Tennessee Claim for Exemptions

Description

How to fill out Tennessee Claim For Exemptions?

How much time and resources do you normally spend on composing formal documentation? There’s a greater way to get such forms than hiring legal specialists or spending hours searching the web for an appropriate template. US Legal Forms is the leading online library that offers professionally drafted and verified state-specific legal documents for any purpose, including the Tennessee Claim for Exemptions.

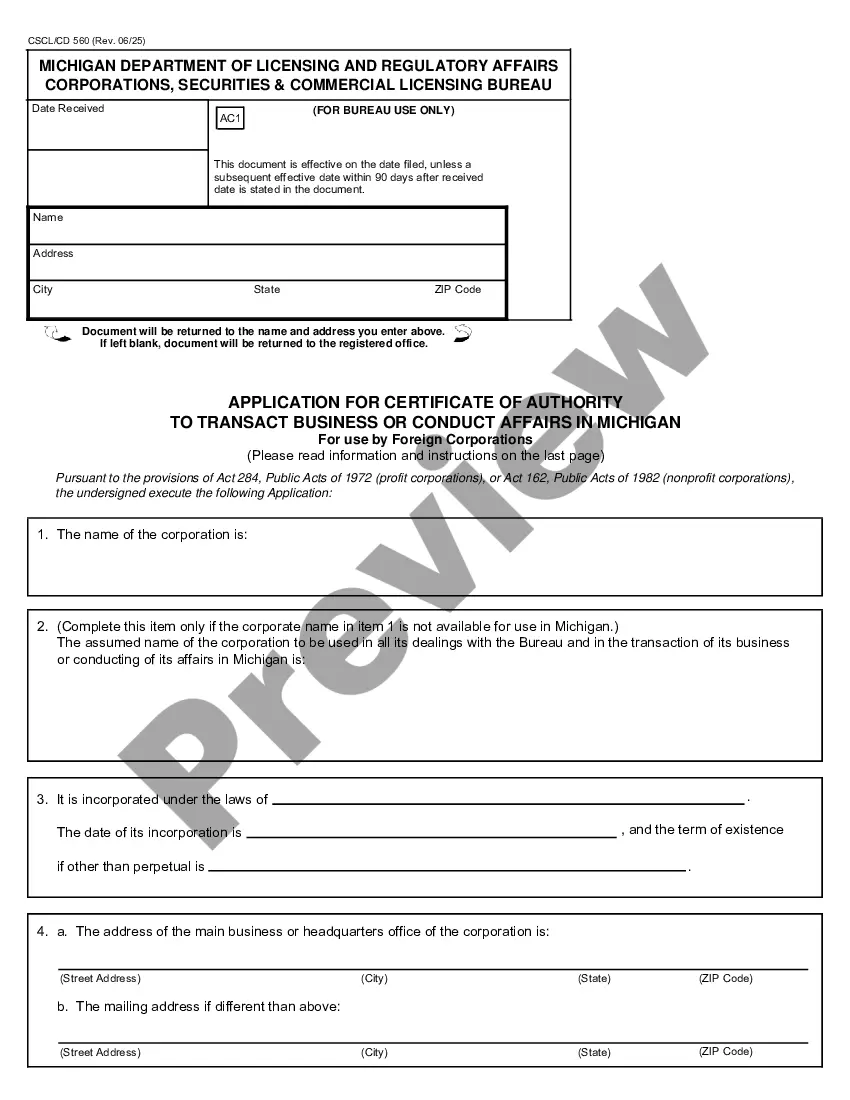

To obtain and prepare an appropriate Tennessee Claim for Exemptions template, adhere to these simple instructions:

