Tennessee Affidavit of Small Estate

Description

- Key Concepts & Definitions

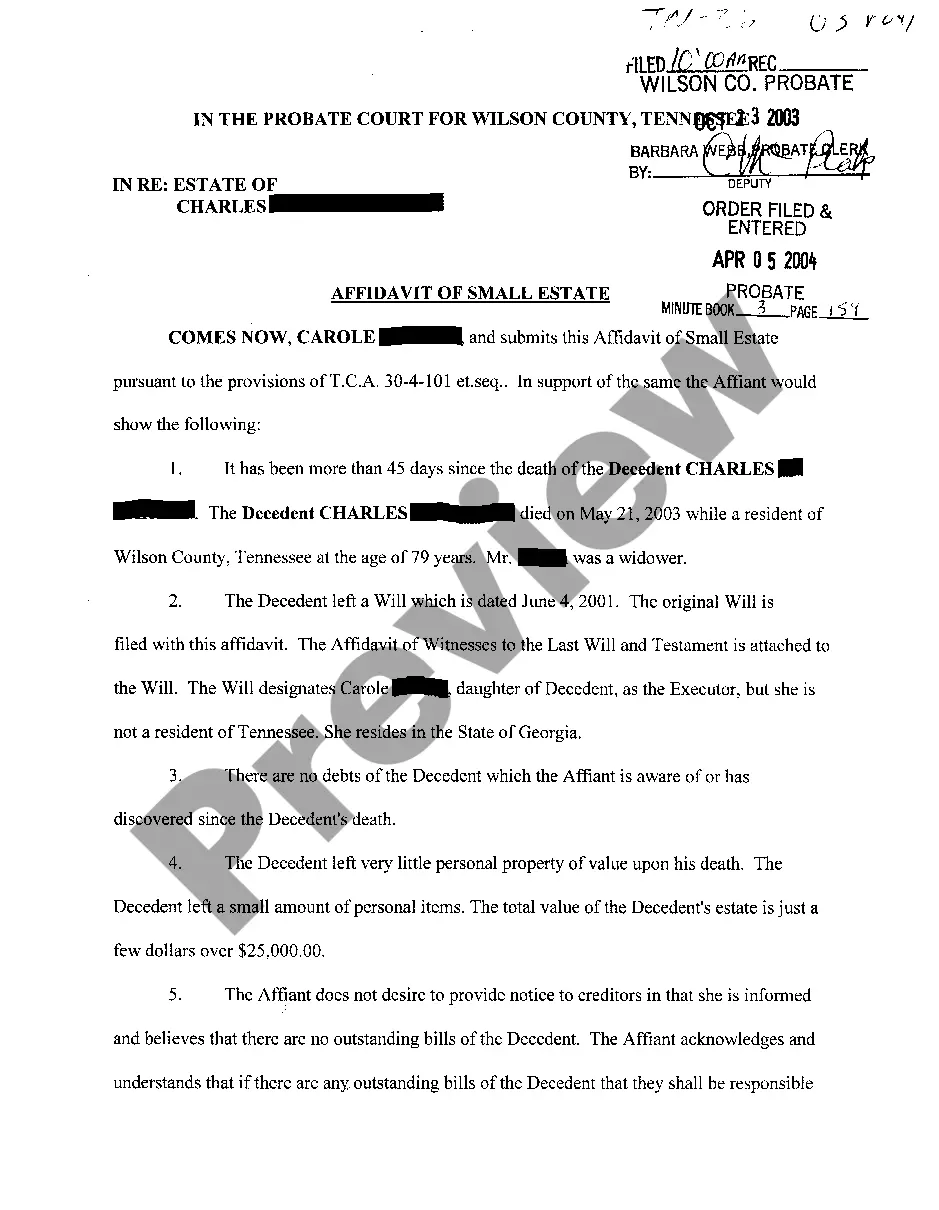

- A01 Affidavit of Small Estate: A legal document used in the United States to facilitate the transfer of assets from a deceased person's estate to their heirs without the need for a formal probate process. Typically applicable when the total value of the estate falls below a specific threshold defined by state law.

