South Dakota Guaranty without Pledged Collateral

Description

How to fill out Guaranty Without Pledged Collateral?

If you desire to complete, acquire, or print legitimate documents topics, utilize US Legal Forms, the best assortment of legal forms, readily accessible online.

Make the most of the site's straightforward and user-friendly search to find the files you require.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. After finding the form you need, click the Buy now button. Select the pricing plan you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Utilize US Legal Forms to locate the South Dakota Guaranty without Pledged Collateral in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and press the Download button to retrieve the South Dakota Guaranty without Pledged Collateral.

- You can also access forms you have previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct city/state.

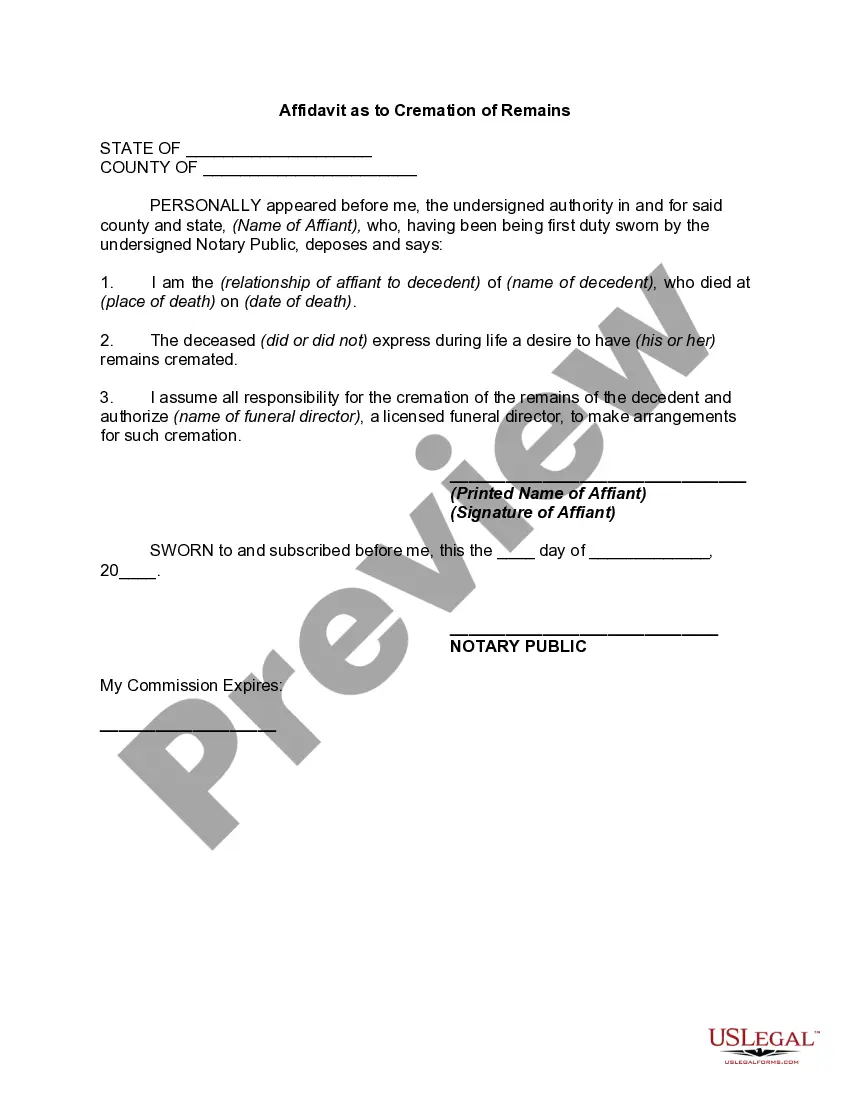

- Step 2. Use the Preview option to review the content of the form. Don't forget to check the description.

- Step 3. If you are dissatisfied with the form, utilize the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

Types of CollateralReal estate.Cash secured loan.Inventory financing.Invoice collateral.Blanket liens.

A guarantee is a simple security document. It states the conditions where the guarantor must take over the borrower's repayment obligations upon default. As a lender, you want to be sure that the guarantor will be able to satisfy its obligations under the guarantee.

Pledged collateral refers to assets that are used to secure a loan. The borrower pledges assets or property to the lender to guarantee or secure the loan.

A pledged asset is collateral held by a lender in return for lending funds. Pledged assets can reduce the down payment that is typically required for a loan as well as reduces the interest rate charged. Pledged assets can include cash, stocks, bonds, and other equity or securities.

Types of Collateral When you take out a mortgage, your home becomes the collateral. If you take out a car loan, then the car is the collateral for the loan. The types of collateral that lenders commonly accept include carsonly if they are paid off in fullbank savings deposits, and investment accounts.

Therefore, 'Guarantee', 'Pledge' and 'Mortgage' share a similar definition that is to make an agreement or a contract for reliability and as a guarantee for debt payment.

Understanding Financial Guarantees Guarantees may take on the form of a security deposit. Common in the banking and lending industries, this is a form of collateral provided by the debtor that can be liquidated if the debtor defaults.

A Pledge Loan means using money you have in savings or a CD as collateral for a loan. If you don't pay back the loan, the lender uses the money you pledged to pay back the loan. You will pay a slightly higher interest rate on the loan than you are earning on your savings.

As nouns the difference between pledge and collateral is that pledge is a solemn promise to do something while collateral is a security or guarantee (usually an asset) pledged for the repayment of a loan if one cannot procure enough funds to repay (originally supplied as "accompanying" security).

Collateral is when an asset is pledged to secure repayment. The five main types of collateral are consumer goods, equipment, farm products, inventory, and property on paper. All can be used as collateral when applying for loans, provided there is a recognizable value associated with the item.