Tennessee Deed of Trust - Multistate

Description

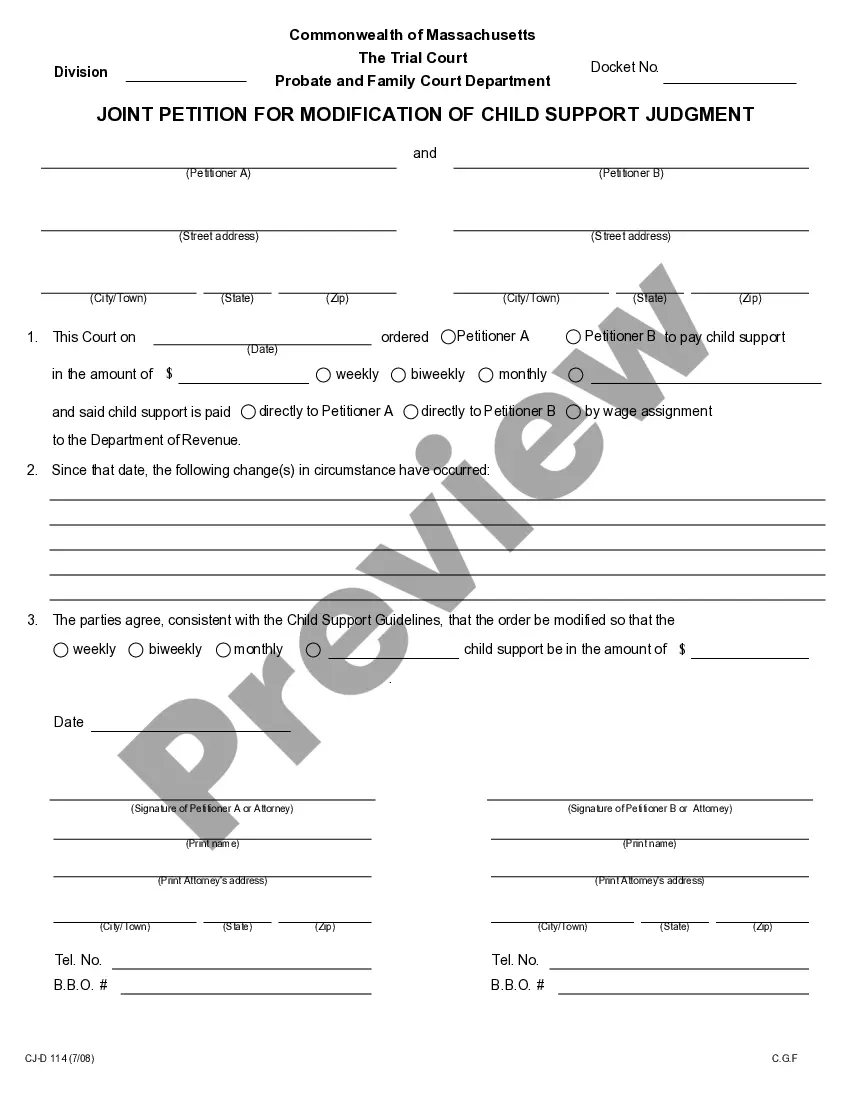

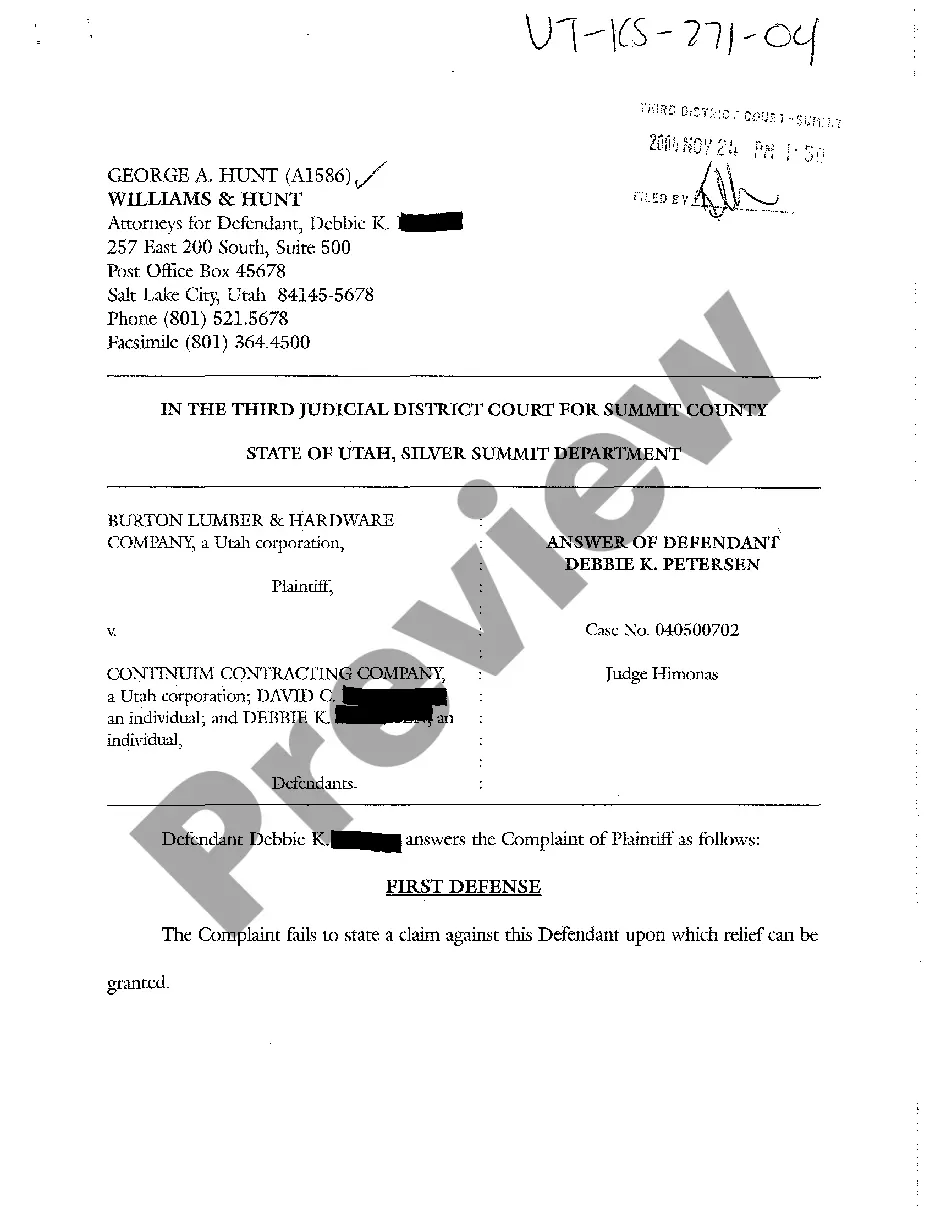

How to fill out Deed Of Trust - Multistate?

If you need to download, print, or obtain legitimate document templates, utilize US Legal Forms, the largest repository of legitimate forms available online. Take advantage of the site’s user-friendly and convenient search feature to find the documents you require. Various templates for business and personal purposes are sorted by categories and states, or keywords. Use US Legal Forms to locate the Tennessee Deed of Trust - Multistate with just a few clicks.

If you are already a US Legal Forms client, Log In to your account and click the Acquire button to get the Tennessee Deed of Trust - Multistate. You can also access forms you previously downloaded in the My documents section of your account.

If you are using US Legal Forms for the first time, follow the steps below: Step 1. Ensure you have selected the form for the correct area/state. Step 2. Use the Review option to examine the form’s content. Do not forget to read the details. Step 3. If you are unsatisfied with the form, utilize the Lookup field at the top of the screen to find other versions of the legitimate form template. Step 4. Once you have found the form you need, click the Buy now button. Choose the pricing plan you prefer and enter your credentials to register for an account. Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction. Step 6. Select the format of the legitimate form and download it to your device. Step 7. Complete, edit, and print or sign the Tennessee Deed of Trust - Multistate.

Do not alter or remove any HTML tags. Only synonymize plain text outside of the HTML tags.

- Each legitimate document template you purchase is yours permanently.

- You will have access to every form you downloaded in your account.

- Select the My documents section and choose a form to print or download again.

- Obtain and download, and print the Tennessee Deed of Trust - Multistate with US Legal Forms.