- Small Estate: Refers to the estate of a deceased person that does not meet the threshold limits requiring formal probate. The limits vary by state but generally involve modest amounts of personal property and financial assets.

- Estate Law: A branch of law that deals with the disposition of a persons assets and debts after they have passed away, including the administration of estates.

- Step-by-Step Guide

- Confirm eligibility for using an A01 Affidavit of Small Estate by checking the state's threshold value for small estates.

- Collect necessary details about the deceased, including death certificate, list of assets, and information on any debts.

- Fill out the A01 affidavit form accurately. Ensure that details such as assets, debts, and heir information are correctly listed.

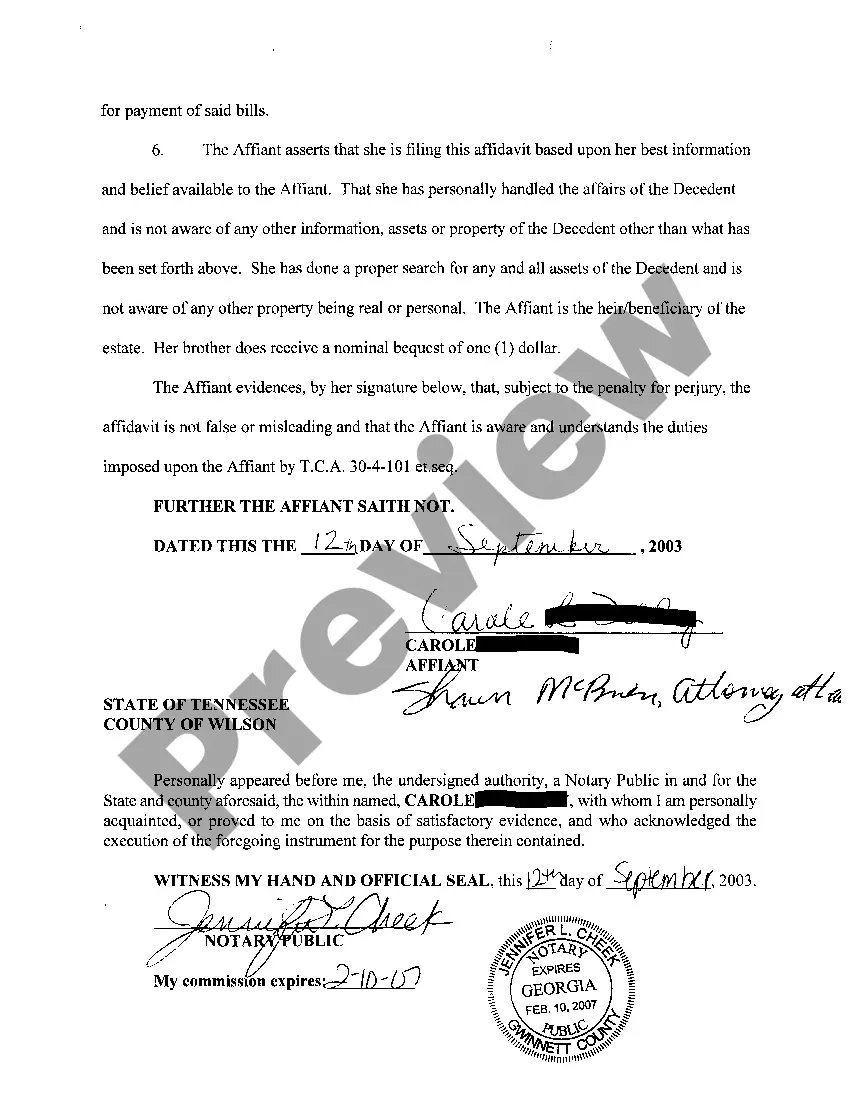

- Sign the affidavit in the presence of a notary public to legalise the document.

