South Dakota Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool)

Description

How to fill out Assignment Of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right To Pool)?

Have you been inside a placement where you require files for either business or specific reasons virtually every day? There are a variety of legitimate file themes accessible on the Internet, but discovering types you can rely on is not easy. US Legal Forms gives 1000s of type themes, much like the South Dakota Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool), that happen to be published to meet state and federal demands.

When you are previously knowledgeable about US Legal Forms internet site and possess your account, simply log in. Next, you can down load the South Dakota Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool) format.

Should you not provide an bank account and would like to begin to use US Legal Forms, follow these steps:

- Find the type you require and ensure it is to the correct area/region.

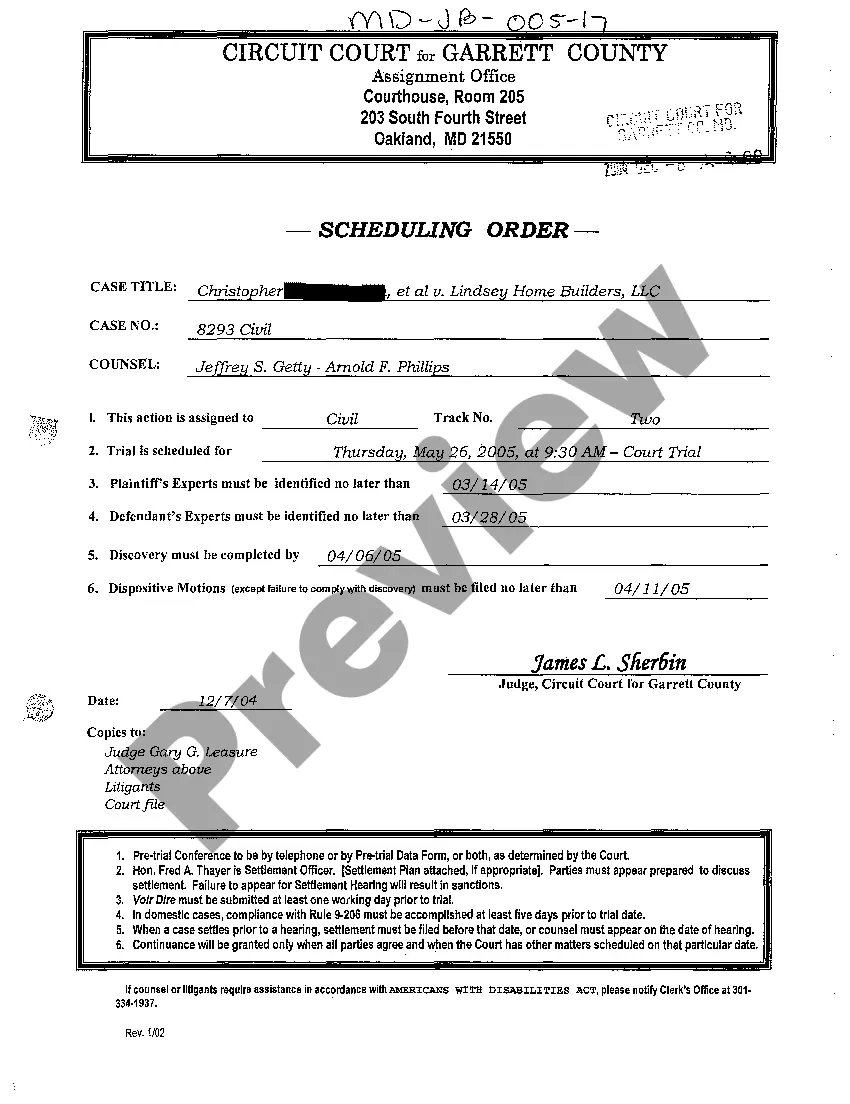

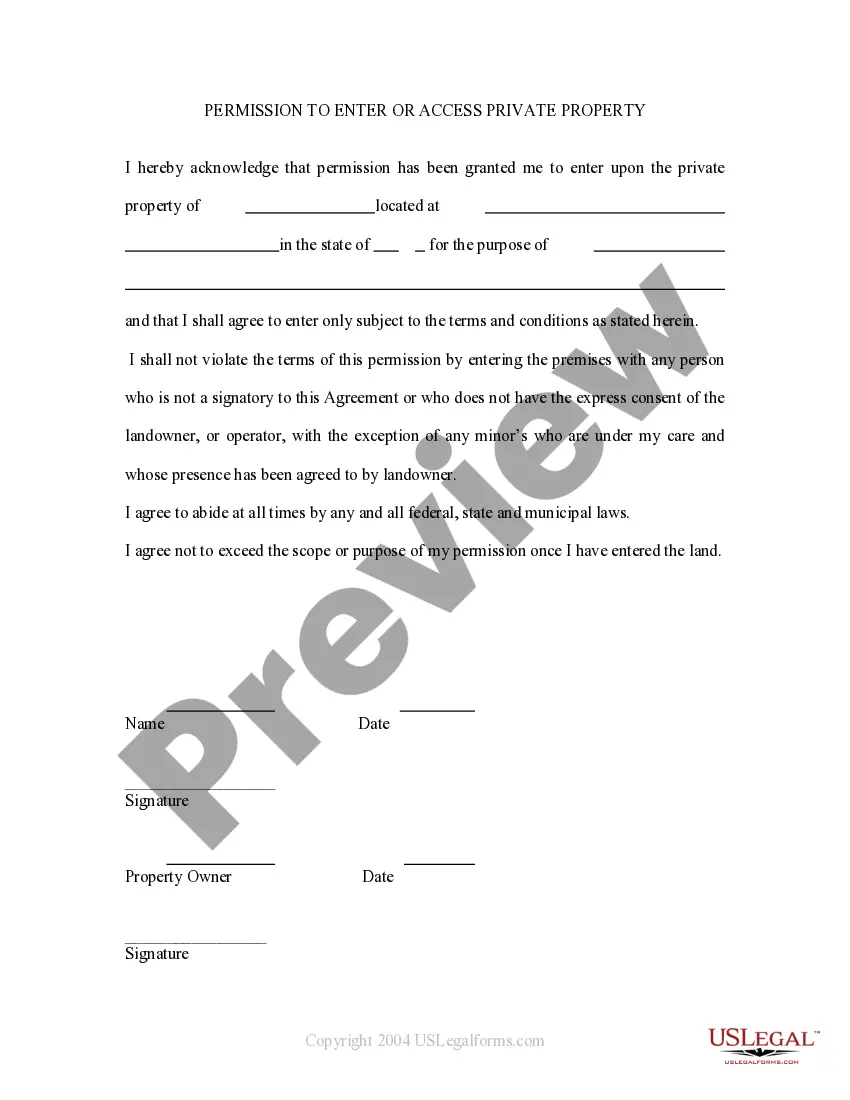

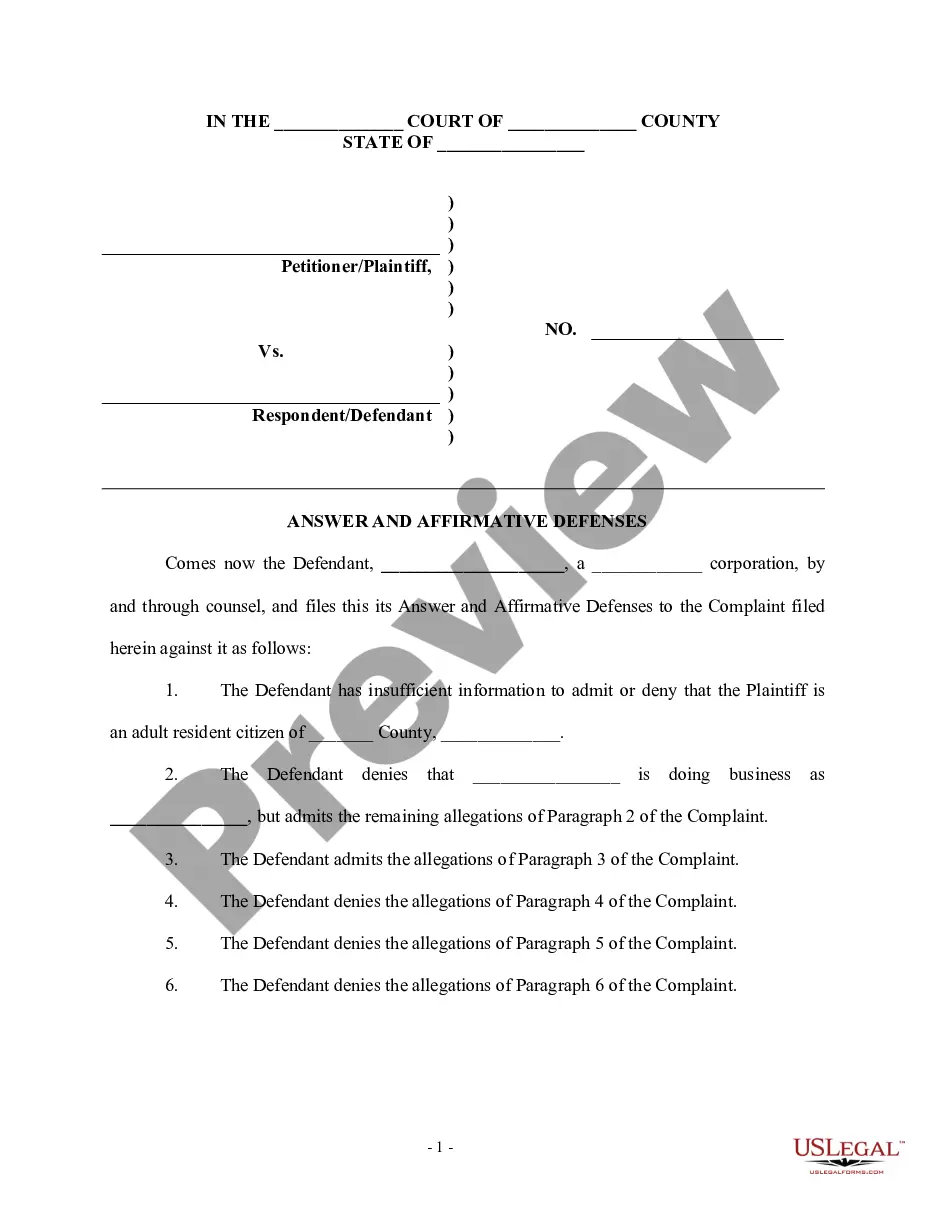

