South Dakota Personal Guaranty of Another Person's Agreement to Pay Consultant

Description

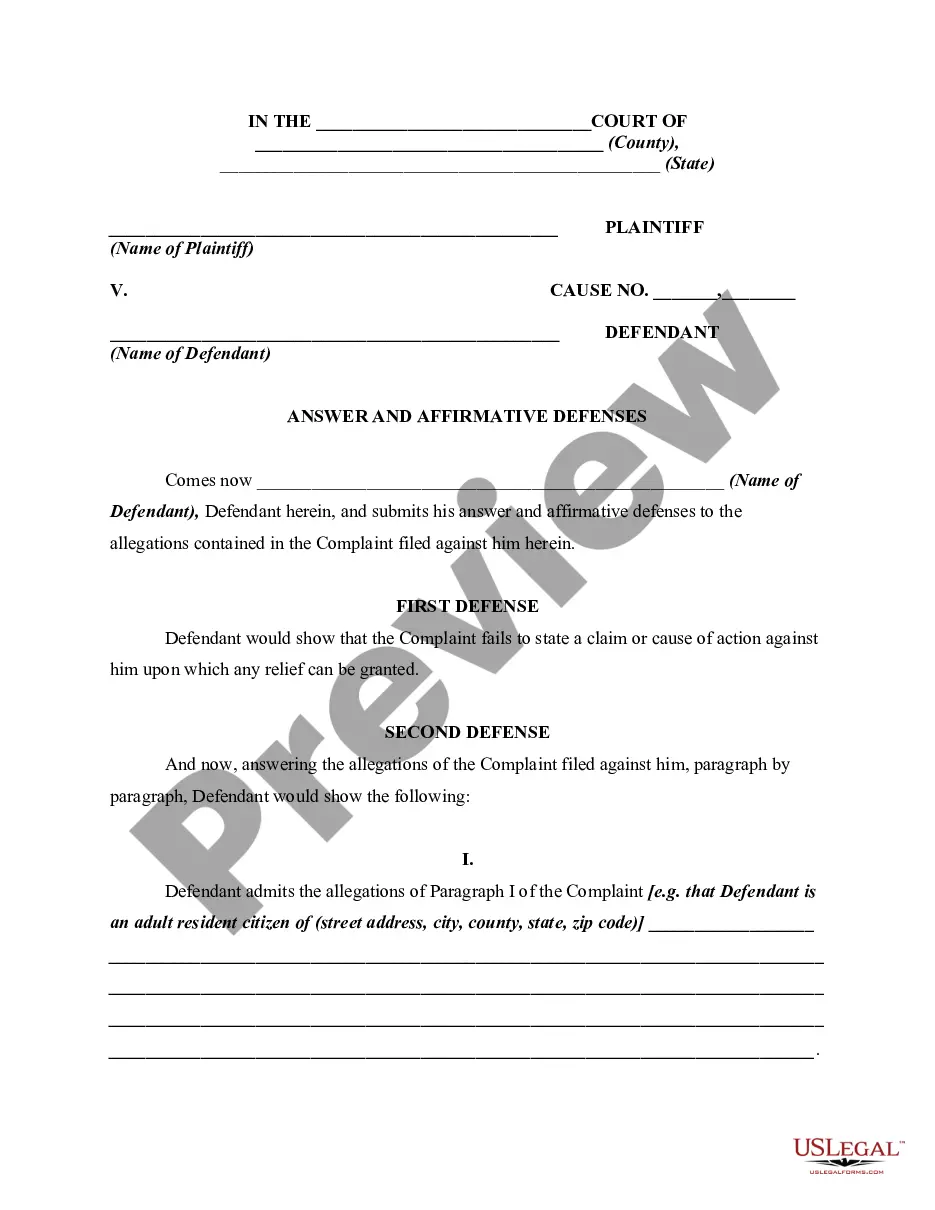

How to fill out Personal Guaranty Of Another Person's Agreement To Pay Consultant?

Selecting the correct legitimate document format can be a challenge.

Certainly, there are numerous templates accessible online, but how can you acquire the official form you need.

Utilize the US Legal Forms website. The platform offers a vast array of templates, such as the South Dakota Personal Guaranty of Another Person's Agreement to Pay Consultant, suitable for professional and personal purposes.

First, ensure that you have selected the appropriate form for your locality/region. You can review the form using the Review button and read the form details to confirm it is right for you. If the form does not meet your needs, use the Search feature to find the correct form. Once you are confident that the form is suitable, click the Get now button to obtain the form. Choose the pricing plan you prefer and enter the required information. Create your account and complete the payment using your PayPal account or credit card. Select the file format and download the official document format to your device. Fill out, edit, print, and sign the obtained South Dakota Personal Guaranty of Another Person's Agreement to Pay Consultant. US Legal Forms is the largest collection of legal forms where you can discover various document templates. Utilize the service to download professionally crafted papers that meet state requirements.

