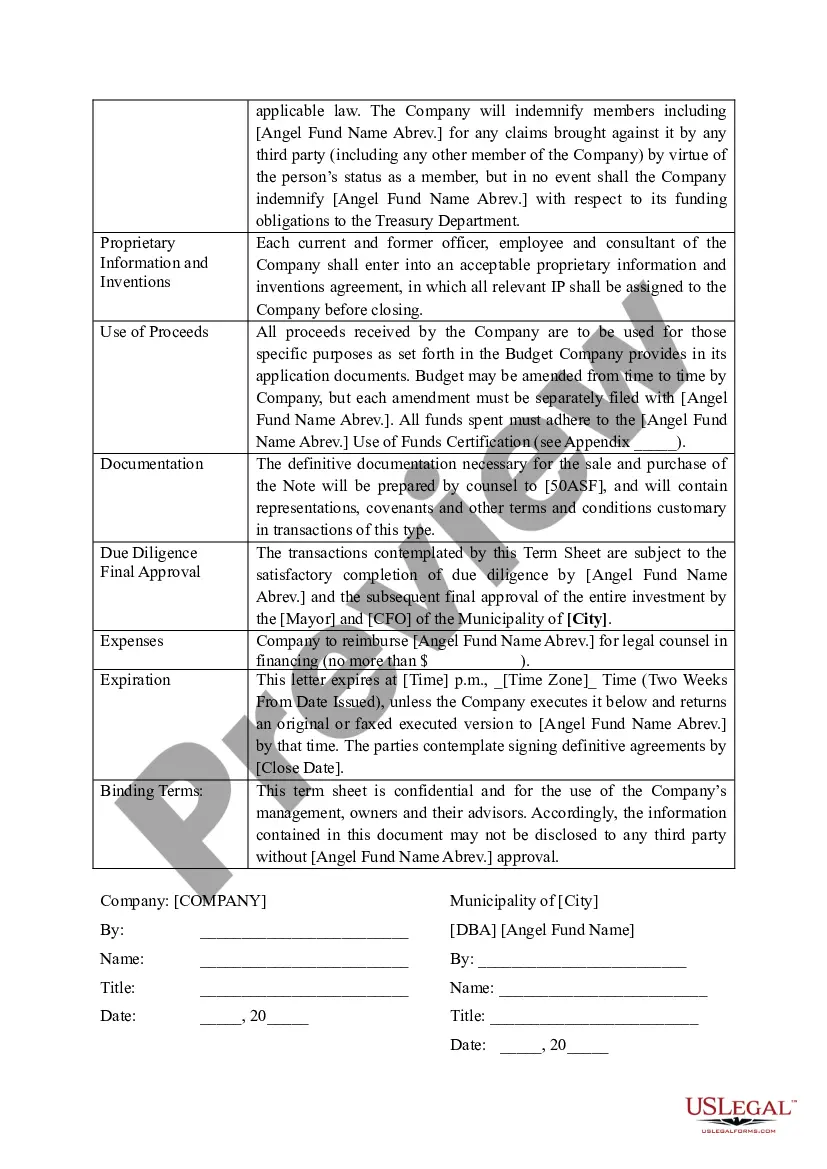

South Dakota Angel Fund Promissory Note Term Sheet

Description

Term sheet is a non-binding agreement setting forth the basic terms and conditions under which an investment will be made.

How to fill out Angel Fund Promissory Note Term Sheet?

If you wish to complete, obtain, or print out authorized papers templates, use US Legal Forms, the greatest selection of authorized forms, which can be found on the Internet. Take advantage of the site`s simple and practical lookup to find the files you will need. Different templates for company and individual uses are categorized by groups and claims, or search phrases. Use US Legal Forms to find the South Dakota Angel Fund Promissory Note Term Sheet in a couple of clicks.

In case you are presently a US Legal Forms consumer, log in to the accounts and click the Down load key to have the South Dakota Angel Fund Promissory Note Term Sheet. You may also access forms you previously saved in the My Forms tab of your own accounts.

Should you use US Legal Forms initially, follow the instructions under:

- Step 1. Ensure you have selected the form for that correct area/nation.

- Step 2. Use the Preview choice to look over the form`s content material. Don`t forget to learn the explanation.

- Step 3. In case you are not satisfied with the form, make use of the Search industry on top of the display screen to discover other types of your authorized form web template.

- Step 4. When you have discovered the form you will need, click the Get now key. Opt for the prices plan you favor and put your qualifications to sign up for the accounts.

- Step 5. Process the financial transaction. You can use your charge card or PayPal accounts to finish the financial transaction.