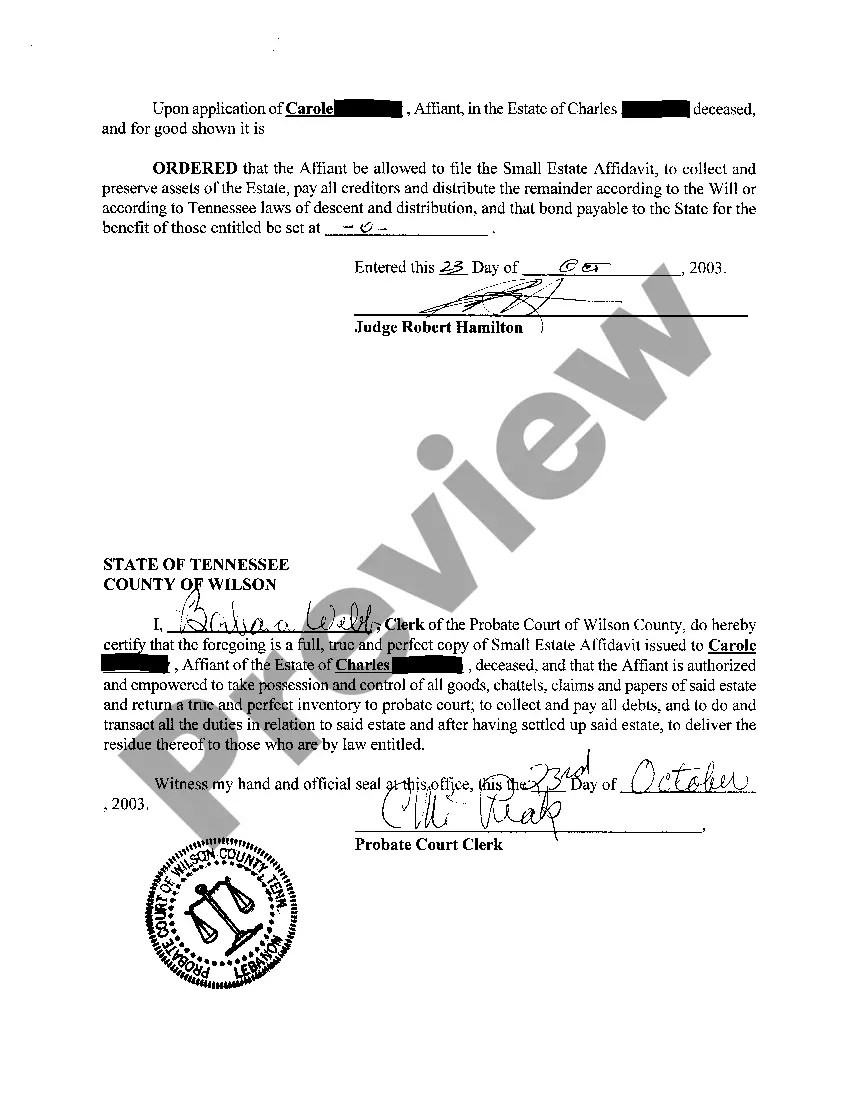

- Distribute the assets among the heirs as specified in the affidavit, being mindful of any debts that must be settled.

- Use email delivery for sending copies to relevant parties or state departments if permitted by law.

- Risk Analysis

- Legal Risks: Errors in the affidavit can lead to legal disputes among heirs or claims from creditors. Professional advice may be necessary.

- Financial Risks: Mismanagement or misallocation of assets can result in financial losses for the heirs.

- Compliance Risks: Non-compliance with state-specific estate laws can result in the affidavit being invalidated or penalties.

- Best Practices

- Consult with a team experienced in estate law, like the LegalClarity team, to ensure the affidavit forms are filled out correctly.

- Use a standardized affidavit form free from errors and adapted to the specifics of your state's law.

