Hawaii Order/Notice To Withhold Income for Support — Instructions & Sample Order is a court document used by separating spouses or parents in Hawaii to ensure that one parent or spouse is paying child support or alimony in a timely and consistent manner. The document includes instructions on how to complete the order, the sample order form, and information on how to serve the order to the employer. There are two types of Hawaii Order/Notice To Withhold Income for Support — Instructions & Sample Order: 1. The Income Withholding for Support (TWO) order form: This is a legally binding document that must be completed and served to the employer of the obliged (the parent or spouse responsible for paying the support). The TWO order form includes the employer's name and address, the amount to be withheld from the obliged's paycheck, and other pertinent information. 2. The Notice to Withhold Income for Support (NCIS) order form: This is a less legally binding document that can be used if the obliged is self-employed or does not have an employer. The NCIS order form includes the obliged's name and address, the amount to be withheld from their income, and other pertinent information. These Hawaii Order/Notice To Withhold Income for Support — Instructions & Sample Order forms are designed to ensure that parents or spouses are able to obtain the child support or alimony they are owed in a timely and consistent manner.

Hawaii Order/Notice To Withhold Income for Support - Instructions & Sample Order

Description

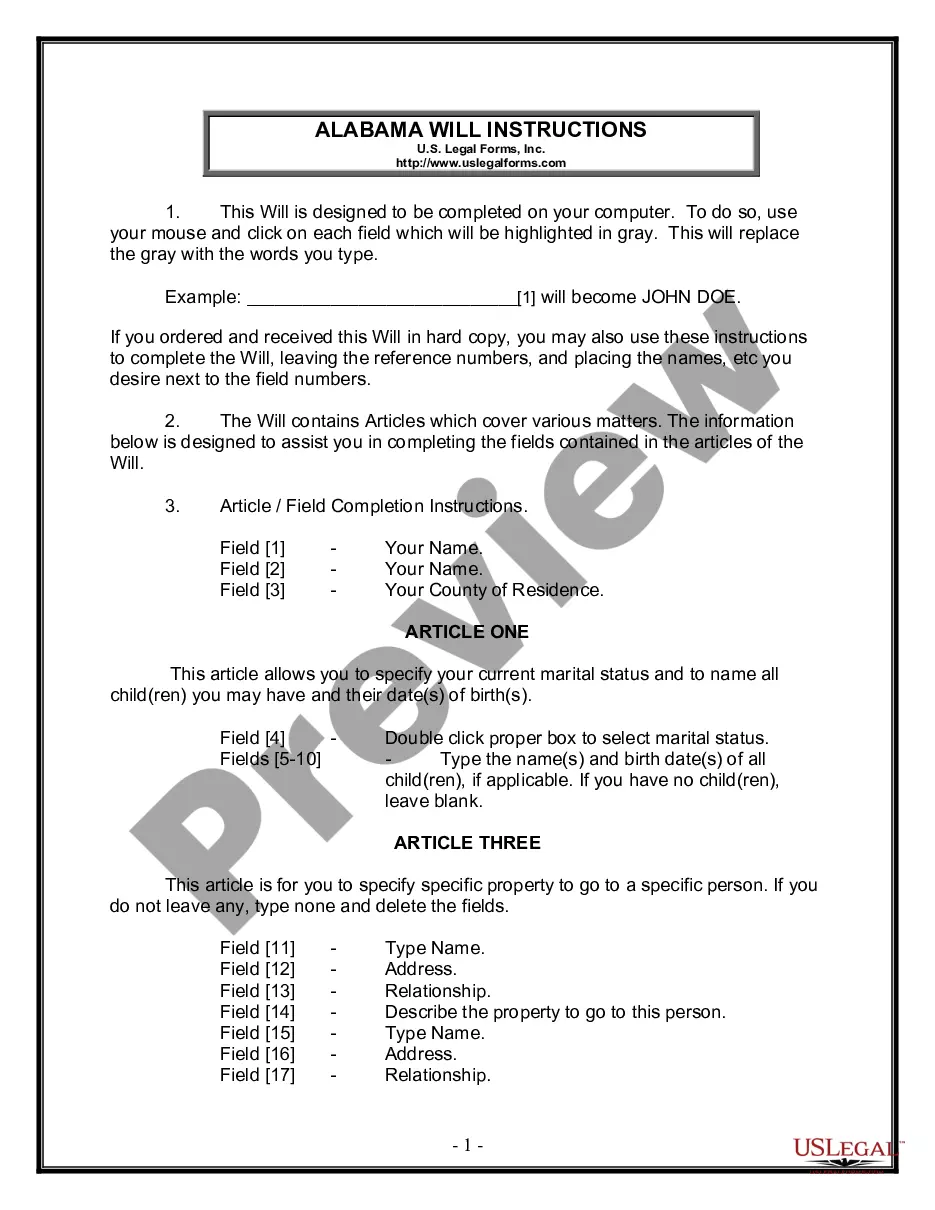

How to fill out Hawaii Order/Notice To Withhold Income For Support - Instructions & Sample Order?