- All the forms are reviewed by experts and comply with state and federal regulations.

- If you are currently signed up, Log In to your account and click on the Acquire button to obtain the South Dakota Personal Guaranty of Another Person's Agreement to Pay Consultant.

- Utilize your account to search through the legal documents you have previously obtained.

- Navigate to the My documents section of your account and retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions to follow.

Form popularity

FAQ

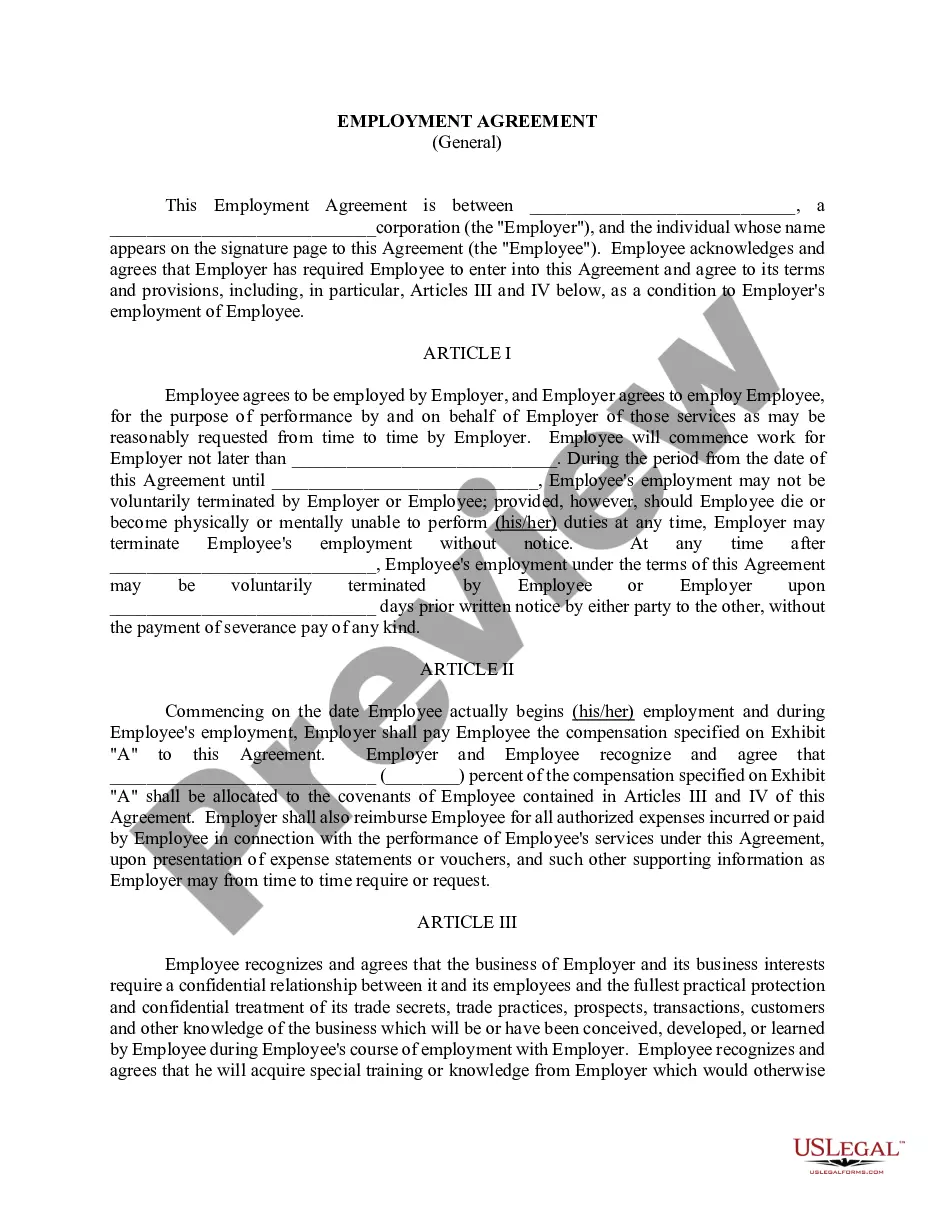

However, the guarantee and the underlying loan agreement are separate legal obligations and are not consolidated simply because both of the agreements are written on the same instrument or executed concurrently.

