South Dakota Cash Disbursements and Receipts

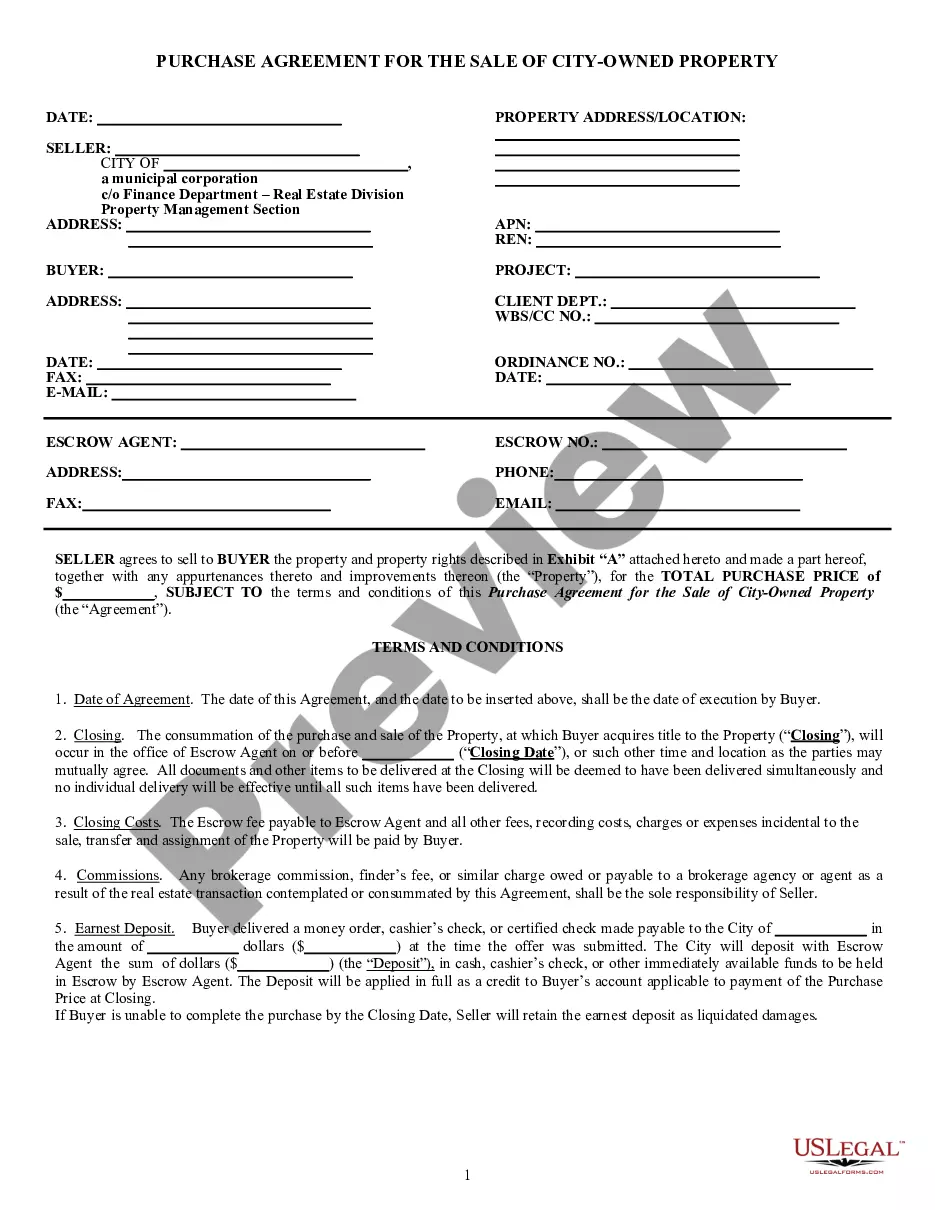

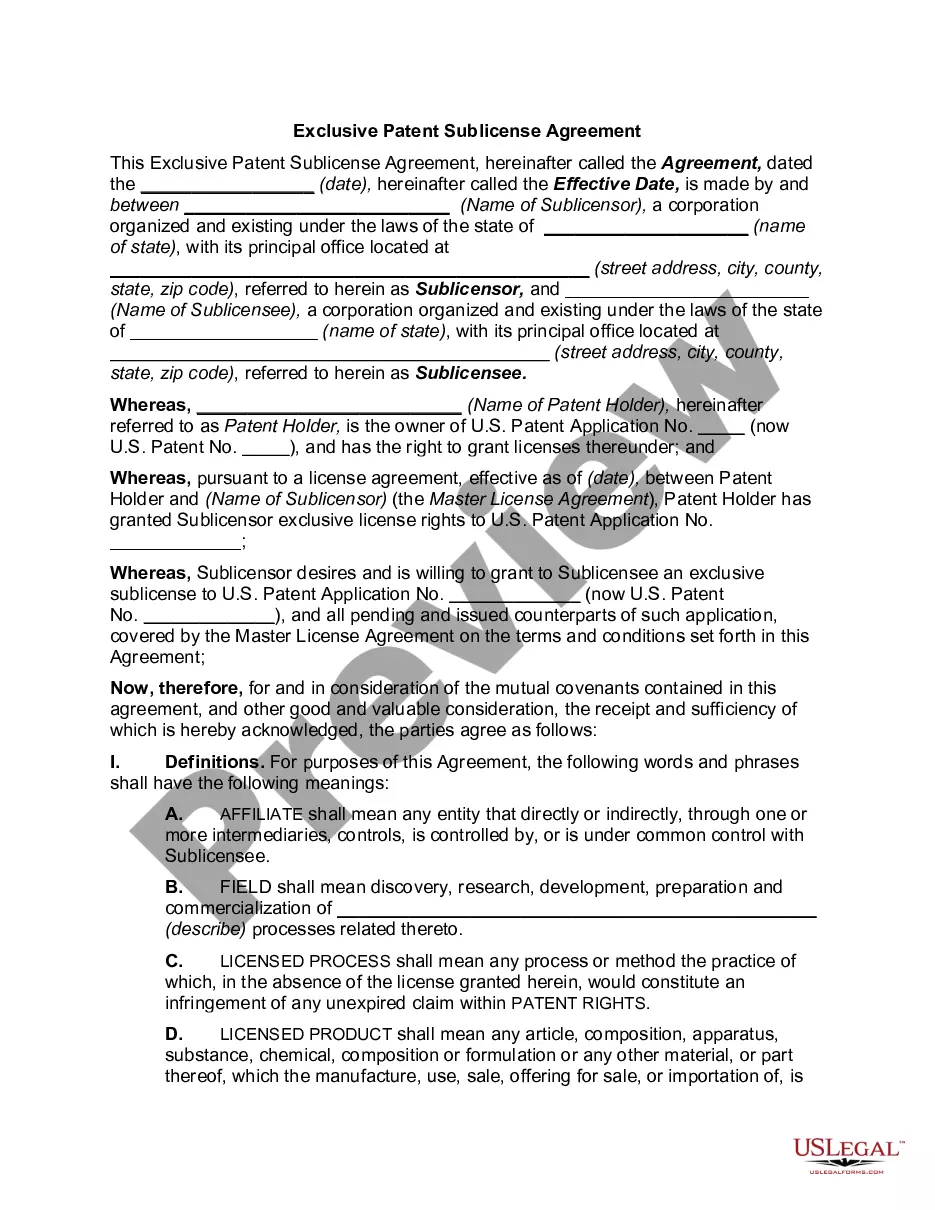

Description

How to fill out Cash Disbursements And Receipts?

Selecting the optimal legal document template can be a challenge. Of course, there are numerous templates accessible online, but how do you find the legal form you need.

Utilize the US Legal Forms website. This service offers thousands of templates, including the South Dakota Cash Disbursements and Receipts, which can be used for business and personal needs.

All forms have been evaluated by professionals and comply with federal and state regulations.

Once you are confident the form is suitable, click on the Get it now option to acquire the form. Select the pricing plan you want and enter the required information. Create your account and complete your purchase using your PayPal account or Visa or MasterCard. Choose the file format and download the legal document template to your device. Fill out, modify, print, and sign the acquired South Dakota Cash Disbursements and Receipts. US Legal Forms is the largest repository of legal forms where you can discover various document templates. Take advantage of the service to download professionally-crafted documents that adhere to state requirements.

- If you are already registered, Log In to your account and click on the Download button to obtain the South Dakota Cash Disbursements and Receipts.

- Use your account to browse through the legal forms you have previously acquired.

- Navigate to the My documents tab of your account to retrieve an additional copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions to follow.

- First, ensure you have chosen the correct form for your city/state. You can review the form using the Review option and read the form description to confirm this is the appropriate one for you.

- If the form does not meet your requirements, utilize the Search area to find the right form.

Form popularity

FAQ