US Legal Forms is the easiest and most economical method to locate suitable legal templates.

It’s the largest online collection of business and personal legal documents created and validated by legal experts.

Here, you can access printable and fillable templates that adhere to national and local laws - just like your Hawaii Order/Notice To Withhold Income for Support - Instructions & Sample Order.

Once you save a template, you can access it any time you wish - simply locate it in your profile, re-download it for printing and manual completion or import it to an online editor to fill it in and sign more efficiently.

Take advantage of US Legal Forms, your dependable partner in acquiring the necessary official documentation. Give it a try!

- Examine the form description or view a preview of the document to confirm it meets your requirements, or find another one using the search feature above.

- Click Buy now when you are certain of its suitability with all the criteria, and select the subscription plan that you prefer the most.

- Establish an account with our service, Log In, and pay for your subscription using PayPal or your credit card.

- Choose your desired file format for your Hawaii Order/Notice To Withhold Income for Support - Instructions & Sample Order and download it onto your device using the appropriate button.

Form popularity

FAQ

Income withholding for child support fl195 is a legal process where a portion of an individual's earnings is automatically deducted to fulfill child support obligations. This process is guided by the Hawaii Order/Notice To Withhold Income for Support - Instructions & Sample Order, which simplifies compliance for employers and obligors. Utilizing uslegalforms can help you navigate this process efficiently, ensuring that all necessary forms and instructions are completed properly.

The amount deducted from a paycheck for child support varies based on the individual's financial situation and the court's orders. Generally, employers are required to follow the withholding limits defined in the Hawaii Order/Notice To Withhold Income for Support - Instructions & Sample Order, which often sets percentages based on disposable income. This approach helps the custodial parent receive the support they need while allowing the paying parent to meet their living expenses.

The maximum amount that can be withheld for child support is known as the 'withholding limit.' This limit is set to ensure that the obligor retains enough income to support themselves while fulfilling their child support obligations. The Hawaii Order/Notice To Withhold Income for Support - Instructions & Sample Order provides clear guidelines and ensures that both parents understand their responsibilities regarding child support withholding.

In Florida, employers are mandated to withhold child support when they receive a valid order. This means they process income withholdings according to court instructions to ensure timely support for children. Understanding how the process works can help both employers and employees. For guidance, the 'Hawaii Order/Notice To Withhold Income for Support - Instructions & Sample Order' can provide clear steps and sample formats that streamline compliance.

