This form for use in litigation against an insurance company for bad faith breach of contract. Adapt this model form to fit your needs and specific law. Not recommended for use by non-attorney.

Tennessee Complaint For Failure Of Insurer To pay Benefits - Jury Trial Demand

Description

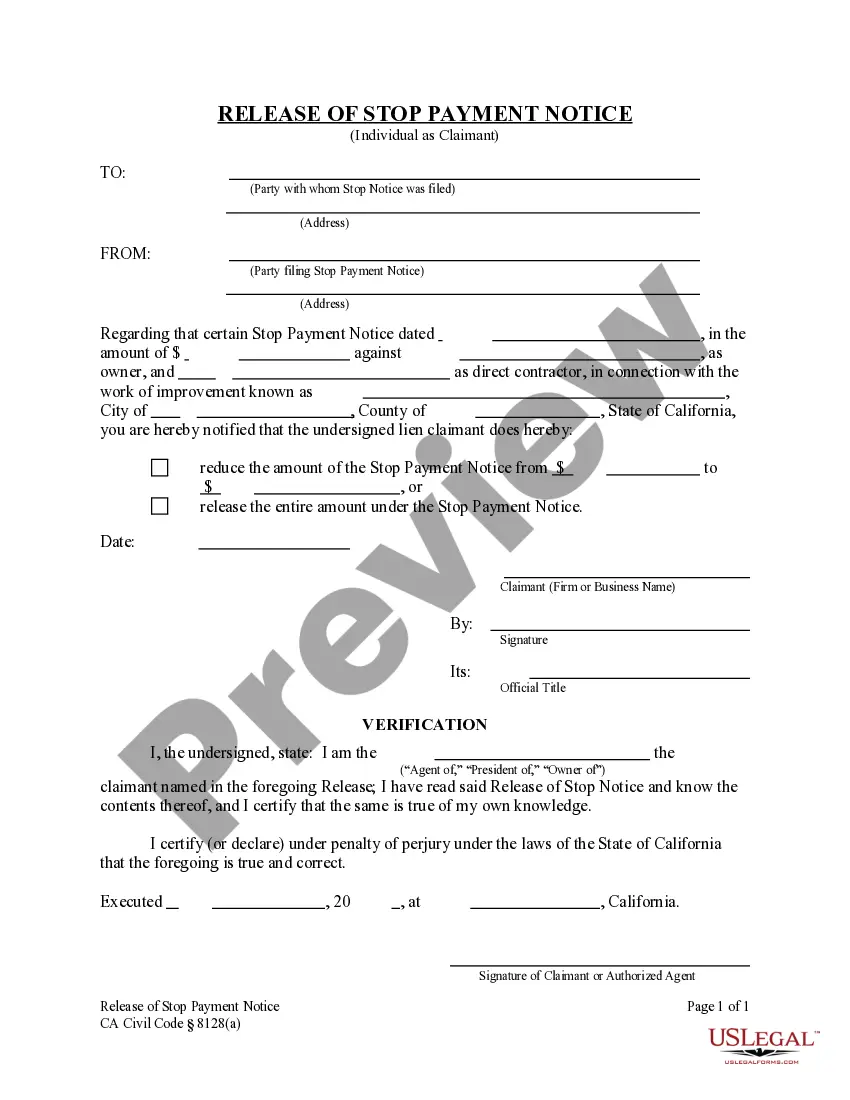

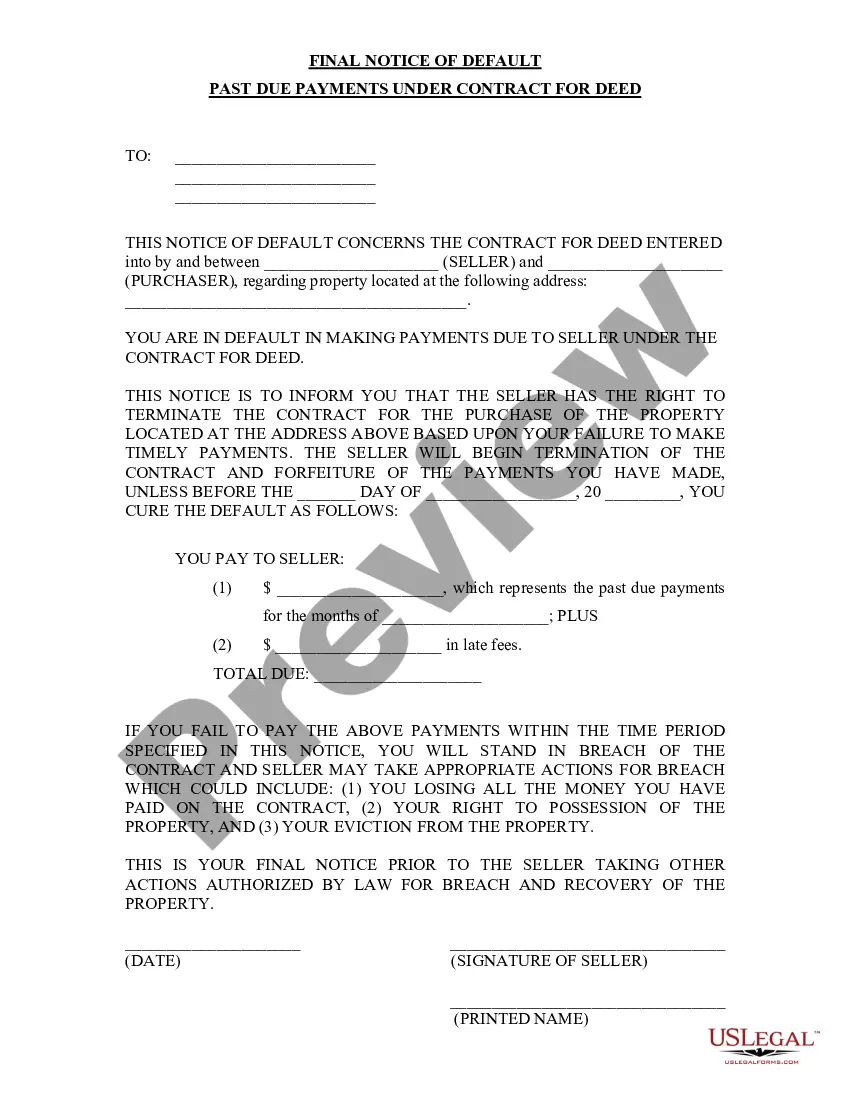

How to fill out Complaint For Failure Of Insurer To Pay Benefits - Jury Trial Demand?

You can spend countless hours online searching for the official document template that complies with the state and federal requirements you need.

US Legal Forms provides thousands of legal documents that are reviewed by experts.

You can download or print the Tennessee Complaint For Failure Of Insurer To Pay Benefits - Jury Trial Demand from their service.

If available, use the Preview button to view the document template as well. If you wish to obtain another version of the form, use the Search field to find the template that meets your needs and requirements. Once you have found the template you want, click Get now to proceed. Choose the pricing plan you want, enter your credentials, and register for an account on US Legal Forms. Complete the purchase. You can use your credit card or PayPal account to buy the legal document. Select the format of the document and download it to your device. Make adjustments to the document if necessary. You can fill out, edit, sign, and print the Tennessee Complaint For Failure Of Insurer To Pay Benefits - Jury Trial Demand. Access and print thousands of document layouts using the US Legal Forms website, which offers the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- Then, you can fill out, edit, print, or sign the Tennessee Complaint For Failure Of Insurer To Pay Benefits - Jury Trial Demand.

- Every legal document template you obtain is yours permanently.

- To retrieve another copy of any purchased form, go to the My documents tab and click the appropriate button.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your county/city that you choose.

- Check the form details to confirm you have selected the correct template.

Form popularity

FAQ

Tennessee Code 56-7-109 pertains to the obligations of insurers to act in good faith during the claims process. This statute emphasizes that insurers must investigate claims thoroughly and fairly. If you feel that your insurer has violated this code, you may consider filing a Tennessee Complaint For Failure Of Insurer To Pay Benefits - Jury Trial Demand. Resources like USLegalForms can help you understand your rights and obligations under this code.

If an insurer does not conduct a thorough investigation of your claim, it may lead to an improper denial of benefits. This failure can expose the insurer to legal action, including the filing of a Tennessee Complaint For Failure Of Insurer To Pay Benefits - Jury Trial Demand. You have the right to demand accountability and ensure that your claim is treated fairly. Platforms like USLegalForms can assist you in taking the necessary legal steps.