- There are millions of professional and state-specific forms you can use for your personal business or individual needs.

Form popularity

FAQ

Not all states recognize a Trust Deed. Use a Mortgage Deed if you live in: Connecticut, Delaware, Florida, Indiana, Iowa, Kansas, Louisiana, New Jersey, New York, North Dakota, Ohio, Oklahoma, Pennsylvania, South Carolina, Vermont, or Wisconsin.

Tennessee is a deed of trust state. However, a mortgage is enforceable. The trustee must be a resident of Tennessee or a corporation domiciled in Tennessee.

There are three parties involved in a deed of trust: Trustor: This is the borrower. Trustee: This is the third party who will hold the legal title to the real property. Beneficiary: This is the lender.

Deeds of trust are the most common instrument used in the financing of real estate purchases in Alaska, Arizona, California, Colorado, the District of Columbia, Idaho, Maryland, Mississippi, Missouri, Montana, Nebraska, Nevada, North Carolina, Oregon, Tennessee, Texas, Utah, Virginia, Washington, and West Virginia, ...

Trust deeds are an alternative to mortgages in certain states. Instead of an agreement directly between a lender and a borrower, a trust deed places the title of a property in the hands of a third party, or trustee.

What Is A Deed Of Trust? A deed of trust is an agreement between a home buyer and a lender at the closing of a property. The agreement states that the home buyer will repay the home loan and the mortgage lender will hold the property's legal title until the loan is paid in full.

The majority of the time a deed of trust is used in a real estate transaction in North Carolina, it will be a purchase money mortgage, or a mortgage issued to the borrower by the seller of the home as part of the purchase transaction, unlike a traditional mortgage which is obtained through a bank.

Deeds of trust are the most common instrument used in the financing of real estate purchases in Alaska, Arizona, California, Colorado, the District of Columbia, Idaho, Maryland, Mississippi, Missouri, Montana, Nebraska, Nevada, North Carolina, Oregon, Tennessee, Texas, Utah, Virginia, Washington, and West Virginia, ...