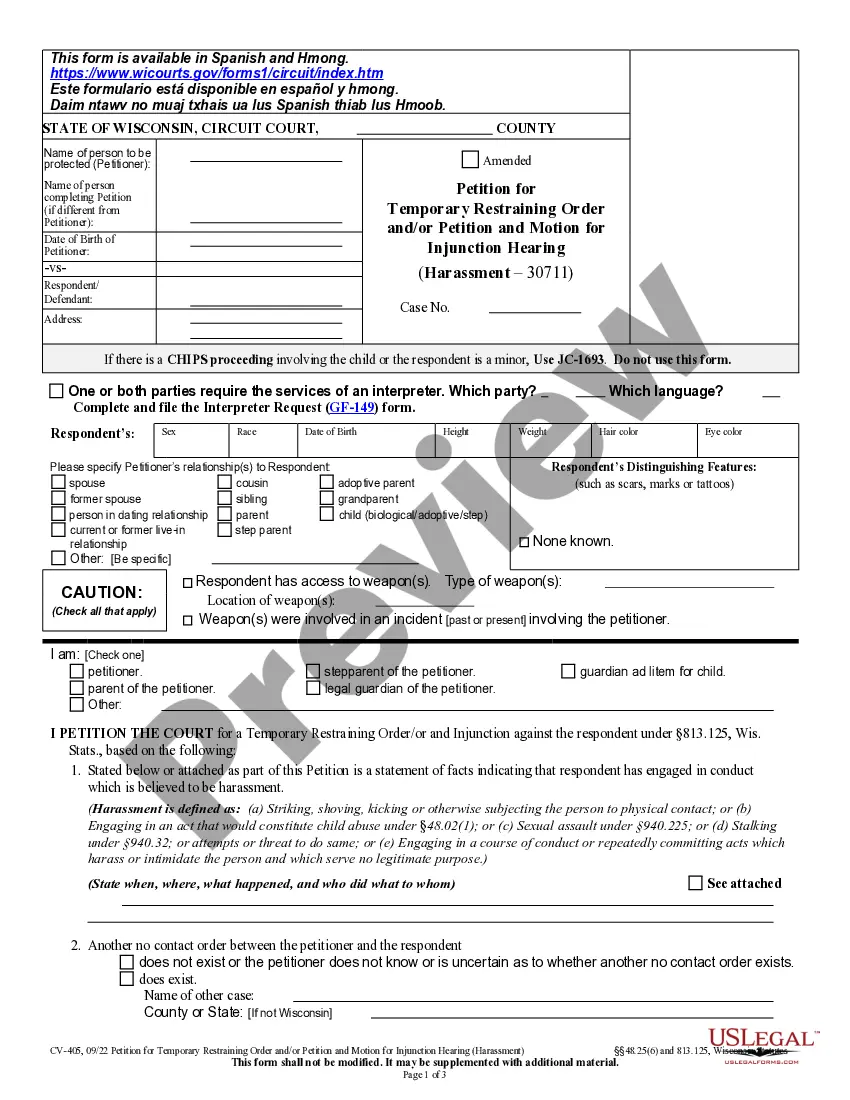

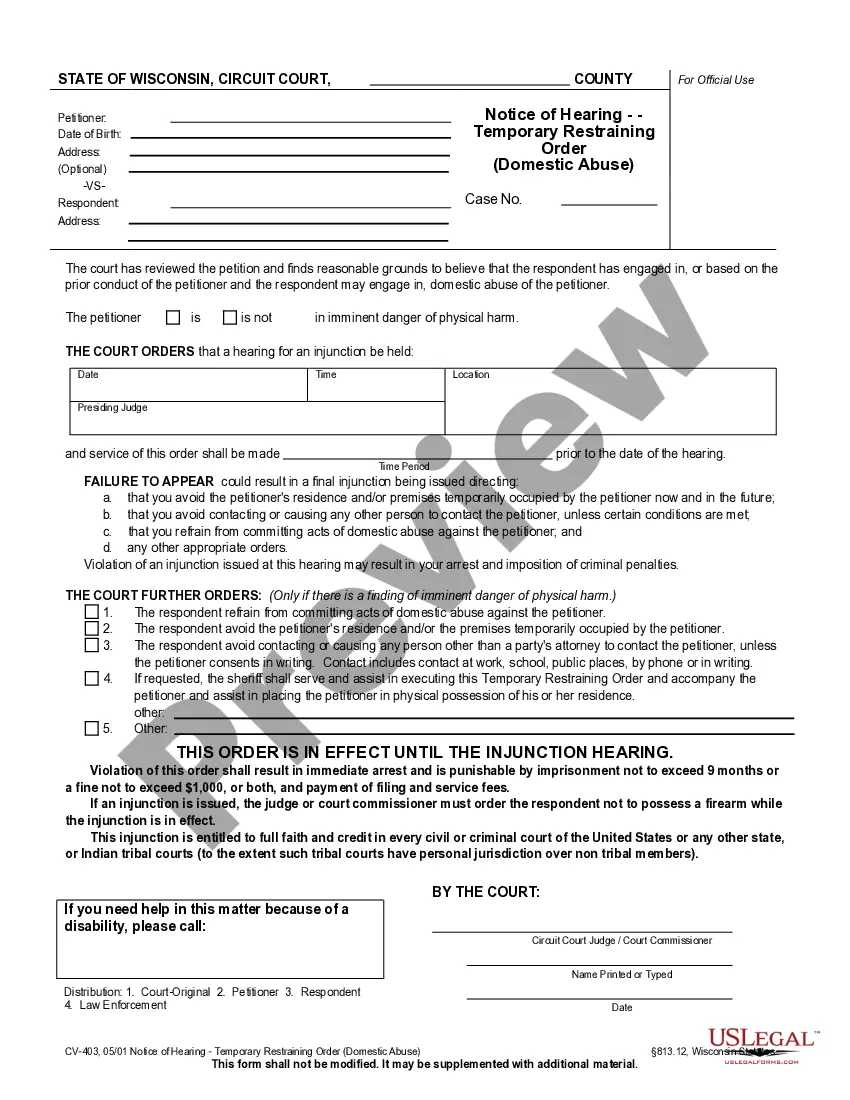

An earnings withholding order is usually issued when there are unmet obligations regarding child support or alimony. If you received a Hawaii Order/Notice To Withhold Income for Support - Instructions & Sample Order, it means that your employer is required to withhold a portion of your earnings to fulfill these obligations. Understanding the order can help you address any concerns while staying compliant with your responsibilities.