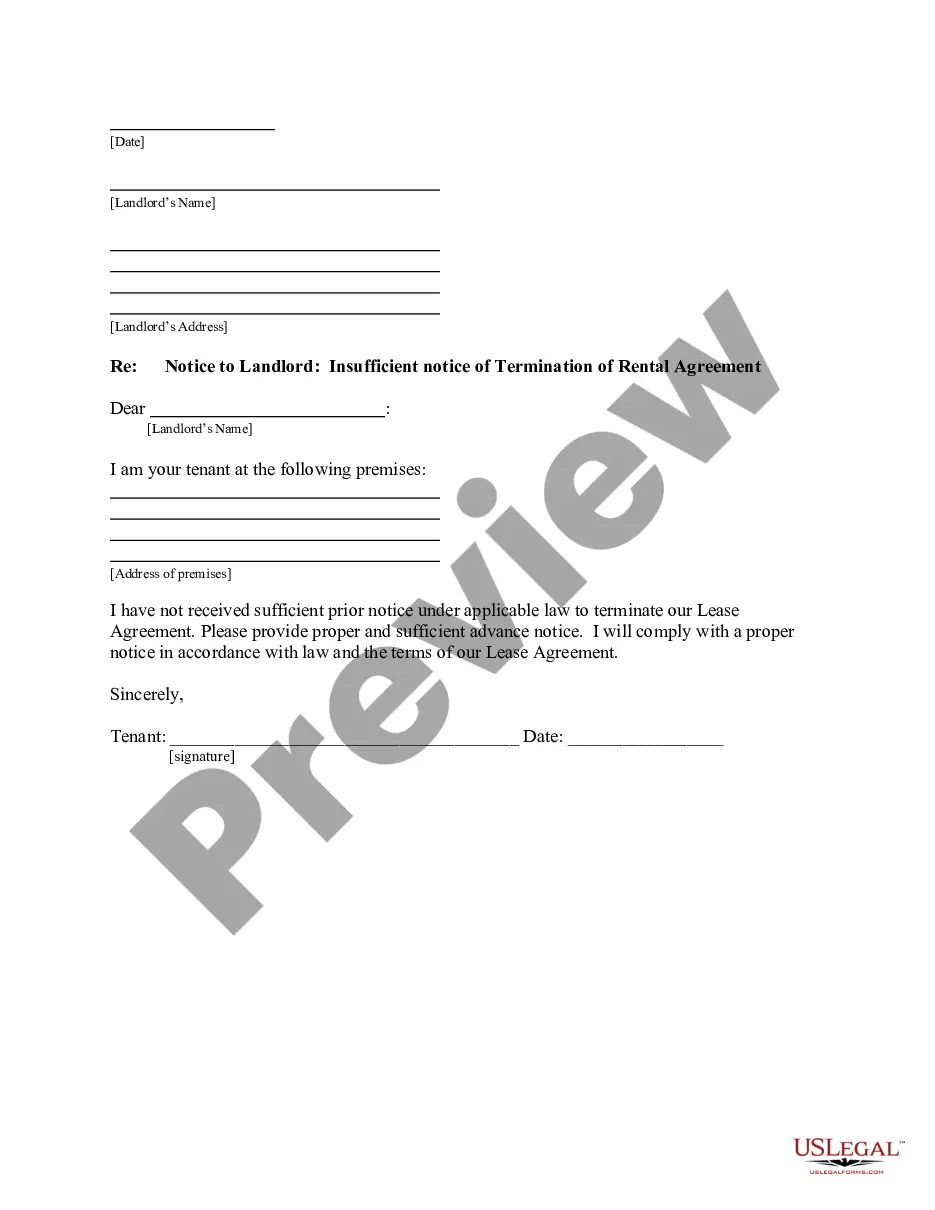

- Look through the form content to ensure it complies with your state requirements. To do so, check the form description or utilize the Preview option.

- If your legal template doesn’t meet your needs, locate another one using the search tab at the top of the page.

- If you already have an account with us, log in and download the Tennessee Claim for Exemptions. If not, proceed to the next steps.

- Click Buy now once you find the correct blank. Opt for the subscription plan that suits you best to access our library’s full service.

- Sign up for an account and pay for your subscription. You can make a payment with your credit card or through PayPal - our service is absolutely secure for that.

- Download your Tennessee Claim for Exemptions on your device and complete it on a printed-out hard copy or electronically.

Another advantage of our service is that you can access previously acquired documents that you safely keep in your profile in the My Forms tab. Pick them up at any moment and re-complete your paperwork as frequently as you need.

Save time and effort preparing official paperwork with US Legal Forms, one of the most trustworthy web services. Join us today!

