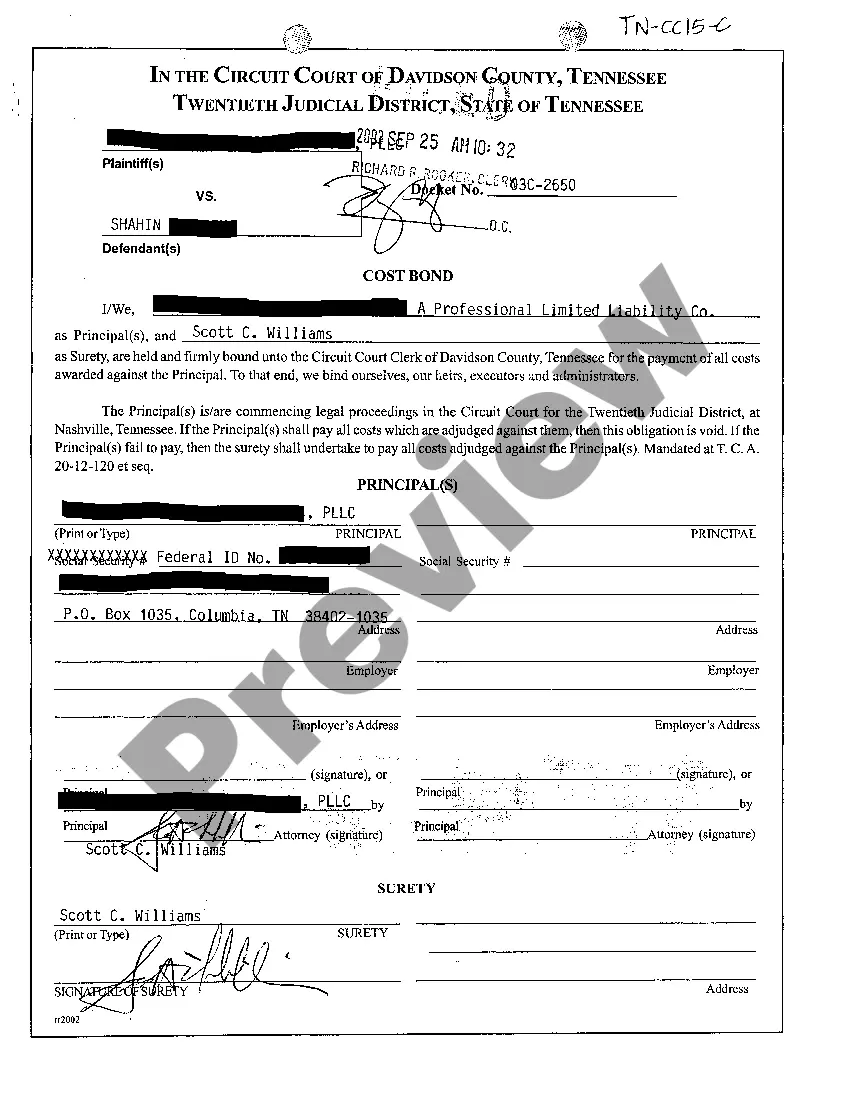

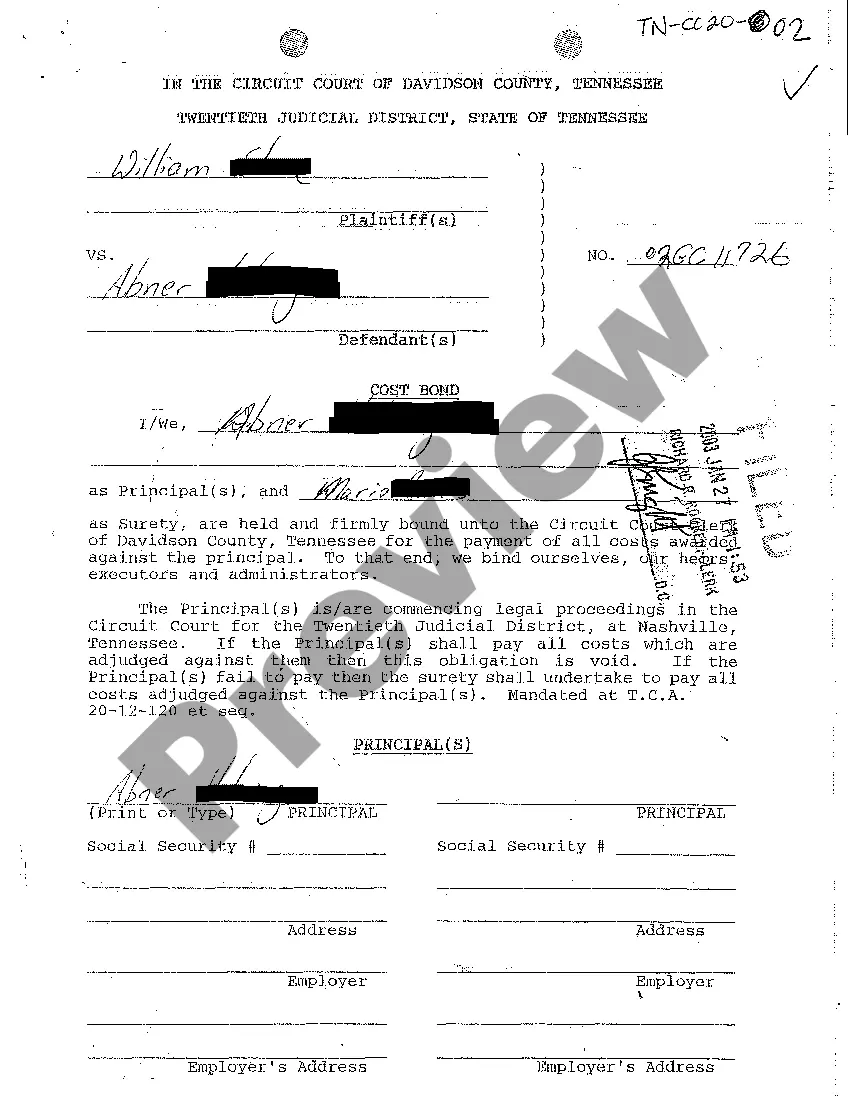

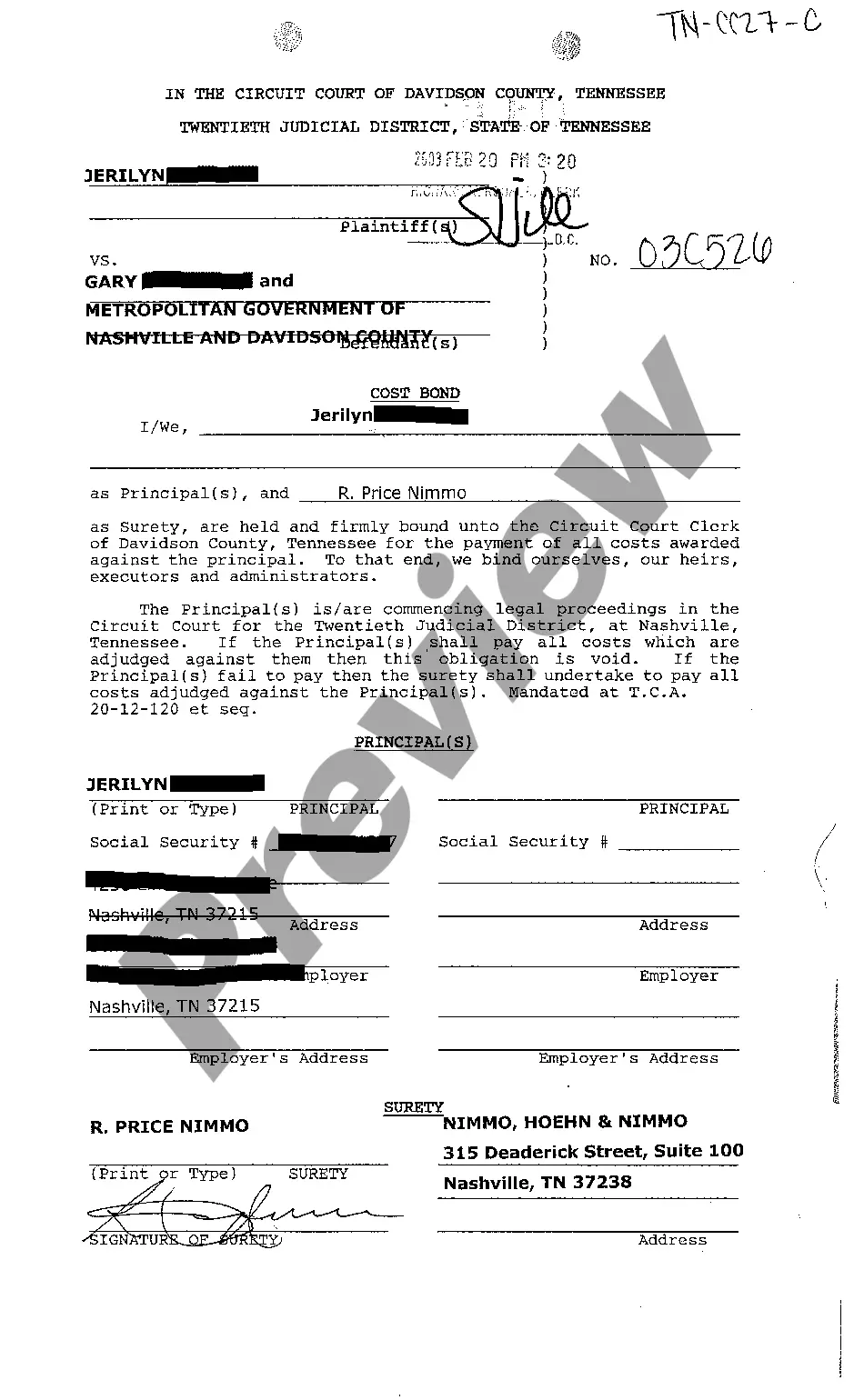

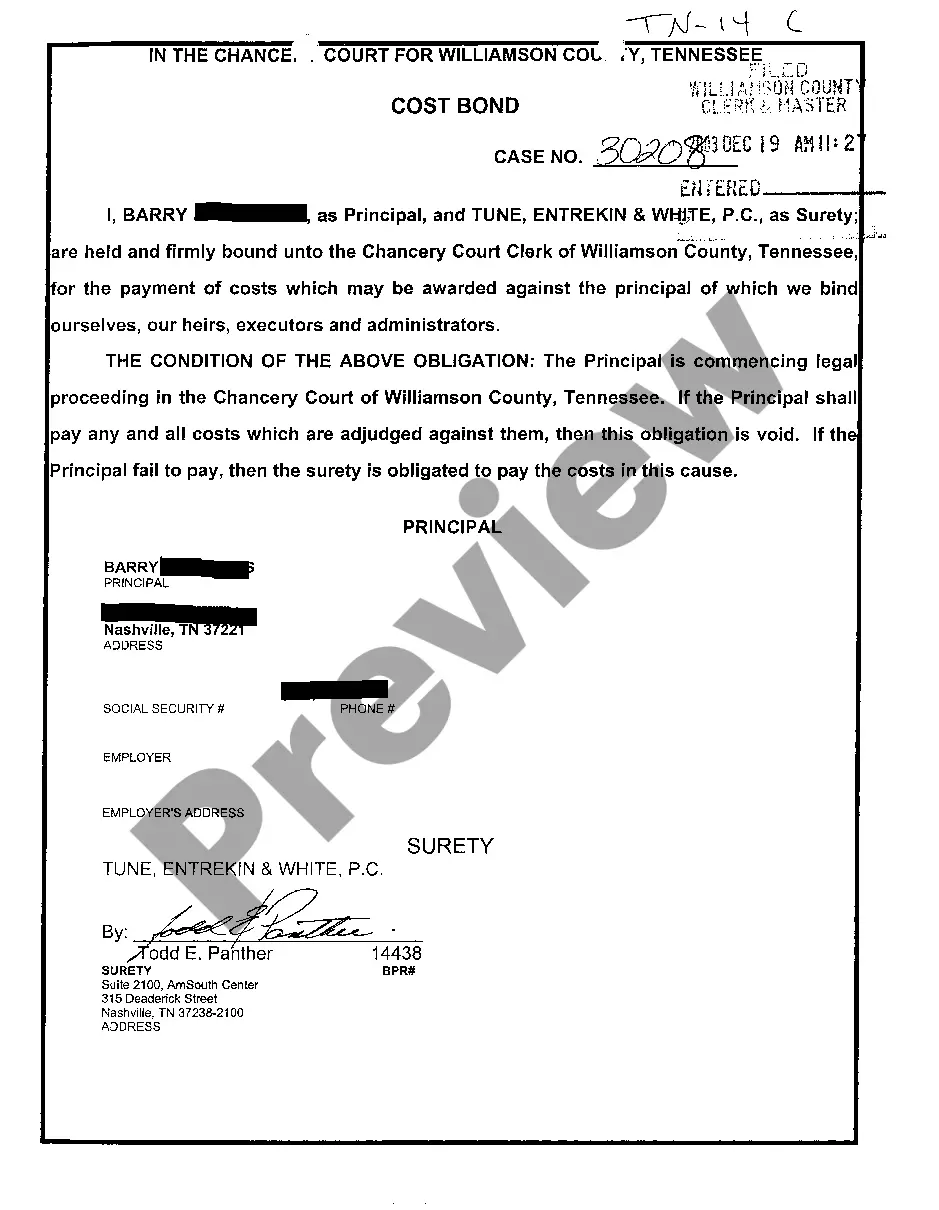

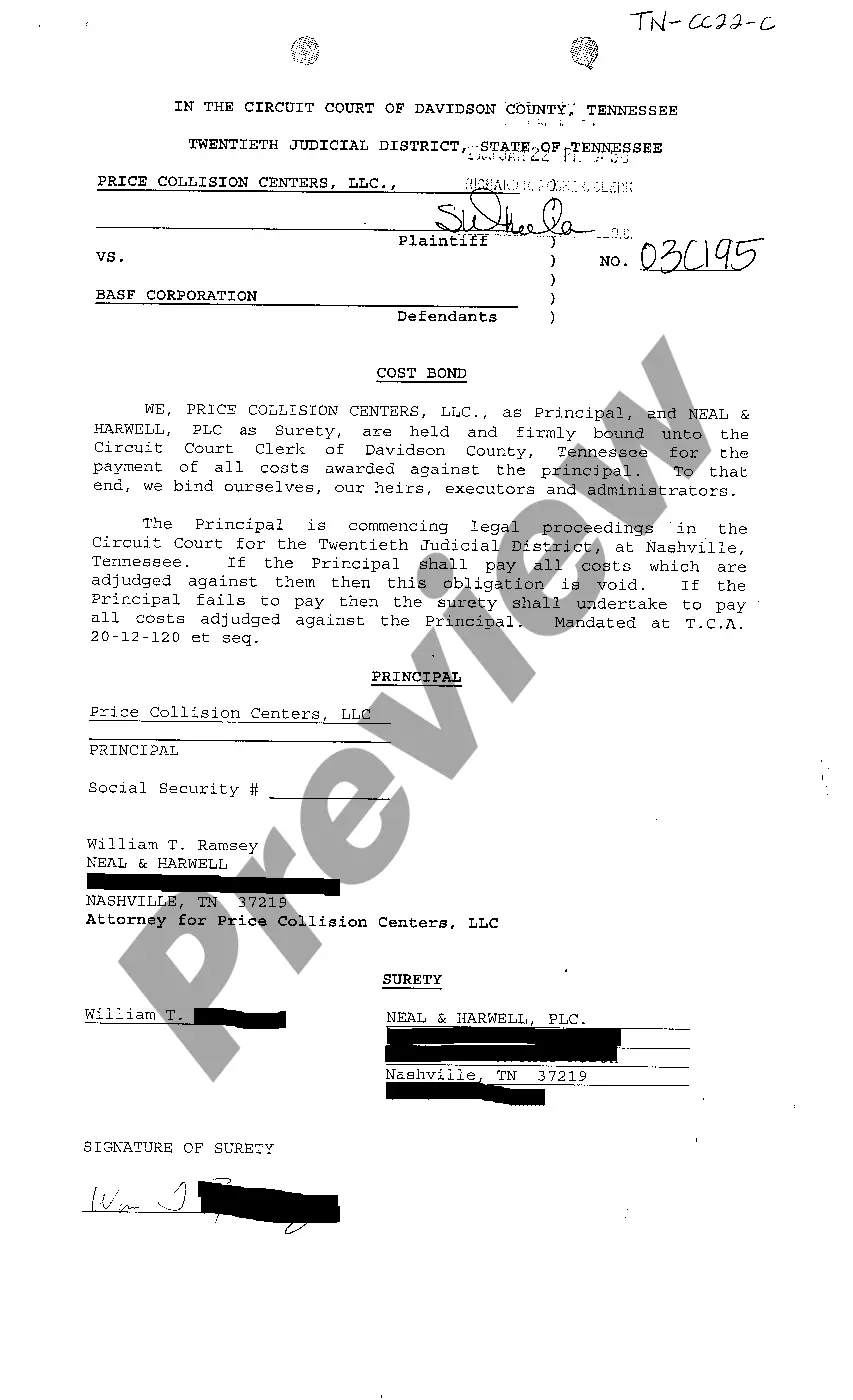

Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principal to Act as Surety for Principal in the Case

Description

How to fill out Tennessee Cost Bond To Act As Surety For Payments Of Costs Awarded Against The Principal To Act As Surety For Principal In The Case?

Access to quality Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principal to Act as Surety for Principal in the Case templates online with US Legal Forms. Steer clear of hours of misused time seeking the internet and dropped money on files that aren’t updated. US Legal Forms offers you a solution to exactly that. Find more than 85,000 state-specific authorized and tax templates that you could save and submit in clicks in the Forms library.

To get the sample, log in to your account and then click Download. The file is going to be saved in two places: on your device and in the My Forms folder.

For those who don’t have a subscription yet, check out our how-guide below to make getting started easier:

- Check if the Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principal to Act as Surety for Principal in the Case you’re considering is appropriate for your state.

