Tennessee Lease or Rental of Computer Equipment

Description

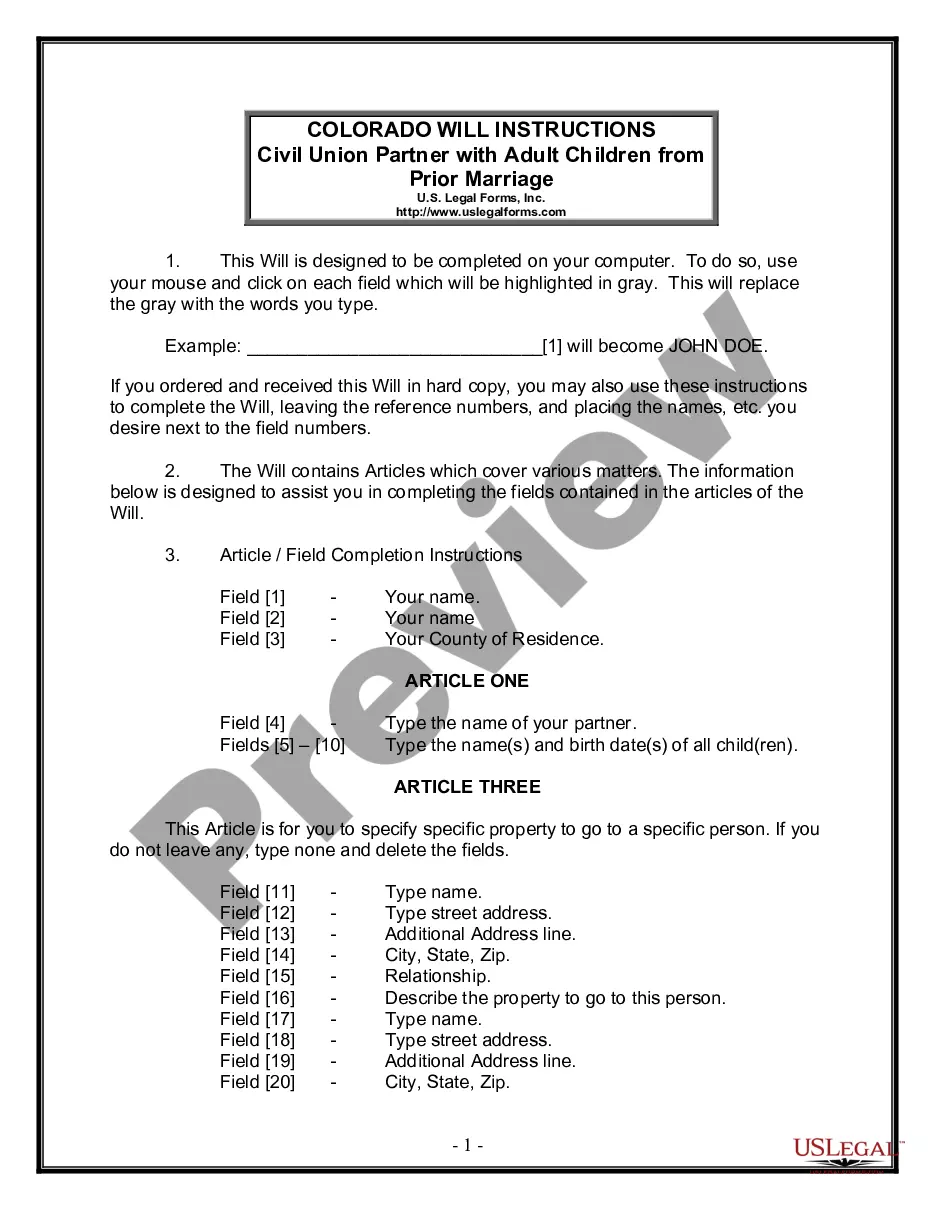

How to fill out Lease Or Rental Of Computer Equipment?

If you aim to finalize, obtain, or create sanctioned document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Take advantage of the site's user-friendly and trouble-free search feature to locate the documents you need.

A variety of templates for business and personal purposes are classified by types and states, or keywords.

Step 4. Once you find the form you need, click the Get now button. Choose the payment plan you prefer and enter your information to register for an account.

Step 6. Complete the transaction. You can use your credit card or PayPal account to finalize the transaction.

- Employ US Legal Forms to download the Tennessee Lease or Rental of Computer Equipment with just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and click the Download button to retrieve the Tennessee Lease or Rental of Computer Equipment.

- You can also find forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your correct city/state.

- Step 2. Utilize the Review option to assess the form's details. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other variations of the legal form template.

Form popularity

FAQ

Yes, equipment rental in Tennessee, including the rental of computer equipment, is generally subject to sales and use tax. This tax applies when an individual or business rents or leases equipment for a specified period. To ensure you are compliant with the state's tax laws, consider leveraging USLegalForms to obtain the necessary documents and forms.

In Tennessee, rental income, including from the lease or rental of computer equipment, is subject to state income tax. It is crucial to report this income accurately on your tax return to meet state law requirements. For assistance in understanding the complexities of taxation, including potential deductions, check out the legal forms offered by USLegalForms.

Tennessee has specific exemptions from sales tax, including certain groceries, prescription drugs, and some medical devices. However, items like rental of computer equipment are typically taxable, so it is essential to be aware of your obligations. To ensure compliance with all taxation rules, consider exploring resources available through USLegalForms for guidance.

Yes, leasing a computer is a common practice that allows users to access the latest technology without buying it outright. This option is particularly beneficial for businesses looking to manage their budgets effectively. If you are looking into the Tennessee Lease or Rental of Computer Equipment, consider platforms like US Legal Forms that can help you create the right lease agreements and understand your options.

A computer rental shop specializes in providing computers and related equipment on a rental basis. These shops often offer various models and configurations to suit different needs and budgets. If you are researching the Tennessee Lease or Rental of Computer Equipment, a computer rental shop is a great place to start your search for affordable options.

Computer rental involves leasing computer equipment for short-term or long-term use. This option allows businesses and individuals to access high-quality technology without the financial burden of ownership. For those considering the Tennessee Lease or Rental of Computer Equipment, renting can be a practical choice to meet temporary demands.

A computer shop is a retail establishment that specializes in computers and related technology. It typically offers a variety of products like laptops, desktops, and peripherals, along with services like installation and maintenance. When looking at the Tennessee Lease or Rental of Computer Equipment, visiting a computer shop can provide you with valuable insight and options available to you.

Computer shops provide a range of services including selling hardware, software, and accessories. They also offer repairs, technical support, and sometimes leasing options for equipment. If you are interested in the Tennessee Lease or Rental of Computer Equipment, these shops can guide you in finding the right solution for your needs.

Yes, rental income is generally taxable in Tennessee. If you earn income from leasing equipment, that income qualifies as taxable income. Maintaining careful records of your earnings can ensure compliance when engaging in a Tennessee lease or rental of computer equipment. Using professional services like US Legal Forms can help you navigate these tax implications effectively.

Tangible personal property includes items that can be physically touched and moved, such as equipment, furniture, and computers. In Tennessee, this classification is significant because it determines the application of sales tax. When considering a Tennessee lease or rental of computer equipment, remember that this classification also affects your tax responsibilities as both a lessee and lessor.