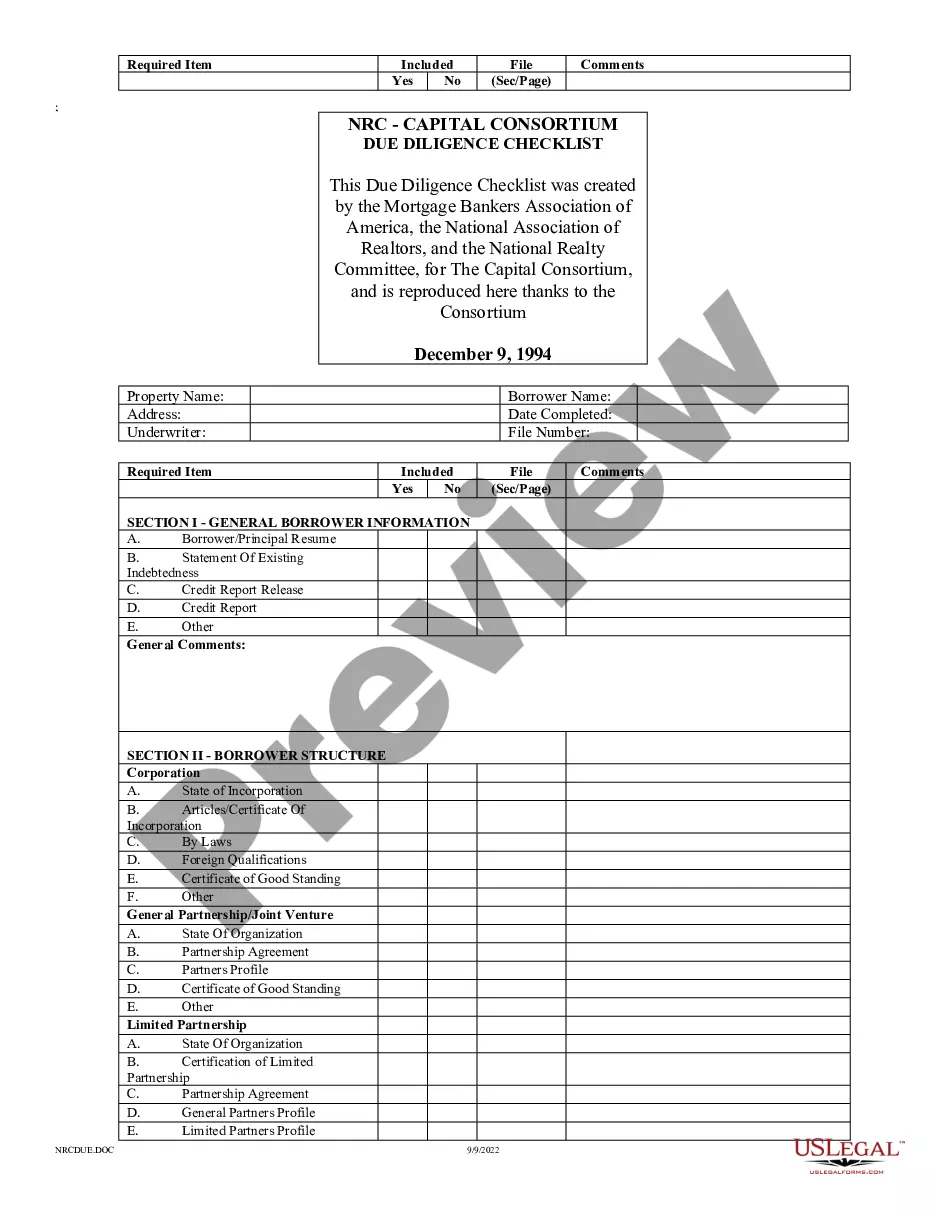

"Capital Consortium Due Diligence Checklist" is a American Lawyer Media form. This form is a checklist that was created by the Mortgage Bankers Association of America, the National Association of Realtors, and the National Realty Committee, for The Capital Consortium.

South Dakota Capital Consortium Due Diligence Checklist

Description

How to fill out Capital Consortium Due Diligence Checklist?

You may spend several hours on-line looking for the lawful document format that fits the state and federal needs you will need. US Legal Forms gives a large number of lawful varieties that are reviewed by specialists. It is simple to obtain or produce the South Dakota Capital Consortium Due Diligence Checklist from my assistance.

If you currently have a US Legal Forms accounts, you are able to log in and then click the Acquire button. After that, you are able to comprehensive, modify, produce, or signal the South Dakota Capital Consortium Due Diligence Checklist. Each lawful document format you get is the one you have eternally. To get an additional copy of the acquired kind, visit the My Forms tab and then click the related button.

If you are using the US Legal Forms internet site the first time, follow the straightforward guidelines below:

- First, ensure that you have selected the best document format for that area/metropolis of your choosing. Look at the kind explanation to make sure you have selected the right kind. If offered, use the Preview button to search from the document format as well.