- Communicate clearly with all deceased heirs to ensure transparency and consensus regarding the distribution of assets.

- Keep thorough records of all communications and decisions made during the estate settlement process.

- Common Mistakes & How to Avoid Them

- Incorrectly Assessing the Value of the Estate: Hire a professional appraiser to ensure accurate valuation of personal property.

- Not Filling the Form Properly: Double-check the affidavit form free of common errors before submission. Have it reviewed by a legal professional if unsure.

- Ignoring Debts: Settle all outstanding debts before distributing assets to avoid legal complications.

- FAQ

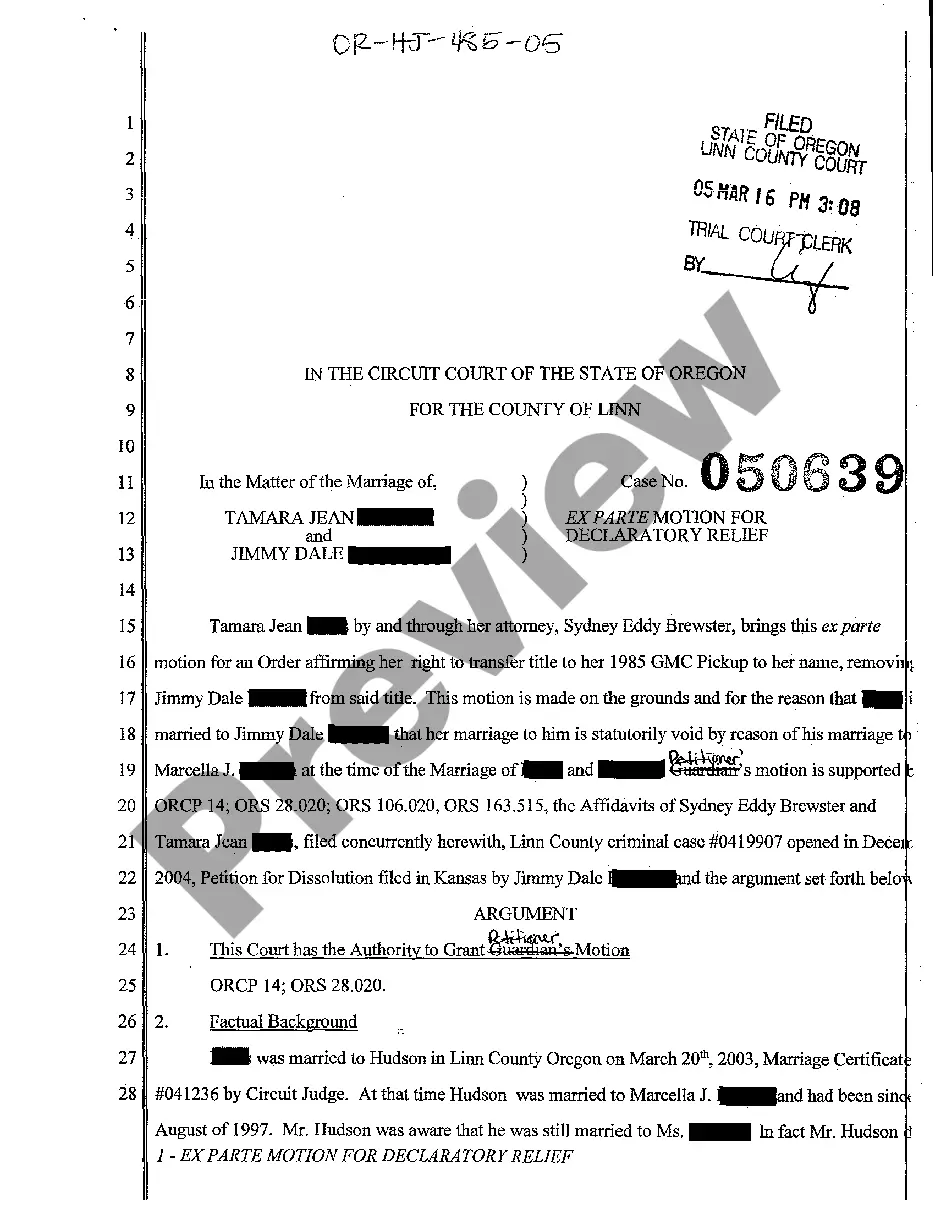

- What happens if someone contests the A01 affidavit? Contesting an A01 affidavit can lead to a court process where the validity of the affidavit might be challenged. Legal assistance is recommended in such cases.