Sales tax applies to almost anything you purchase while excise tax only applies to specific goods and services. Sales tax is typically applied as a percentage of the sales price while excise tax is usually applied at a per unit rate.

South Dakota does not have an individual income tax. South Dakota also does not have a corporate income tax. South Dakota has a 4.50 percent state sales tax rate, a max local sales tax rate of 4.50 percent, and an average combined state and local sales tax rate of 6.40 percent.

South Dakota law allows municipalities to impose a municipal sales or use tax, and gross receipts tax.

A 2% contractor's excise tax is imposed on the gross receipts of all prime and subcontractors engaged in construction services or reality improvement projects. The work must be for the utility company and the prime contractor must receive payment directly from the utility company to be taxed under SDCL 10-46B.

If you want to avoid income taxes, you should consider relocating to South Dakota, as there's no income tax in the state. This means your income from wages, salaries, capital gains, interest and dividends are not taxed at the state level. Furthermore, taxpayers in South Dakota do not need to file a state tax return.

The bill specifically states to apply 2026a tax of zero percent on the gross receipts from the sale of food. Food does not include candy, alcoholic beverages, soft drinks, dietary supplements or food sold through a vending machine. In addition, prepared foods will not be exempt from sales tax.

What is South Dakota's Sales Tax Rate? The South Dakota sales tax and use tax rates are 4.5%.

Goods that are subject to sales tax in South Dakota include physical property, like furniture, home appliances, and motor vehicles. The purchase of prescription medication and gasoline are tax-exempt. South Dakota is unique in the fact that almost all services are taxable.

The state of South Dakota does not tax lottery winnings.

States with gross receipts taxDelaware.Michigan.Nevada.New Mexico.Ohio.Oregon.Tennessee.Texas.More items...?