- If you want to find an additional variation from the kind, use the Research area to get the format that meets your needs and needs.

- Once you have discovered the format you need, just click Purchase now to move forward.

- Choose the costs prepare you need, type in your credentials, and sign up for an account on US Legal Forms.

- Full the purchase. You should use your Visa or Mastercard or PayPal accounts to cover the lawful kind.

- Choose the file format from the document and obtain it for your product.

- Make modifications for your document if necessary. You may comprehensive, modify and signal and produce South Dakota Capital Consortium Due Diligence Checklist.

Acquire and produce a large number of document web templates while using US Legal Forms web site, which offers the largest collection of lawful varieties. Use expert and express-particular web templates to tackle your small business or person demands.

Form popularity

FAQ

The process of due diligence ensures that potential acquirers gain an accurate and complete understanding of a company. It helps evaluate a company's strengths, weaknesses, risks, and opportunities. The creation of a due diligence checklist provides the detailed roadmap required to guide such an extensive analysis.

Hear this out loud PauseBelow is a basic outline of the financial due diligence checklist: Income statements (past five years) showing income and expenditure, profit and loss. Balance sheets (past five years) showing company assets and liabilities. Cash flow statements (past five years) showing all cash inflows and cash outflows.

The due diligence questionnaire (DDQ) is an industry-standard form that many LPs, especially the larger institutional ones, may use to quickly cross-compare and answer typical questions that arise in their diligence process.

Due diligence questionnaire is a crucial process for vendor selection. It offers numerous benefits that include: Helps to gain deep visibility into vendor practices to identify potential risks. Helps to understand how well your business goals and objectives align with vendor practices.

Hear this out loud PauseA vendor due diligence questionnaire is an evaluation factor to gain a comprehensive understanding of the vendor's security posture and practices. It helps organizations to make an informed decision and avoid buyer's remorse.

A due diligence questionnaire is a formal document with questions designed to ascertain a third party's compliance with industry standards, laws and regulations, cybersecurity best practices and anything else material to the company.

