South Dakota Educator Agreement - Self-Employed Independent Contractor

Description

How to fill out Educator Agreement - Self-Employed Independent Contractor?

Are you presently in a situation where you require documents for either business or personal purposes nearly every workday.

There are numerous legal document templates available online, but finding ones you can trust is challenging.

US Legal Forms provides a vast array of form templates, such as the South Dakota Educator Agreement - Self-Employed Independent Contractor, which are designed to comply with state and federal standards.

Once you find the correct form, click Purchase now.

Select the pricing plan you prefer, fill in the required information to create your account, and complete your order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the South Dakota Educator Agreement - Self-Employed Independent Contractor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

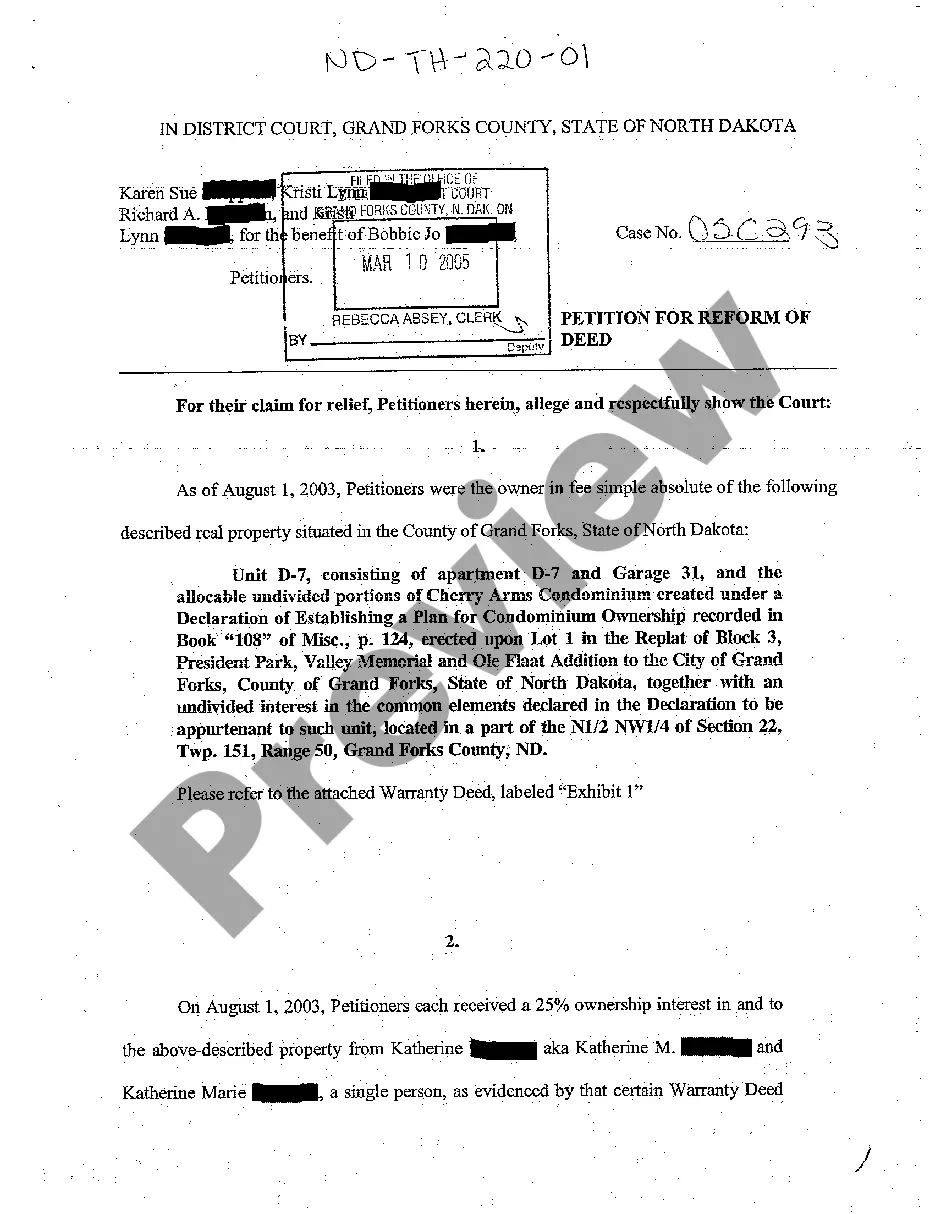

- Obtain the form you need and ensure it is for the correct area/county.

- Utilize the Review button to examine the form.

- Check the details to confirm that you have selected the correct form.

- If the form is not what you're looking for, use the Search section to find the form that suits your needs and specifications.

Form popularity

FAQ

An independent contractor typically fills out several key documents. This includes the independent contractor agreement, W-9 form for tax identification, and sometimes an invoice for services rendered. When working under the South Dakota Educator Agreement - Self-Employed Independent Contractor, ensure you have all necessary paperwork organized. Uslegalforms provides resources to help you navigate these requirements efficiently.

Filling out an independent contractor agreement requires you to specify important details. Start with your name and the contractor's name, then state the services rendered and payment terms. Make sure to mention any deadlines and compliance with the South Dakota Educator Agreement - Self-Employed Independent Contractor. Properly completing this agreement protects both parties and sets clear expectations.

To write an independent contractor agreement, start by outlining the purpose of the contract clearly. Include details such as the scope of work, deadlines, payment terms, and confidentiality clauses. Always refer to the South Dakota Educator Agreement - Self-Employed Independent Contractor to ensure you meet legal standards. Platforms like uslegalforms can assist you in creating a comprehensive and tailored agreement.

Filling out an independent contractor form involves providing specific details about your work arrangement. You need to include your personal information, the services you are offering under the South Dakota Educator Agreement - Self-Employed Independent Contractor, and payment terms. Using a clear and straightforward format helps ensure the form is completed accurately, which is essential for legal and tax purposes.

Yes, independent contractors file as self-employed. When you work as a South Dakota Educator Agreement - Self-Employed Independent Contractor, you report your income on Schedule C of your tax return. This means you handle your own taxes, including paying self-employment tax. Understanding this process is crucial for your financial planning.

Absolutely, an independent contractor counts as self-employed under U.S. law. They have the freedom to choose projects, set their schedules, and operate their businesses independently. By entering into a South Dakota Educator Agreement - Self-Employed Independent Contractor, you can establish a solid foundation for your self-employment endeavors.

Yes, an independent contractor is indeed considered self-employed. This classification allows them to work for themselves, offering services to clients on a contractual basis. Utilizing a South Dakota Educator Agreement - Self-Employed Independent Contractor can provide important legal protections and clarify expectations with clients.

A person qualifies as self-employed if they operate their own business or work independently without an employer-employee relationship. This status is often reflected in tax filings, allowing individuals to report income from various sources. If you're in this situation, consider using the South Dakota Educator Agreement - Self-Employed Independent Contractor to formalize your business relationships.

Writing an independent contractor agreement involves several key components. Start by clearly defining the scope of work, payment terms, and duration of the contract. Incorporating a South Dakota Educator Agreement - Self-Employed Independent Contractor template can streamline the process, ensuring you include all legal requirements and considerations.

Yes, receiving a 1099 form generally indicates that you are considered self-employed in the eyes of the IRS. This form signifies that you earned income as an independent contractor or from another self-employed activity. To ensure compliance, it's recommended that you understand the implications of your status and consider a South Dakota Educator Agreement - Self-Employed Independent Contractor for clarity.