South Dakota Share Exchange Agreement regarding shareholders issued exchangeable nonvoting shares of capital stock

Description

How to fill out Share Exchange Agreement Regarding Shareholders Issued Exchangeable Nonvoting Shares Of Capital Stock?

You may commit hrs on the Internet trying to find the legitimate papers design that suits the state and federal needs you want. US Legal Forms gives 1000s of legitimate types which can be evaluated by specialists. You can actually download or printing the South Dakota Share Exchange Agreement regarding shareholders issued exchangeable nonvoting shares of capital stock from our support.

If you currently have a US Legal Forms account, you are able to log in and click on the Acquire option. After that, you are able to comprehensive, change, printing, or signal the South Dakota Share Exchange Agreement regarding shareholders issued exchangeable nonvoting shares of capital stock. Every legitimate papers design you purchase is your own property eternally. To get another copy associated with a purchased type, check out the My Forms tab and click on the corresponding option.

If you are using the US Legal Forms web site initially, follow the easy directions beneath:

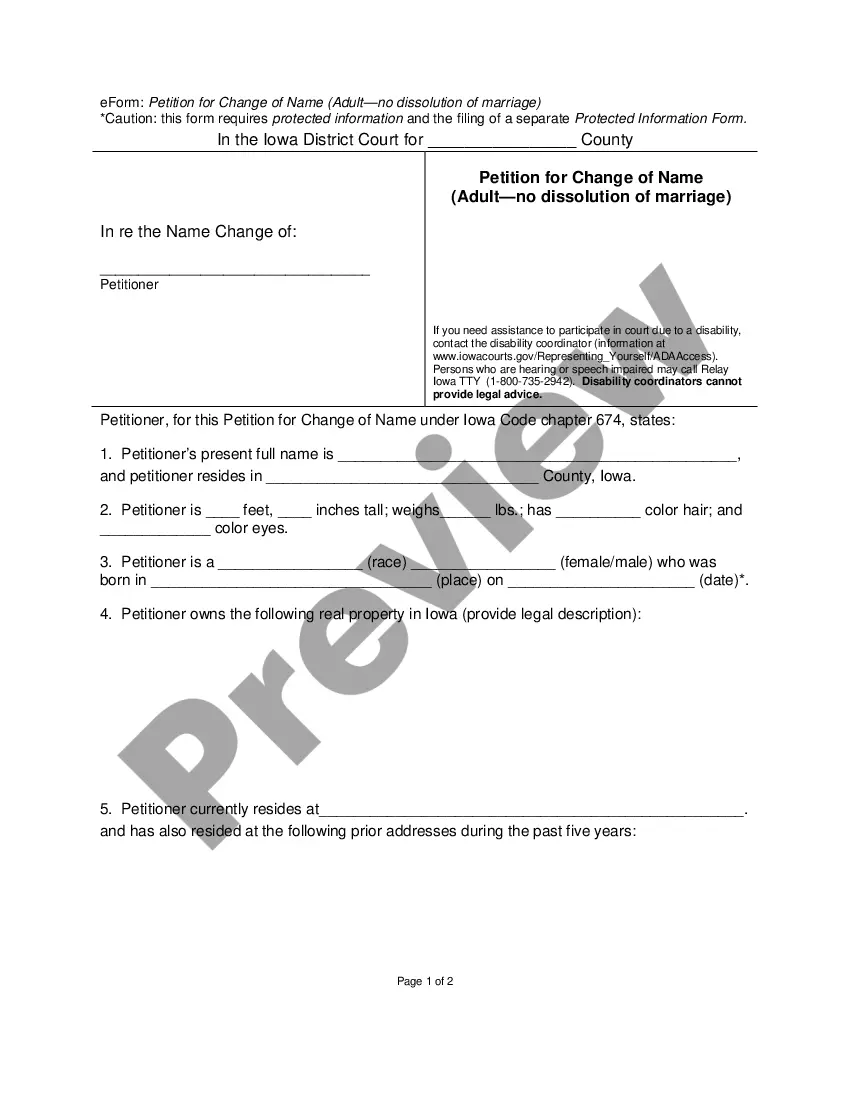

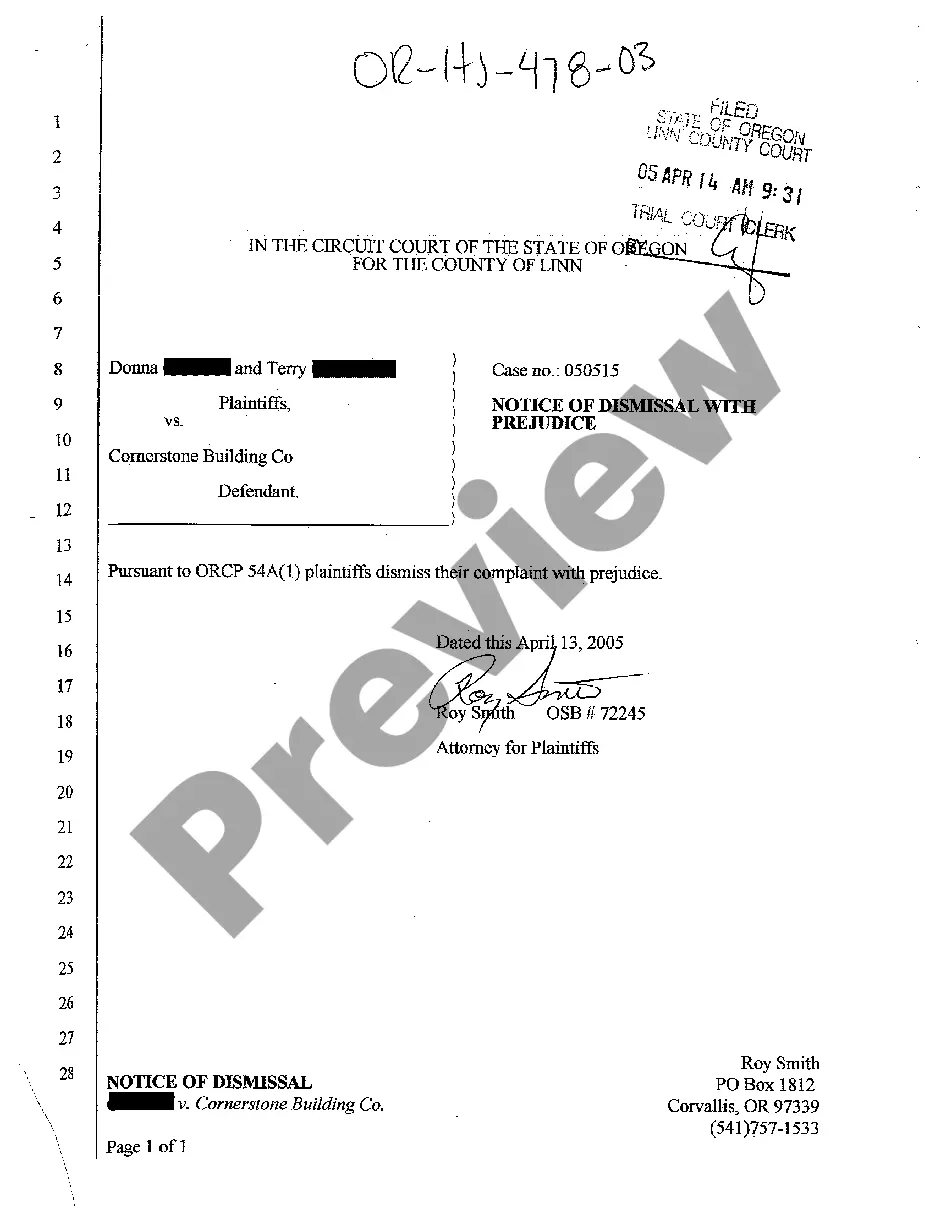

- Initial, ensure that you have selected the right papers design for your state/area of your liking. Read the type description to ensure you have picked out the right type. If readily available, use the Review option to search through the papers design also.

- In order to get another variation in the type, use the Lookup area to discover the design that suits you and needs.

- After you have discovered the design you would like, click Purchase now to move forward.

- Find the prices strategy you would like, type in your accreditations, and register for a merchant account on US Legal Forms.

- Total the purchase. You can use your credit card or PayPal account to purchase the legitimate type.

- Find the formatting in the papers and download it for your product.

- Make adjustments for your papers if required. You may comprehensive, change and signal and printing South Dakota Share Exchange Agreement regarding shareholders issued exchangeable nonvoting shares of capital stock.

Acquire and printing 1000s of papers templates using the US Legal Forms website, that offers the greatest collection of legitimate types. Use specialist and state-certain templates to deal with your small business or specific needs.

