the Tennessee Personal Guaranty - General through our services.

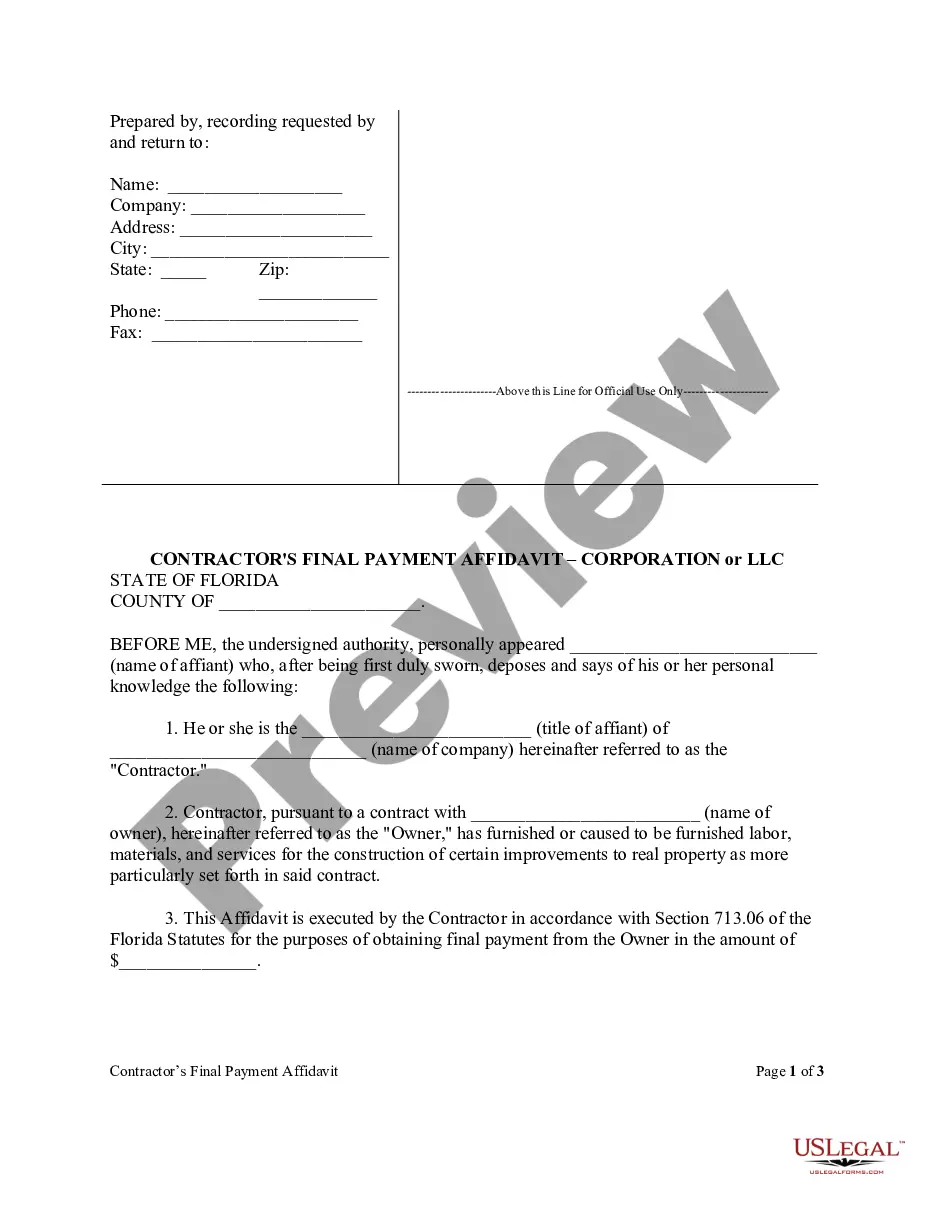

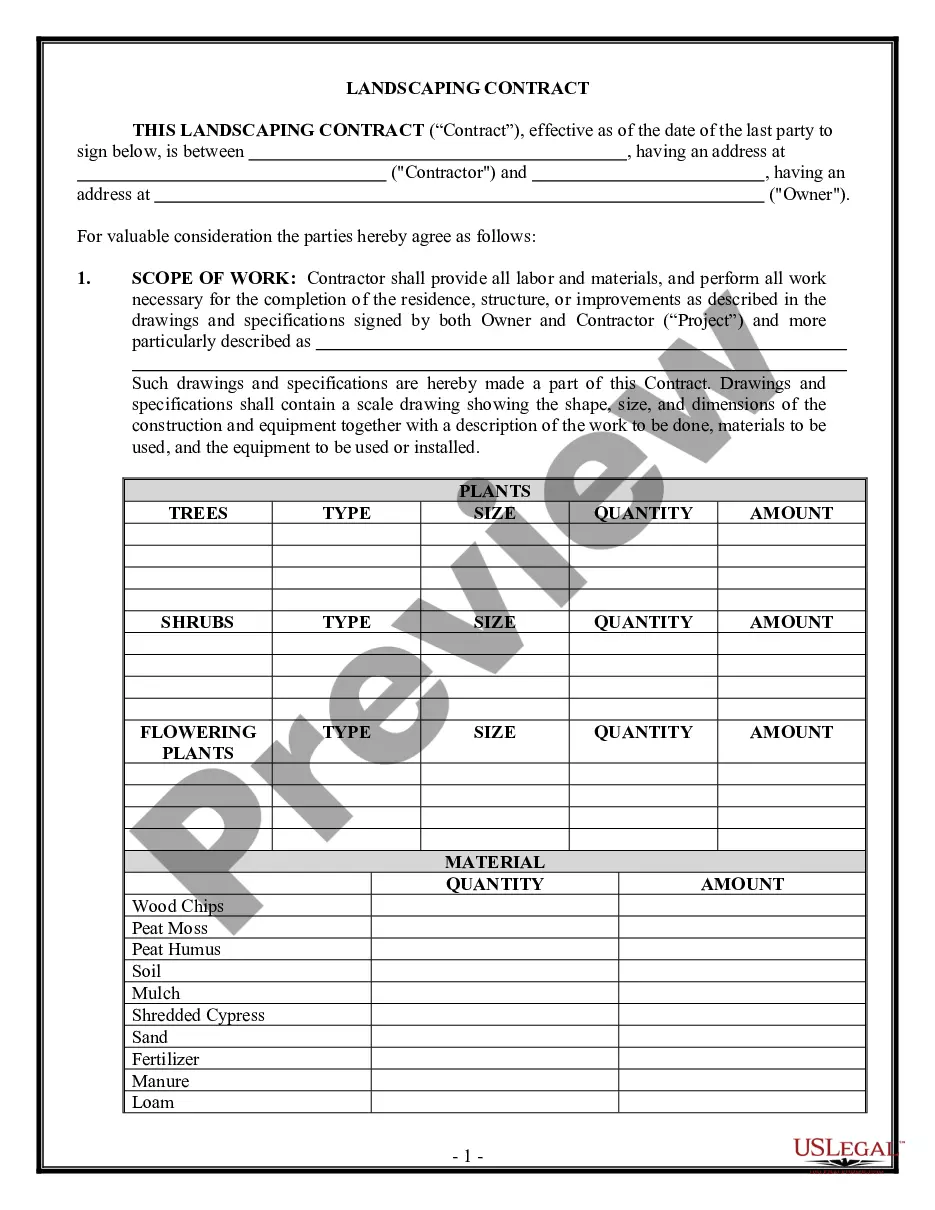

Review the document description to confirm you have selected the right form. If available, use the Preview option to view the document template as well.

- If you already have a US Legal Forms account, you can Log In and click on the Download button.

- Then, you can complete, modify, print, or sign the Tennessee Personal Guaranty - General.

- Every legal document template you purchase is yours permanently.

- To obtain an additional copy of any purchased form, visit the My documents section and select the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your specific area/town.

Form popularity

FAQ

Yes, the Tennessee Contractors exam is indeed open book. This format allows you to refer to relevant materials and resources while taking the test. However, it's essential to familiarize yourself with the rules surrounding the exam and understand how to effectively utilize your resources. Utilizing tools and information correctly can significantly help you navigate through your Tennessee Personal Guaranty - General responsibilities.

Contracting without a license in Tennessee can result in significant penalties, including fines and potential legal action. Engaging in unauthorized contracting activities may lead to a citation for violating state laws. It's also possible you could jeopardize your rights to enforce contracts in court. Thus, obtaining the correct licensing is vital for anyone involved in the construction industry, especially when dealing with Tennessee Personal Guaranty - General.

In Tennessee, you may perform a variety of tasks without a contractor’s license, typically limited to projects under $25,000. This includes activities such as minor repairs, simple home improvement jobs, or DIY renovations. It’s vital to remain aware of the rules governing this threshold, as exceeding it can lead to legal troubles. Remember, having guidance from platforms like USLegalForms can clarify the scope of work you can manage under Tennessee Personal Guaranty - General.

