Tennessee Order of Settlement or Petitioner to Receive Title and Possession to Property Rights

Description

How to fill out Tennessee Order Of Settlement Or Petitioner To Receive Title And Possession To Property Rights?

Access to high quality Tennessee Order of Settlement or Petitioner to Receive Title and Possession to Property Rights samples online with US Legal Forms. Prevent hours of lost time browsing the internet and lost money on documents that aren’t updated. US Legal Forms offers you a solution to just that. Get over 85,000 state-specific legal and tax templates that you could download and fill out in clicks in the Forms library.

To get the sample, log in to your account and then click Download. The file will be saved in two places: on your device and in the My Forms folder.

For people who don’t have a subscription yet, look at our how-guide listed below to make getting started simpler:

- Verify that the Tennessee Order of Settlement or Petitioner to Receive Title and Possession to Property Rights you’re looking at is appropriate for your state.

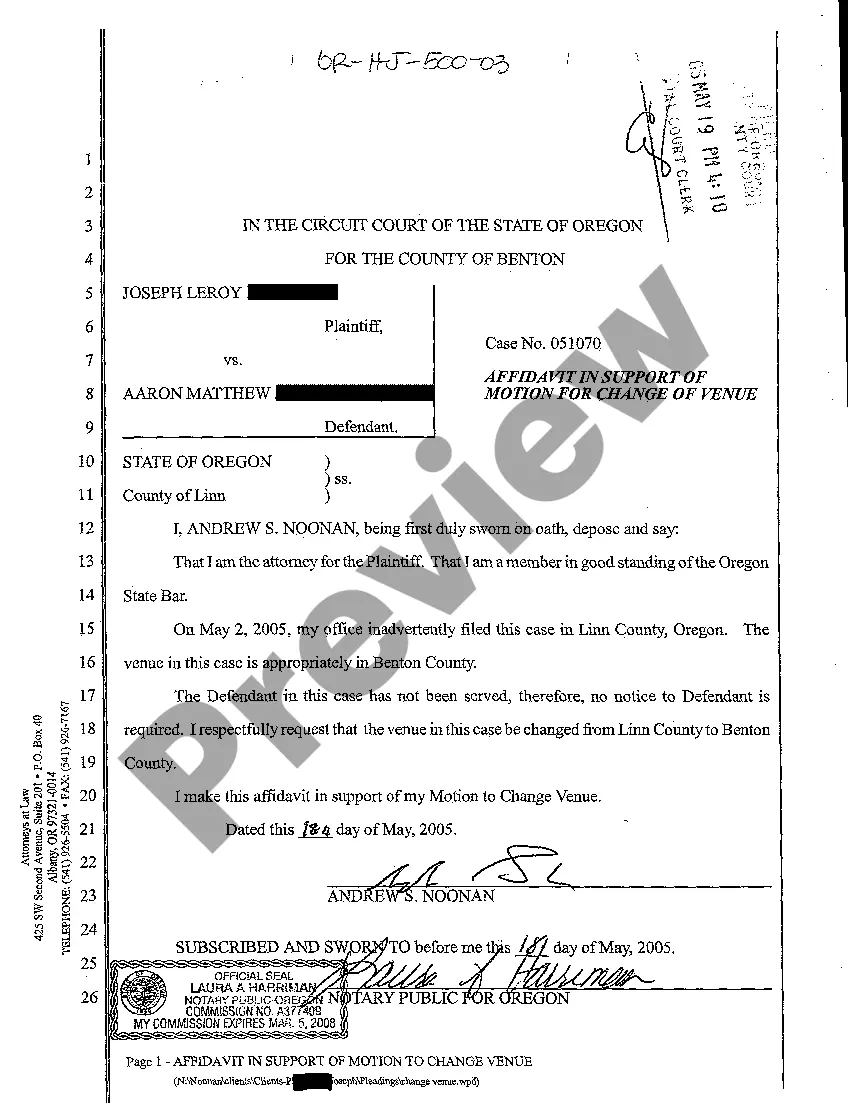

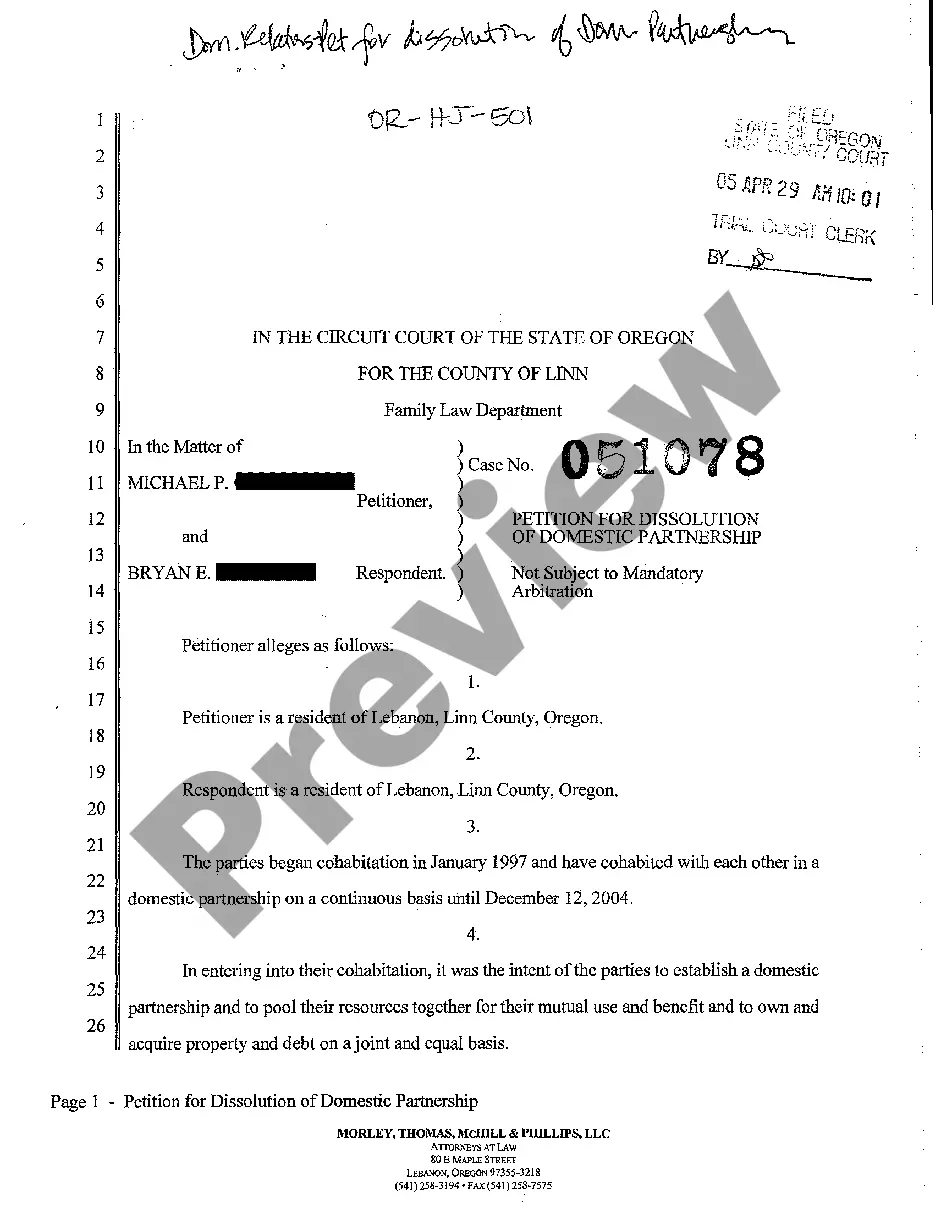

- See the form using the Preview function and read its description.

- Go to the subscription page by clicking Buy Now.

- Select the subscription plan to go on to register.

- Pay out by credit card or PayPal to complete creating an account.

- Select a preferred format to download the file (.pdf or .docx).

You can now open the Tennessee Order of Settlement or Petitioner to Receive Title and Possession to Property Rights example and fill it out online or print it and get it done yourself. Take into account giving the document to your legal counsel to make certain everything is filled out properly. If you make a mistake, print out and complete application again (once you’ve created an account all documents you download is reusable). Make your US Legal Forms account now and get access to a lot more samples.

Form popularity

FAQ

