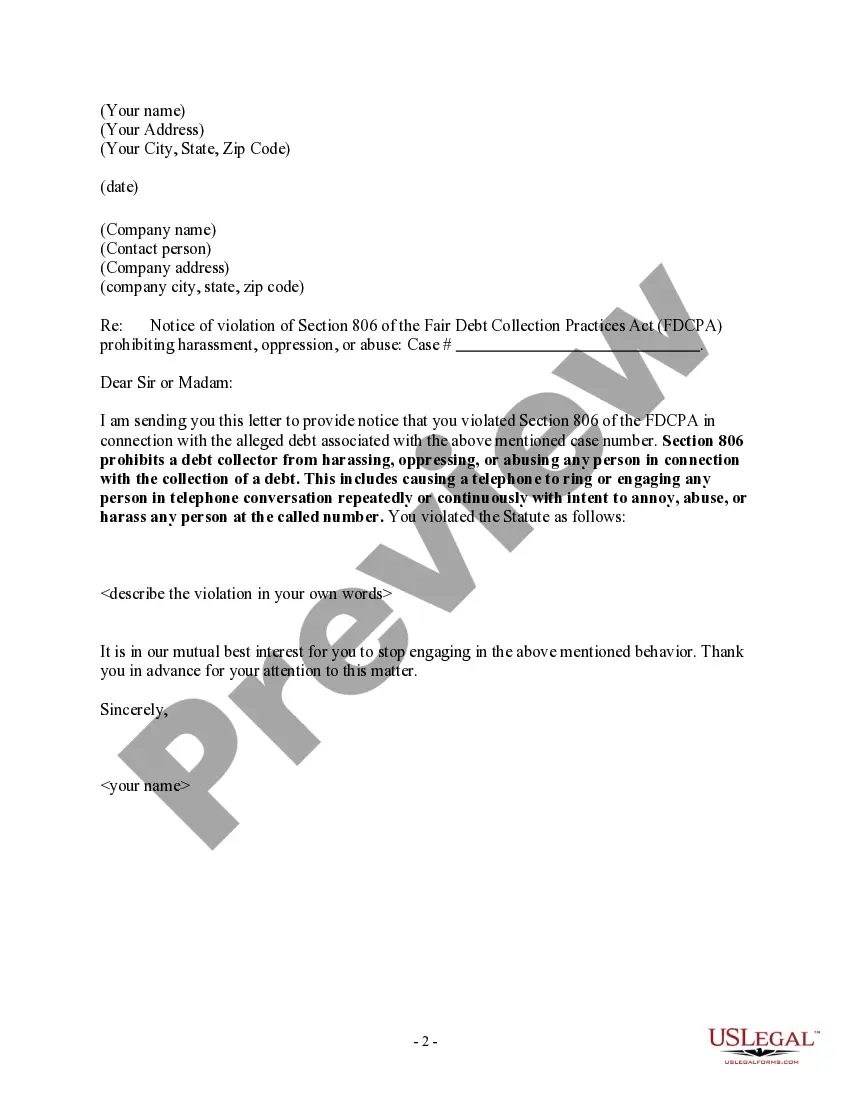

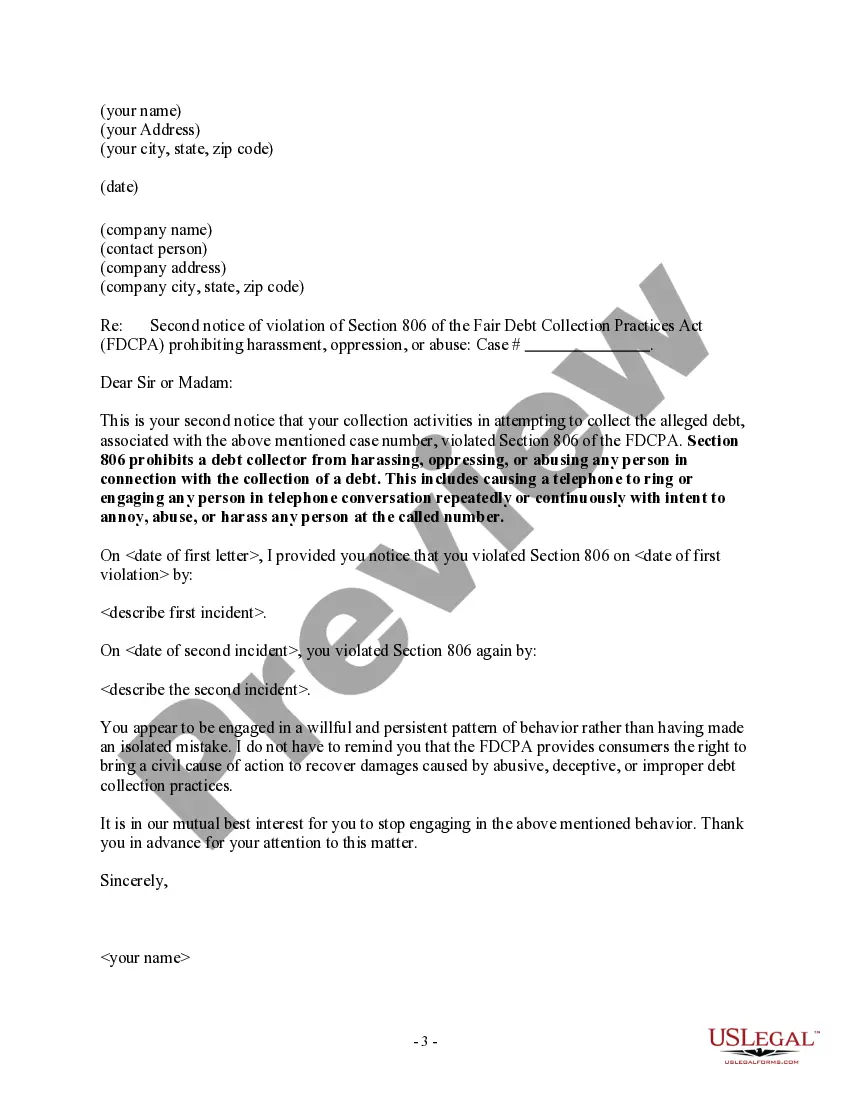

Section 806 of the Fair Debt Collection Practices Act says a debt collector may not harass, oppress, or abuse any person in connection with the collection of a debt. This includes causing a telephone to ring or engaging any person in telephone conversation repeatedly or continuously with intent to annoy, abuse, or harass any person at the called number.

South Dakota Notice to Debt Collector - Unlawful Repeated or Continuous Telephone Calls

Description

How to fill out Notice To Debt Collector - Unlawful Repeated Or Continuous Telephone Calls?

US Legal Forms - one of the largest collections of sanctioned documents in the United States - offers a broad selection of sanctioned document templates that you can download or print.

By utilizing the website, you can access thousands of documents for business and personal purposes, organized by categories, states, or keywords. You will find the latest versions of documents such as the South Dakota Notice to Debt Collector - Unlawful Repeated or Continuous Telephone Calls in seconds.

If you are a registered user, Log In to download the South Dakota Notice to Debt Collector - Unlawful Repeated or Continuous Telephone Calls from the US Legal Forms library. The Download button will be visible on every template you view. You have access to all previously saved documents from the My documents section of your account.

Choose the format and download the document to your device.

Make changes. Fill out, edit, print, and sign the downloaded South Dakota Notice to Debt Collector - Unlawful Repeated or Continuous Telephone Calls.

Every template you add to your account does not have an expiration date and is yours indefinitely. So, if you want to download or print another copy, just go to the My documents section and click on the template you desire.

Access the South Dakota Notice to Debt Collector - Unlawful Repeated or Continuous Telephone Calls with US Legal Forms, the largest collection of sanctioned document templates. Use thousands of professional and state-specific templates that fulfill your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are straightforward instructions to help you get started.

- Make sure you have selected the correct template for your city/state. Click the Preview button to review the content of the document.

- Check the document description to confirm that you have selected the right template.