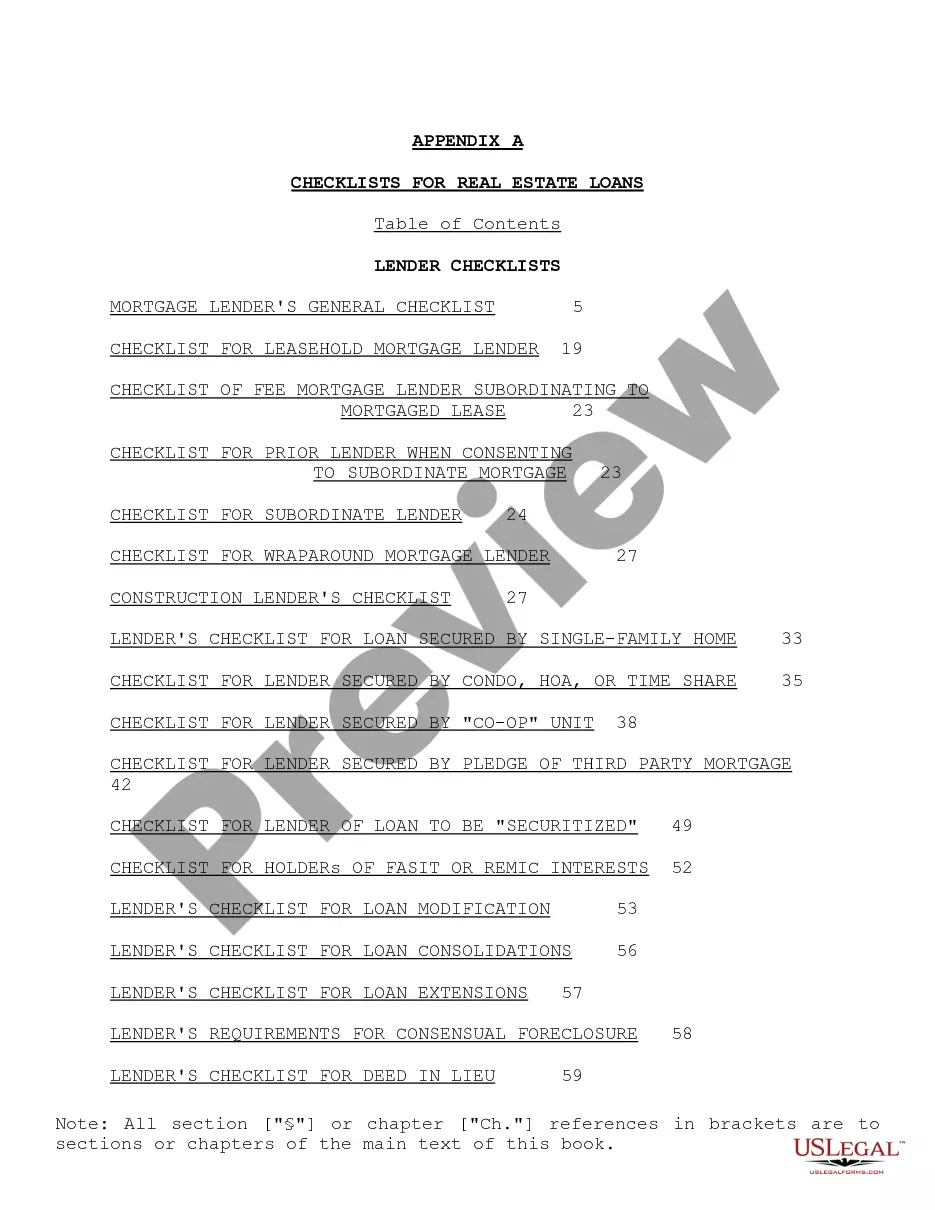

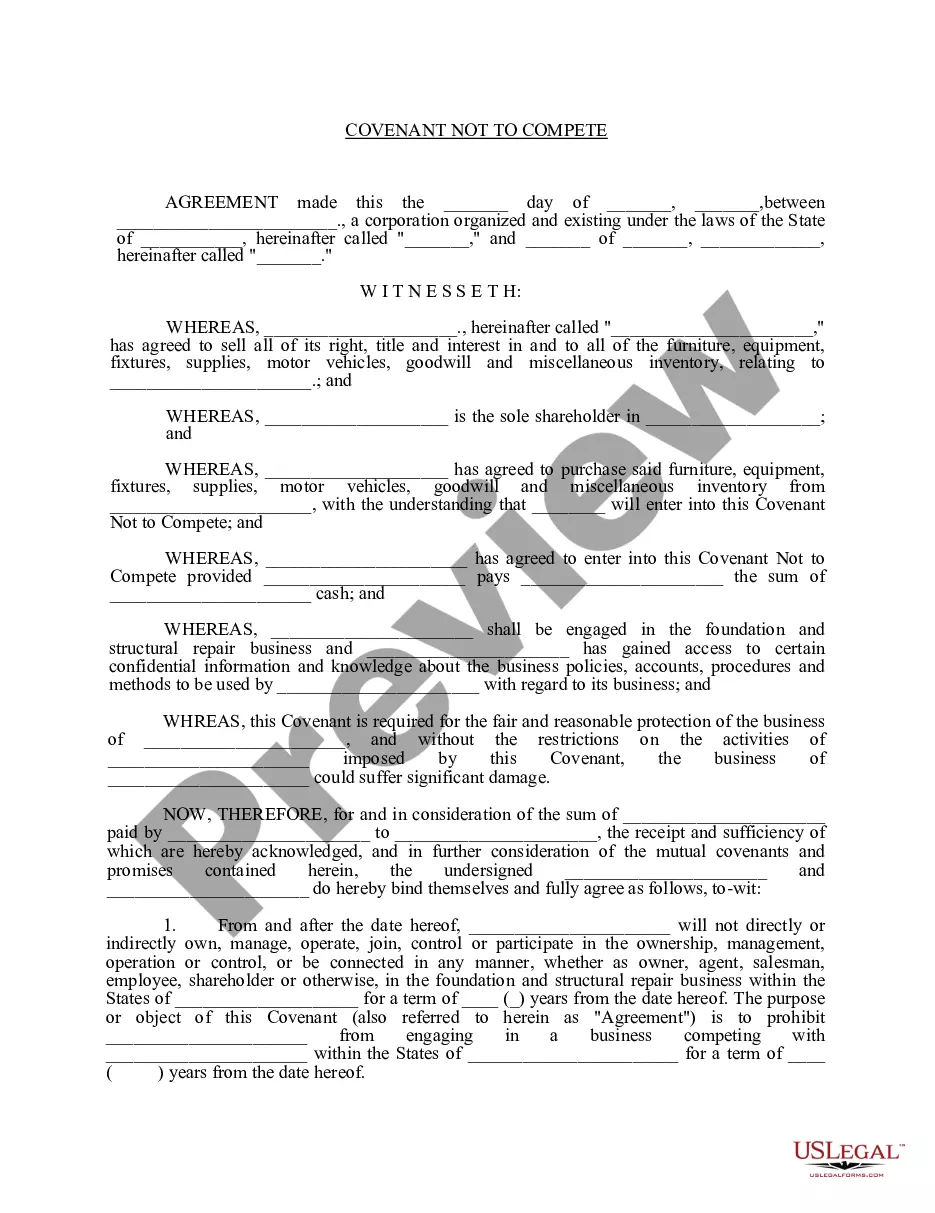

Complete Due Diligence Documents Checklist Shareholder certificate documents. Local/state/federal business licenses. Occupational license. Building permits documents. Zonal and land use permits. Tax registration documents. Power of attorney documents. Previous or outstanding legal cases.