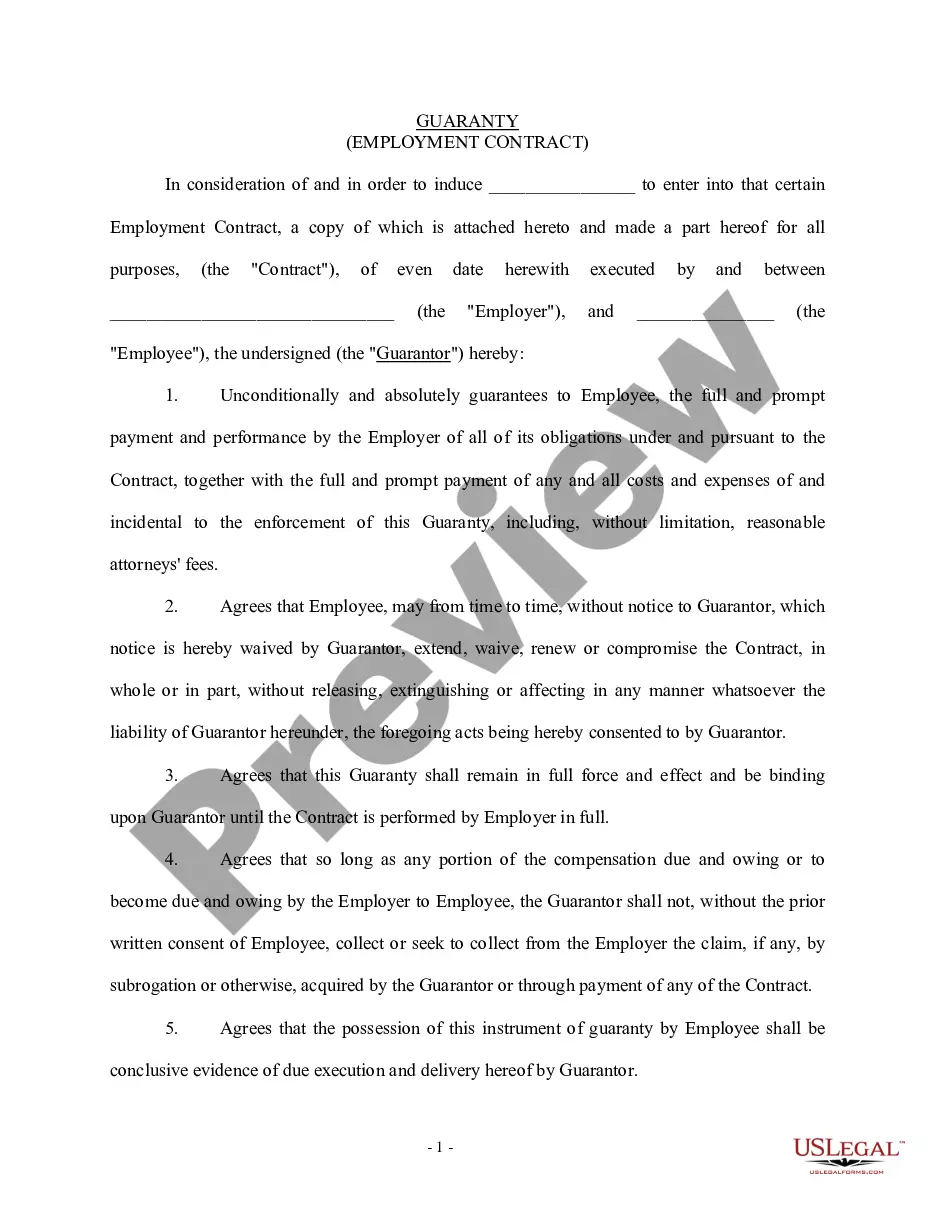

A guarantee agreement definition is common in real estate and financial transactions. It concerns the agreement of a third party, called a guarantor, to provide assurance of payment in the event the party involved in the transaction fails to live up to their end of the bargain.

A guaranty agreement is a contract between two parties where one party agrees to pay a debt or perform a duty in the event that the original party fails to do so. The party who makes the guaranty is called the guarantor. An agreement of this nature is often used in real estate, insurance, or financial transactions.

Guarantor contracts are unenforceable unless they meet these two requirements. Note that it's not necessary to have a formal, written contract. The memorandum should simply prove that an oral contract was made and prove any material terms of that contract.

A guaranty is the written promise of an individual to pay the debt of another. In a commercial setting, a guaranty is typically the promise of an owner or officer of a corporate entity to pay the debt of that corporate entity should it default on its obligation.

A guarantee must be in writing (or evidenced in writing) and signed by the guarantor or a person authorised by the guarantor (section 4, Statute of Frauds 1677). Guarantees and indemnities are often executed as deeds to overcome any argument about whether good consideration has been given.

A personal guarantee is a provision a lender puts in a business loan agreement that requires owners to be personally responsible for their company's debt in case of default. Lenders often ask for personal guarantees because they have concerns over the credit history, age or financial stability of your business.

Guaranty Agreement a two-party contract in which the first party agrees to perform in the event that a second party fails to perform. Unlike a surety, a guarantor is only required to perform after the obligee has made every reasonable and legal effort to force the principal's performance.

Guaranty Agreement a two-party contract in which the first party agrees to perform in the event that a second party fails to perform. Unlike a surety, a guarantor is only required to perform after the obligee has made every reasonable and legal effort to force the principal's performance.