South Dakota Professional Limited Liability Company - PLLC - Formation Questionnaire

Description

This questionnaire may also be used by an attorney as an important information gathering and issue identification tool when forming an attorney-client relationship with a new client. This form helps ensure thorough case preparation and effective evaluation of a new client's needs. It may be used by an attorney or new client to save on attorney fees related to initial interviews.

How to fill out Professional Limited Liability Company - PLLC - Formation Questionnaire?

Discovering the right legitimate document design might be a have a problem. Obviously, there are a lot of web templates accessible on the Internet, but how will you find the legitimate kind you want? Make use of the US Legal Forms site. The assistance gives a huge number of web templates, for example the South Dakota Professional Limited Liability Company - PLLC - Formation Questionnaire, that you can use for business and personal needs. Each of the varieties are checked by specialists and meet up with state and federal demands.

When you are already registered, log in to the bank account and click the Download key to get the South Dakota Professional Limited Liability Company - PLLC - Formation Questionnaire. Make use of bank account to look from the legitimate varieties you might have bought previously. Visit the My Forms tab of your bank account and obtain yet another backup of your document you want.

When you are a new customer of US Legal Forms, here are simple instructions so that you can stick to:

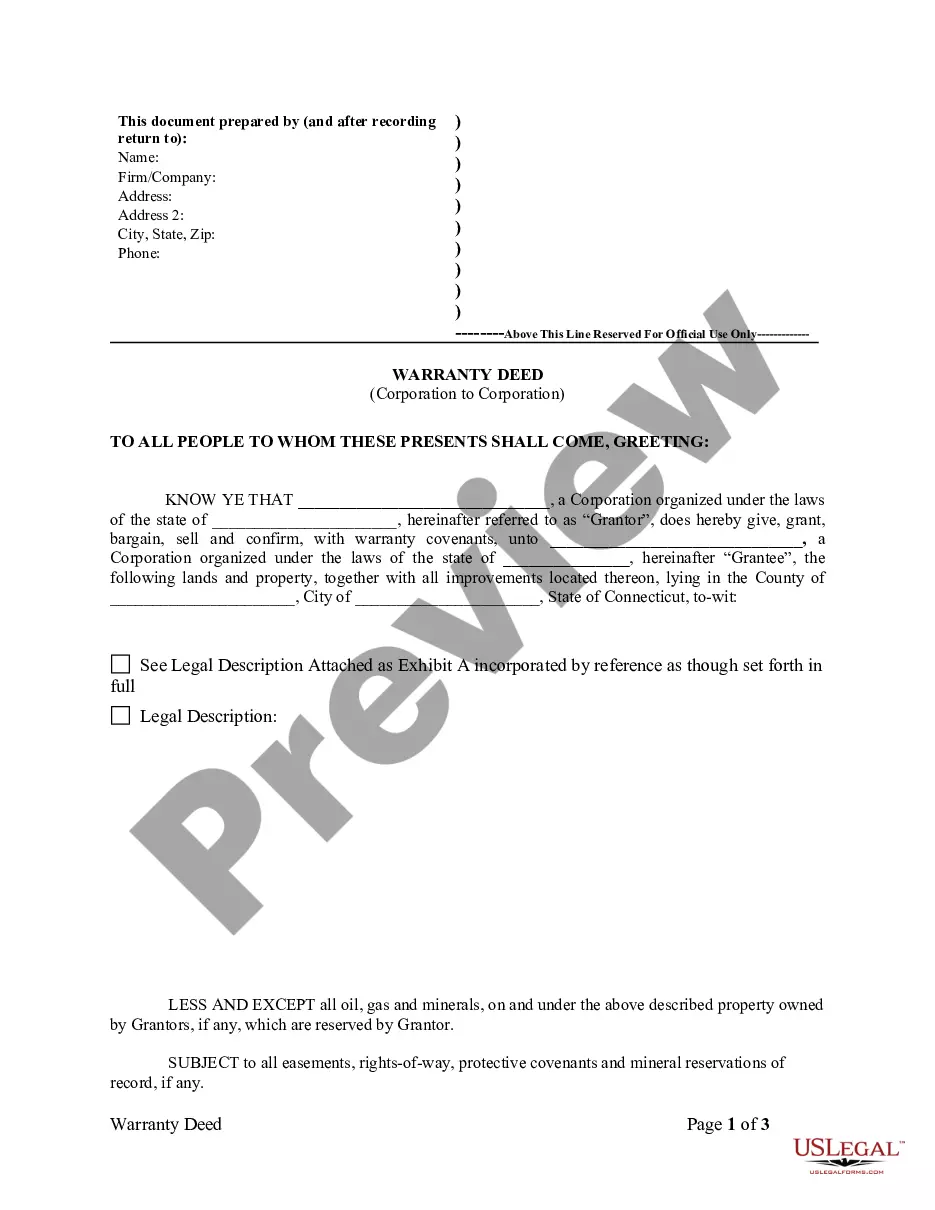

- Initially, be sure you have chosen the right kind for your town/region. It is possible to examine the form while using Preview key and study the form explanation to make certain this is the right one for you.

- In the event the kind will not meet up with your expectations, use the Seach industry to obtain the right kind.

