South Dakota Affidavit as to Heirship of (Name of Person), Deceased (With Corroborating Affidavit)

Description

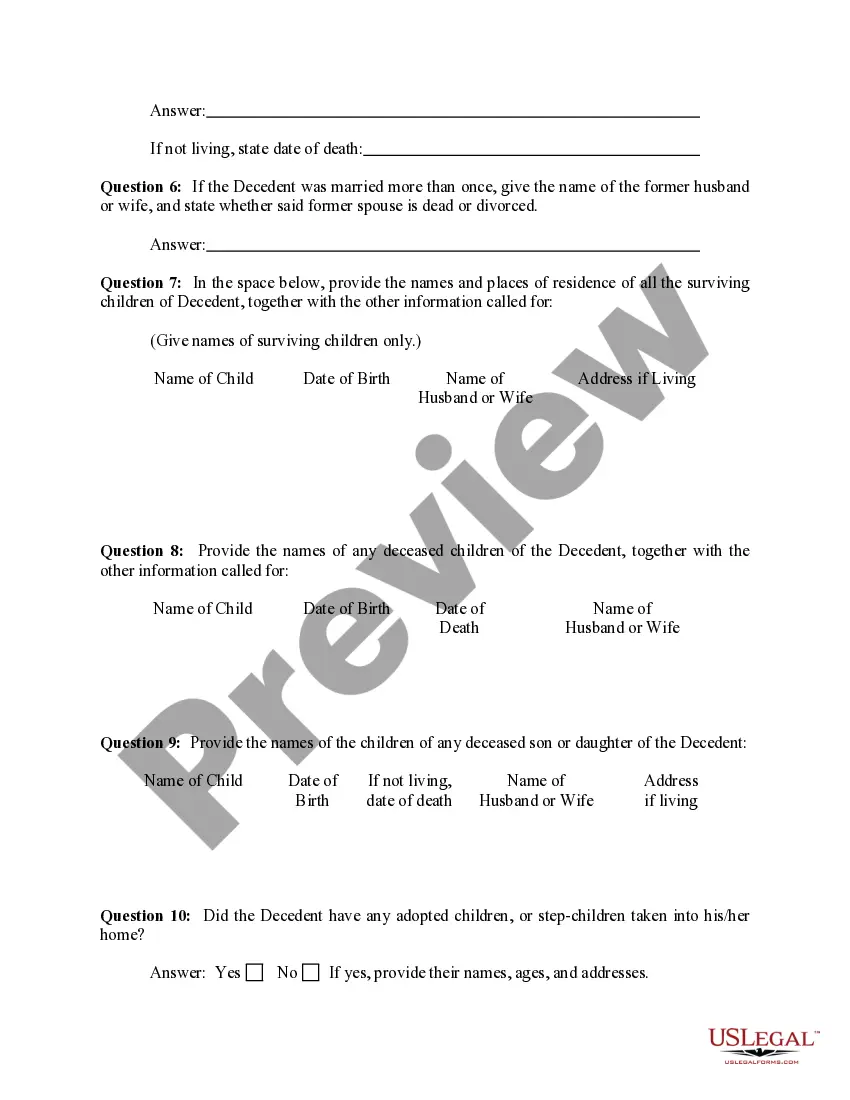

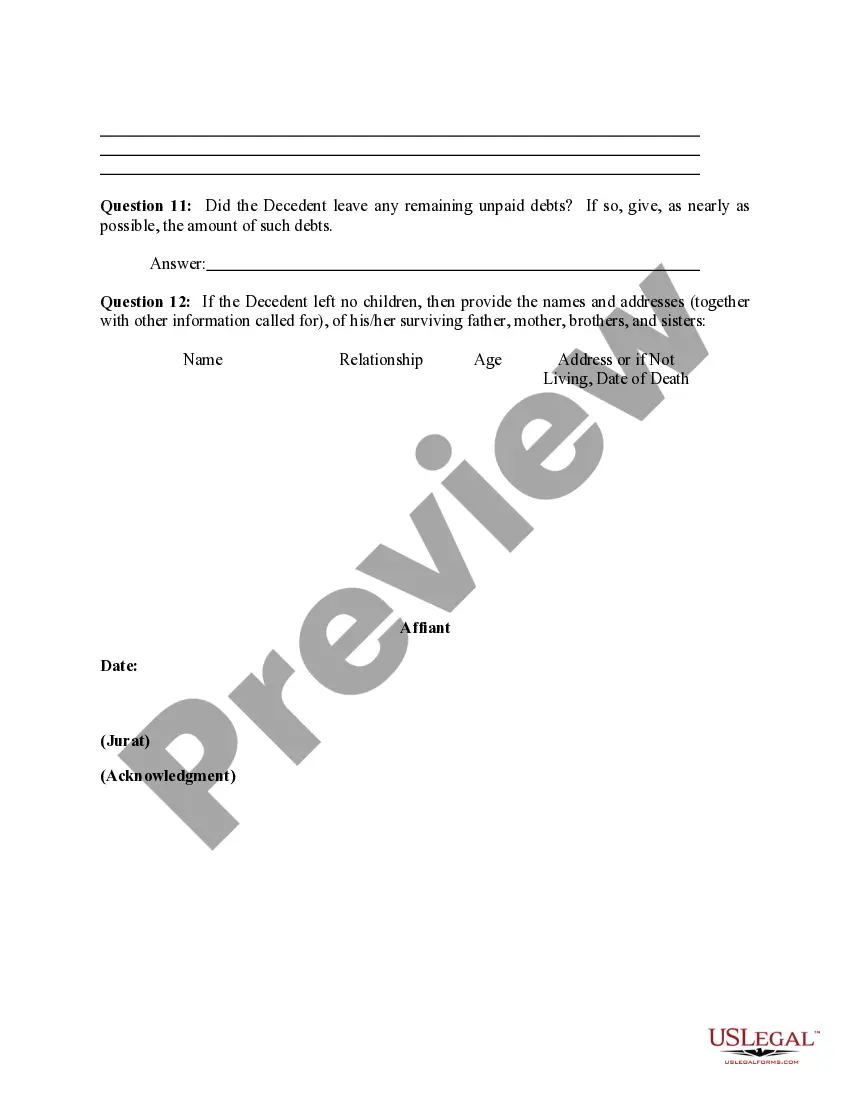

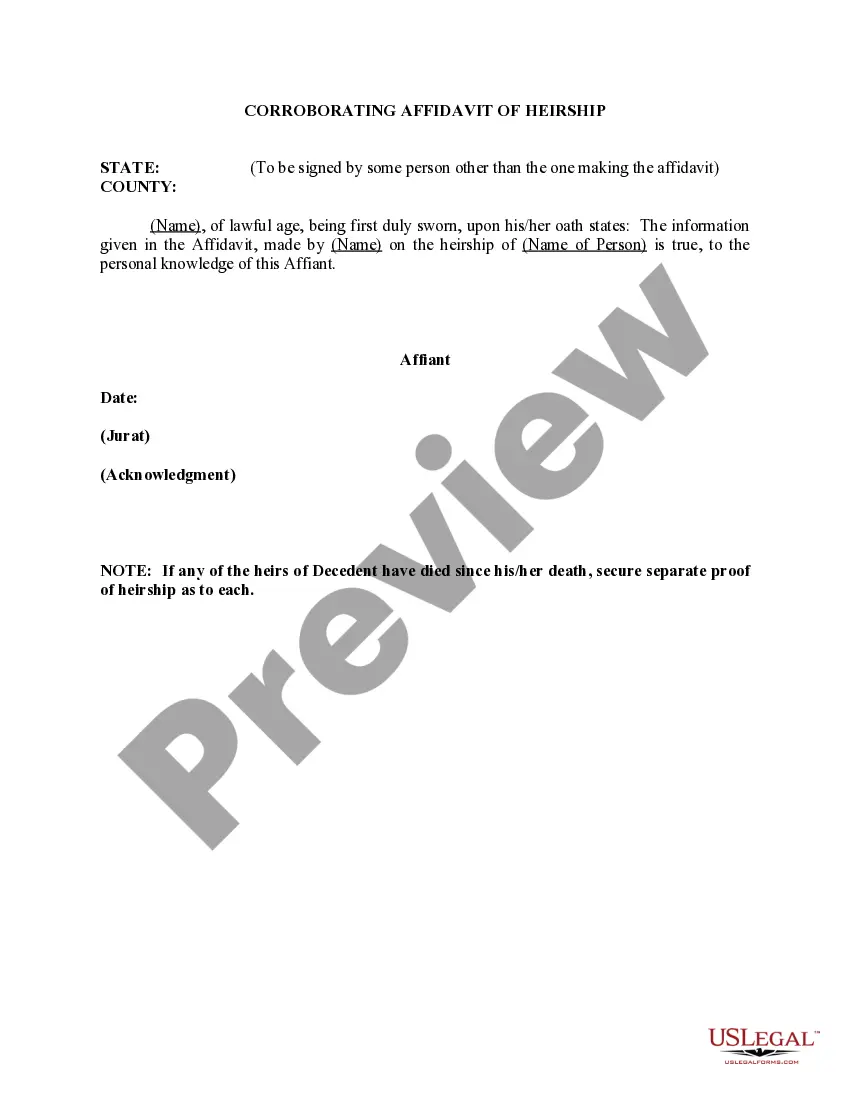

How to fill out Affidavit As To Heirship Of (Name Of Person), Deceased (With Corroborating Affidavit)?

US Legal Forms - one of the biggest libraries of legal forms in the USA - provides an array of legal file web templates you may acquire or print out. Using the internet site, you can get thousands of forms for company and personal reasons, categorized by classes, says, or keywords and phrases.You will find the most up-to-date models of forms like the South Dakota Affidavit as to Heirship of (Name of Person), Deceased (With Corroborating Affidavit) in seconds.

If you already possess a subscription, log in and acquire South Dakota Affidavit as to Heirship of (Name of Person), Deceased (With Corroborating Affidavit) through the US Legal Forms library. The Acquire option can look on each kind you see. You have access to all in the past delivered electronically forms from the My Forms tab of the profile.

If you wish to use US Legal Forms for the first time, allow me to share easy recommendations to get you started:

- Make sure you have picked out the proper kind for the town/state. Go through the Preview option to check the form`s articles. Look at the kind outline to actually have chosen the correct kind.

