Tennessee Articles of Charter Surrender

Description

How to fill out Tennessee Articles Of Charter Surrender?

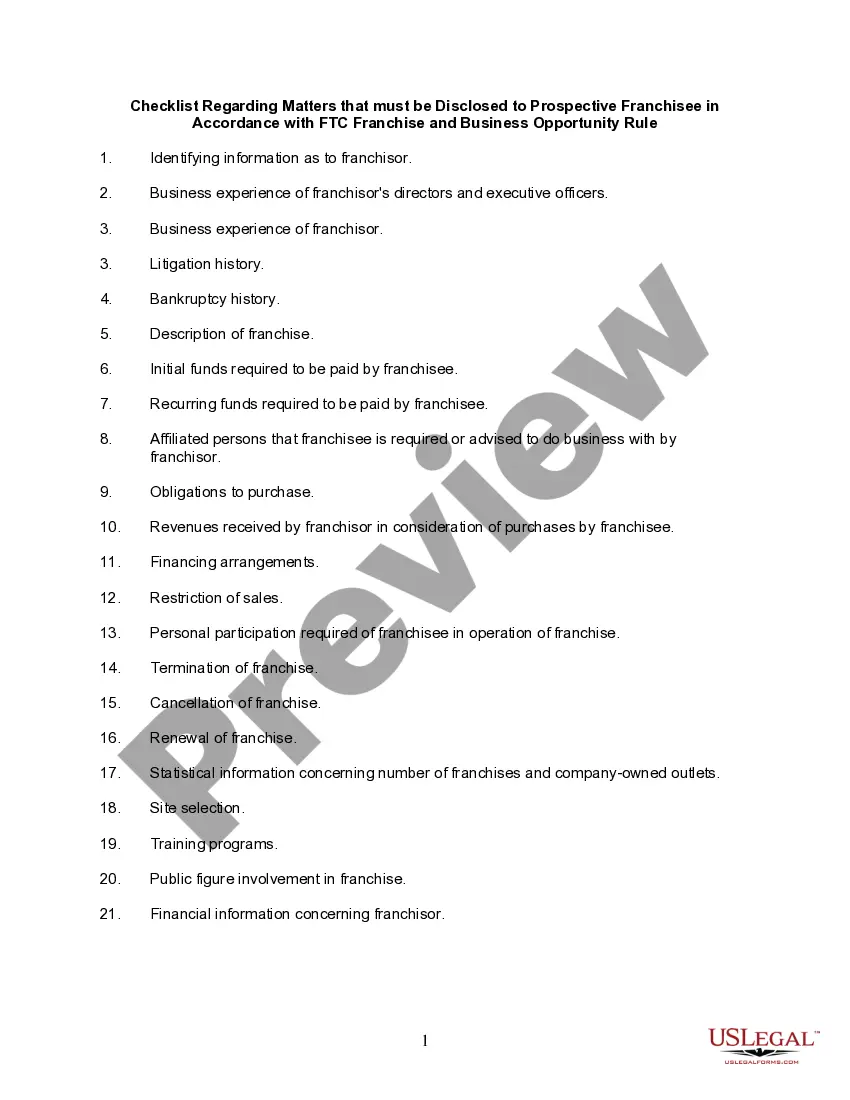

Coping with official paperwork requires attention, precision, and using well-drafted blanks. US Legal Forms has been helping people across the country do just that for 25 years, so when you pick your Tennessee Articles of Charter Surrender template from our library, you can be sure it meets federal and state regulations.

Working with our service is straightforward and quick. To obtain the required paperwork, all you’ll need is an account with a valid subscription. Here’s a quick guide for you to find your Tennessee Articles of Charter Surrender within minutes:

- Remember to attentively examine the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Look for an alternative formal template if the previously opened one doesn’t suit your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and save the Tennessee Articles of Charter Surrender in the format you need. If it’s your first time with our website, click Buy now to continue.

- Create an account, decide on your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to obtain your form and click Download. Print the blank or add it to a professional PDF editor to prepare it electronically.

All documents are drafted for multi-usage, like the Tennessee Articles of Charter Surrender you see on this page. If you need them one more time, you can fill them out without re-payment - simply open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and accomplish your business and personal paperwork rapidly and in full legal compliance!

Form popularity

FAQ

How to Close a Corporation in Tennessee Have a board of directors' meeting.Have a shareholders' meeting in order to approve the motion to dissolve the corporation. Submit a written Consent to Dissolution to the Tennessee Secretary of State. Submit any required annual reports to the Tennessee Secretary of State.

The Department of Revenue issues this letter upon taxpayer request. A Certificate of Tax Clearance declares that all tax returns administered by the Department of Revenue have been filed and all liabilities have been paid. Certificates of Tax Clearance are issued to both terminating and ongoing businesses.

The first step in terminating a Tennessee LLC is to file Form SS-4246, Notice of Dissolution (Limited Liability Company) with the Department of State, Division of Business Services (DBS). After you file notice of dissolution and wind up your business, you will have to file the appropriate Articles of Termination.

File an original form SS-4247, Articles of Amendment to Articles of Organization (LLC)with the Tennessee Department of State, Division of Business Services (DBS). The DBS amendment form is in your online account when you sign up for registered agent service and is available on the DBS website.

Sales and use tax certificates can be verified using the Tennessee Taxpayer Access Point (TNTAP) under Information and Inquiries. This verification does not relieve the vendor of the responsibility of maintaining a copy of the certificate on file.

The first step in terminating a Tennessee LLC is to file Form SS-4246, Notice of Dissolution (Limited Liability Company) with the Department of State, Division of Business Services (DBS). After you file notice of dissolution and wind up your business, you will have to file the appropriate Articles of Termination.

To obtain a certificate of tax clearance, a business must file all returns to date and make all required payments. This includes filing a final franchise & excise tax return through the date of liquidation or the date the taxpayer ceased operations in Tennessee.

To obtain a certificate of tax clearance, a business must file all returns to date and make all required payments. This includes filing a final franchise & excise tax return through the date of liquidation or the date the taxpayer ceased operations in Tennessee.