Insurers may deny claims if the insured does not follow the specific provisions outlined in the policy. This could include failure to report incidents promptly, not providing necessary documentation, or not adhering to coverage limits. Understanding these provisions is crucial because a Tennessee Complaint For Failure Of Insurer To Pay Benefits - Jury Trial Demand may arise if the insurer unjustly denies a valid claim. Always keep thorough records of your communications with your insurer.

When an insurance company refuses to pay your claim, the first step is to review your policy carefully. Ensure that your claim is valid according to the terms outlined in your policy. If you believe your claim is justified and the insurer still denies it, consider filing a Tennessee Complaint For Failure Of Insurer To Pay Benefits - Jury Trial Demand. Utilizing platforms like USLegalForms can help you draft a complaint effectively.

In Tennessee, an insurance company typically has 30 days to pay a claim after receiving proper notice of the claim. If the insurer fails to pay within this timeframe, you may consider filing a Tennessee Complaint For Failure Of Insurer To Pay Benefits - Jury Trial Demand. This complaint can help ensure that your rights are protected and that you receive the benefits you deserve. For further assistance in this process, consider using the resources available at USLegalForms, where you can find templates and guidance tailored to your situation.

When an insurance company refuses to pay a claim, it is typically referred to as a claim denial. This situation can arise for various reasons, including insufficient evidence or policy exclusions. If you believe the denial is unjust, you can pursue a Tennessee Complaint For Failure Of Insurer To pay Benefits - Jury Trial Demand to address the issue and seek the benefits you deserve.

To file a complaint against an insurance company in Tennessee, start by gathering all necessary documentation related to your claim. You can then submit your complaint to the Tennessee Department of Commerce and Insurance, providing details about your case. If the issue remains unresolved, you may consider filing a Tennessee Complaint For Failure Of Insurer To pay Benefits - Jury Trial Demand to seek further legal action.

Insurers can be liable for bad faith in several ways. Firstly, they may unjustly delay payment of a valid claim, leaving the policyholder in distress. Secondly, they might undervalue a claim without reasonable justification, ignoring the actual damages incurred. Lastly, they can deny a claim outright without providing clear evidence or rationale, which can lead to a Tennessee Complaint For Failure Of Insurer To pay Benefits - Jury Trial Demand.