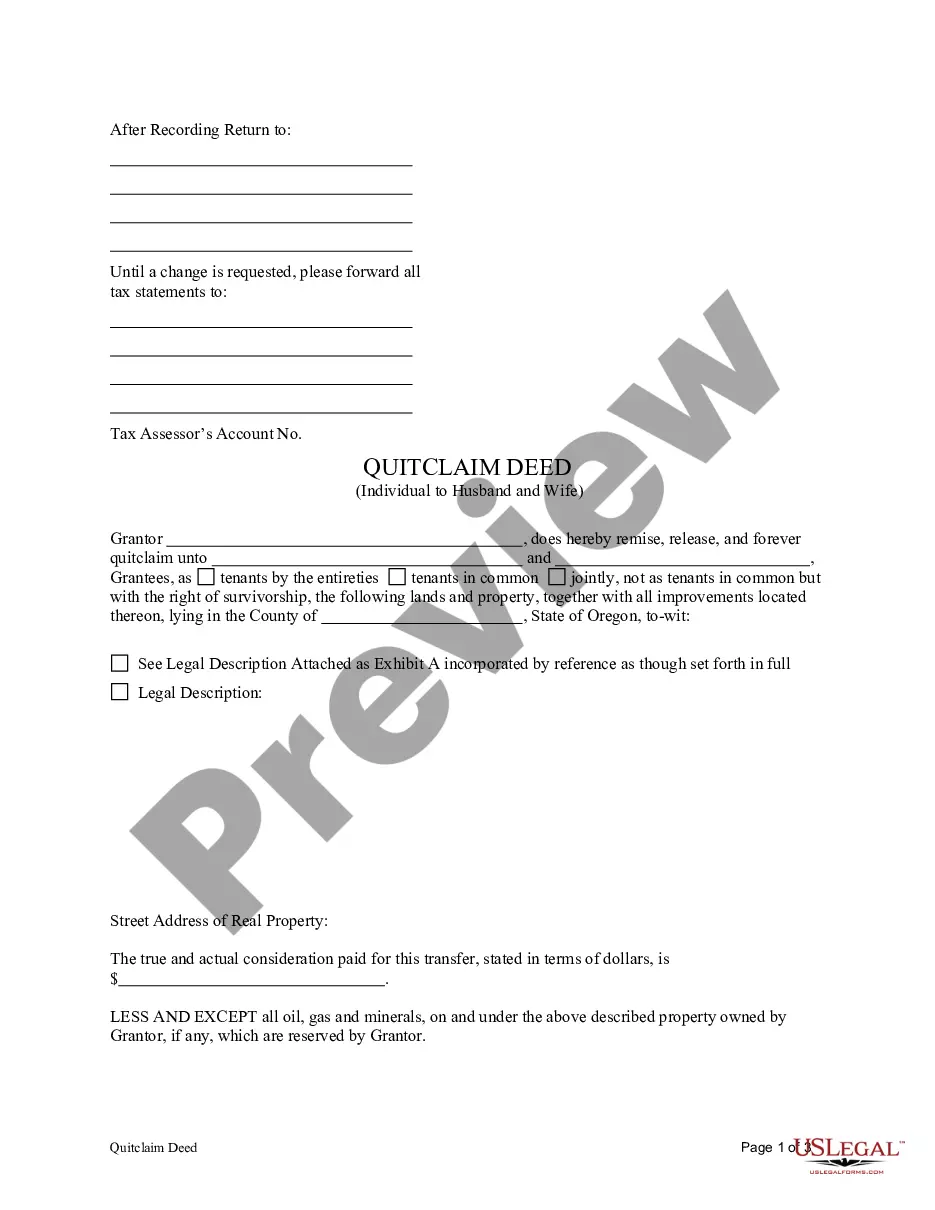

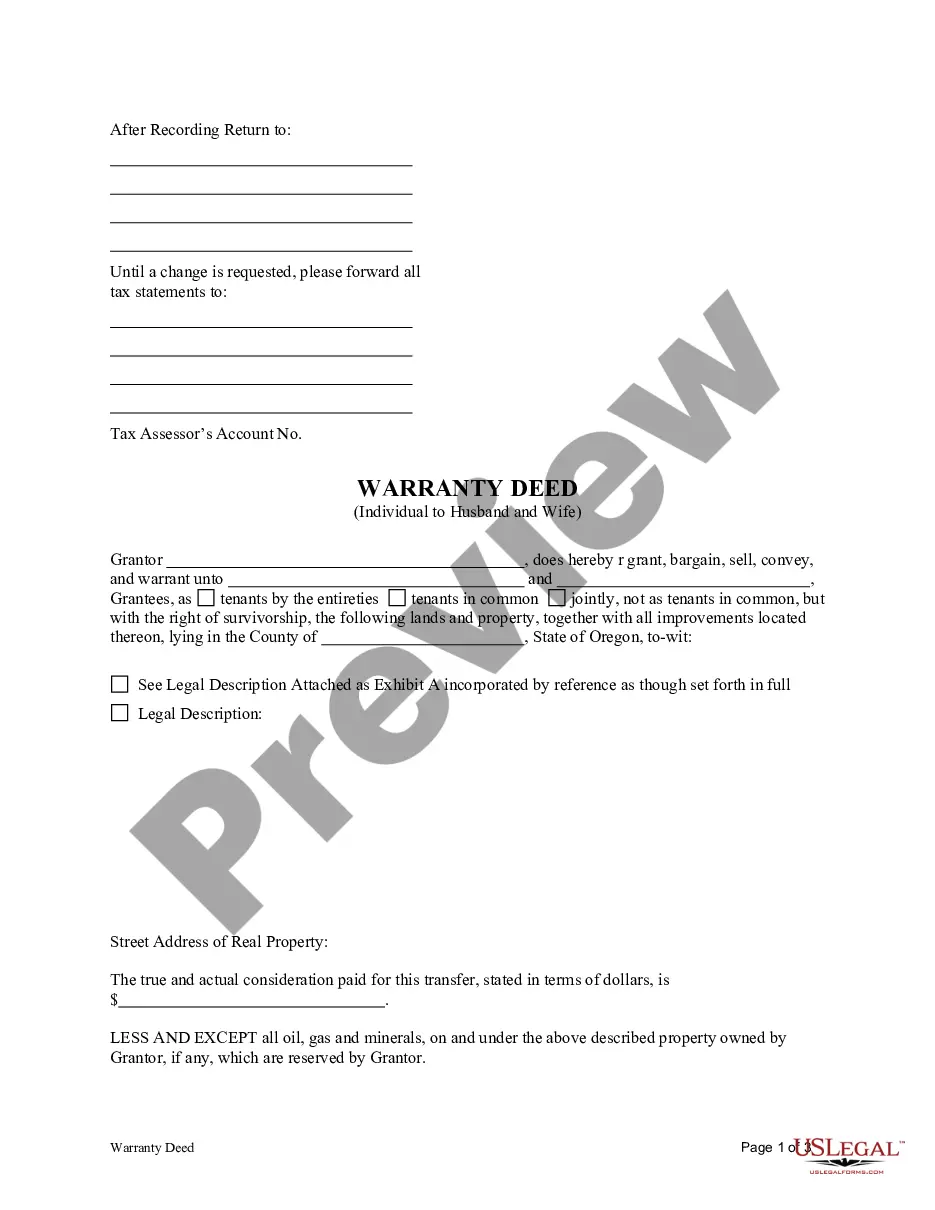

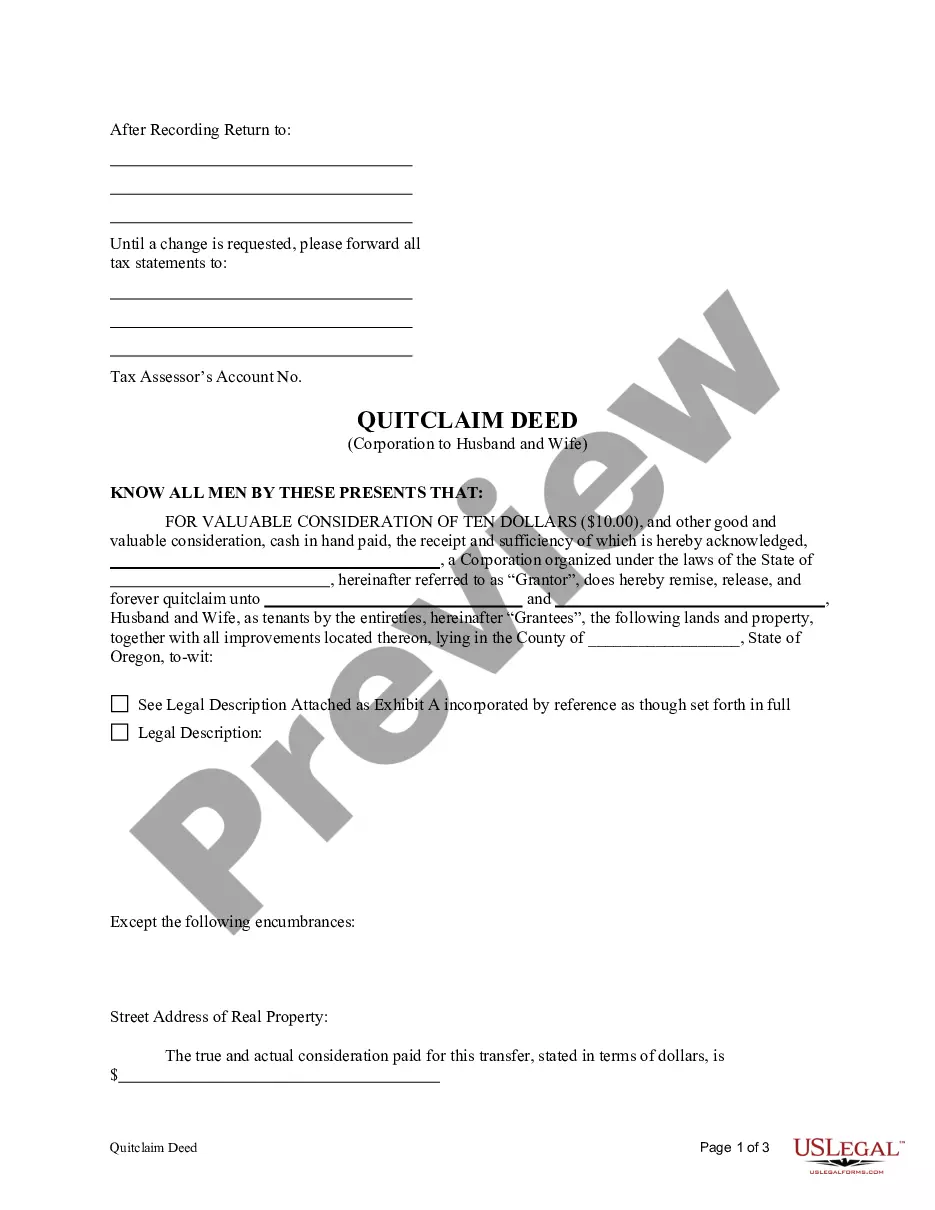

- View the form using the Preview function and read its description.

- Visit the subscription page by clicking on Buy Now button.

- Select the subscription plan to keep on to sign up.

- Pay out by card or PayPal to finish making an account.

- Select a preferred file format to download the document (.pdf or .docx).

Now you can open the Tennessee Cost Bond to Act as Surety for Payments of Costs Awarded Against the Principal to Act as Surety for Principal in the Case example and fill it out online or print it out and get it done by hand. Take into account mailing the document to your legal counsel to make sure things are filled out properly. If you make a error, print out and fill sample again (once you’ve registered an account all documents you save is reusable). Create your US Legal Forms account now and access more samples.

Form popularity

FAQ

