South Dakota Payroll Deduction - Special Services

Description

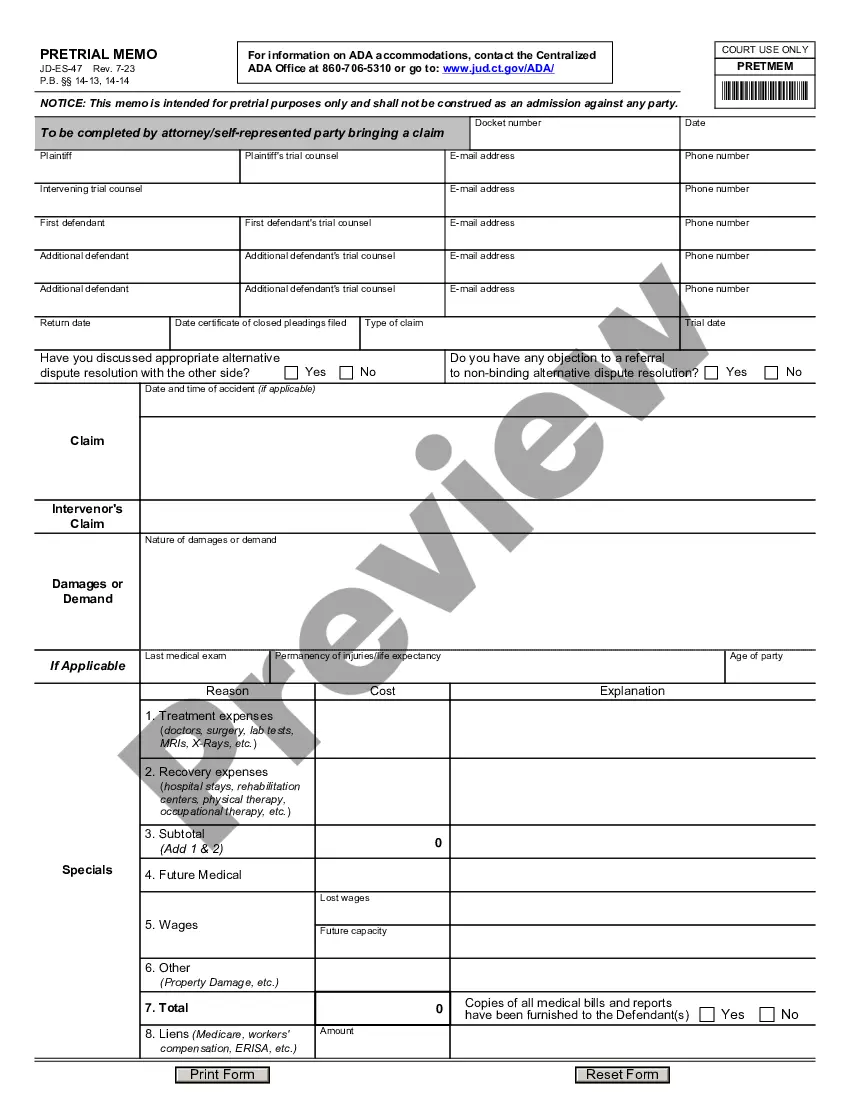

How to fill out Payroll Deduction - Special Services?

You can easily spend hours on the web looking for the legal document template that fulfills the state and federal requirements you need.

US Legal Forms provides thousands of legal forms that are reviewed by experts.

You can conveniently download or print the South Dakota Payroll Deduction - Special Services from our platform.

If available, utilize the Preview button to review the document template as well.

- If you possess a US Legal Forms account, you can Log In and click on the Download button.

- Then, you can fill out, edit, print, or sign the South Dakota Payroll Deduction - Special Services.

- Every legal document template you acquire is yours indefinitely.

- To obtain another copy of any purchased form, navigate to the My documents section and click the corresponding button.

- If you're visiting the US Legal Forms website for the first time, follow the straightforward steps below.

- First, ensure that you have selected the correct document template for your area/city of choice.

- Review the form details to confirm that you have selected the right form.

Form popularity

FAQ

State Disability Insurance (SDI) The SDI taxable wage limit is $145,600 per employee, per year. The 2022 DI/PFL maximum weekly benefit amount is $1,540.00.

Several examples of items that exempt from South Dakota sales tax are prescription medications, farm machinery, advertising services, replacement parts, and livestock. These categories may have some further qualifications before the special rate applies, such as a price cap on clothing items.

Are services subject to sales tax in South Dakota? "Goods" refers to the sale of tangible personal property, which are generally taxable. "Services" refers to the sale of labor or a non-tangible benefit. In South Dakota, services are taxable unless specifically exempted.

South Dakota is unique in the fact that almost all services are taxable. The only major service that is exempt from being taxed is construction.

State Disability Insurance (SDI) The SDI taxable wage limit is $145,600 per employee, per year. The 2022 DI/PFL maximum weekly benefit amount is $1,540.00.

Wages include, but are not limited to: Salaries, hourly pay, piece rate, or payments by the job. Commissions and bonuses. Overtime and vacation pay.

Students under the age of 22 in a qualified work experience program are exempt from UI, ETT, and SDI but are subject to PIT withholding. Students working for the school in which they are enrolled and regularly attending classes are not subject to UI, ETT, and SDI.

The SDI tax is calculated up to the SDI taxable wage limit of each employee's wages and is withheld from the employee's wages. Calculated amounts are for computing the contribution amounts to be paid or withheld for reporting to the EDD.

The UI tax funds unemployment compensation programs for eligible employees. In South Dakota, state UI tax is one of the primary taxes that employers must pay. Unlike most other states, South Dakota does not have state withholding taxes.

South Dakota Administrative Fee 2018 The fee is 0.02% for all applicable employers.