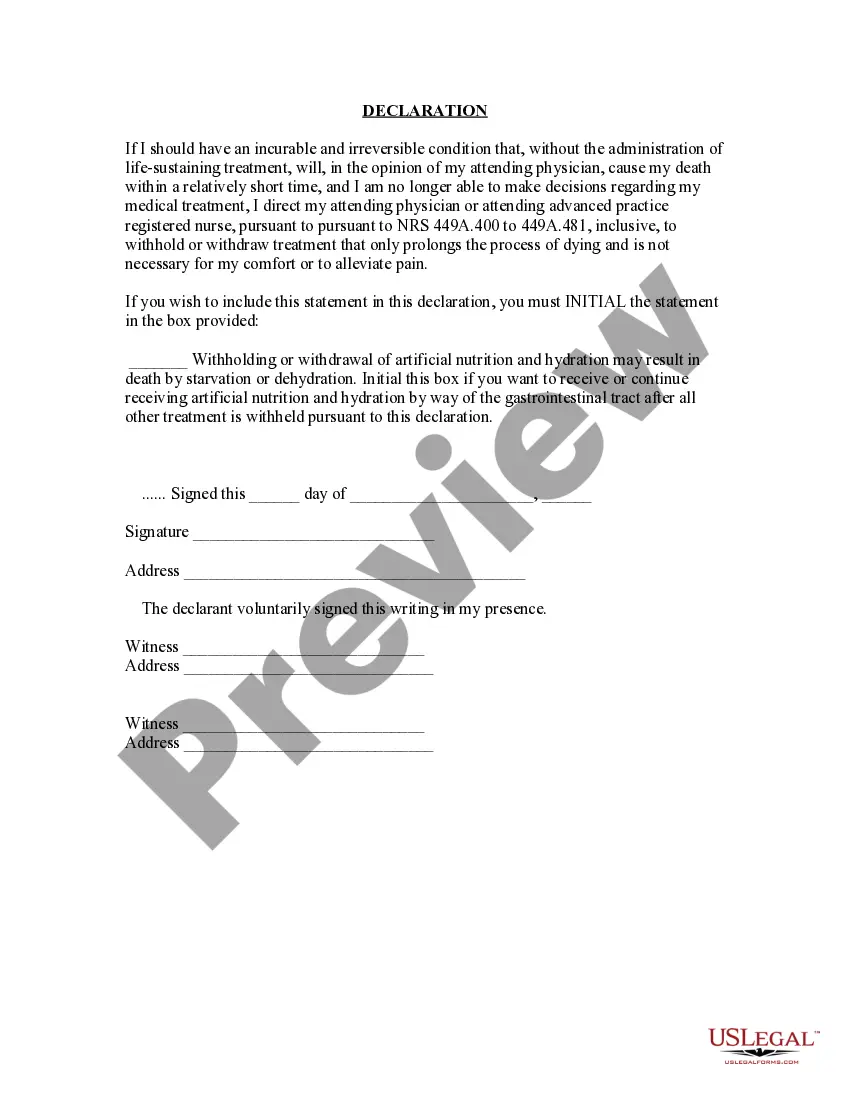

The income withholding for support form is typically filled out by the agency or party requesting the income withholding. This may include the custodial parent or a child support enforcement agency in Hawaii. Utilizing the Hawaii Order/Notice To Withhold Income for Support - Instructions & Sample Order simplifies this process, providing precise instructions to ensure accuracy.

A withholding order is a legal directive that instructs an employer to divert a portion of an employee's earnings towards child support or spousal support. The Hawaii Order/Notice To Withhold Income for Support - Instructions & Sample Order outlines the necessary steps to create and enforce such orders. Understanding this order is crucial for both recipients and payers to ensure compliance and avoid complications.

Income withholding refers to the process where a portion of an employee's paycheck is automatically deducted to cover child support or alimony obligations. In Hawaii, this is formalized through the Hawaii Order/Notice To Withhold Income for Support - Instructions & Sample Order, which provides a clear guideline on how these deductions should occur. This ensures timely payments, benefiting both parties involved.

The time it takes to implement an income withholding order can vary based on several factors, such as the local jurisdiction and the employer's responsiveness. Generally, once the Hawaii Order/Notice To Withhold Income for Support - Instructions & Sample Order is submitted, employers have a specific timeframe to begin withholding income. Therefore, it is beneficial to ensure that all documentation is correctly filled out to avoid delays.

In legal terms, 'IWO' typically refers to Income Withholding Order, an essential tool for enforcing child or spousal support payments. This order ensures that the support payments are deducted directly from a person's income, making the process smoother for both parties involved. For those looking for clarity on the procedures and examples, our Hawaii Order/Notice To Withhold Income for Support - Instructions & Sample Order is an excellent resource to rely on.