- Once you are sure that the form is acceptable, go through the Get now key to get the kind.

- Pick the rates program you need and enter in the required details. Make your bank account and purchase the transaction utilizing your PayPal bank account or Visa or Mastercard.

- Select the document file format and acquire the legitimate document design to the gadget.

- Comprehensive, modify and produce and indicator the acquired South Dakota Professional Limited Liability Company - PLLC - Formation Questionnaire.

US Legal Forms is the most significant local library of legitimate varieties that you will find various document web templates. Make use of the company to acquire professionally-produced paperwork that stick to express demands.

Form popularity

FAQ

Professional services businesses South Carolina does not allow professionals, such as accountants, attorneys and physicians, to form a professional limited liability company (PLLC) ; however, professionals can incorporate as an .

Incorporating in South Dakota offers a number of benefits like limited liability, perpetual existence, ease of ownership transfer, and easy accessibility to investment.

Management structure: Members can manage the LLC or elect a management group to do so. Corporations, on the other hand, are managed by a board of directors, not shareholders. When an LLC is managed by members (a ?member-managed? management structure), owners oversee daily business operations.

Nebraska allows professionals, such as accountants, attorneys and physicians, to form a professional limited liability companies (PLLCs).. After forming a limited liability company (LLC) , you must undertake certain steps on an ongoing basis to keep your business in compliance.

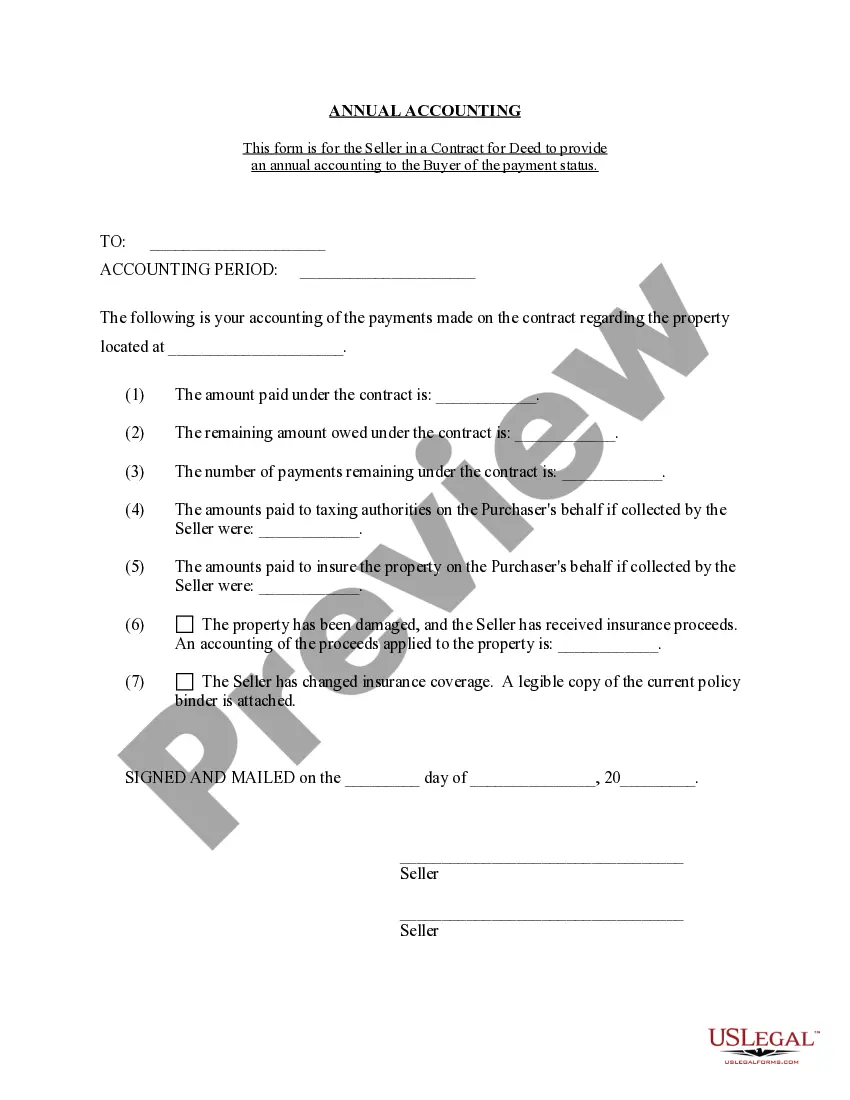

An Operating Agreement specifies the rights and duties of the Limited Liability Company members. It also states the distribution of income of the LLC to its members.

A South Dakota PLLC is permitted but not required to adopt a written operating agreement by the state. Because this internal agreement describes how you plan to run your business, it's wise to have one.

A limited liability company, or LLC, is a type of business entity authorized under state law in all 50 states. Unlike sole proprietorships and general partnerships, LLCs offer personal liability protection for their owners.

Like Alaska, South Dakota does not have state income tax. Along with no state income tax, South Dakota also has a 0% corporate tax rate, making it a great place to start an LLC that is taxed as a corporation. Advantages of South Dakota: No state income tax.