South Dakota Collections Agreement - Self-Employed Independent Contractor

Description

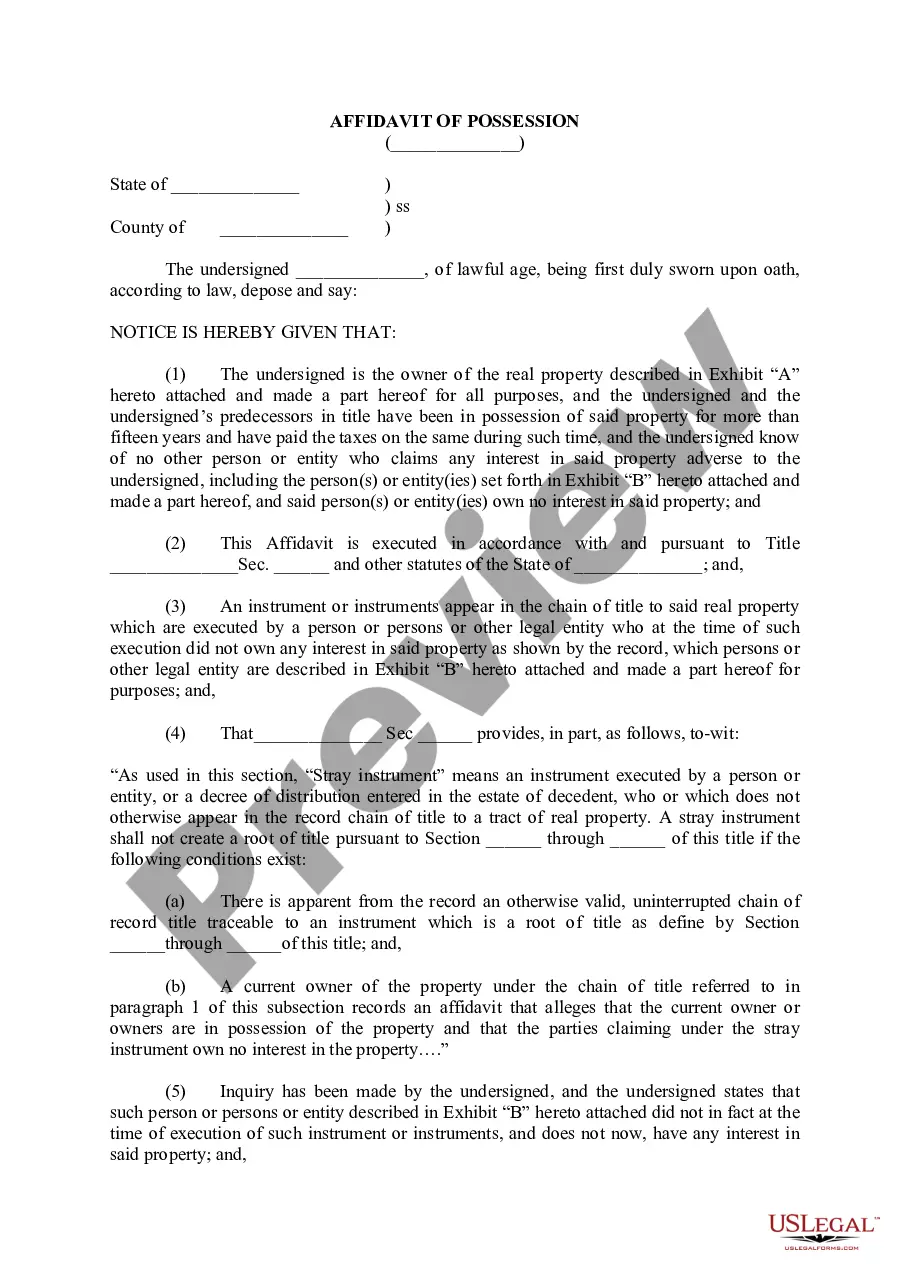

How to fill out Collections Agreement - Self-Employed Independent Contractor?

It is feasible to dedicate time online searching for the legal document template that meets the federal and state requirements you require. US Legal Forms provides thousands of legal forms that are evaluated by experts.

It is easy to obtain or create the South Dakota Collections Agreement - Self-Employed Independent Contractor from my services. If you already possess a US Legal Forms account, you can Log In and then select the Acquire option. Subsequently, you can complete, modify, create, or sign the South Dakota Collections Agreement - Self-Employed Independent Contractor.