- When the kind doesn`t fit your needs, make use of the Lookup industry on top of the display screen to get the one which does.

- If you are satisfied with the shape, validate your decision by clicking on the Buy now option. Then, opt for the prices program you prefer and give your references to sign up for the profile.

- Process the deal. Utilize your credit card or PayPal profile to complete the deal.

- Find the format and acquire the shape on your gadget.

- Make modifications. Fill up, change and print out and sign the delivered electronically South Dakota Affidavit as to Heirship of (Name of Person), Deceased (With Corroborating Affidavit).

Every single template you included with your money does not have an expiry date and is yours eternally. So, if you want to acquire or print out an additional version, just visit the My Forms segment and click in the kind you require.

Get access to the South Dakota Affidavit as to Heirship of (Name of Person), Deceased (With Corroborating Affidavit) with US Legal Forms, probably the most extensive library of legal file web templates. Use thousands of professional and state-distinct web templates that meet up with your small business or personal requires and needs.

Form popularity

FAQ

However, it is possible to skip probate in South Dakota if the entire value of an estate is less than $50,000. In that case, the estate would pass through what's called a simplified probate process.

An affidavit of heirship must be signed and sworn to before a notary public by a person who knew the decedent and the decedent's family history. This person can be a friend of the decedent, an old friend of the family, or a neighbor, for example.

A South Dakota small estate affidavit is a document that can help a person using it, known as an ?affiant,? avoid traditional probate proceedings.

You may be able to avoid probate in South Dakota using any of the following strategies: Establish a Revocable Living Trust. Title property in Joint Tenancy. Create assets/accounts that are TOD or POD (Transfer on Death; Payable on Death)

Sixty days after the death of a decedent, any person claiming to be a successor to the decedent's interest in real property in this state may file, or cause to be filed on their behalf, an affidavit describing the real property owned by the decedent and the interest of the decedent in the property.

A South Dakota small estate affidavit aids the transfer of personal property of a deceased individual (the "decedent") to their successors without formal probate proceedings. Any beneficiary entitled to the decedent's property may fill out this affidavit and use it to collect the assets from its current custodians.

A South Dakota small estate affidavit aids the transfer of personal property of a deceased individual (the "decedent") to their successors without formal probate proceedings. Any beneficiary entitled to the decedent's property may fill out this affidavit and use it to collect the assets from its current custodians.