Tennessee, however, has no statutory time limit for when an executor must submit the will for probate. There is no penalty for not probating a will. That means if the will is never submitted to probate, the assets remain in the decedent's name so long as the estate continues to pay the required taxes.

When a Will is probated as a Muniment of Title, no executor or executrix is appointed to administer the estate.Muniment of title probate is a simpler way to establish the validity of the Will and pass title to the beneficiaries named in the Will.

By filing a Petition for Estate Administration, the petitioner is asking to be appointed as the estate Executor or Administrator.It is the responsibility of the Executor/Administrator to see that the assets of the decedent's estate are collected and its debts paid, if sufficient funds exist in the estate.

To apply for a Letter of Administration you need to have details of everything the deceased person owned and how much this is worth, as well as their outstanding debts. You will need this information to complete the Inheritance Tax returns and calculate any Inheritance Tax that needs to be paid to HM Revenue & Customs.

5% on the first $20K. 4% on the next $80K. 3% on the next $150K. 2% on the next $500K.

The Will must be filed with the probate court in the county where the decedent lived. A Petition for Probate must be filed with the probate court as well. This requests the appointment of an executor.

Real Estate: Muniment of Title is a legal action used to legally transfer clear title of one type of property (for assets such as real estate, a bank account, or a stock account) to a beneficiary. This procedure is appropriate only if the decedent executed a valid Will.

This four-month period must pass before the estate can be closed. Even under the best of circumstances, a simple estate will usually take at least six months to close.

File the Will and Probate Petition. Secure Personal Property. Appraise and Insure Valuable Assets. Cancel Personal Accounts. Determine Cash Needs. Remove Estate Tax Lien. Determine Location of Assets and Secure "Date of Death Values" Submit Probate Inventory.