- Step 6. Choose the file format of your authorized form and obtain it on your device.

- Step 7. Complete, edit and print out or sign the South Dakota Angel Fund Promissory Note Term Sheet.

Every authorized papers web template you buy is yours eternally. You might have acces to every single form you saved within your acccount. Select the My Forms segment and decide on a form to print out or obtain once more.

Compete and obtain, and print out the South Dakota Angel Fund Promissory Note Term Sheet with US Legal Forms. There are thousands of skilled and express-certain forms you may use for your company or individual requires.

Form popularity

FAQ

SAFEs vs. convertible notes NotesSAFEsValuation cap??Conversion discount??Maturity date??Accrues interest??1 more row ?

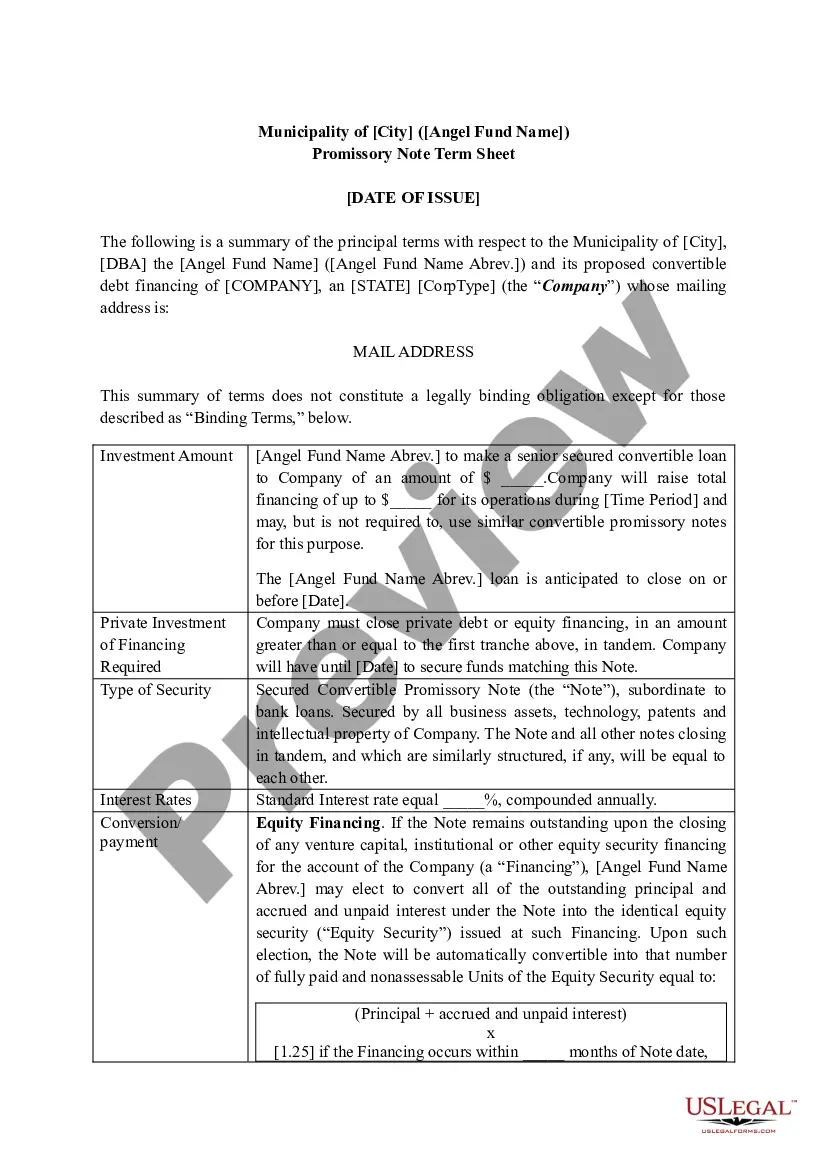

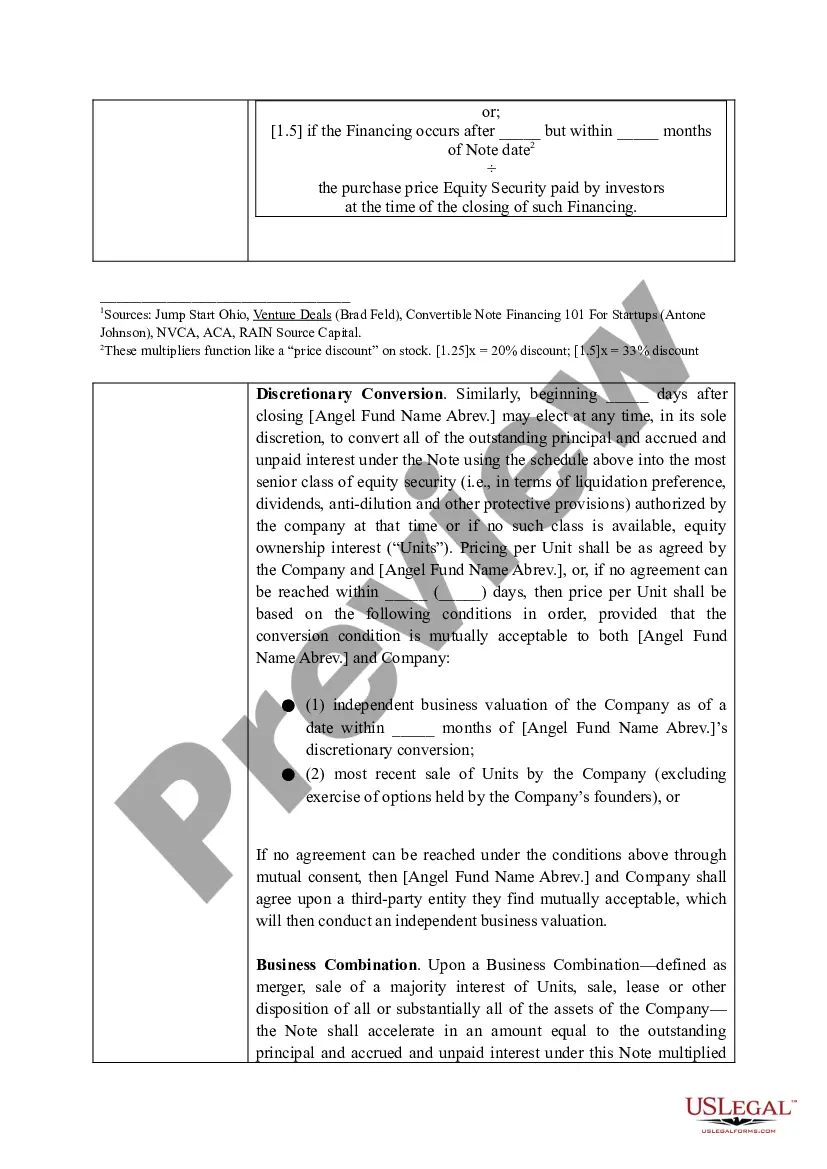

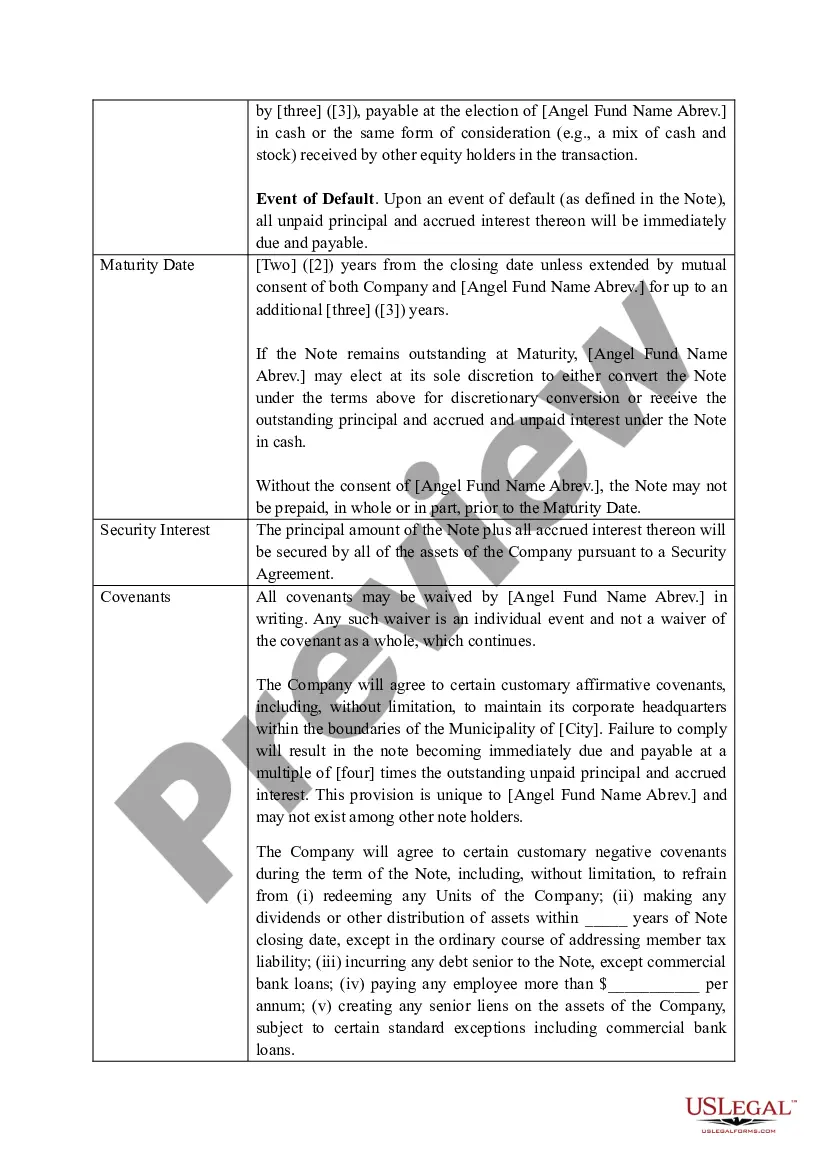

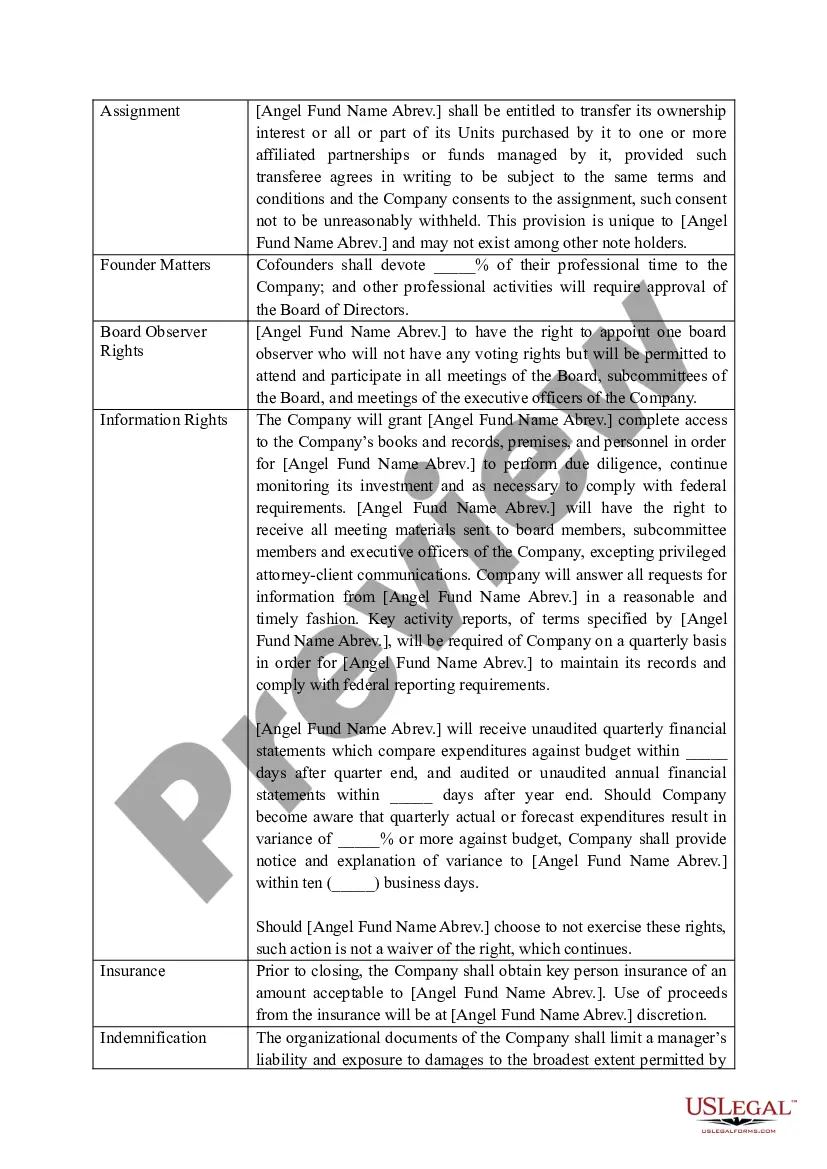

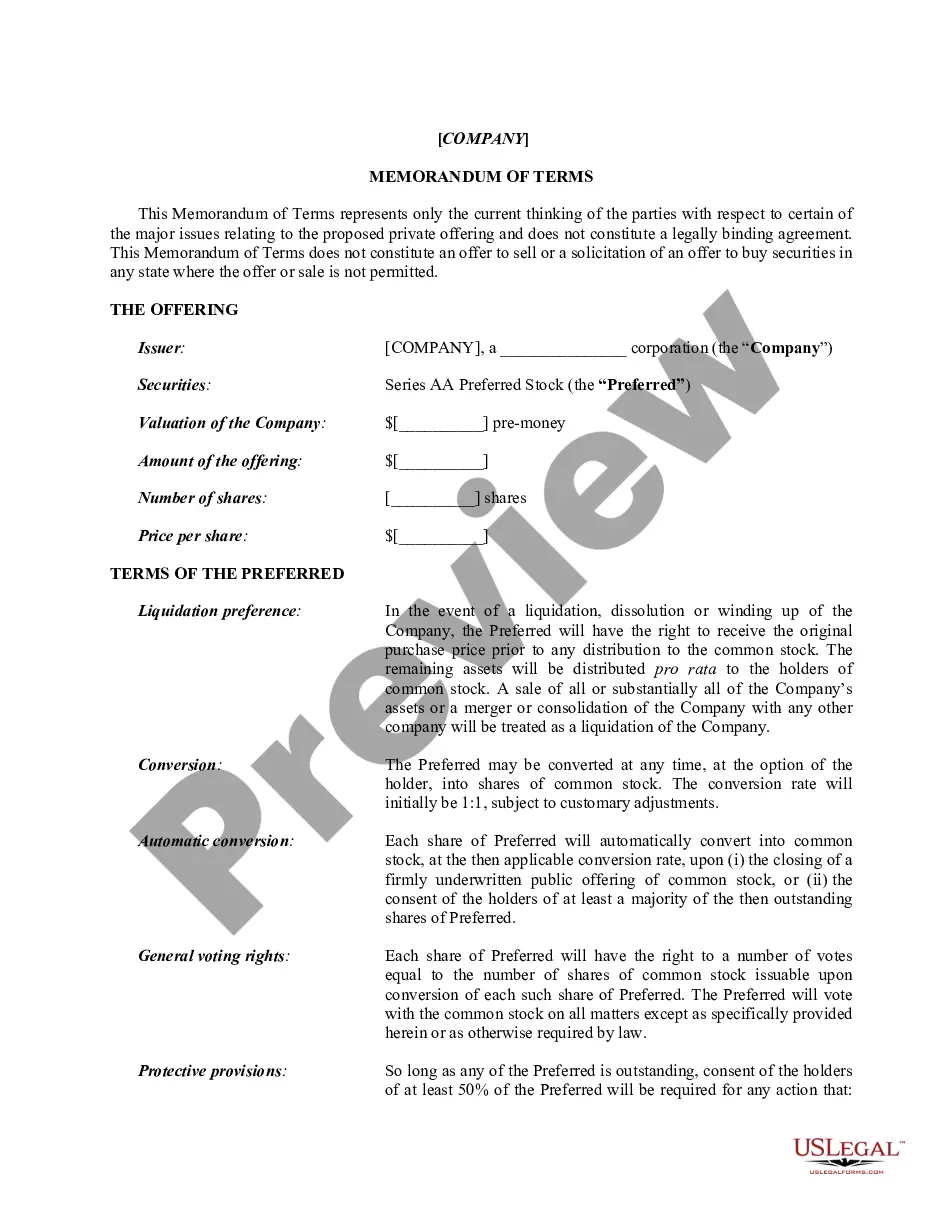

A term sheet is usually a non-binding agreement outlining the basic terms and conditions of the investment. It serves as a template for the convertible note for both parties.

The SAFE is legally a contract of the issuer, constituting an agreement to issue equity in the future at a purchase price paid in advance. It is not debt and, unlike a convertible promissory note, accrues no interest and has no maturity date.

Convertible notes are promissory notes that serve an additional business purpose other than merely representing debt. Convertible notes include all of the terms of a vanilla promissory note, such as an interest rate and the pledge of underlying security (if applicable).

A promissory note is a form of debt that companies and individuals sometimes use, like loans, to raise money. The issuer, through the notes, promises to return the buyer's funds (principal) and to make fixed interest payments to the buyer in exchange for borrowing the money.

Standard convertible note terms are parameters for a specific form of short-term business debt. A convertible note will convert into equity at a future date, meaning that the investor loans money to an entrepreneur and receives equity in the company rather than payments on the principal plus interest.

A convertible note is a debt instrument often used by angel or seed investors looking to fund an early-stage startup that has not been valued explicitly. After more information becomes available to establish a reasonable value for the company, convertible note investors can convert the note into equity.