In Tennessee, you can build a house without a contractor's license if you are the property owner and you are doing the work yourself. However, it's important to understand that certain duties might still require licensing or permits. If you plan to hire subcontractors, you will need to ensure they have the appropriate licenses. Understanding these regulations is crucial to avoid complications, especially when it comes to matters related to Tennessee Personal Guaranty - General.

Yes, you can be your own general contractor in Tennessee, provided you meet the necessary licensing requirements and abide by the state's regulations. This allows you to manage your projects, but it requires proper knowledge and skills in construction. To ensure that you are equipped for this role, consider using US Legal Forms, which provides all the essential documents needed to take on this responsibility confidently.

Getting a general contractor license in Tennessee can take anywhere from a few weeks to a few months based on various factors like document readiness and exam scheduling. It’s essential to prepare thoroughly and submit your application accurately to avoid delays. With the help of US Legal Forms, you can access comprehensive resources that help you navigate this process smoothly and efficiently.

The process to obtain a massage license in Tennessee generally takes a few months due to the required coursework and examination. Candidates must complete a recognized program and submit their application to the Tennessee Board of Massage Licensure. US Legal Forms can streamline this process by providing necessary paperwork and instructions, ensuring you meet all requirements efficiently.

Obtaining a general contractor license in Tennessee typically takes several weeks to months, depending on your preparedness and submission of required documents. You must complete the application, pass the necessary exams, and provide relevant experience. Using a platform like US Legal Forms can simplify this process by providing essential forms and guidance to help you stay on track.