- Make use of the Review option to examine the shape.

- Read the description to ensure that you have chosen the right type.

- When the type is not what you are searching for, use the Research industry to find the type that suits you and demands.

- Once you find the correct type, click on Get now.

- Choose the rates plan you would like, submit the necessary information to produce your bank account, and pay for the transaction using your PayPal or credit card.

- Decide on a practical data file file format and down load your duplicate.

Discover each of the file themes you possess purchased in the My Forms menus. You can aquire a more duplicate of South Dakota Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool) whenever, if possible. Just go through the necessary type to down load or print out the file format.

Use US Legal Forms, one of the most considerable assortment of legitimate forms, to save time and stay away from blunders. The service gives expertly created legitimate file themes that can be used for a range of reasons. Make your account on US Legal Forms and commence creating your way of life easier.

Form popularity

FAQ

Calculating Overriding Royalty Interest An ORRI is a straight percentage. For example, a 2% override would appear on the royalty statement as 0.02 interest in the proceeds from the sale of the leased hydrocarbons.

Participating Royalty Interest (NPRI) is an interest in oil and gas production which is created from the mineral estate. Like the plain ?royalty interest? it is expensefree, bearing no operational costs of production.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

A gross overriding royalty entitles the owner to a share of the market price of the mined product as at the time they are available to be taken less any costs incurred by the operator to bring the product to the point of sale.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

Overriding Royalty Interests To calculate the ORRI, multiply the gross production revenue by the ORRI interest percentage, and the figure gotten is what the ORRI owner is entitled to.

To calculate the number of net royalty acres I'm selling, I use this formula: [acres in tract] X [% of minerals owned] X 8 X [royalty interest reserved in lease] X [fraction of royalty interest being sold]. 640 acres X 25% X 8 X 1/4 X 1/2 = 160 net royalty acres.