Tennessee Employment Application for Accountant

Description

How to fill out Employment Application For Accountant?

Are you currently in the position that you need documents for both business or personal purposes nearly every day.

There are numerous legal document templates available online, but finding ones you can rely on isn't simple.

US Legal Forms provides thousands of form templates, such as the Tennessee Employment Application for Accountant, designed to meet federal and state standards.

Once you find the correct form, simply click Buy now.

Choose the payment plan you desire, enter the necessary information to create your account, and pay for the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, just Log In.

- After that, you can download the Tennessee Employment Application for Accountant template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and confirm it is for the correct city/state.

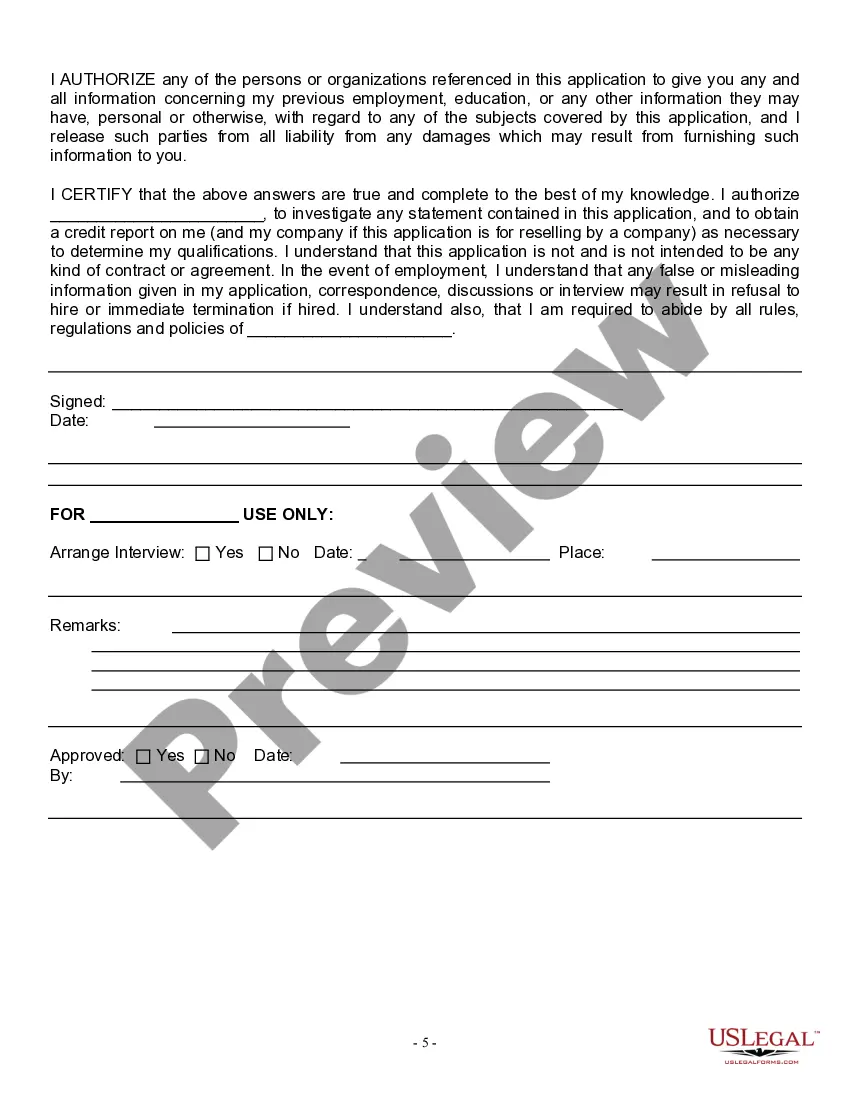

- Use the Preview button to review the form.

- Check the description to ensure you have selected the appropriate form.

- If the form isn't what you're looking for, utilize the Search field to locate the form that meets your needs.

Form popularity

FAQ

Steps to become an accountantObtain a bachelor's degree.Choose a specialty.Get an internship or entry-level position.Determine whether you will be an accountant or CPA.Pass all required exams.Consider pursuing continuing education.

All Online@UT (Canvas) users have a unique Tennessee ID (TN ID) number. This 9-digit number can be found in your MyUTK right beneath your Name and Student ID number.

Tennessee CPA Exam Fees The cost to take all four sections of the CPA exam in Tennessee is $743 plus the initial $155 application fee. The re-examination registration fee varies from $75 $120 depending on the number of sections you are signing up for.

Information and an application to take the CPA examination may be obtained by calling 1-800/CPA-EXAM (272-3926) or clicking below....Requirements to Become a CPAComplete 150 college credit hours.Complete one year of experience in accounting.Pass the Uniform CPA Examination.Pass the Ethics Examination.

Almost all states require CPA candidates to complete 150 semester hours of college coursework to be licensed, which is 30 hours more than the usual four-year bachelor's degree. Add this together, and you can expect to spend at least five years in your journey to become an accountant.

Registration of sales tax is available on the Tennessee Taxpayer Access Point (TNTAP). To apply, please go to Tennessee Taxpayer Access Point (TNTAP) and select Register a New Business.

Initial CPA License Application If the applicant has met the requirements for licensure, he or she may apply for a Tennessee CPA license online at core.tn.gov. Applicants must attach a completed work experience form during the application process.

To locate your Employer Account Number:If you've filed state payroll tax returns in the past, you can find your Tennessee Employer Account Number on any previously submitted quarterly wage report.Call the Tennessee Department of Labor & Workforce Development at 615-741-2486.

Employer's Registration Number: Your Registration Number can be found on the top left corner of your Tax Clearance Certificate. It will contain either 8 or 9 characters, which may include letters and numbers.

Aspiring accountants need a bachelor's degree in accounting or business to begin work in the field. A bachelor's degree usually takes about four years and 120 credits to complete. Those with an associate degree might enter the field as bookkeepers or accounting clerks.