- If the document doesn't meet your needs, use the Search box at the top of the screen to find one that does.

- If you are satisfied with the document, confirm your choice by clicking the Purchase now button. Then, select the payment plan you prefer and provide your credentials to register for an account.

- Process the transaction. Use your credit card or PayPal account to complete the purchase.

Form popularity

FAQ

Also, debt collectors can't call you numerous times a day. Doing so is considered a form of harassment by the Federal Trade Commission (FTC) and is explicitly not allowed.

Federal law doesn't give a specific limit on the number of calls a debt collector can place to you. A debt collector may not call you repeatedly or continuously intending to annoy, abuse, or harass you or others who share the number.

While an account in collection can have a significant negative impact on your credit, it won't stay on your credit reports forever. Accounts in collection generally remain on your credit reports for seven years, plus 180 days from whenever the account first became past due.

In most cases, the statute of limitations for a debt will have passed after 10 years. This means a debt collector may still attempt to pursue it (and you technically do still owe it), but they can't typically take legal action against you.

The statute of limitations is a law that limits how long debt collectors can legally sue consumers for unpaid debt. The statute of limitations on debt varies by state and type of debt, ranging from three years to as long as 20 years.

The only permissible means of communicating is by regular mail. Alberta and Nova Scotia have a similar "three strikes" rule limiting the amount of contact from collectors within a seven-day consecutive period.

Also, debt collectors can't call you numerous times a day. Doing so is considered a form of harassment by the Federal Trade Commission (FTC) and is explicitly not allowed.

Under the Fair Credit Reporting Act, debts can appear on your credit report generally for seven years and in a few cases, longer than that. Under state laws, if you are sued about a debt, and the debt is too old, you may have a defense to the lawsuit.

Even if the debt is yours, you still have the right not to talk to the debt collector and you can tell the debt collector to stop calling you. However, telling a debt collector to stop contacting you does not stop the debt collector or creditor from using other legal ways to collect the debt from you if you owe it.