- Can an affidavit of small estate be used for real estate? It depends on the states laws. Some states exclude real estate from small estate proceedings, while others include it under certain conditions.

- How long does it take to process a small estate affidavit? The processing time can vary widely, often from a few weeks to a few months, depending on state laws and the complexity of the estate.

How to fill out Tennessee Affidavit Of Small Estate?

Get access to high quality Tennessee Affidavit of Small Estate samples online with US Legal Forms. Avoid days of wasted time browsing the internet and dropped money on documents that aren’t updated. US Legal Forms provides you with a solution to just that. Get more than 85,000 state-specific authorized and tax samples that you can save and complete in clicks within the Forms library.

To find the sample, log in to your account and click Download. The document will be saved in two places: on the device and in the My Forms folder.

For individuals who don’t have a subscription yet, look at our how-guide below to make getting started easier:

- Check if the Tennessee Affidavit of Small Estate you’re looking at is appropriate for your state.

- See the sample making use of the Preview function and read its description.

- Go to the subscription page by simply clicking Buy Now.

- Select the subscription plan to keep on to sign up.

- Pay by card or PayPal to finish creating an account.

- Pick a favored file format to save the document (.pdf or .docx).

You can now open up the Tennessee Affidavit of Small Estate template and fill it out online or print it out and do it by hand. Take into account giving the file to your legal counsel to make sure things are completed correctly. If you make a mistake, print and fill application again (once you’ve created an account every document you save is reusable). Create your US Legal Forms account now and get far more templates.

Form popularity

FAQ

Guadalupe County Small Estate Affidavit Checklist Individuals then fill out a form without reading the statute and without understanding Texas intestacy law. They pay a $261 filing fee and expect approval.

In most states, however, there is the option to use a small estate affidavit when the assets of the estate are under a certain dollar amount, which varies by state. An attorney is not required to file a small estate affidavit, although it may be helpful to consult with one prior to filing the small estate affidavit.

Fortunately, not all property needs to go through this legal process before it passes to your heirs.The quick rule of thumb is probate is not required when the estate is small, or the property is designed to pass outside of probate. It doesn't matter if you leave a will.

When you use a small estate affidavit , you have to pay the decedent's bills before paying money to anyone else. For example, the decedent might have owed money to a credit card company when they died. If you use the small estate affidavit, you must give money from the estate to pay the credit card company.

The Illinois small estate affidavit provides a streamlined way for an heir-at-law of a decedent to gather and distribute the assets of the estate of a person who died, provided that no other petition to open an estate in probate court has been filed and that the assets of the person who died do not exceed $100,000.

To be able to file a small estate affidavit in Texas for a loved one, when no will was executed, you must be a person who would inherit under Texas intestacy law (this is generally the spouse and children, or other close relatives if there are no spouse or children).

Under Tennessee law, there are simplified rules for handling a small estate. A small estate is one in which the total value of the personal property of the estate is $50,000 or less. Many county probate courts have forms online to help you handle a small estate.

Visit the appropriate court office. Check the court's limits for the estate's value. Obtain the correct affidavit form. Fill out the affidavit in full. Sign the affidavit. Obtain a death certificate.

Probate is required when an estate's assets are solely in the deceased's name. In most cases, if the deceased owned property that had no other names attached, an estate must go through probate in order to transfer the property into the name(s) of any beneficiaries.