South Dakota Milker Services Contract - Self-Employed

Description

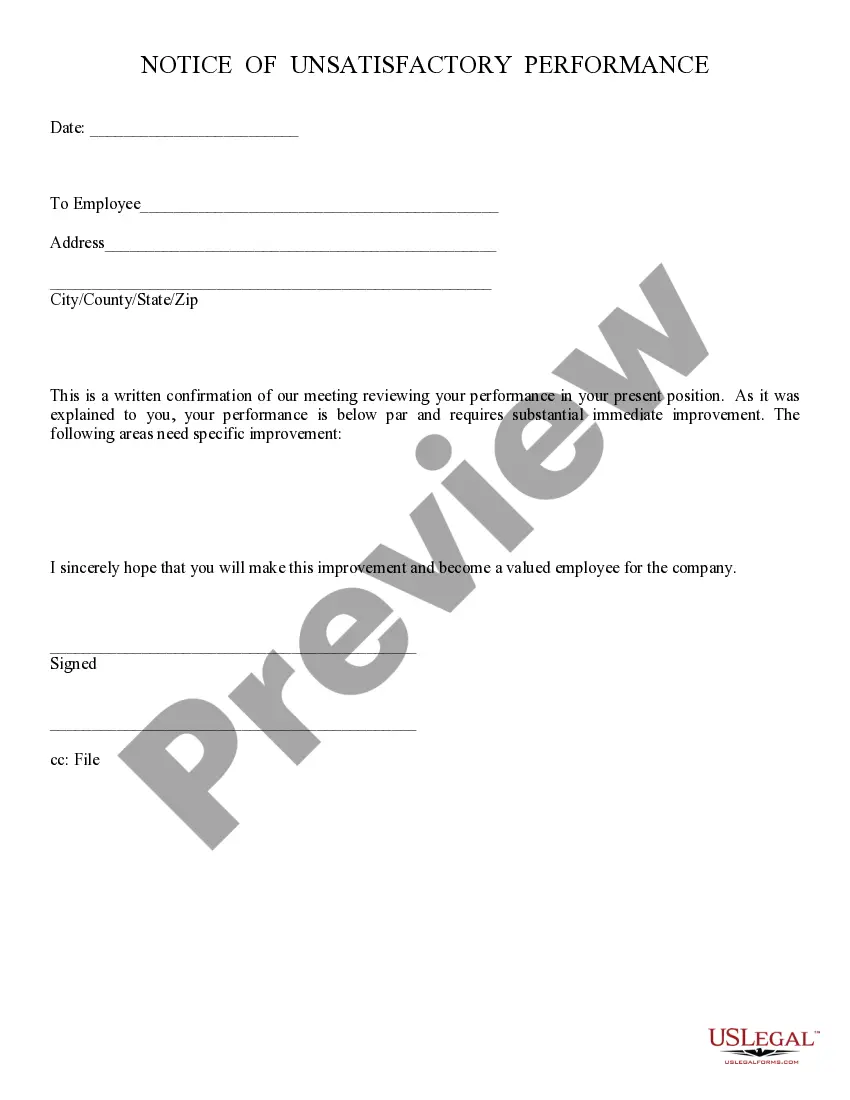

How to fill out Milker Services Contract - Self-Employed?

You might spend time online searching for the appropriate legal document template that meets the state and federal requirements you need.

US Legal Forms provides thousands of legal documents that are reviewed by experts.

You can download or print the South Dakota Milker Services Contract - Self-Employed from the platform.

Review the form description to confirm you have chosen the right one. If available, use the Review button to look through the document template as well. If you wish to obtain another version of your form, use the Search section to find the template that meets your needs and requirements. Once you have found the template you require, click Purchase now to proceed. Choose the pricing plan you desire, enter your details, and create an account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to pay for the legal form. Choose the format of your document and download it to your device. Make adjustments to the document if necessary. You can complete, modify, sign, and print the South Dakota Milker Services Contract - Self-Employed. Download and print thousands of document templates using the US Legal Forms site, which offers the largest collection of legal forms. Utilize professional and state-specific templates to manage your business or personal needs.

- If you already have a US Legal Forms account, you can Log In and click on the Download button.

- After that, you can complete, modify, print, or sign the South Dakota Milker Services Contract - Self-Employed.

- Each legal document template you acquire is yours indefinitely.

- To obtain another copy of any purchased form, visit the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the county/city of your choice.

Form popularity

FAQ

The self-employment tax in South Dakota is calculated based on your net earnings from self-employment. This tax includes both Social Security and Medicare taxes, making understanding it crucial when you file your taxes. Utilizing a South Dakota Milker Services Contract - Self-Employed can help track your business income accurately, simplifying your tax calculations.

To write a service contract agreement, begin by defining the scope of services, payment terms, and the duration of the agreement. Additionally, refer to examples like the South Dakota Milker Services Contract - Self-Employed to ensure completeness. A well-crafted contract helps establish expectations and protects both parties involved.

Yes, you can write your own legally binding contract as long as it includes essential elements like offer, acceptance, and consideration. Review templates such as the South Dakota Milker Services Contract - Self-Employed for guidance. Having a clear, well-structured contract will provide security and clarity in your self-employment arrangements.

To create a self-employment contract, gather necessary details, including the project's scope, deadlines, and payment method. Consider modeling your contract after the South Dakota Milker Services Contract - Self-Employed to ensure all critical aspects are covered. A well-written contract protects both parties and clarifies the nature of the business relationship.

Writing a self-employed contract involves detailing the services provided, payment terms, and both parties' obligations. Utilize a template like the South Dakota Milker Services Contract - Self-Employed for reference. Ensure the contract is clear and comprehensive to establish a mutually beneficial agreement and reduce the risk of disputes.

When writing a contract for a 1099 employee, include essential details such as the scope of work, payment terms, and duration of the agreement. A well-structured South Dakota Milker Services Contract - Self-Employed can serve as a guide for these elements. Clearly outline the responsibilities and expectations to avoid any misunderstanding in the relationship.

To show proof of self-employment, you can provide documentation like tax returns, 1099 forms, or a South Dakota Milker Services Contract - Self-Employed. These documents demonstrate your income and establish your business operations. Additionally, maintaining records of invoices or receipts can further substantiate your self-employed status.

Yes, contract employees are typically regarded as self-employed, especially in contexts like the South Dakota Milker Services Contract - Self-Employed. This classification means they operate independently and manage their own business affairs. Recognizing this status can help in managing taxes and responsibilities effectively.

Not all 1099 employees are considered self-employed, but many are. A 1099 form indicates that he or she does not receive typical employment benefits, which aligns closely with the South Dakota Milker Services Contract - Self-Employed. Understanding the nuances of your tax classification is essential for proper reporting.

A contract is not synonymous with being self-employed, although they are closely related. A South Dakota Milker Services Contract - Self-Employed establishes the terms of your work. However, self-employment refers more broadly to the status of running your own independent business.