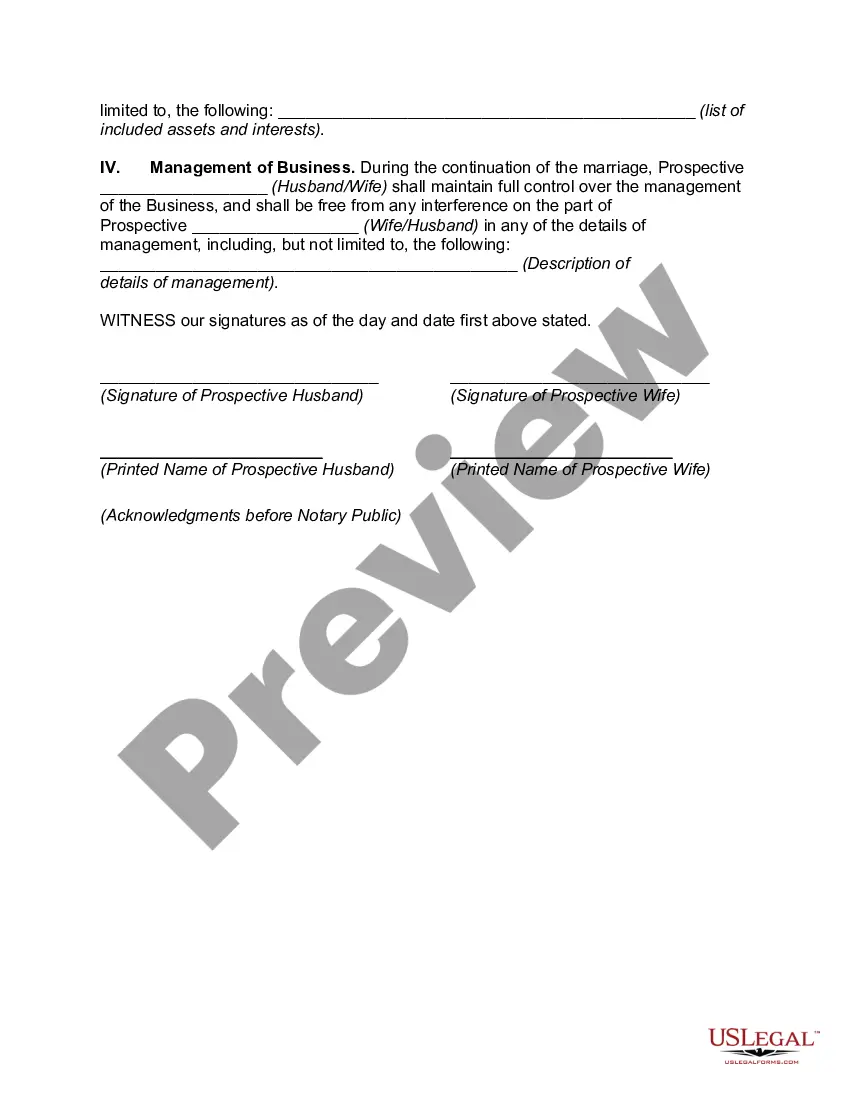

South Dakota Prenuptial Property Agreement with Business Operated by Spouse Designated to be Community Property

Description

How to fill out Prenuptial Property Agreement With Business Operated By Spouse Designated To Be Community Property?

If you need to complete, acquire, or print out legitimate file web templates, use US Legal Forms, the largest assortment of legitimate types, which can be found on the Internet. Use the site`s simple and handy research to discover the papers you will need. Different web templates for enterprise and person reasons are categorized by categories and says, or key phrases. Use US Legal Forms to discover the South Dakota Prenuptial Property Agreement with Business Operated by Spouse Designated to be Community Property in a number of click throughs.

When you are presently a US Legal Forms client, log in to the bank account and click on the Download option to obtain the South Dakota Prenuptial Property Agreement with Business Operated by Spouse Designated to be Community Property. You can even entry types you formerly saved in the My Forms tab of your respective bank account.

If you work with US Legal Forms the very first time, follow the instructions beneath:

- Step 1. Be sure you have chosen the shape to the correct city/land.

- Step 2. Utilize the Preview option to check out the form`s articles. Don`t overlook to learn the information.

- Step 3. When you are not satisfied together with the type, take advantage of the Search area near the top of the display screen to get other types in the legitimate type design.

- Step 4. After you have located the shape you will need, go through the Purchase now option. Pick the pricing plan you like and add your accreditations to sign up on an bank account.

- Step 5. Method the purchase. You can use your Мisa or Ьastercard or PayPal bank account to accomplish the purchase.

- Step 6. Find the format in the legitimate type and acquire it in your device.

- Step 7. Comprehensive, change and print out or indicator the South Dakota Prenuptial Property Agreement with Business Operated by Spouse Designated to be Community Property.

Every legitimate file design you get is yours permanently. You may have acces to each and every type you saved within your acccount. Click on the My Forms portion and pick a type to print out or acquire once more.

Remain competitive and acquire, and print out the South Dakota Prenuptial Property Agreement with Business Operated by Spouse Designated to be Community Property with US Legal Forms. There are thousands of specialist and condition-specific types you can use for your enterprise or person requirements.

Form popularity

FAQ

A prenuptial agreement cannot include personal preferences, such as who has what chores, whose name to use, where to spend the holidays, information on child-rearing, or what relationship to have with specific relatives. Premarital agreements are meant to address monetary issues.

Separate property in a community property state includes:All property owned by a spouse prior to marriage. Any property obtained by a spouse after a legal separation. Any property received as a gift or inheritance during the marriage from a third party such as joint banking accounts. Any pre-marriage debts.

Generally, under California Community Property law found in California Family Code fffd 760. Defined, everything acquired after the date of marriage, before the date of separation (that is not inheritance or gift from third party) is community property.

The legal definition of an asset in a divorce is anything that has a real value. Assets can include tangible items that can be bought and sold such as cars, properties, furniture, or jewelry. Collectables, art, and memorabilia are frequently over looked assets because their value is often hard to ascertain.

Can a California divorce affect my business? In California, businesses are considered assets and will be divided based on whether or not the business is separate or community property.

Assets that were inherited by one spouse or assets that were earned prior to marriage are considered separate property. If you owned a thriving business prior to getting married, the business is your separate property and will be treated as such in a divorce proceeding.

Property that one party owned before the marriage is not owned by the community, and thus is treated as separate, and not community property. Separate property also encompasses gifts and inheritance specifically given to one party, and property purchased or earned after the separation.

The only asset that may be excluded from the joint estate is an inheritance.

If you do not enter into a prenuptial agreement before you get married you will automatically be married in community of property. This means that: All debts and assets of both parties are joined into what is called a 'common estate', which is owned equally by both.

(1) the property owned or claimed by the spouse before marriage; (2) the property acquired by the spouse during marriage by gift, devise, or descent; (3) the recovery for personal injuries sustained by the spouse during marriage, except any recovery for loss of earning capacity during marriage.