South Dakota Clauses Relating to Venture IPO

Description

How to fill out Clauses Relating To Venture IPO?

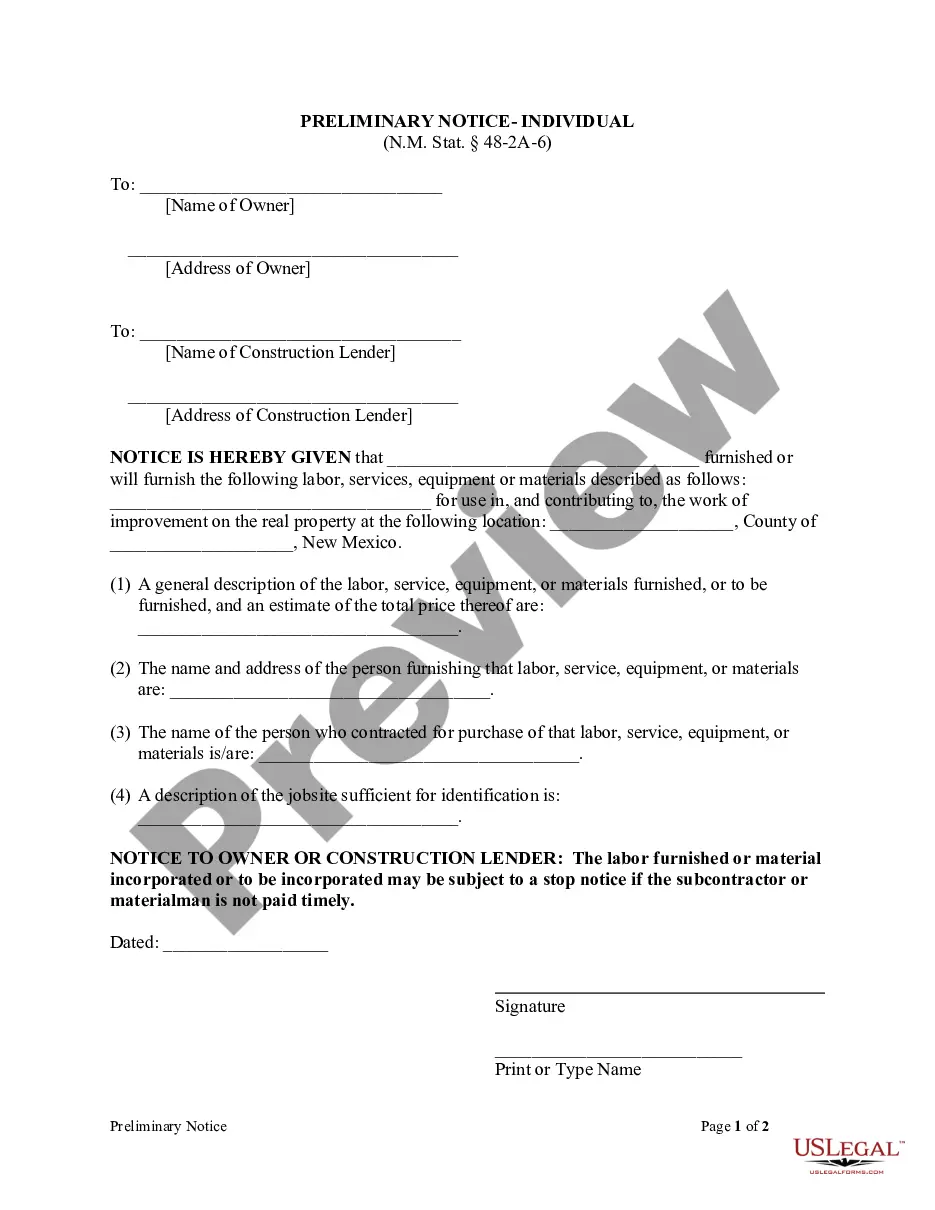

US Legal Forms - among the most significant libraries of authorized types in America - delivers a wide array of authorized papers templates you may obtain or produce. Utilizing the internet site, you will get thousands of types for enterprise and individual uses, sorted by groups, says, or key phrases.You can get the most recent models of types just like the South Dakota Clauses Relating to Venture IPO within minutes.

If you already possess a registration, log in and obtain South Dakota Clauses Relating to Venture IPO through the US Legal Forms collection. The Download switch can look on each form you view. You get access to all previously saved types inside the My Forms tab of your respective accounts.

If you would like use US Legal Forms the very first time, allow me to share simple guidelines to help you began:

- Be sure to have chosen the correct form for your personal city/region. Select the Preview switch to check the form`s articles. Read the form information to actually have chosen the proper form.

- When the form does not fit your needs, take advantage of the Search area at the top of the screen to discover the one who does.

- In case you are pleased with the shape, affirm your selection by visiting the Purchase now switch. Then, choose the prices program you prefer and offer your qualifications to register for an accounts.

- Method the transaction. Utilize your credit card or PayPal accounts to perform the transaction.

- Choose the formatting and obtain the shape on your own product.

- Make changes. Complete, edit and produce and indicator the saved South Dakota Clauses Relating to Venture IPO.

Every single format you added to your bank account does not have an expiry date and it is your own property eternally. So, in order to obtain or produce yet another version, just visit the My Forms section and click on about the form you will need.

Get access to the South Dakota Clauses Relating to Venture IPO with US Legal Forms, by far the most substantial collection of authorized papers templates. Use thousands of professional and condition-certain templates that meet up with your organization or individual demands and needs.

Form popularity

FAQ

IPO Process Steps: Step 1: Hiring Of An Underwriter Or Investment Bank. ... Step 2: Registration For IPO. ... Step 3: Verification by SEBI: ... Step 4: Making An Application To The Stock Exchange. ... Step 5: Creating a Buzz By Roadshows. ... Step 6: Pricing of IPO. ... Step 7: Allotment of Shares.

An initial public offering (IPO) refers to the process of offering shares of a private corporation to the public in a new stock issuance. Companies must meet requirements by exchanges and the Securities and Exchange Commission (SEC) to hold an IPO.

Historically, an initial public offering, or IPO, has referred to the first time a company offers its shares of capital stock to the general public. Under the federal securities laws, a company may not lawfully offer or sell shares unless the transaction has been registered with the SEC or an exemption applies.

After its IPO, the company will be subject to public reporting requirements. If you decide to conduct a registered public offering, the Securities Act requires your company to file a registration statement with the SEC before it may offer its securities for sale.

When a private company first sells shares of stock to the public, this process is known as an initial public offering (IPO). In essence, an IPO means that a company's ownership is transitioning from private ownership to public ownership. For that reason, the IPO process is sometimes referred to as "going public."