South Dakota Sales Receipt

Description

How to fill out Sales Receipt?

Finding the appropriate legal document template can be a challenge. Naturally, there are numerous templates available online, but how do you locate the legal form you actually require.

Utilize the US Legal Forms website. The platform offers a plethora of templates, including the South Dakota Sales Receipt, which you can use for both business and personal purposes.

All the forms are reviewed by experts and comply with federal and state requirements.

Once you are confident that the form is appropriate, click the Buy Now button to obtain the form. Choose your desired pricing plan and enter the necessary details. Create your account and complete the purchase using your PayPal account or credit card. Select the file format and download the legal document template to your device. Fill out, edit, print, and sign the acquired South Dakota Sales Receipt. US Legal Forms is the largest repository of legal forms where you can find diverse document templates. Leverage the service to obtain professionally crafted paperwork that adheres to state regulations.

- If you are already registered, Log In to your account and click the Download button to acquire the South Dakota Sales Receipt.

- Use your account to access the legal forms you have purchased previously.

- Visit the My documents tab in your account to retrieve another copy of the documents you need.

- If you are a new user of US Legal Forms, here are straightforward tips to follow.

- First, ensure that you have selected the correct form for your city/county.

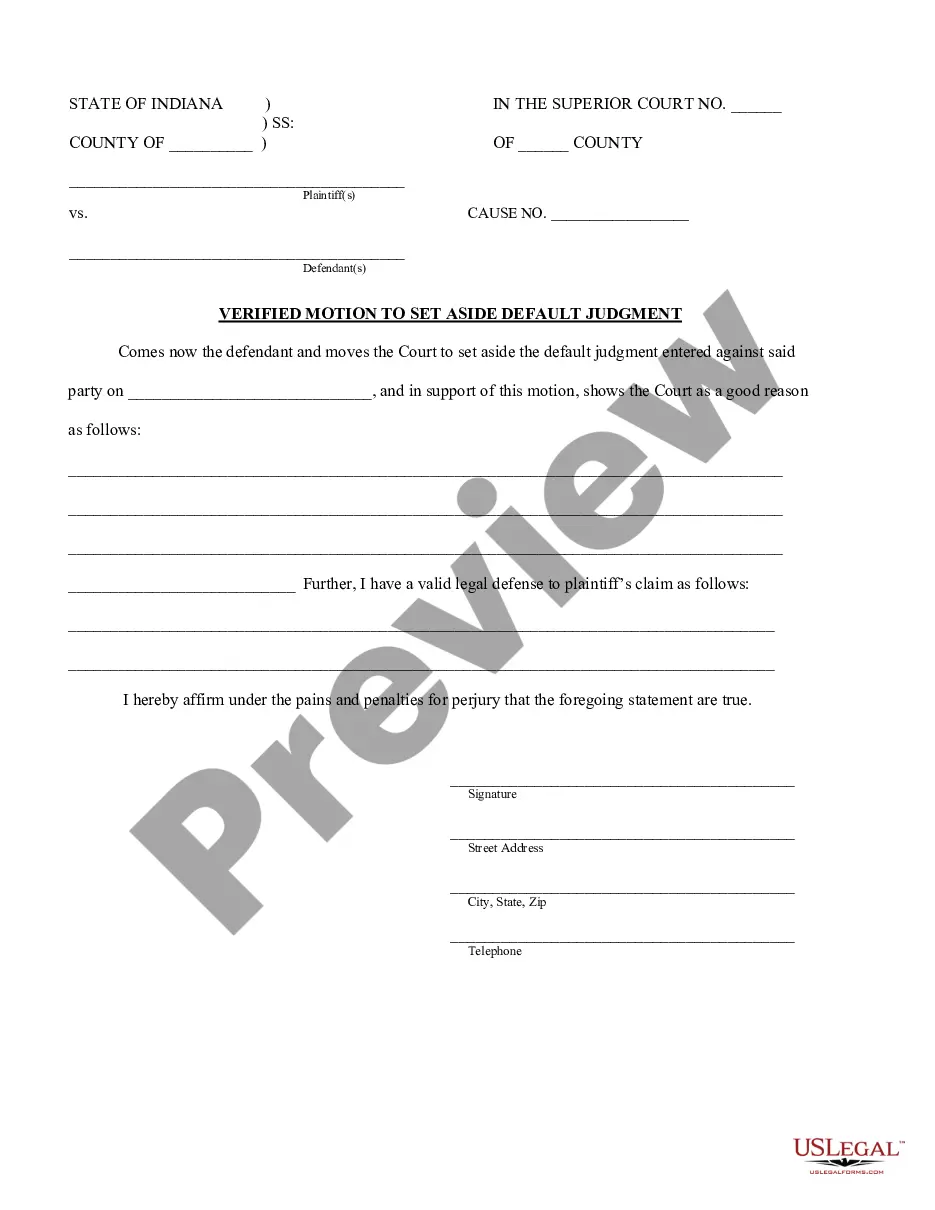

- You can preview the form using the Review button and read the form description to confirm it is the suitable one for your needs.

- If the form does not meet your requirements, use the Search field to find the correct form.

Form popularity

FAQ

South Dakota does not legally require a bill of sale for all transactions, but it is essential when selling certain items like vehicles. By creating a South Dakota Sales Receipt, both parties can agree on the terms of the sale, which can help prevent future misunderstandings. This document also serves as proof of ownership transfer and is beneficial when registering the vehicle. Using a bill of sale streamlines your transaction and adds a layer of protection.

While it is not legally required to have a bill of sale in South Dakota, it is highly recommended to create one. Utilizing a South Dakota Sales Receipt can clarify the terms of the sale, including any obligations. A bill of sale can also help protect you in case any disputes arise regarding the transaction later. Therefore, having this document ensures a smoother process for both the seller and buyer.