Form popularity

FAQ

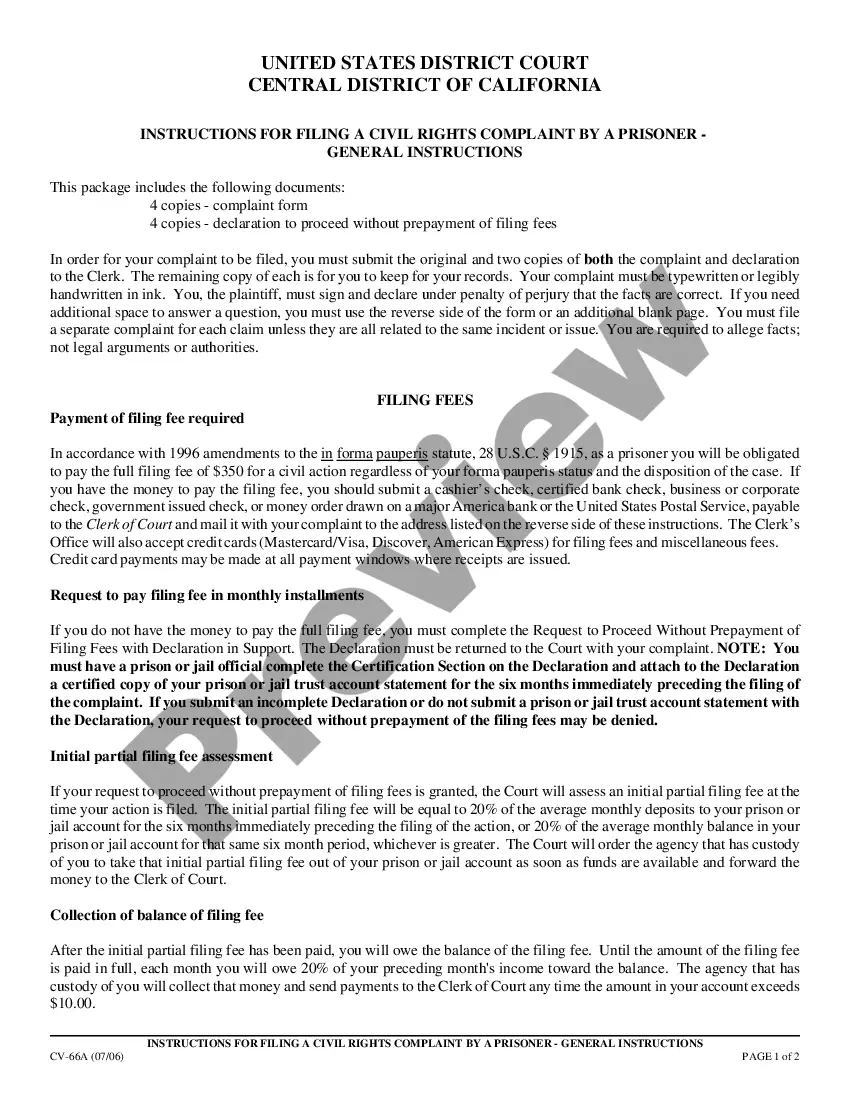

If you are not tax-exempt, you are going to have to pay your taxes eventually, and filing a withholding exemption is not going to change that. If you claim exempt on your Form W-4 without actually being eligible, anticipate a large tax bill and possible penalties after you file your tax return.

Tennessee state law provides for property tax relief for low-income elderly and disabled homeowners, as well as disabled veteran homeowners or their surviving spouses. This is a state program funded by appropriations authorized by the General Assembly.

Sales and Use Tax Certificate of Exemption This organization or institution qualifies for the authority to make sales and use tax exempt purchases of goods and services that It will use, consume or give away. This authorization for exemption is limited to sales made directly to the referenced organization.

In Tennessee, the homestead exemption is automatic ? you don't have to file a homestead declaration with the recorder's office to claim the homestead exemption in bankruptcy.

There are two types of exemptions-personal and dependency. Each exemption reduces the income subject to tax.

Businesses with less than $100,000 in taxable sales sourced to a county are exempt from the state business tax in that county, and businesses with less than $100,000 in taxable sales sourced to a municipality are exempt from the municipality business tax in that municipality.

Note: In order for an entity to qualify for the Farming Activity exemption: 1) at least 66.67% of its income must be from farming; 2) at least 66.67% of its assets must be used in farming; and 3) at least 95% of the voting rights, capital interest or profits must be owned by family members as defined above.

Certain Tennessee non-profits are eligible to be exempt from Tennessee state and local sales tax. You will need to complete an application for non-profit sales and use tax exemption and submit it and all required documentation (copies of articles, bylaws, IRS determination)to the Tennessee Department of Revenue.