South Dakota Marketing of Production

Description

How to fill out Marketing Of Production?

Are you currently inside a situation the place you need to have paperwork for both company or specific purposes nearly every working day? There are plenty of legitimate document web templates available online, but discovering versions you can trust is not straightforward. US Legal Forms gives a huge number of form web templates, such as the South Dakota Marketing of Production, which are written to meet federal and state demands.

In case you are currently informed about US Legal Forms web site and possess an account, simply log in. Following that, it is possible to download the South Dakota Marketing of Production template.

If you do not have an bank account and wish to begin using US Legal Forms, abide by these steps:

- Discover the form you require and make sure it is to the appropriate metropolis/county.

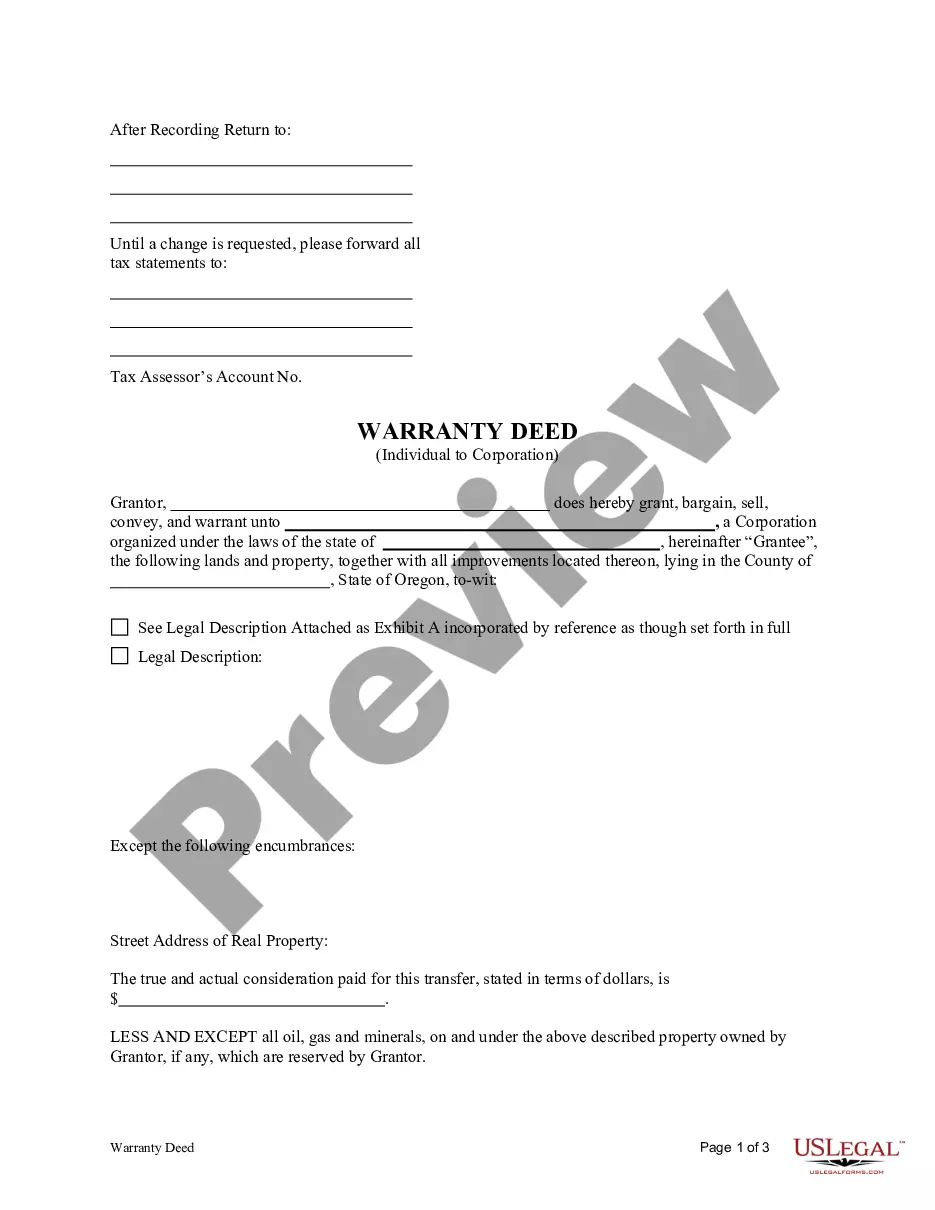

- Use the Review key to examine the shape.

- Browse the explanation to actually have chosen the correct form.

- If the form is not what you`re trying to find, utilize the Research area to get the form that fits your needs and demands.

- Whenever you discover the appropriate form, click on Get now.

- Opt for the prices program you desire, submit the required details to generate your money, and pay for an order making use of your PayPal or credit card.

- Select a convenient document formatting and download your version.

Find all the document web templates you might have purchased in the My Forms menus. You can obtain a further version of South Dakota Marketing of Production anytime, if required. Just go through the essential form to download or print the document template.

Use US Legal Forms, the most considerable selection of legitimate varieties, to conserve time and stay away from blunders. The service gives expertly made legitimate document web templates which you can use for an array of purposes. Produce an account on US Legal Forms and begin making your life a little easier.

Form popularity

FAQ

All business with a physical presence in South Dakota are required to collect and remit state and local taxes.

LLC members' income is taxed at the federal self-employment tax rate of 15.3% (12.4% for social security and 2.9% for Medicare). South Dakota does not levy state personal or corporate income taxes, though the LLC will most likely need to pay state sales and local taxes, as well as industry-specific taxes.

Most jurisdictions exempt food sold in grocery stores, prescription medications, and many agricultural supplies. Sales taxes, including those imposed by local governments, are generally administered at the state level.

Sales and Use Tax A church is not exempt from paying sales tax on purchases even though it may have a 501(c)(3) or other exempt status with the IRS. A church is not required to have a sales tax license for most activities, but it may be required to obtain a license if it sells taxable products or services.

If you are conducting business in South Dakota you need a license even if you do not have a physical location. If you have nexus then all your sales in South Dakota are taxable (including online and catalog sales) and you must be licensed with the Department of Revenue.

South Dakota is one of a few states that tax groceries at the same rate as general sales. Democrats had long supported the grocery tax cut.

Some goods are exempt from sales tax under South Dakota law. Examples include gasoline, purchases made with food stamps, and prescription drugs.

Charges by the newspaper to insert a publication or advertising flyer are not subject to sales tax. Advertisements sold directly to the client are subject to sales tax. Professional business services such as public relations and consulting services are taxable.