Yes, you typically need a bill of sale in South Dakota for certain transactions, especially when selling vehicles. This document serves as proof of the transaction and helps ensure both parties are clear on the terms of the sale. A South Dakota Sales Receipt can fulfill this requirement and provide an organized record for both the seller and buyer.

You can contact South Dakota sales tax services through the Department of Revenue's official website. This site provides various contact options, including phone numbers and email addresses to address your inquiries. If you have specific questions about sales tax or documentation like a South Dakota Sales Receipt, these resources can be very helpful.

To obtain a sales tax license in South Dakota, you must complete an application through the state's Department of Revenue. This process involves providing information about your business and intended sales activities. Once your application is processed, you’ll receive your sales tax license, which is essential for using a South Dakota Sales Receipt in your transactions.

To print a seller's permit in South Dakota, begin by applying through the South Dakota Department of Revenue's website. You will need to provide your business information and tax identification data. Once approved, you can easily print your seller's permit online. This document is important for sales tax purposes and can complement a South Dakota Sales Receipt.

A handwritten bill of sale is permissible to use in South Dakota. It functions as a formal agreement between the buyer and seller, providing proof of the transaction. However, ensure that it includes essential details and is signed by both parties. Opting for a South Dakota Sales Receipt can streamline the process and help avoid any misunderstandings.

A resale certificate allows businesses to buy goods without paying sales tax, with the expectation that these goods will be resold. In contrast, an exemption certificate applies to purchases made for specific exempt purposes, such as non-profit activities. Understanding the distinction is crucial for proper tax compliance. Accurately using these certificates will assist in generating accurate South Dakota sales receipts and maintaining your business's financial integrity.

In South Dakota, a general business license is not required at the state level, but some local jurisdictions may have their own requirements. Depending on your specific location and type of business, you might need to check with your city or county for any permits or licenses. It is important to comply with local laws, as this will help you avoid issues down the line, especially when it comes to maintaining proper South Dakota sales receipts.

Yes, if you sell taxable goods or services in South Dakota, you need a sales tax license. This license allows your business to collect and remit sales tax properly. To obtain a sales tax license, simply apply through the South Dakota Department of Revenue. Once licensed, you are ready to issue South Dakota sales receipts and remain compliant with state regulations.