Form popularity

FAQ

A share for share exchange is where one or more shareholders exchange shares they hold in one company for shares in another company. A common example of this is where a new holding company B is put on top of existing company A.

We have 5 steps. Step 1: Decide on the issues the agreement should cover. ... Step 2: Identify the interests of shareholders. ... Step 3: Identify shareholder value. ... Step 4: Identify who will make decisions - shareholders or directors. ... Step 5: Decide how voting power of shareholders should add up.

A shareholders' agreement includes a date; often the number of shares issued; a capitalization table that outlines shareholders and their percentage ownership; any restrictions on transferring shares; pre-emptive rights for current shareholders to purchase shares to maintain ownership percentages (for example, in the ...

A shareholders agreement will almost always contain clauses which regulate the company's directors and management structure. Generally, this will include clauses relating to decision making, the rights of shareholders to appoint or remove directors and the powers of the managing director.

Share Transfer-specific Clauses Clauses regarding treatment of shares are some of the most important clauses in a SHA. A share provides a bundle of legal rights to each shareholder which enables a shareholder to derive value from their shares in multiple ways.

The shareholders agreement should set out matters that are reserved for the board and those matters that will require shareholder approval. It will also set out the level of majority required to pass a particular resolution. Decisions reserved for the board typically relate to the day?to?day management of the company.

Accounts and reports. AGMs. Audit. Banking and finance for corporate lawyers. Clause bank for corporate lawyers. Companies and other forms of business vehicle. Company disclosures, records and registers. ... Ancillary documents. Auction sale. Completion and post-completion. Cross-border. Due diligence and disclosure. General issues.

Exit Strategy: The agreement should include an exit strategy for each shareholder, including what happens if a shareholder wants to sell their shares, retire or die. Dispute Resolution: The agreement should outline a process for resolving disputes between shareholders, such as mediation or arbitration.