Every legal document template you buy is yours permanently. To obtain another copy of any purchased form, visit the My documents tab and then click the appropriate option. If you are using the US Legal Forms website for the first time, follow the simple instructions below.

Choose the file format of the document and download it to your system. Make modifications to your document if necessary. You can complete, revise, sign, and create the South Dakota Collections Agreement - Self-Employed Independent Contractor. Download and create thousands of document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize expert and state-specific templates to address your business or personal needs.

- First, ensure that you have selected the correct document template for the county/region you choose.

- Review the form description to confirm you have selected the right form.

- If available, use the Review option to look over the document template as well.

- If you wish to find another version of the form, use the Search field to locate the template that meets your needs and requirements.

- Once you have found the template you need, click Get now to proceed.

- Select the pricing plan you want, enter your credentials, and register for an account on US Legal Forms.

- Complete the transaction. You can use your credit card or PayPal account to purchase the legal form.

Form popularity

FAQ

An independent contractor arrangement is a work structure where a self-employed individual provides services to a client without becoming an employee. This arrangement allows for flexibility in work hours and project selection, making it ideal for many professionals. In South Dakota, a Collections Agreement for Self-Employed Independent Contractors outlines the terms of this working relationship, ensuring both parties understand their rights and obligations. By utilizing US Legal Forms, you can easily create a comprehensive South Dakota Collections Agreement tailored to your needs.

Yes, an independent contractor can face lawsuits for various reasons, including breach of contract or non-payment issues. If you are working under a South Dakota Collections Agreement - Self-Employed Independent Contractor, it is vital to understand your legal responsibilities and rights. Utilizing platforms like US Legal Forms can help you draft solid agreements that minimize risks and protect your interests.

In South Dakota, you cannot be imprisoned for merely being in debt. Jailing occurs only in cases of fraud or failure to appear in court regarding debts. The South Dakota Collections Agreement - Self-Employed Independent Contractor emphasizes the importance of following legal procedures and recognizing your rights as a consumer.

In South Dakota, the statute of limitations for collecting a debt typically spans six years. After this period, creditors or collectors can no longer legally pursue you for the owed amount. Being aware of the South Dakota Collections Agreement - Self-Employed Independent Contractor can provide clarity on timelines and your rights regarding debt collection.

Debt collectors in South Dakota cannot threaten violence or use abusive language when contacting individuals. Additionally, they cannot misrepresent the amount of debt owed or the legal status of the debt. Understanding the South Dakota Collections Agreement - Self-Employed Independent Contractor can help you recognize your rights and protect yourself from misconduct by debt collectors.

In South Dakota, debt collector laws are designed to protect consumers from unfair practices. These laws ensure that debt collectors treat individuals respectfully and provide honest information about the debts owed. The South Dakota Collections Agreement - Self-Employed Independent Contractor outlines the rights of individuals while promoting fair collection processes. It's essential to understand these laws to guard against potential abuses.

To fill out an independent contractor form effectively, start by gathering pertinent information, such as contact details for both parties, work descriptions, and payment arrangements. Make sure to include specific terms that address responsibilities and timelines. The South Dakota Collections Agreement - Self-Employed Independent Contractor can clarify expectations. Utilizing USLegalForms can provide structured support, ensuring you do not miss important details.

Filling out an independent contractor agreement involves detailing specific information about both parties. Be sure to include identification details, project descriptions, compensation methods, and project timelines. The South Dakota Collections Agreement - Self-Employed Independent Contractor can guide you through essential clauses. By leveraging resources from USLegalForms, you can simplify completion and ensure legal preparedness.

Crafting an independent contractor agreement starts with a clear outline of the working relationship. You'll want to include essential details such as the scope of work, payment terms, and deadlines. For a strong focus on compliance, consider integrating the South Dakota Collections Agreement - Self-Employed Independent Contractor. Utilizing templates from platforms like USLegalForms can streamline this process and ensure you cover all necessary aspects.

Creating an independent contractor agreement is a vital step towards establishing a clear working relationship. Begin by outlining the scope of work, payment terms, and deadlines. A South Dakota Collections Agreement - Self-Employed Independent Contractor provides a solid framework for your contract, detailing the necessary terms that protect both parties. Using platforms like uslegalforms can simplify this process, offering templates tailored to your specific needs.