This is one way a surety bond differs from an insurance policy. While an insurance company does not expect to be paid back for a claim, a surety company does.You are also responsible for paying back the surety company every penny they pay out on a claim, including all costs associated with the claim.

Surety bond claims come with a price. If the claim is determined to be valid, the surety bond company will pay the claimant up to the full amount of the bond. The surety company will then come to you for repayment. You are responsible for repaying the surety company every penny they paid out on your bond claim.

A performance bond provides assurance that the obligee will be protected if the principal fails to perform the bonded contract. If the obligee declares the principal in default and terminates the contract, it can call on the surety to meet the surety's obligations under the bond.

A surety bond is a promise to be liable for the debt, default, or failure of another. It is a three-party contract by which one party (the surety) guarantees the performance or obligations of a second party (the principal) to a third party (the obligee).

The surety is the guarantee of the debts of one party by another. A surety is an organization or person that assumes the responsibility of paying the debt in case the debtor policy defaults or is unable to make the payments. The party that guarantees the debt is referred to as the surety, or as the guarantor.

At its simplest, a surety bond requires the surety to pay a set amount of money to the obligee if a principal fails to perform a contractual obligation.The surety bond requires the principal to sign an indemnity agreement that pledges company and personal assets to reimburse the surety if a claim occurs.

A surety is an organization or person that assumes the responsibility of paying the debt in case the debtor policy defaults or is unable to make the payments. The party that guarantees the debt is referred to as the surety, or as the guarantor.

Essentially, this means the bond can be cancelled by the surety company. Some bonds do not have a cancellation clause, though, so the only way they can be cancelled is upon receipt of a letter of release from the Obligee.Probate bonds usually require a court order to terminate the bond.